The Only Reasons to Buy a Stock – Part 3

If you’re in the market to make money, there are really only 3 reasons to buy a stock. If you missed Part 1 or Part 2, be sure to check them out.

Reason #3: The Catalyst – “I believe this stock is going higher”

The catalyst investing rationale is seemingly the most straightforward. It’s certainly the most simple to explain. The catalyst buyer is completely unconcerned with the first two reasons for buying a stock. There’s no spreadsheets discounting future cash flows, no faith in long-term growth. The only interest is which direction prices will go.

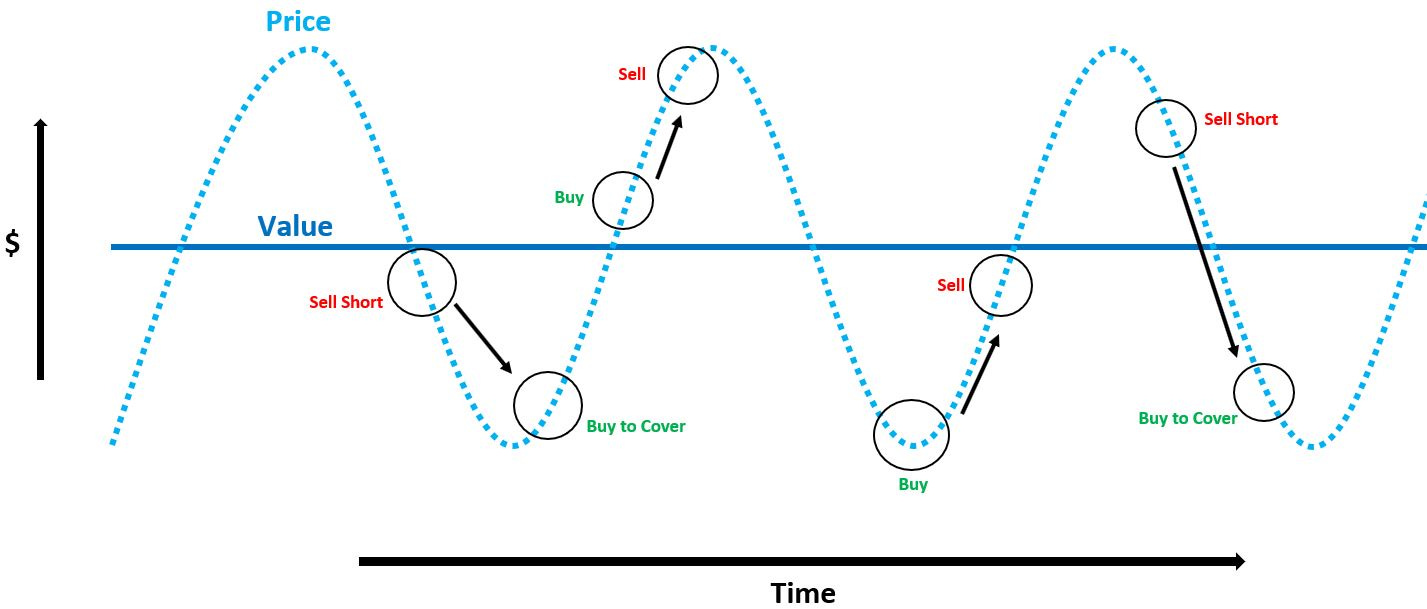

Let’s use the price vs. value graphic once more to illustrate various profitable transactions a catalyst investor might try to make. At times the strategy may appear to align with a value approach, while at other times it seems to run directly counter. It makes no difference, because the relationship between the two variables has no impact on the decision.

The concept is simple, but the practice is less so. There is a limitless number of inputs to stock price changes. Catalysts, though, are most often things that affect human behavior, and human behavior is what drives stock prices on a day to day basis.

It would not be possible to give a detailed explanation of the many areas of catalyst investing. It includes all forms of technical analysis – an incredibly diverse discipline focused on historical price trends and patterns – but also extends to various algorithmic trading strategies, headline watching, and even less sophisticated approaches, like buying the stock your buddy talked about at the bar because ‘it keeps going up’.

Making investment decisions guided by Reason #3 is often referred to as ‘trading’. The approach has a mixed reputation in the professional investing community, given a lack of research backing the usefulness of many approaches. It’s certain that many investors, professional or not, have gone bust trying to master the intricate art. But make no mistake, some of the most successful market participants of all time have been ‘traders’, rather than sophisticated fundamental investors.

What’s the point?

So now you’ve read about all three reasons to buy a stock. If you’re unfamiliar with the world of investing, these topics may have been new to you. If you’re an experienced investor, perhaps I just told you things you already knew. But identifying your own strategy is important for both the rookie and veteran. Without it, you risk making decisions that are logically inconsistent.

For instance, the strictly value-based approach, as defined earlier, is not a long-term strategy, despite conventional wisdom. Many such investors prefer to think of themselves as long-term, but we’ve seen that a longer holding period presents risks. In reality, the strategy is based on reversion to the mean, which more closely aligns with short and intermediate-term timeframes.

Alternatively, the investor who focuses solely on long-term growth potential shouldn’t be waiting for the next dip to buy. It may yield a lower purchase price, but if belief is in long-term growth, current price matters very little. If you believe value is rising over time, the last thing you want to do is spend time on the sideline. Waiting for a dip that may or may not come contradicts the growth thesis.

What about the catalyst trader? Their biggest enemy is emotion. The strategy is based on taking advantage of other investors’ emotional decisions, so allowing emotion to cloud their judgment eliminates their advantage. A logical trader should follow a system with clearly-defined rules and avoid holding positions after the initial thesis has played out.

Among the worst things an investor can do is change their strategy to justify a losing position. Often the changed approach is not even a conscious effort. It manifests itself when we don’t have a clear understanding of our own approach. It’s not uncommon to see an underwater value investor, who watched value fall to price, turn to faith and believe that value will reverse course. Or a growth believer who turned out to be wrong, pointing out that the stock is underpriced. Even catalyst investors can be convinced to read financial statements if a stock moves against them. When egos get in the way, investors will make any excuse to avoid admitting they were wrong. The best defense is to know the pitfalls of your chosen strategy before a decision to buy or sell is ever made.

Of course, that doesn’t mean your strategy must be restricted to only one of the three above. They aren’t mutually exclusive. Catching the bottom of an undervalued stock, with an underlying business that will grow for a long time is the holy trinity of investing, but any combination will do. Some guy named Warren Buffett once said, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” Notice his dual focus: company and price. He targets good companies – those that will grow for a long time – and tries to buy them at fair prices. He combines Reasons 1 and 2, while ignoring 3. Alternatively, many investors use catalyst investing to complement their focus on value. Successfully timing the market mitigates the term risk associated with a value-only approach. Several combinations are possible, and a single investor can even use a different strategy for each position. But in each case, it’s imperative that a thesis be defined before a stock is bought, not after.

What’s most important is understanding who you are as an investor and having the discipline to both define your process and stick to it.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post The Only Reasons to Buy a Stock – Part 3 first appeared on Grindstone Intelligence.