Sector Rotation is Alive – But is it Healthy?

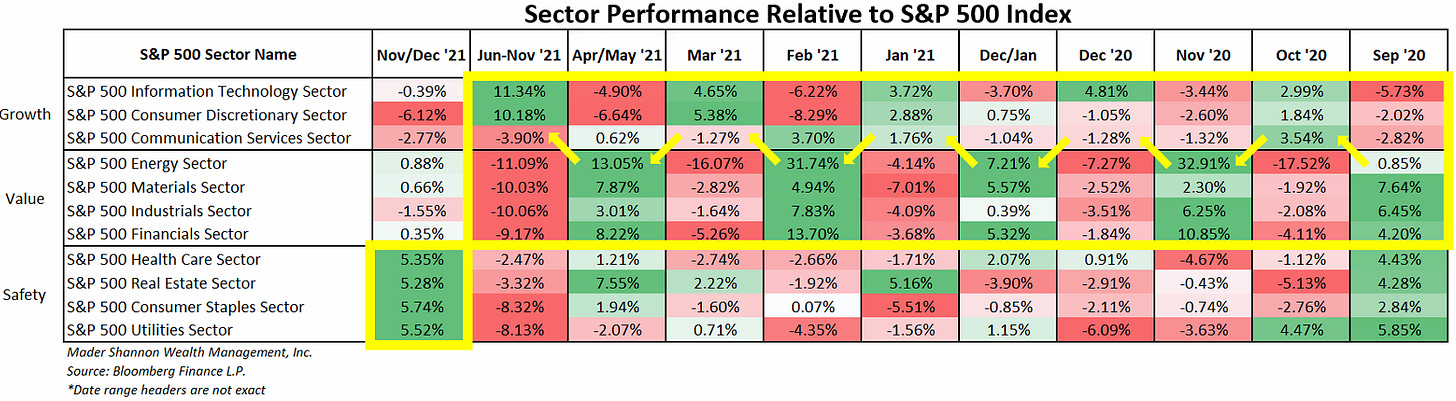

Since last September, growth-oriented sectors and their value-tilted counterparts have alternated in leadership roles to propel U.S. stocks steadily higher. One month would be dominated by Information Technology, Consumer Discretionary, and Communication Services, and the next by Energy, Materials, Industrials, and Financials. The only consistent action has come from the group more commonly associated with risk aversion – Safety sectors underperformed in virtually every period. Until now that is.

Health Care, Real Estate, Consumer Staples, and Utilities have each outperformed the S&P 500 Index by more than 5% since mid-November.

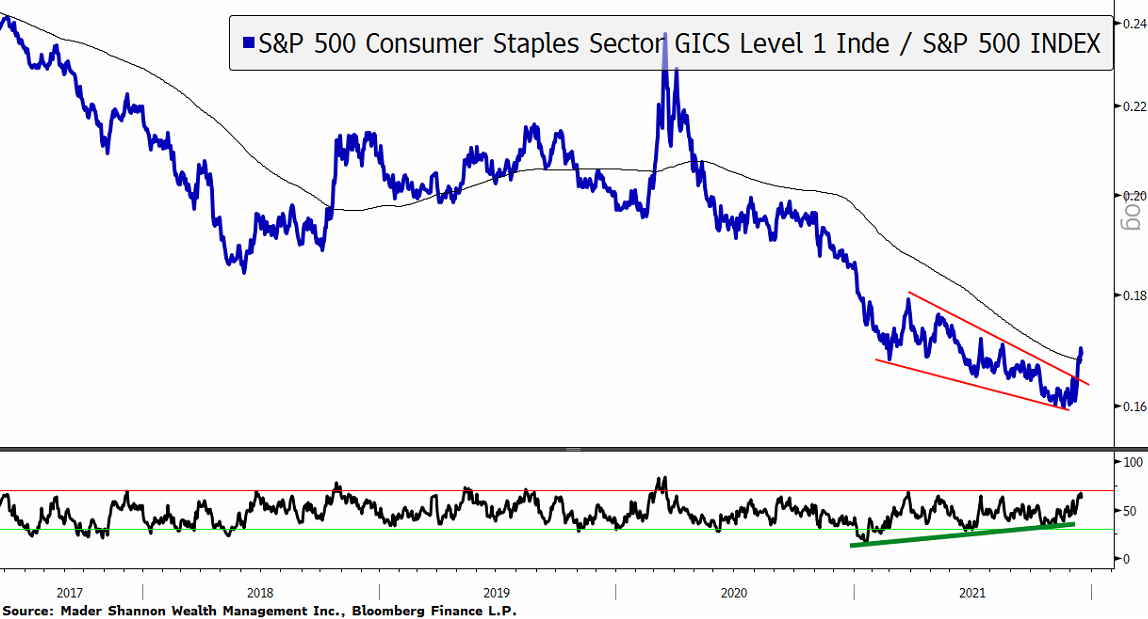

Consumer Staples are threatening to break out of a multi-year downtrend relative to the S&P. The sector spent the first eleven months of 2021 setting lower highs and lower lows, but momentum actually troughed back in January. On the most recent decline, RSI failed to even reach oversold territory. During the last few weeks of trading, the ratio has broken a downtrend line and closed above its 200-day moving average for the first time since last spring.

