Strength Beneath the Surface: Don't Ignore the Industrials - 12/13/2023

Sector Deep Dive

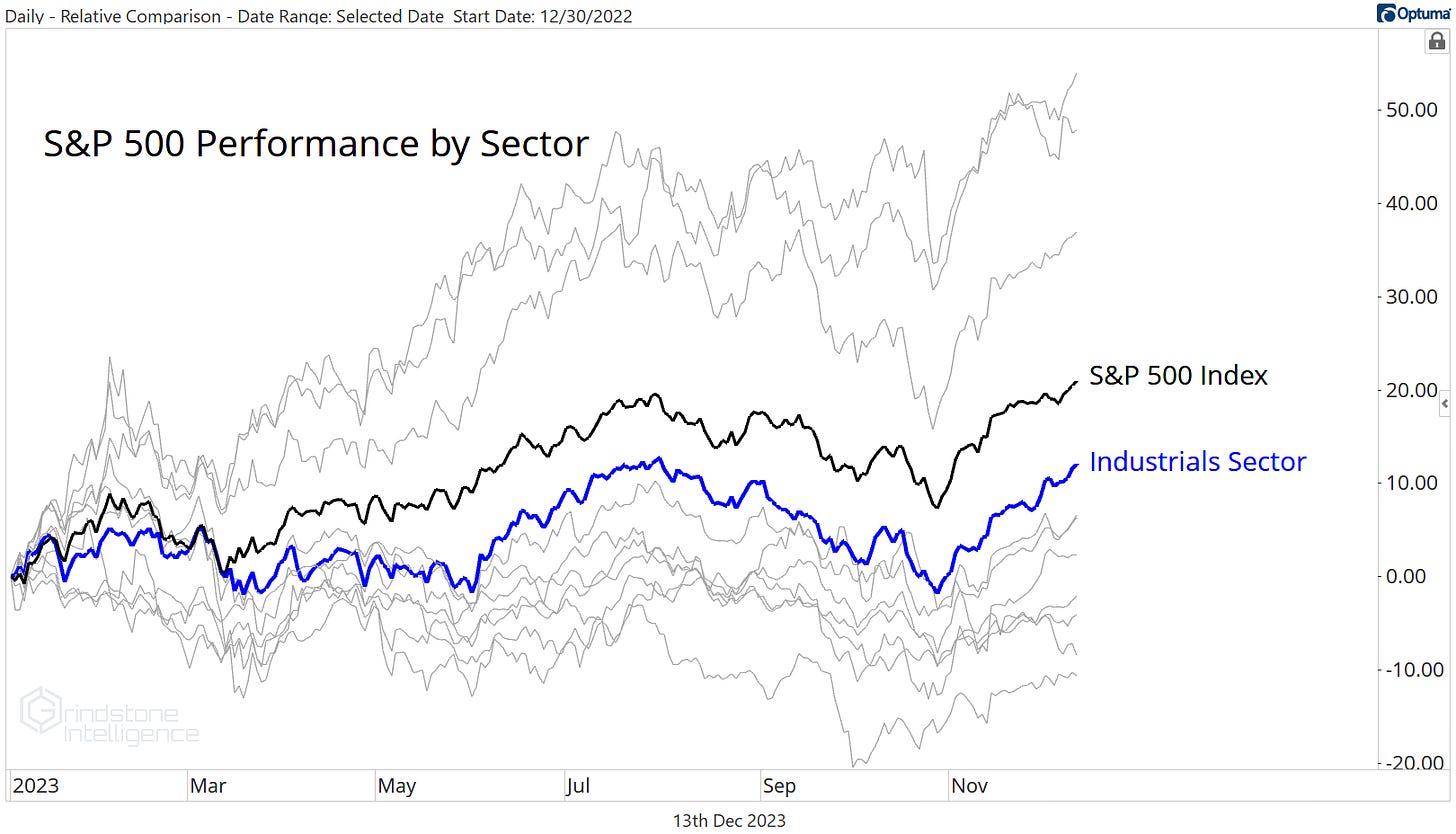

A surface-level glance at stock market returns this year will tell you that gains are limited to a handful of mega cap growth stocks. Thanks to leadership from the Elite 8 (Apple, Amazon, NVIDIA, Microsoft, Alphabet, Meta, Tesla, and Broadcom) the Information Technology, Communication Services, and Consumer Discretionary sectors are each up more than 35%. The next closest contender, the Industrials, is up just 12%.

