Sector Ratings and Model Portfolio Update

And an update on our paid tier

First, a bit of housekeeping.

I’ll cut to the chase. The price of a paid membership is going up.

I had a big, long explanation written for you guys, but it all comes down to this: I’m putting a lot more time and effort into this stuff than I was when we launched, and you guys are getting a lot more content. The current price doesn’t reflect that.

Starting next week, the price of an annual membership will be $500, and the price of a monthly membership will be $50.

The price for existing subscribers won’t change.

This price only applies to NEW subscriptions that begin after the hike goes into effect on March 9th. That means if you aren’t on the premium package yet, I’m giving you another week to lock in the launch price of $200/year.

If you just like getting the free stuff, that’s great, too. You’ll continue to get access to excerpts and occasional full posts just like you were before. All I ask is that you help spread the word about what we’re building. Whether it’s sharing a post on Twitter, telling your friends about a trade idea you got from us, or secretly signing up all of your coworkers to receive email updates, every little bit helps. And it ensures I won’t have to resort to making up doom and gloom or shilling random cryptocurrencies to drive clicks.

As always, thanks to all of you for your continued support. Whether you’re paying for premium content or just reading the free stuff, you’re helping keep Grindstone alive.

Now, onto this month’s sector ratings update:

The Grindstone Intelligence Sector Ratings are based on our top-down technical approach. We assess the relative strength and trends within each sector and gauge risk appetite in the broader market to determine which sectors we think are best positioned to lead over the coming weeks and months.

Guess which sectors are front-running the market again in 2024? It’s the same two that led the market in 2023. Communication Services and Information Technology are each up more than 9% for the year, well ahead of the S&P 500’s 6.5% gain.

We don’t think that leadership will last in perpetuity.

This isn’t us screaming that valuations are unsustainable and the bubble is about to pop or anything like that. We’ve been overweight the big growth names in the past, and we expect we’ll be overweight those names again in the future. But the evidence continues to pile up in favor of a new leadership group.

Check out this big bearish momentum divergence shaping up in the Tech sector.

The strongest trends don’t care about momentum divergences, true. And we’re not seeing a ton of price confirmation yet. But we’ve already gotten some price confirmation after a similar divergence in the ratio of Tech compared to the S&P 500.

These types of divergences are typically worked off through either price correction or through time. The lowest likelihood outcome in our opinion is new relative highs for Tech in the near term.

We’ve got the same thing going in the Communication Services sector. Relative to the rest of the market, momentum failed to confirm the most recent highs. We just don’t see that damage getting repaired overnight.

So if it’s not Tech and Communications that will lead us higher, where should we look?

How about the Financials? The Financials/SPX ratio is above its 200-day and just found support at a key, one-year rotational level. That sets the stage for outperformance in the weeks and months ahead.

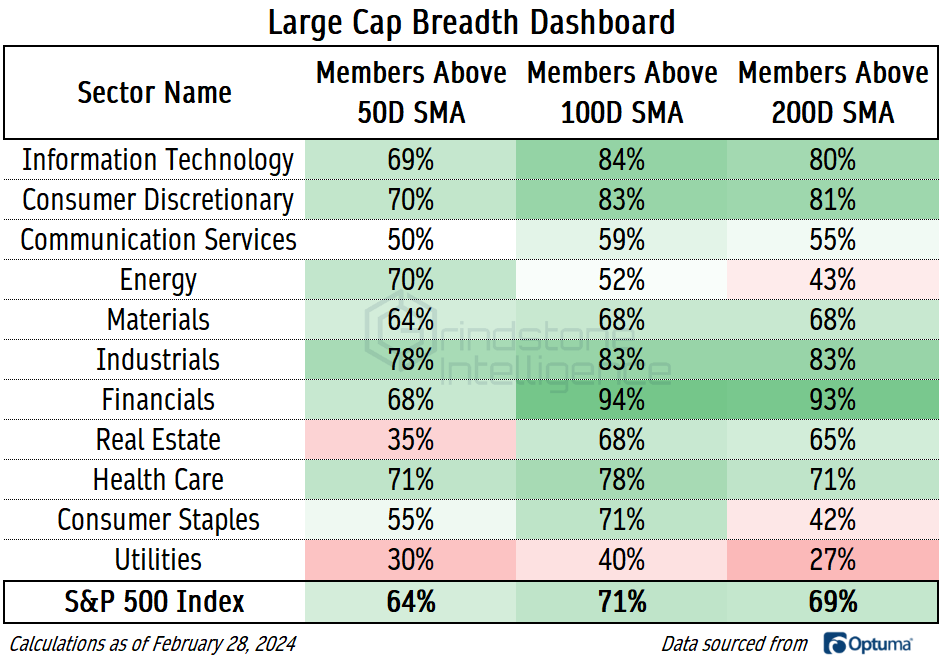

There’s also a ton of strength beneath the surface. Whether you look on an intermediate or long-term basis, no sector has a higher percentage of stocks above their moving average than the Financials.

We also like this continued basing action in Health Care relative to the rest of the market. What better place for Health Care to bottom than here, the exact same place it did back in 2021?