The Utilities sector looks similar, with momentum improving throughout 2021 and failing to get oversold on the most recent decline.

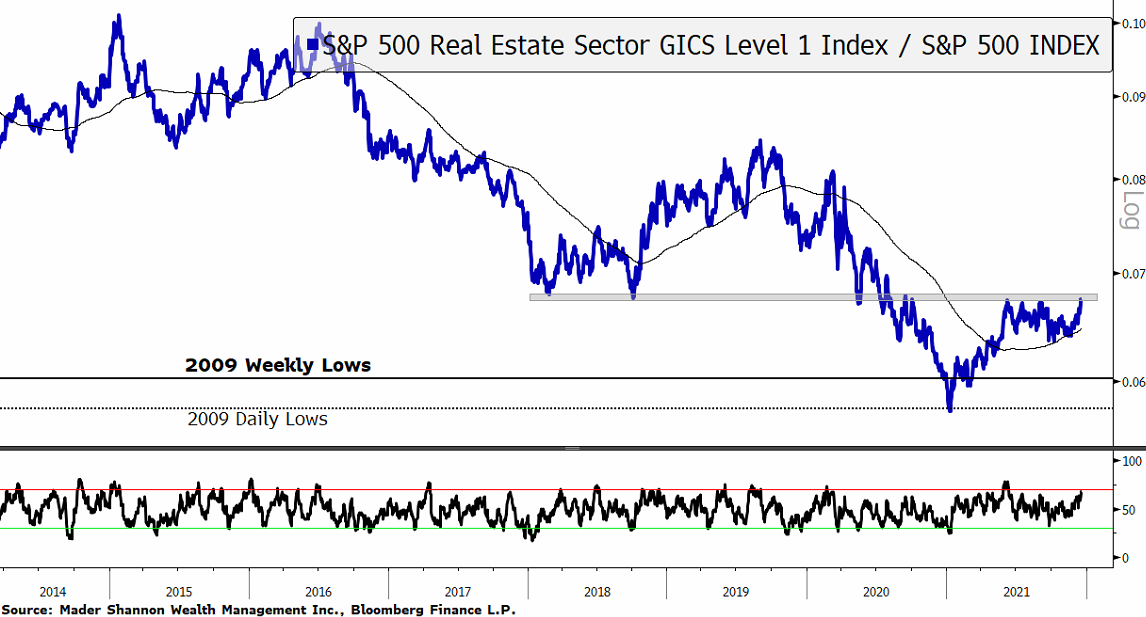

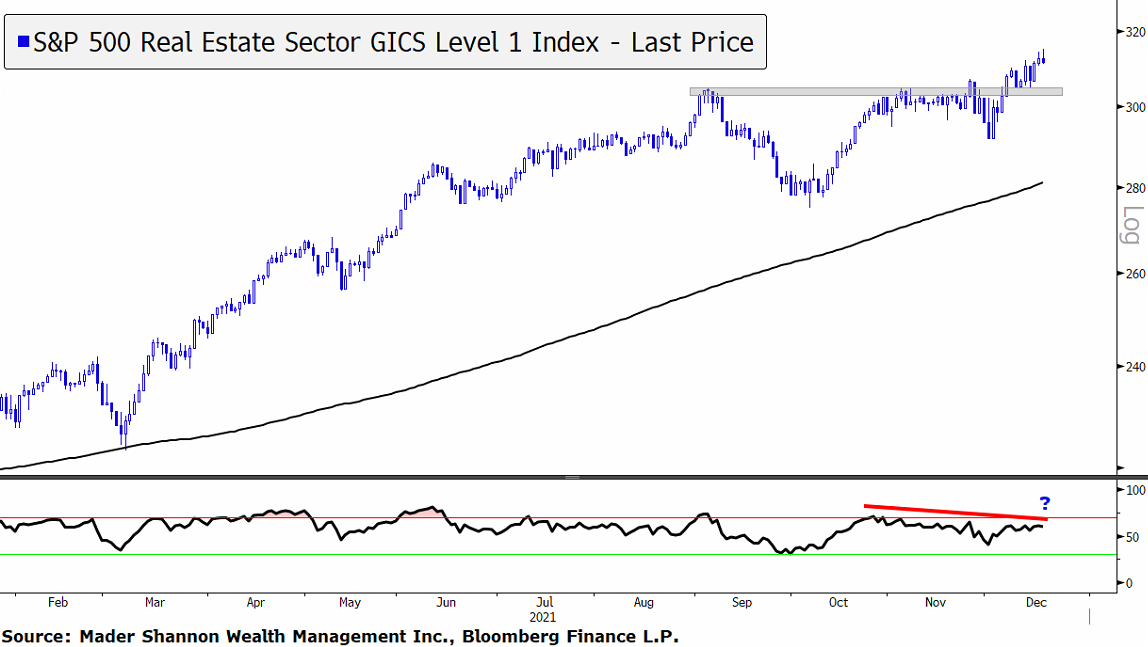

Real Estate set its low vs. the S&P 500 back in January at the exact same place it bottomed in 2009.

The ratio is above a rising 200-day moving average but still battling resistance set up by the 2018 lows. Another week like the last would turn that overhead supply into support.