Those who’ve followed our work know we never stop at a surface-level look.

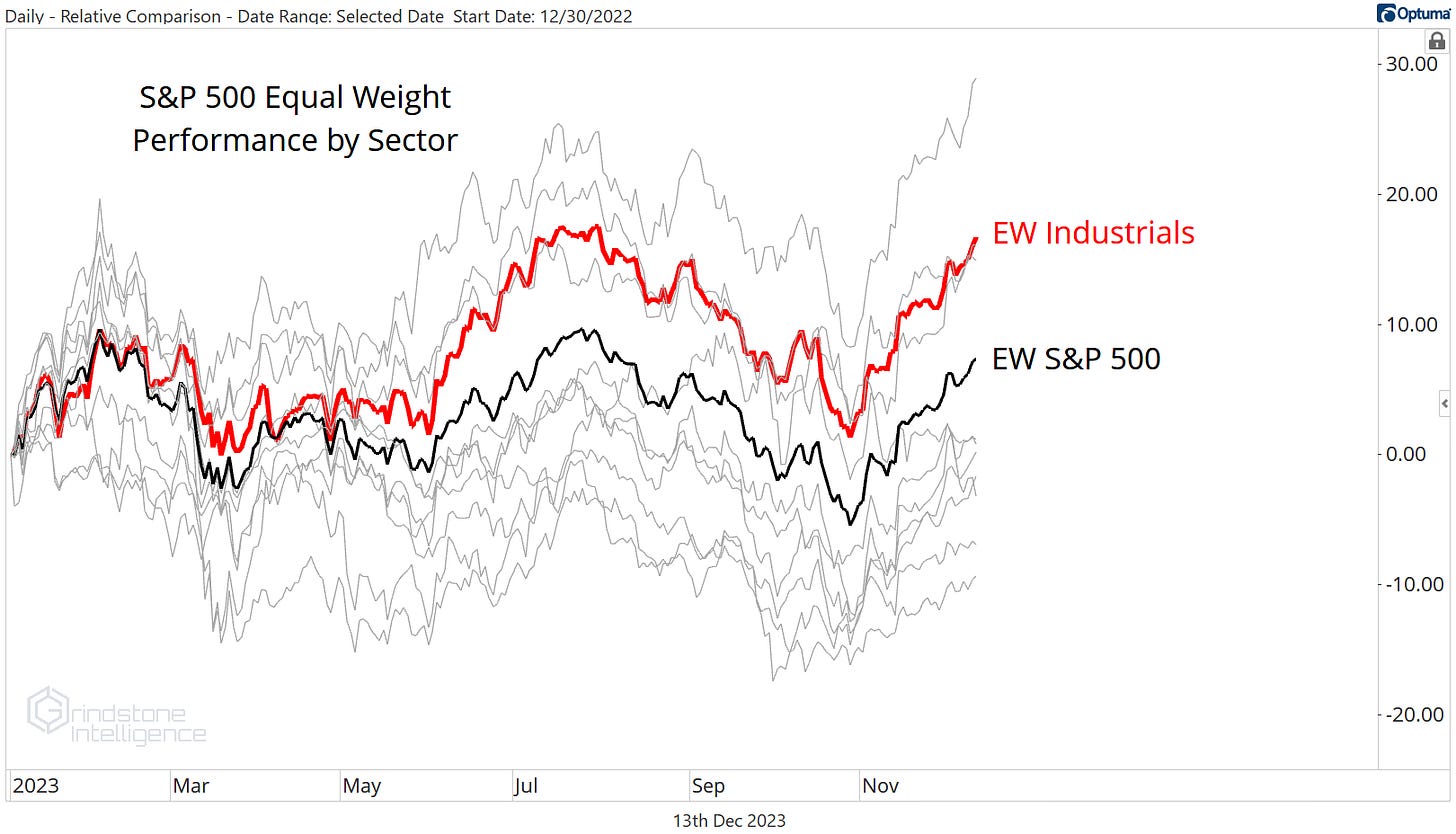

And below the surface, the Industrials sector has been a leader from the start. For the last year, they’ve lagged only Tech on an equally weighted basis.

