Recession? Not According to the Labor Market

There’s plenty of recession chatter out there. First quarter GDP was negative, and a second consecutive decline in Q2 would satisfy a widely-used ‘rule of thumb’ definition for identifying recessions. On the other hand, official recession dates are decided by the Business Cycle Dating Committee at the National Bureau of Economic Research, and their definition doesn’t even mention Gross Domestic Product.

We could spend a whole day arguing about economic downturns and discussing various viewpoints on the current situation. One thing’s for sure, though. A premier aspect of past recessions has been notably absent this time around: a rise in unemployment.

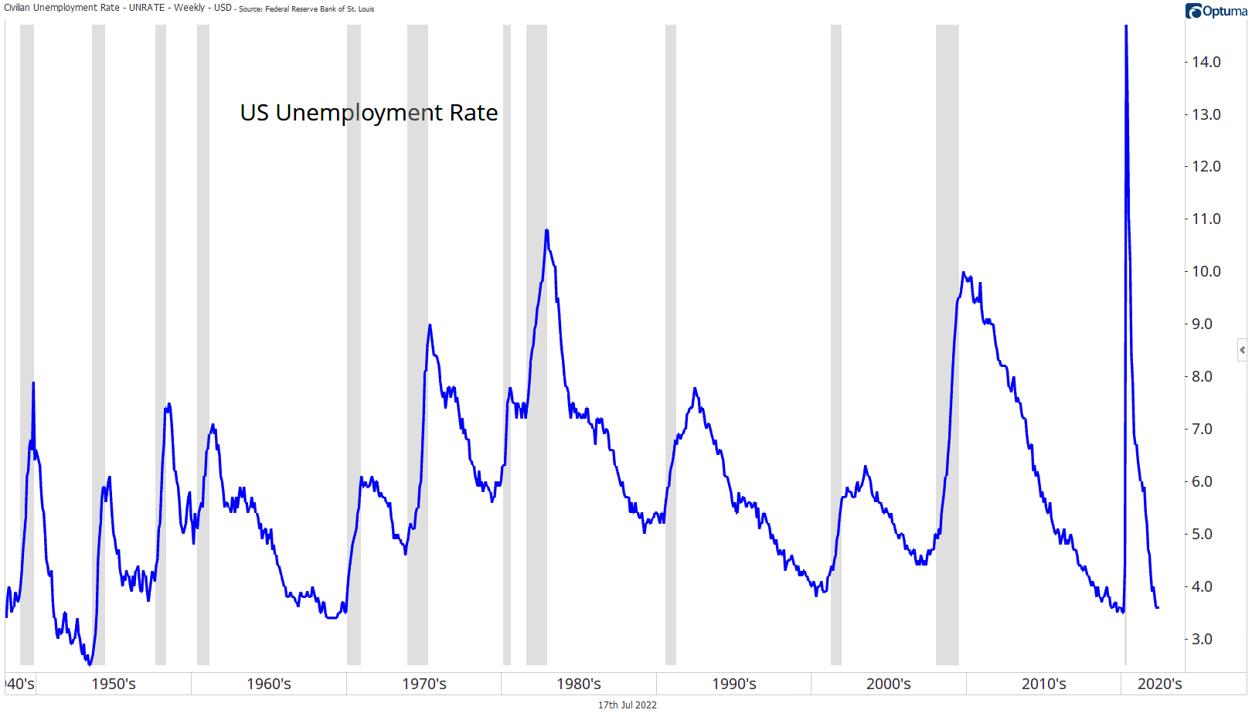

At 3.6%, the US unemployment rate is still near its lowest levels in decades. Take a look at every recession over the last 75 years (highlighted in grey below). In each case, the U-3 rate rose by several percentage points. In most cases, it began rising well before the recession start date. That’s not happening today. If a recession really did start in Q1, it would be the first one that’s begun while unemployment was at its lows.