The problem with leadership by sectors like these, however, is that it’s rarely a sign of healthy market action (Utilities tend to outperform not by rising more than the rest of the market, but by falling less). Perhaps this time is different, though.

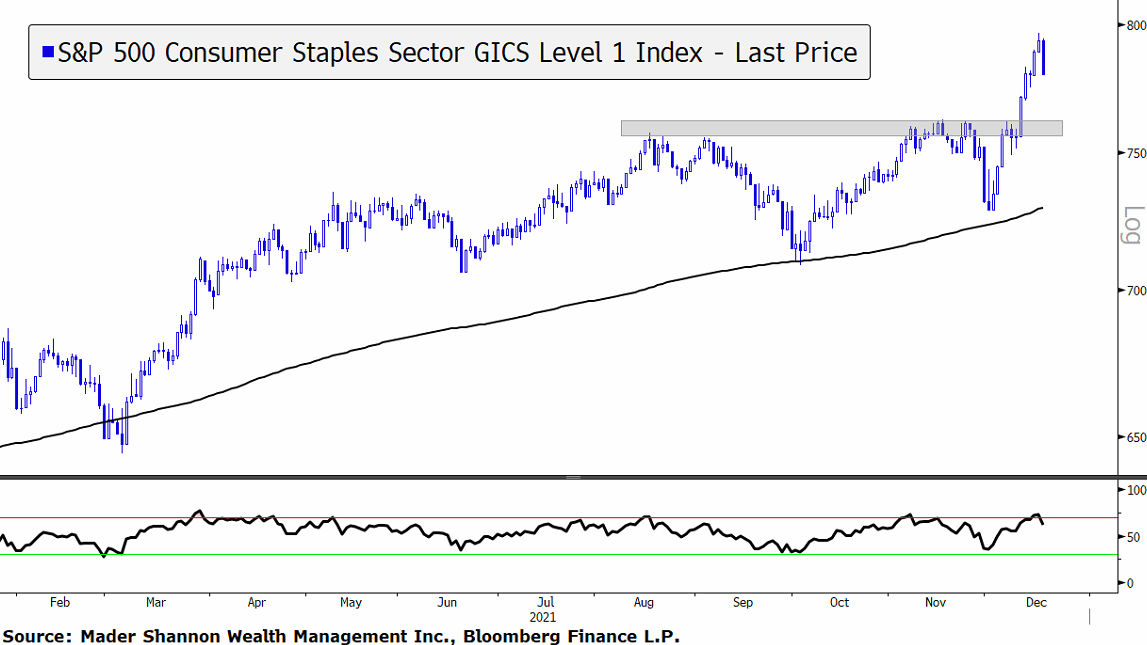

While broad equity indexes have certainly seen increased volatility of late, they haven’t really experienced a major decline. Instead, the outperformance by defensive areas has been attributable to good old fashioned new highs.

Consumer Staples have screamed higher, breaking through resistance created in August and October.

The same goes for Utilities.