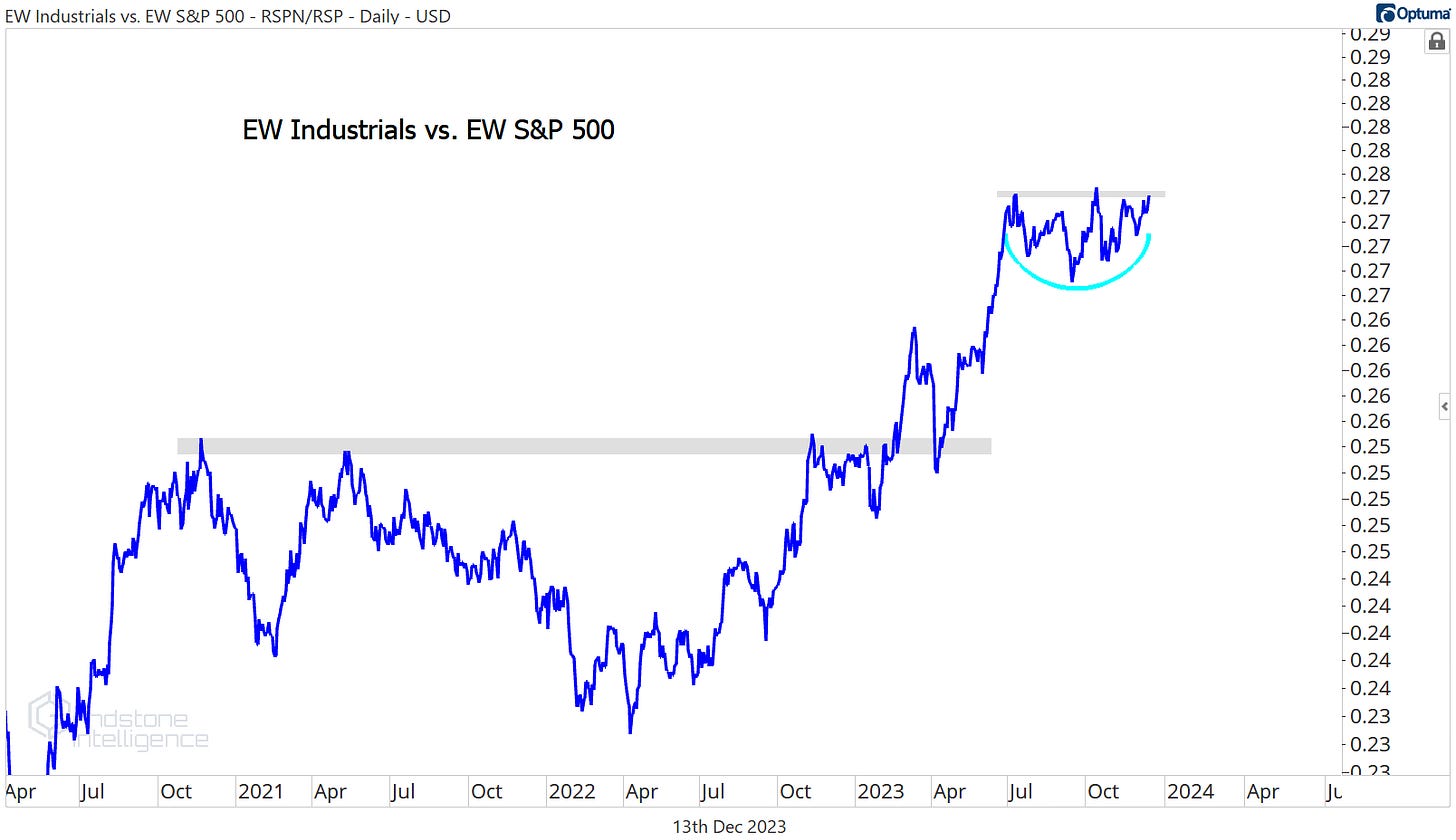

Our single favorite chart to depict the relative strength within the Industrials has been this one, which compares the equally weighted sector to the equally weighted S&P 500.

Since setting that relative bottom in April 2022, the EW Industrials have outperformed the rest