Running Out of Gas: No Love for Energy Stocks - 1/19/2024

Top charts and trade ideas from the Energy sector

Long-term resistance for the Energy sector has simply been too much to overcome. We’ve been dealing with the 2008 and 2014 highs for 18 months now, and while the bears haven’t taken outright control here, the bulls haven’t been able to gain any ground either. At some point, maybe we’ll get the long-awaited breakout. Or we might not. In any case, the risk is skewed to the downside as long as this resistance level remains intact.

After a short stint of outperformance for the sector over the summer, we downgraded Energy to Equalweight at the start of October, then took them a notch lower to Underweight at the end of November. It wasn’t so much that we wanted to be shorting Energy stocks. But the opportunity cost of owning something that’s stuck in the mud while the rest of the market is rallying is just too high. The Energy sector on its own is still knocking on the door of its 2008 highs, but compared to the rest of the market? It’s breaking down to new 52-week lows.

In fact, since the S&P 500 set its bear market lows in October 2022, Energy has been the single worst sector to invest in. It’s fallen 1% over that period, while the SPX has jumped more than 30%.

Fortunately for Energy bulls, we’re about to enter the most bullish seasonal period of the year. Energy has outperformed the rest of the market on average in each February, March, and April since 1990.

But seasonality isn’t gospel. The Energy sector is weak and getting weaker. It’s currently in the ‘Lagging’ quadrant of the daily Relative Rotation Graph, and more importantly, it hasn’t been able to reach the ‘Leading’ quadrant on rallies. There just isn’t much relative strength to be found here.

And below the surface, Energy member trends are weakening. Just 30% of the sector is above a rising, long-term moving average, and more than 80% have dropped below a falling short-term moving average.

There’s no reason to be wasting a bunch of time on stocks in technical downtrends when we’re in the midst of a bull market. We’re keeping our Underweight rating in place. The Energy sector is guilty until proven innocent.

Digging Deeper

Not all Energy stocks are created equal.

Over the past year, the overall Energy sector has dropped 11%. The refiners, meanwhile, have bucked the trend by rising 12% over that period. Relative strength begets relative strength. If we’re forced to be looking for stocks to buy in the Energy sector, this is the area where we want to be focusing our attention.

Marathon Petroleum is at the top of the list. The relative strength here is readily apparent - look how MPC has traded vs. the rest of the sector over the last 5 years. Uptrends don’t get much cleaner than that.

Our target on MPC is $200, which is the 261.8% retracement from the 2018-2020 decline. We only want to be long if the stock is above $130.

Phillips 66 is another refiner to keep an eye on. it just broke out of a 4 year base, and the risk/reward here is very clearly defined with those former highs now acting as support on any pullbacks. We want to be long PSX above $122 with a target of $150.

A breakout for Phillips relative to the rest of the market would be a real show of strength and give us greater confidence that we’ll hit that $150 target.

Leaders

ONEOK is the only Energy stock that’s risen over the last 4 weeks, and that’s helped push the sector to new 52-week highs versus the rest of the sector.

But there’s still no reason to be involved from the long side as long as OKE is below the 2019 highs.

Targa Resources is much more interesting as it continues to consolidate above the 2022 highs. We can only be long if TRGP is above $81, but from there we like it with a target of $96.

And we’d be remiss if we didn’t acknowledge the relative strength that Targa has shown against the rest of the Energy space. If Targa is holding up better while the rest of the sector is falling, we expect it to be an outperformer if Energy stocks reverse course and start to rise.

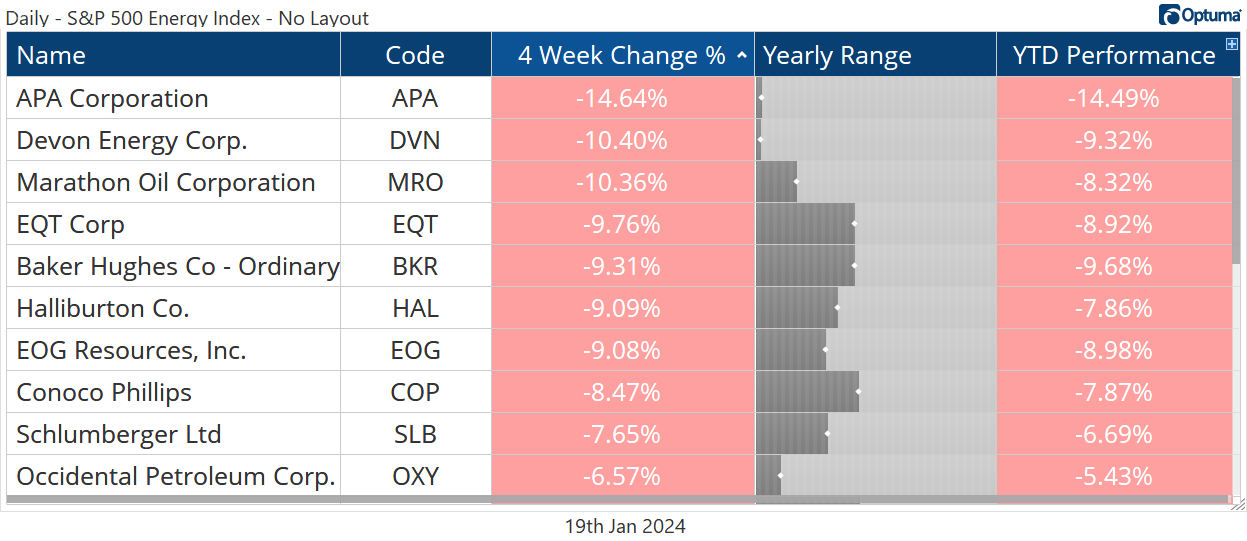

Losers

This is a bull market for stocks, and we don’t like spending time looking for short opportunities when the path of least resistance is higher. Shorting stocks in a bull market is a great way to get burned.

For Energy, we might make an exception.

APA Corporation is breaking down to new lows versus the rest of the sector (which itself is breaking down to new lows vs. the rest of the market). You’d be hard pressed to find a name showing more relative weakness than this one.

The risk/reward is very clearly defined. We can be shorting APA below the pre-COVID highs of $33 with a target down near $23, which is the 61.8% retracement of the 2020 collapse.

That’s all for today. Until next time.