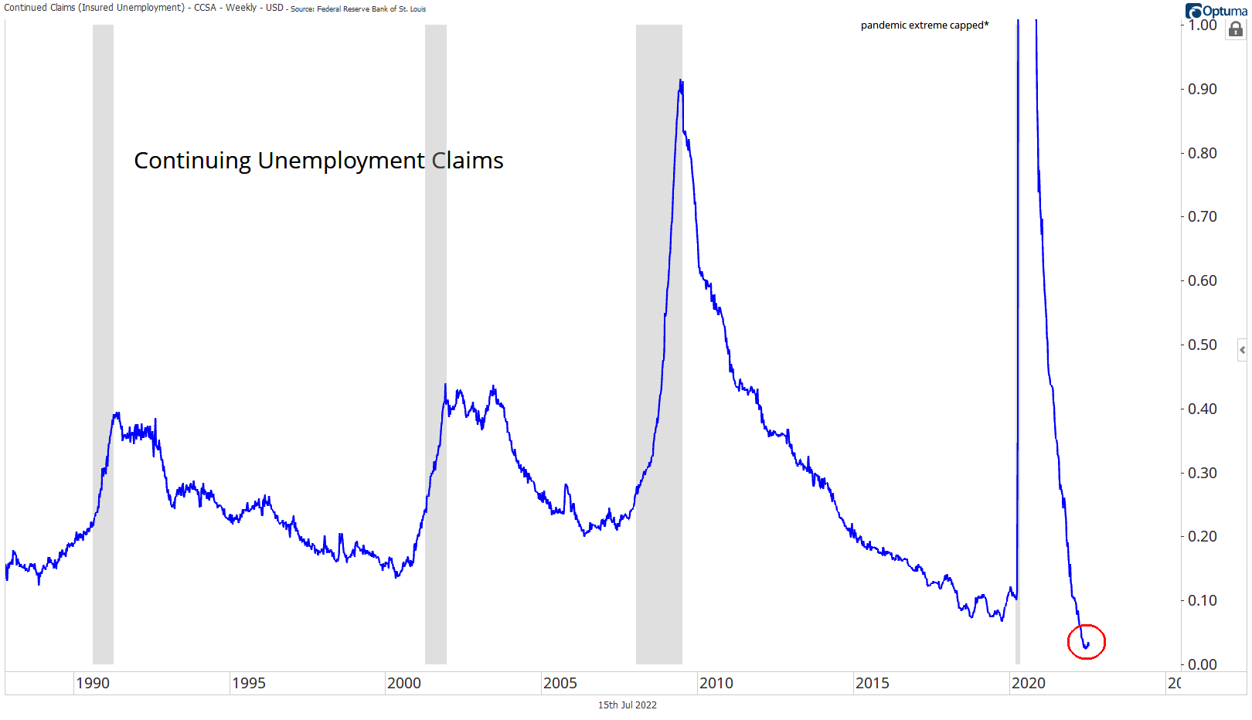

One of the best leading economic indicators has been continuing unemployment claims – they’ve bottomed well ahead of each recession since the start of available data. For the past 50 years and 8 cycles, there’s been an average of 49 weeks (and never fewer than 16 weeks) of rising claims before a recession began. This year, though, continuing claims have yet to show any meaningful deterioration. In fact, they’re near the lowest levels in decades.

But just because some traditional warning signs aren’t confirming the economic slowdown doesn’t mean there are no signs of stress in the labor market. Initial unemployment claims are rising. They tend to be much more volatile from week to week than continuing claims, so trend changes can be harder to identify – a four-week moving average makes it clear that this data set is headed in the wrong direction this summer. Still, similar spikes in the past haven’t always resulted in recessions. Check out the multiple such instances in the ’90s, ’00s, and ’10s that were followed by continued economic growth.

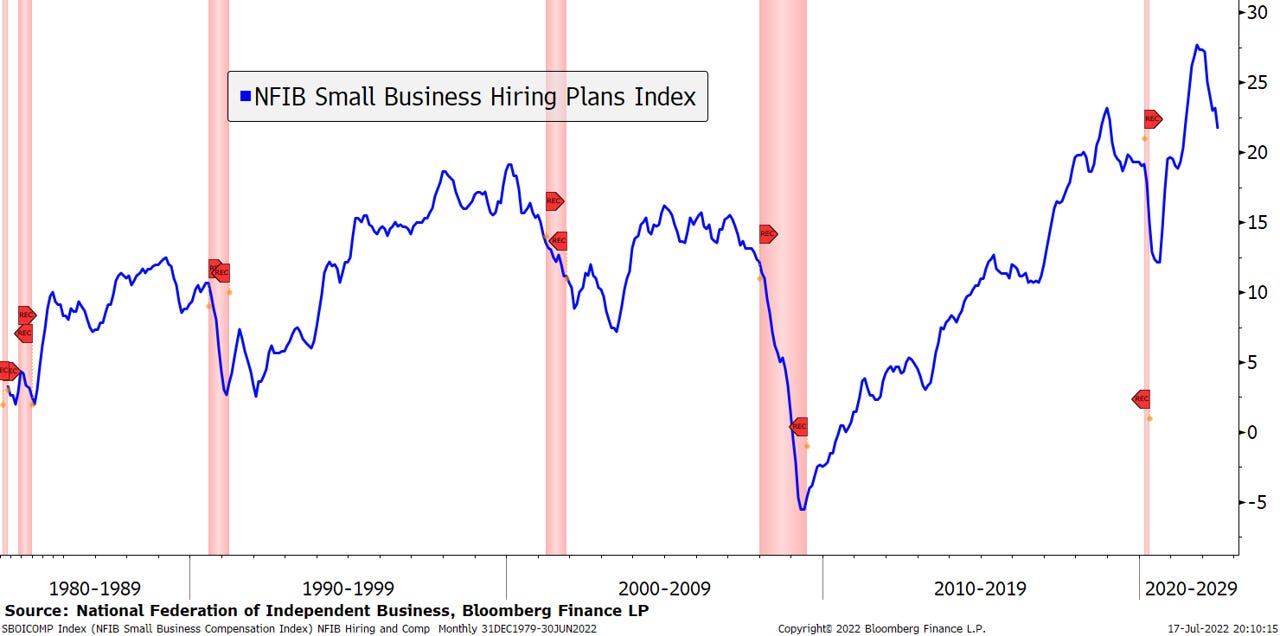

We can also look at survey data to assess the labor market’s future. Every month, the National Federation of Independent Business asks small business owners about operating conditions and their outlooks. Included is a question about hiring plans. Hiring plans tend to fall ahead of economic downturns, as owners batten down the hatches in preparation for weaker sales. It seems they’re pulling back on hiring now.

If we’re in a recession now, it would be the first to occur without first seeing significant deterioration in the labor market.

If we’re not, keep a watchful eye on whether early warning signs in hiring plans turn into an extended rise in continuing claims. It could signal that the recession everyone fears is on the horizon.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Recession? Not According to the Labor Market first appeared on Grindstone Intelligence.