of the market by 17%. And they’re set to begin another leg higher.

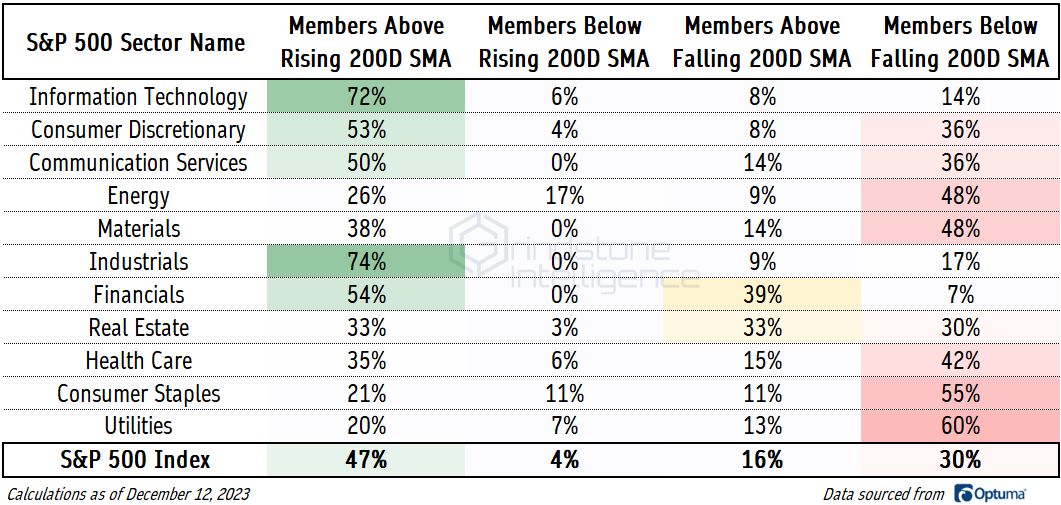

Driving the move is the strongest uptrend breadth of any large cap sector in the index. 74% of S&P 500 Industrial stocks are above a rising 200-day moving average, and just 17% are below a falling 200-day.

