Rotation, Rotation, Rotation – Safety Stocks Stabilizing

The battle between Growth and Value stocks has raged for most of the last year. Growth dominated the early stages of the COVID recovery, but in September last year, a Technology-led selloff brought Value into the limelight. Since then, the S&P 500 has continued higher in seemingly steady fashion. Underneath the surface, though, it’s been anything but steady.

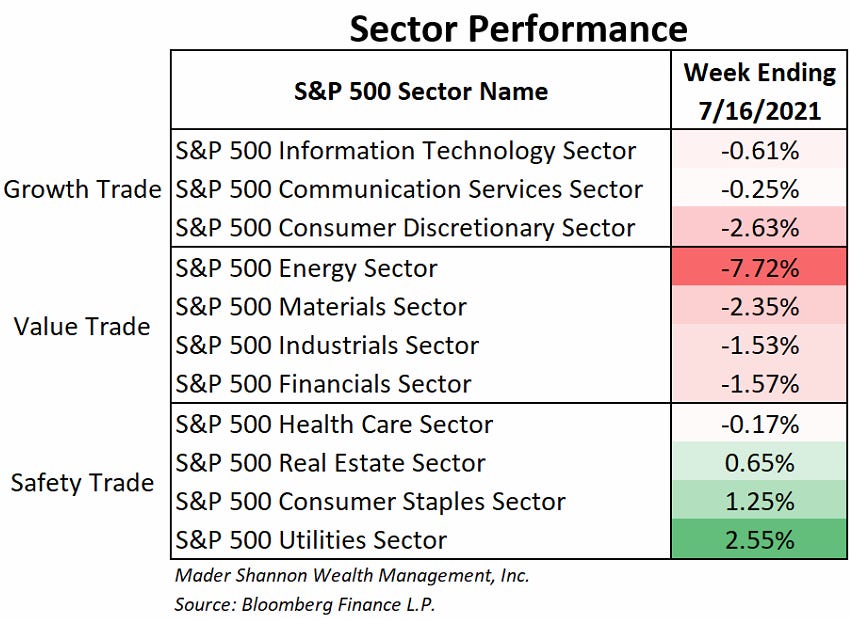

There’s been a distinct rotation between the Growth and Value trades – one group leads for a few weeks, then lags for a few. And back and forth it’s gone:

Growth and Value have traded punches, but no clear winner emerged – they’re fairly even since mid-September. The loser has been obvious. The Safety trade, especially the Utilities and Consumer Staples sectors, lagged in dramatic fashion.

That wasn’t the case last week. For the 7 days ending July 16, Utilities were up 2.55% and Consumer Staples gained 1.25%, performances that led U.S. equities. It’s the first time those sectors have nabbed the top two spots for a week since March 6, 2020.

The relationship between the Safety sectors and the S&P 500 is a helpful gage for risk appetite. Risk-seeking investors avoid these ‘boring’ sectors, while risk-averse investors favor them. Thus when stock prices are rising and risk appetite is strong, Utilities and Staples tend to decline relative to the S&P 500 Index, and vice versa.

Accordingly, during the early days of the pandemic, risk-averse investors drove Utilities and Staples to multi-year highs vs. the broader index. Contrarily, the two fell sharply behind during the subsequent recovery.

It looked like Safety might end its relative decline after forming a low in February. Utilities and Staples both kept pace over the following months – their prices relative to the S&P 500 moved sideways, rather than down. But when Growth resumed its leadership role in June, Safety dropped through its February lows.

Their relative strength last week pushed each Utilities and Staples back above those February lows.

The relative trend in these two sectors is still down – price is well below a falling long-term moving average. That said, ‘false breakdowns’ like this often set the stage for reversions to the mean (or trend reversals). Given their broader implications for investors’ risk appetites, keep an eye on these ratios in the weeks ahead.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Rotation, Rotation, Rotation – Safety Stocks Stabilizing first appeared on Grindstone Intelligence.