Sector Review: Industrials

In college, they taught me to value stocks using the present value of future cash flows. You take dozens of fundamental inputs – from company specific metrics to interest rates to the macroeconomic environment – and determine which businesses are the most undervalued. Having a grasp on these indicators is a crucial part of my job, but equally important is understanding that nobody cares what I think. A company may, in fact, be undervalued, but if no one else thinks so, then no one else will buy it. Sentiment around a stock has value too, and there’s no better way to track sentiment than the price of the stock itself.

Every week, I scan through hundreds (but who’s counting?) of individual stock charts. It can be tough to keep things in perspective, so I find a lot of value in looking at charts of sectors and industries. Trends in these larger groups often reveal the biggest and baddest trends in the underlying constituents. We don’t necessarily have to agree with the trend in sentiment and prices, but as investors we need to know it and understand it.

Here’s a high-level view of the trends in the Industrials sector over the last 5 years. (Click charts to view them full-screen)

S&P Industrials Sector GICS Level 1

The broad sector lacks a trend, hovering near a flat 200-day moving average. It back-tested a couple of long-term Fibonacci extensions in December 2018, then rallied back to the midpoint of its 18-month range. Momentum has weakened over the last few months, and a break below December lows would put the longer-term trend in question. On the other hand, a rally above the highs at 680 puts the next cluster of extensions (near 800) within reach.

The Industrials sector has 12 industries. Of those, 2 are in uptrends, 1 is in a downtrend, and 9, like the overall sector, are struggling to establish a trend. Let’s take a look at each.

Uptrends – Price above a rising 200-day moving average

Commercial Services and Supplies

The group broke above the 2018 highs in March and just kept going. The next long-term extension is up near 420, with a closer level of interest just above 350. The decline in momentum is a potential cause for concern, and it will be important to hold 320 on any pullback.

Road and Rail

The same story here. Momentum is starting to weaken and getting below 1650 would be a problem, but 2180 and 2600 are the levels to watch on the upside.

Downtrends – Price below a falling 200-day moving average

Air Freight and Logistics

It’s been the clear underperformer, but holding above 600 on this decline would be constructive in establishing a bottom. On a retest of the 550 level, I’d be watching for momentum improvement versus the December lows.

Sideways – Price near a flat 200-day moving average

Charts without a trend are messy by nature. Until we get a break out of these ranges, whether it’s up or down, they’re just going to stay messy. With each chart, I’ve identified some levels that could indicate the beginning of a new trend. Of course, at the end of the day they’re just lines on a chart drawn by some analyst. They might not mean anything.

Aerospace and Defense

Levels to watch: Upside 1370. Downside 1180.

Airlines

Levels to watch: Upside 380. Downside 300.

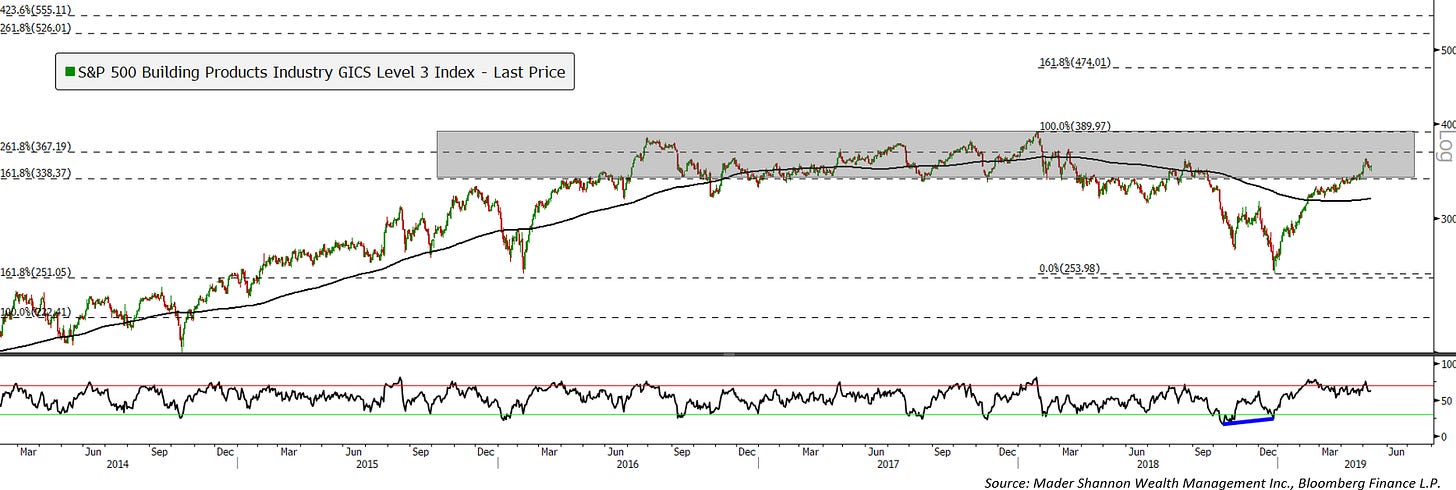

Building Products

Levels to watch: Upside 390. Downside 340.

Construction and Engineering

Levels to watch: Upside 300. Downside 240.

Electrical Equipment

Levels to watch: Upside 800. Downside 680.

Industrial Conglomerates

Levels to watch: Upside 350. Downside 300.

Machinery

Levels to watch: Upside 1115. Downside 930.

Professional Services

Levels to watch: Upside 200. Downside 150.

Trading Companies and Distributors

Levels to watch: Upside 600. Downside 450.

Takeaway

I’ll be watching these underlying industries for a clue as to which way the broad sector will resolve. If more start to break up than down, or vice versa, Industrials as a whole will probably do the same. We’ll see how it plays out.

That’s it for this week. I’m always interested to hear your thoughts.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Sector Review: Industrials first appeared on Grindstone Intelligence.