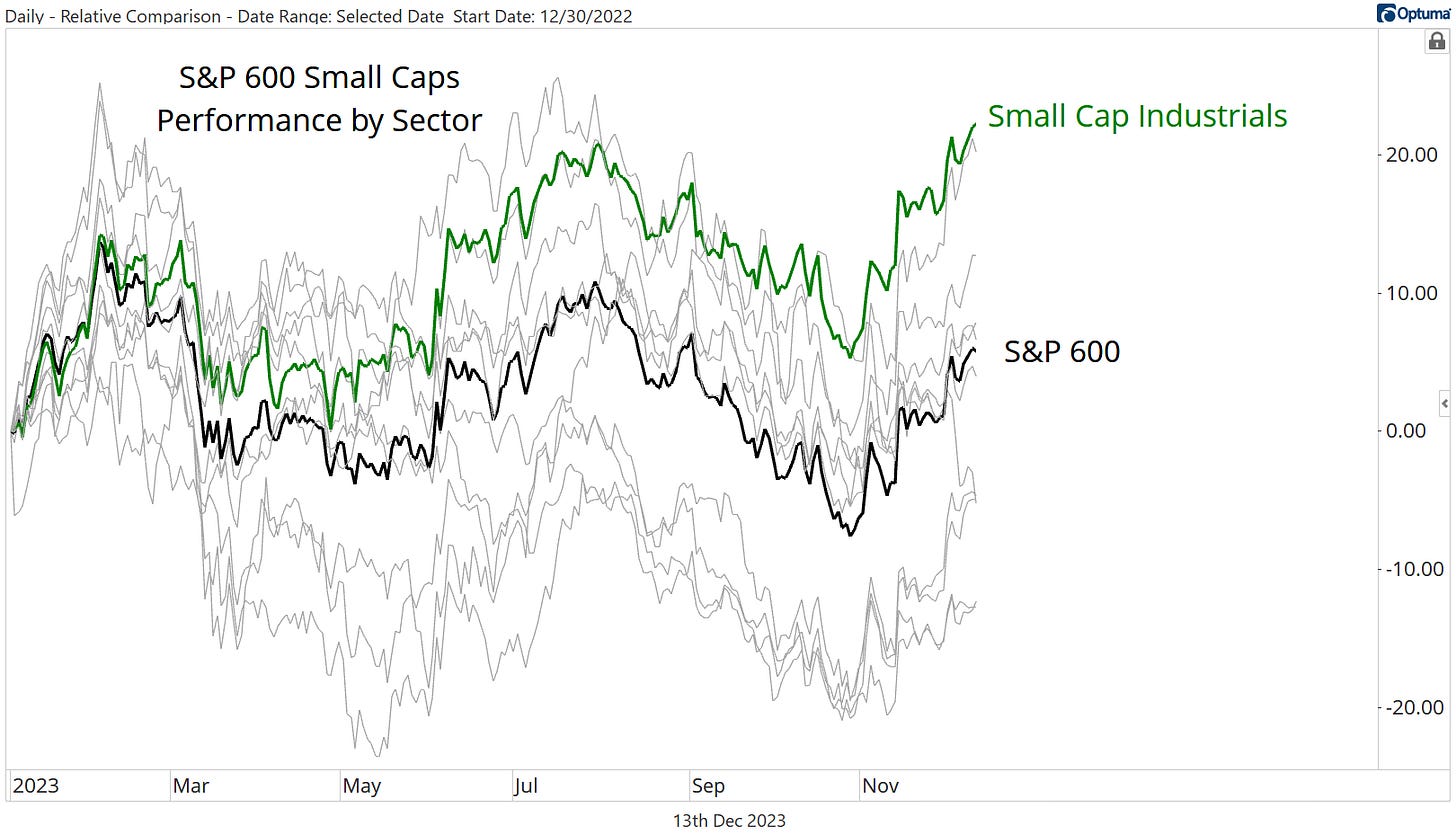

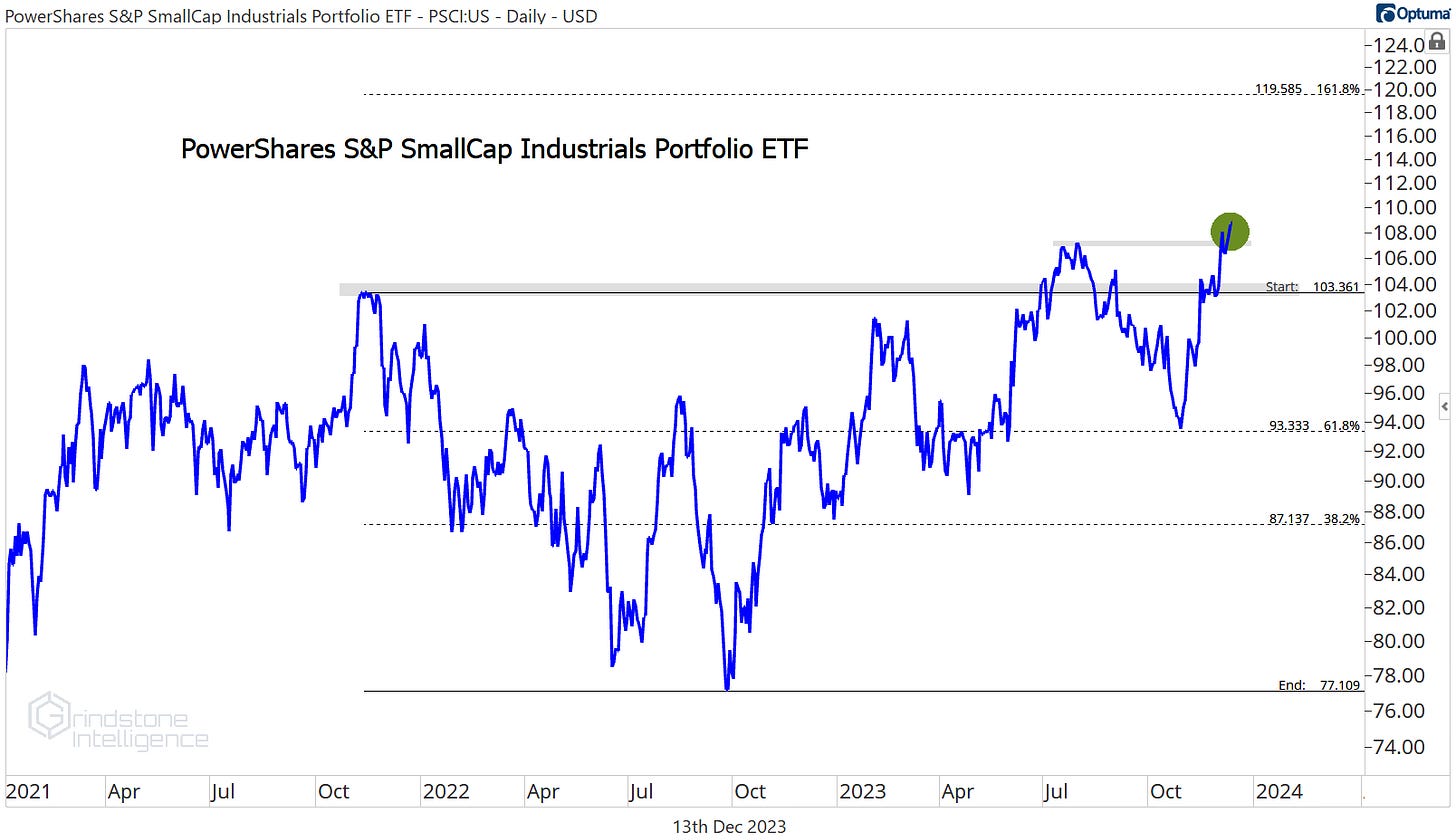

It’s not just the large cap space where we’re seeing the Industrials show strength. In the small cap space, they’re showing even more. No small cap sector has been better than the Industrials. They’re up more than 22% for the year, nearly 4x the gain of the small cap index overall.

The latest leg of this rally has pushed the small cap Industrials to new all-time highs. That’s not bearish.