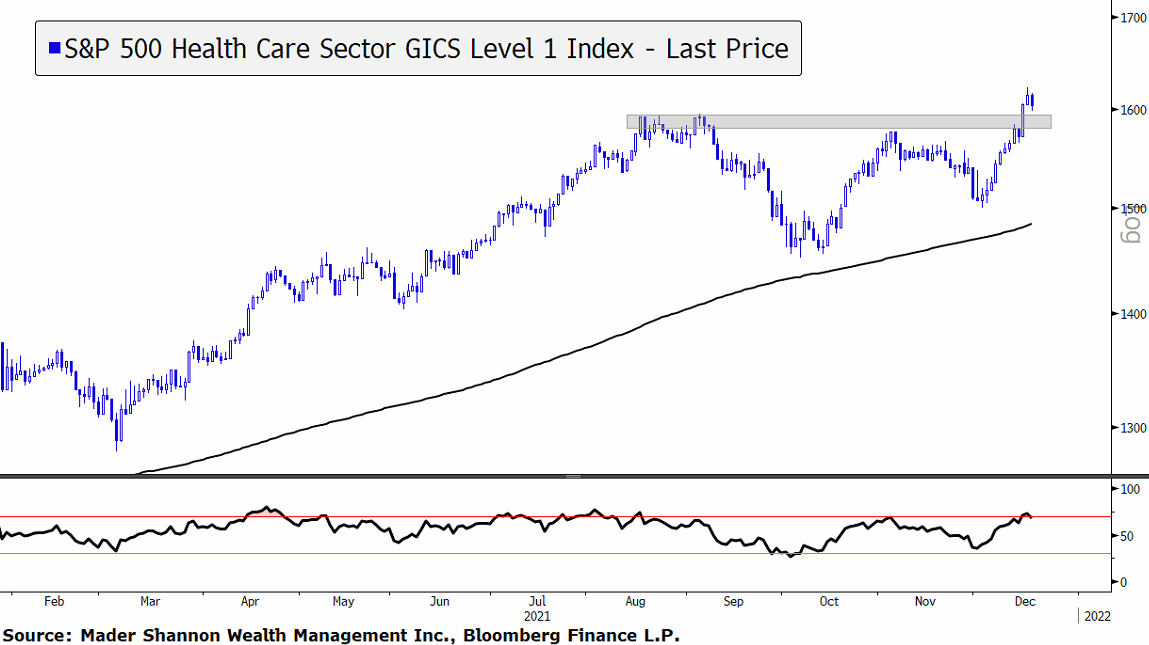

And Health Care.

And Real Estate.

Leadership by Safety, then, could just be a hallmark of healthy rotation. After all, if there’s one thing we know about new all time highs, it’s that they aren’t bearish. And it’s hard to picture a scenario where 4 of the S&P 500’s 11 sectors continue setting new all-time highs, but stocks overall are in a major decline.

So what could go wrong?

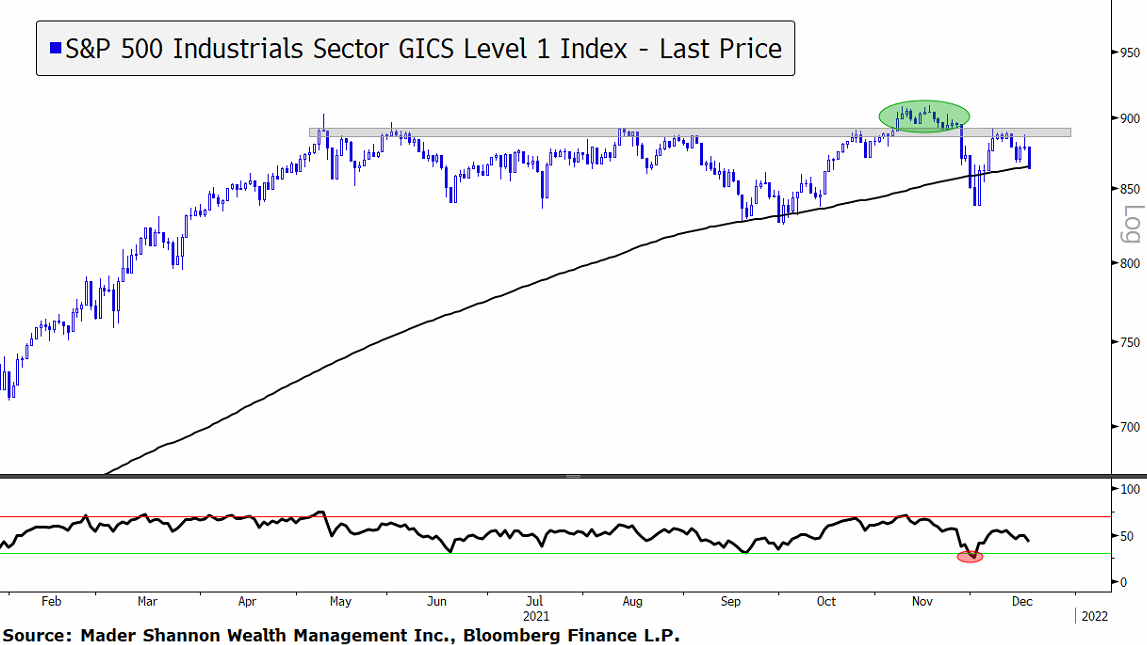

Those new highs in Safety could follow the example set by other areas of the market. They could turn into false breakouts like this:

In a world where no stocks can sustain breakouts, equity gains will be hard to come by.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post Sector Rotation is Alive – But is it Healthy? first appeared on Grindstone Intelligence.