Sector Ratings and Model Portfolio Update - 2/1/2024

The Grindstone Intelligence Sector Ratings are based on our top-down technical approach. We assess the relative strength and trends within each sector and gauge risk appetite in the broader market to determine which sectors we think are best positioned to lead going forward. The ratings below reflect our views over the coming month.

The US Equity Model Portfolio is a hypothetical allocation designed to align with our Sector Ratings. The positions are chosen with investment horizons ranging from one to several months. The Model chooses only funds that track sectors, industries, or categories of stocks - no individual stocks or cash positions are used.

Guess which sector is front-running the market again in 2024? That’s right, it’s Tech. Just over a year ago, the Information Technology sector was breaking down to new multi-year lows relative to the S&P 500. Then a failed breakdown sparked a rally that pushed Tech above 22-year resistance from the dotcom bubble highs:

We aren’t betting against Tech, but a few other sectors have caught our eye. Over the last 6 months, the Financials have been nearly as good:

Check out this big rounded bottom the Financials are trying to complete relative to the S&P 500 index.

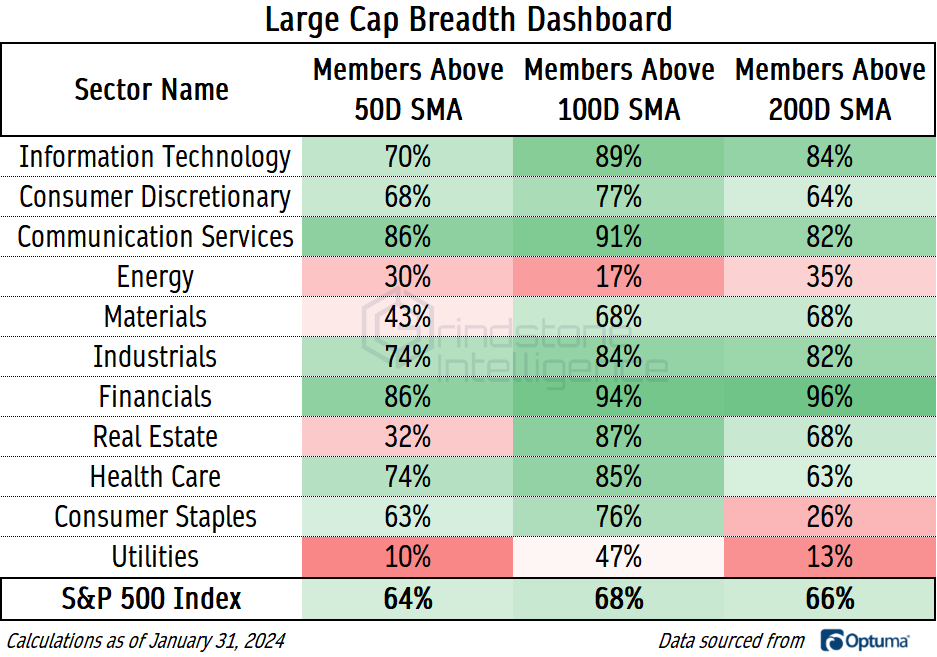

And right now, no sector has more stocks in technical uptrends. 96% of large cap Financials are above their 200-day moving average.

After the March 2023 banking crisis knocked this group down a peg, they’ve still got quite a bit of catching up to do. We’re keeping our Overweight rating on the Financials.

We’re also keeping our Overweight rating on the Health Care sector - though we’ll admit our January upgrade of the sector proved to be premature.

Relative to the S&P 500, Health Care continues to find support at the exact same place it did back in 2021. What we really like is the bullish momentum divergence at these lows. After getting severely oversold on the initial test of those lows last November, RSI hasn’t dropped below 30 on subsequent declines. We saw the same types of momentum divergences at the 2020 and 2023 peaks and the 2021 bottom.

This could just be a mean reversion or it could be the start of a new, long-term uptrend. In any case, we don’t want to be betting against Health Care stocks.

Whether we’re right about a new leadership group emerging all comes down to one chart, really. The Russell 1000 Growth Index vs. Russell 1000 Value. Does this breakout for Growth hold? Or do we see a massive failed breakout in favor of Value? We’re cautiously leaning towards the latter - an outcome that favors sectors like the Financials and Health Care.

Contrary to what we’ve been reading out there after yesterday’s sharp selloff, a failed breakout does NOT mean a bear market is inevitable. It could be a major problem for the ongoing bull market in stocks, a bear market is a much lower probability outcome. Bull markets are much more likely to continue than reverse.

Sector rotation isn’t a risk - it’s a strength. It’s proof that more than one sector is rising. Don’t forget, value outperformed by 20% from September 2020 to May 2021, and the S&P 500 rose nearly 20% over that period. And value stocks dominated for the first few months out of the October 2022 lows, too. Those were great times to be invested.

We aren’t in the business of calling tops in bull markets - that’s a recipe for failure. We think this bull market will continue, and we’re thinking a new leadership group will be in place for the next few months.

Here’s a complete look at our current ratings:

In addition, we’re making the following changes to our Model Portfolio.

It may seem like an odd time to be adding SMH, the VanEck Semiconductor ETF to the model given that we’re favoring more value-oriented areas of the market, but we love this breakout in the semis relative to the rest of the Tech sector. With an equal weight rating on Tech, we want to own things that will outperform Tech.

The medical devices space was a laggard in 2023, but we really like this potential breakout for IHI above $56. And a breakout fits in well with our thesis that Health Care will outperform over the next few months.

We’re also adding the home builders as they consolidate above the 261.8% retracement from the 2020 decline. Given our broader Value > Growth thesis, we’d rather be exposed to this group than the mega cap names that dominate the Consumer Discretionary sector.

That’s all for today. Until next time.