What we really like is the bullish momentum divergence at these lows. After getting oversold on the initial test of those lows last November, RSI hasn’t dropped below 30 on subsequent declines. We saw the same types of momentum divergences at the 2020 and 2023 peaks and the 2021 bottom.

This could just be a mean reversion or it could be the start of a new, long-term uptrend. In any case, we don’t want to be betting against Health Care stocks.

The other thing we aren’t going to do is explicitly bet against risk-on areas of the market right now. Risk appetite continues to run rampant - as evidenced by the ongoing rally in Bitcoin. So even though we expect some new leadership to emerge from some of the left behind areas of the market, we still want to keep exposure to those former leaders. The Information Technology and Communication Services sectors are still in clear uptrends, both on an absolute and a relative basis

What we are avoiding is the traditional ‘safety’ sectors - at least until we see more evidence of risk aversion out there.

One thing to keep an eye on in that regard is this potential bullish momentum divergence in the ratio of Real Estate stocks vs. the S&P 500. If this turns into a failed breakdown, we’d need to take things a little more seriously.

But we aren’t predicting a failed breakdown. We want to react and adjust if it happens.

For now, here’s the complete look at our current ratings:

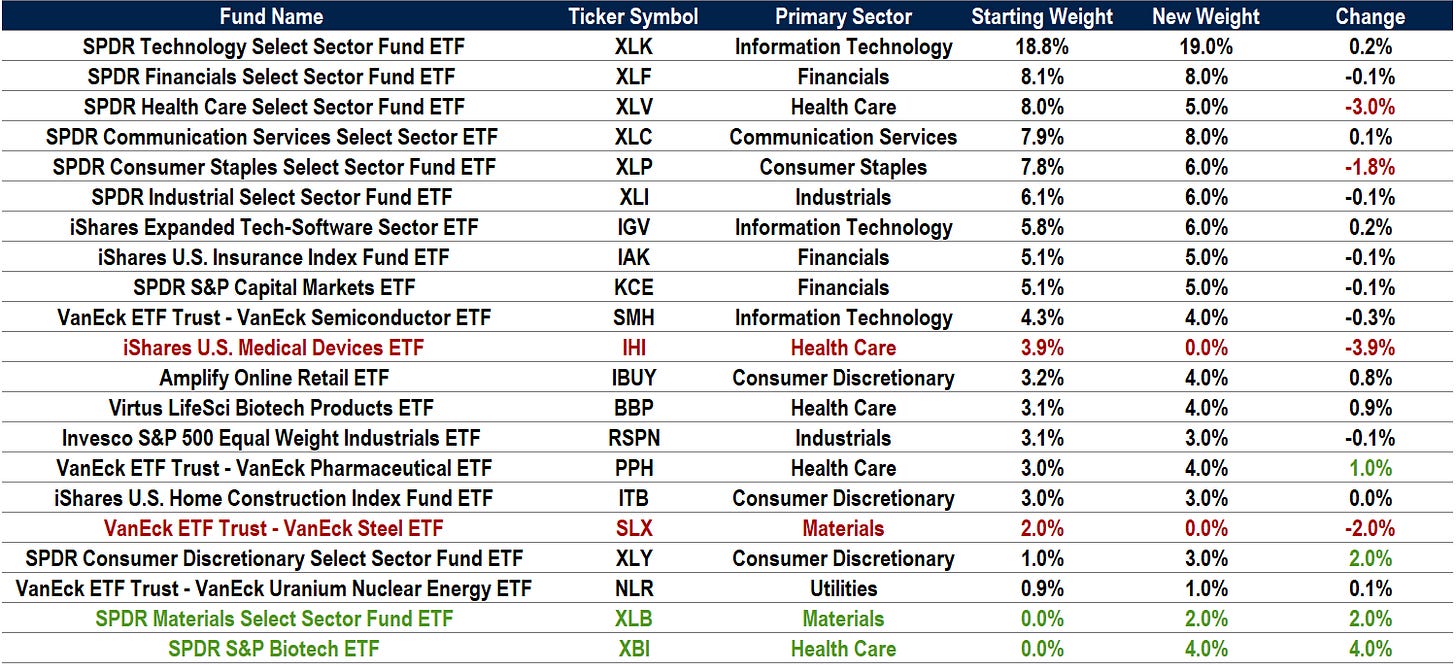

In addition, we’re making the following changes to the Model Portfolio. The US Equity Model Portfolio is a hypothetical allocation designed to align with our Sector Ratings. The positions are chosen with investment horizons ranging from one to several months. The Model chooses only funds that track sectors, industries, or categories of stocks - no individual stocks or cash positions are used.

First, we’re adding some biotechs. XBI just broke out of a multi-year base, and we think it’s headed to $120.

This run of outperformance started with a failed breakdown below the 2022 lows in the XBI/SPX ratio, and we like the odds that the failed move is the start of a major reversal, not just a mean reversion.

We also continue to like IBUY, the Online Retail ETF. This breakout couldn’t be cleaner, and our target is the 38.2% retracement from the 2021-2022 decline, which is all the way up at $77:

That’s all for today. Until next time.