Sector Ratings and Model Portfolio Update

The Grindstone Intelligence Sector Ratings are based on our top-down technical approach. We assess the relative strength and trends within each sector and gauge risk appetite in the broader market to determine which sectors we think are best positioned to lead going forward. The ratings below reflect our views over the coming month.

The US Equity Model Portfolio is a hypothetical allocation designed to align with our Sector Ratings and seeks to outperform the S&P 500 Index over the long-term. Our positions are chosen with investment horizons ranging from a few weeks to several months. The Model will invest only in exchange-traded funds that track sectors, industries, or categories of stocks. No individual stocks or cash positions will be used in the Grindstone US Equity Model Portfolio. Changes to the model will be communicated via email to subscribers and posted on our site.

Never is the future of markets certain. Over the last few weeks, though, the road ahead has become even more foggy than usual. Sharp swings in market leadership have us wary and watching for a major shift, but so far, we’ve failed to see confirmation of any significant changes.

While we wait for resolution, we think it’s best to avoid making aggressive bets or prognostications one way or the other. We’re raising our view on the Utilities sector to Equalweight from Underweight. Check out the chart of the Utes compared to the S&P 500 below.

This ratio has been in a confirmed downtrend since the spring, and we’ve been recommending that our readers avoid the space for most of that period. Now, though, the ratio’s volatility is expanding, resulting in a sort of descending megaphone pattern. While we’re inclined to believe the existing downtrend will continue, the magnitude of recent swings makes it more palatable to step aside, wait, and watch.

For many of the same reasons, we’re lowering our view on the Industrials to Equalweight. We’ve liked the Industrials primarily because of the relative strength they’ve shown on an equally weighted basis. Following a huge breakout earlier this year, the ratio of the equally weighted Industrials to the equally weighted S&P 500 has been digesting gains over the past few months.

The market cap weighted ratio hasn’t performed nearly as well, though, and is struggling to hold onto this key support level. We’re inclined to believe that this consolidation will resolve higher based on the underlying strength we saw above, but it’s taking longer than we would have expected. The risk is growing that a downside move comes instead, so we think we’re better off stepping to the side, waiting, and watching.

We’re maintaining our Overweight view on Communication Services even after last week’s sharp reset. The ratio of Communications to the SPX is in a structural uptrend as long as it remains above the 2018 lows.

We’re also maintaining our Underweight rating on the Real Estate sector, which continues to steadily lag the S&P 500. Could we have finally seen the lows last week? Certainly. But we’ll need to see some evidence of that before changing our view.

Here’s a summary of our current sector ratings:

For the Model Portfolio, our ratings changes mean that we’re adding back some Utilities and trimming our position in the SPDR Industrial Sector ETF. Here’s a summary of the positioning updates.

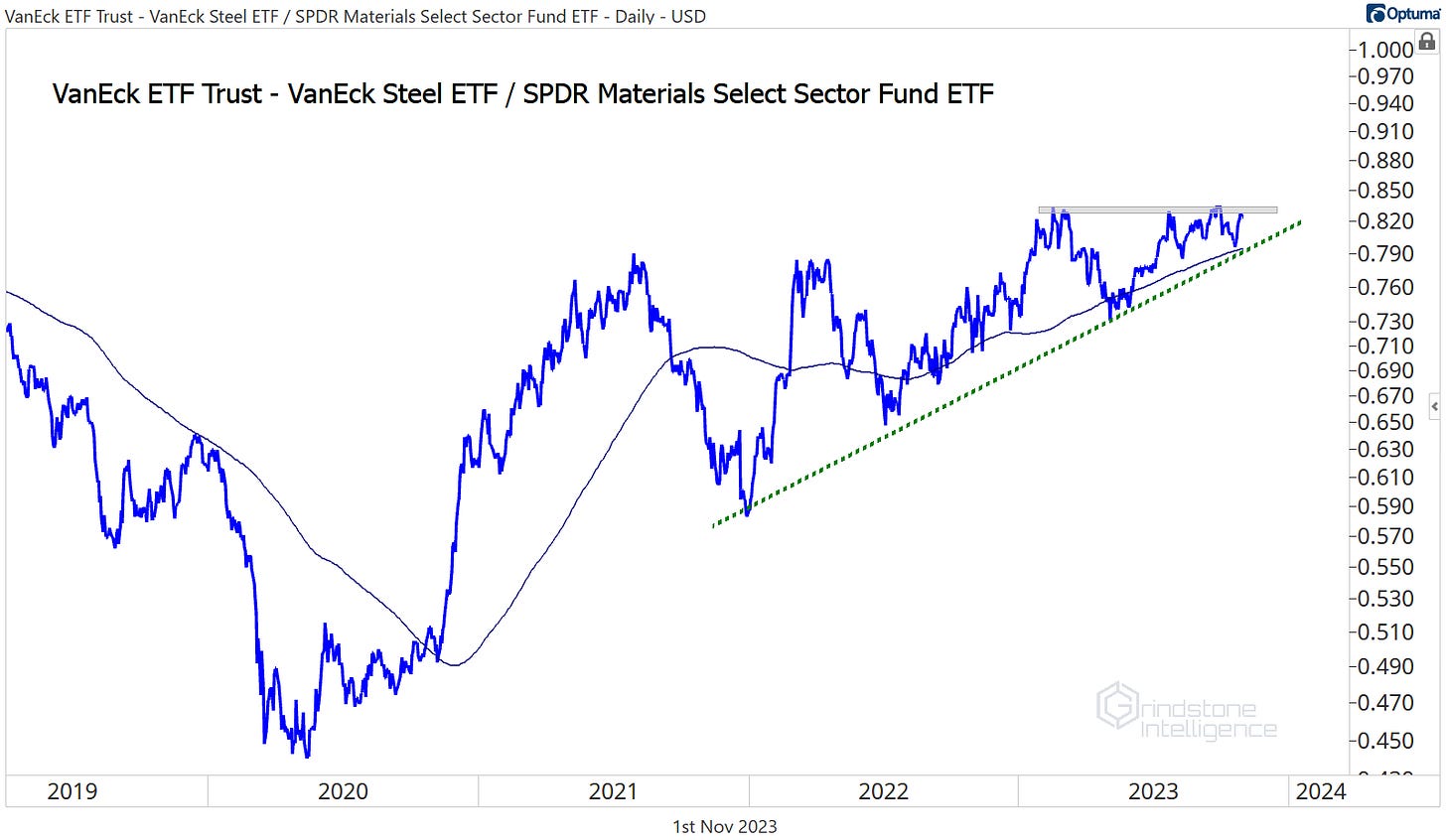

We’re keeping our modest 1.5% position in the VanEck Steel ETF as we await a potential breakout in the fund vs. the rest of the sector. The group set a relative peak in February, but the uptrend from the early-2022 lows has remained intact. After 10 months of going nowhere, we think this one could explode higher.

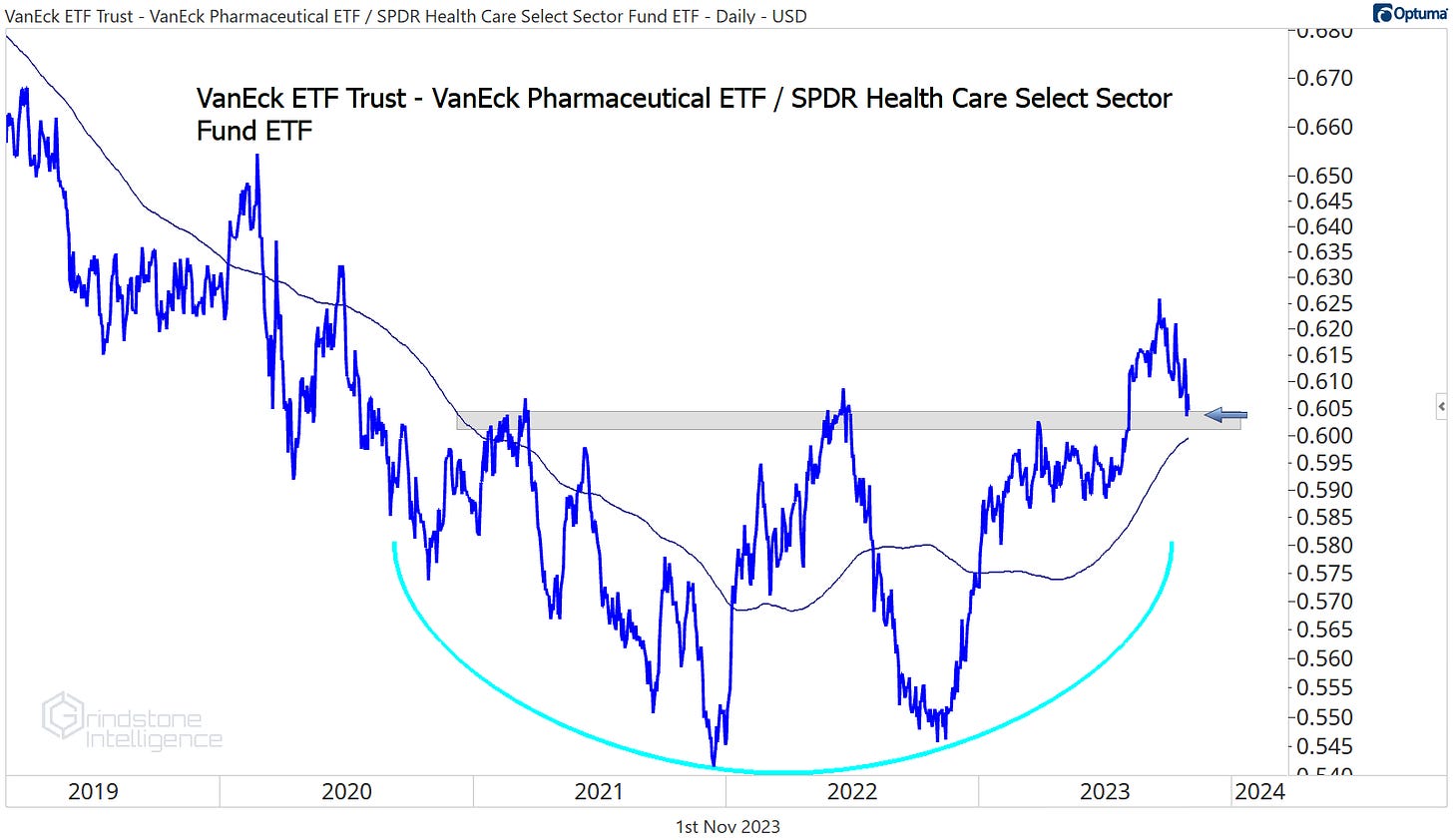

We’ve also kept our position in PPH, a pharmaceutical ETF. It just finished reversing a huge relative downtrend against the rest of the sector, and the recent pullback has done nothing to damage the structural trend in place.

If you have any questions regarding our ratings or the model portfolio, please don’t hesitate to reach out.