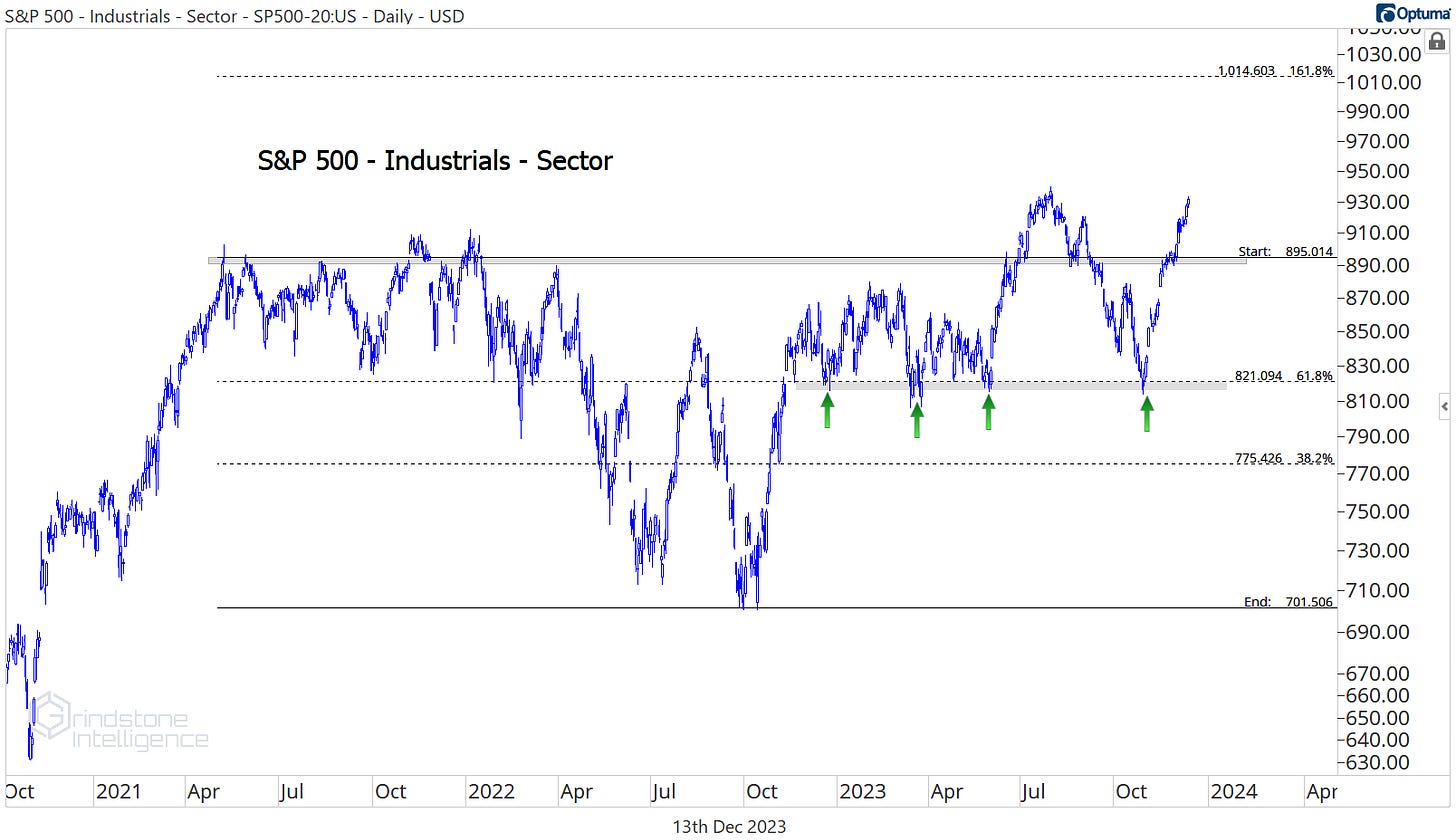

And the large-cap group isn’t far behind. They’re just 0.6% away from the all-time closing high set back in August.

With all that strength beneath the surface, we expect the breakout to come sooner, rather than later.

Digging Deeper

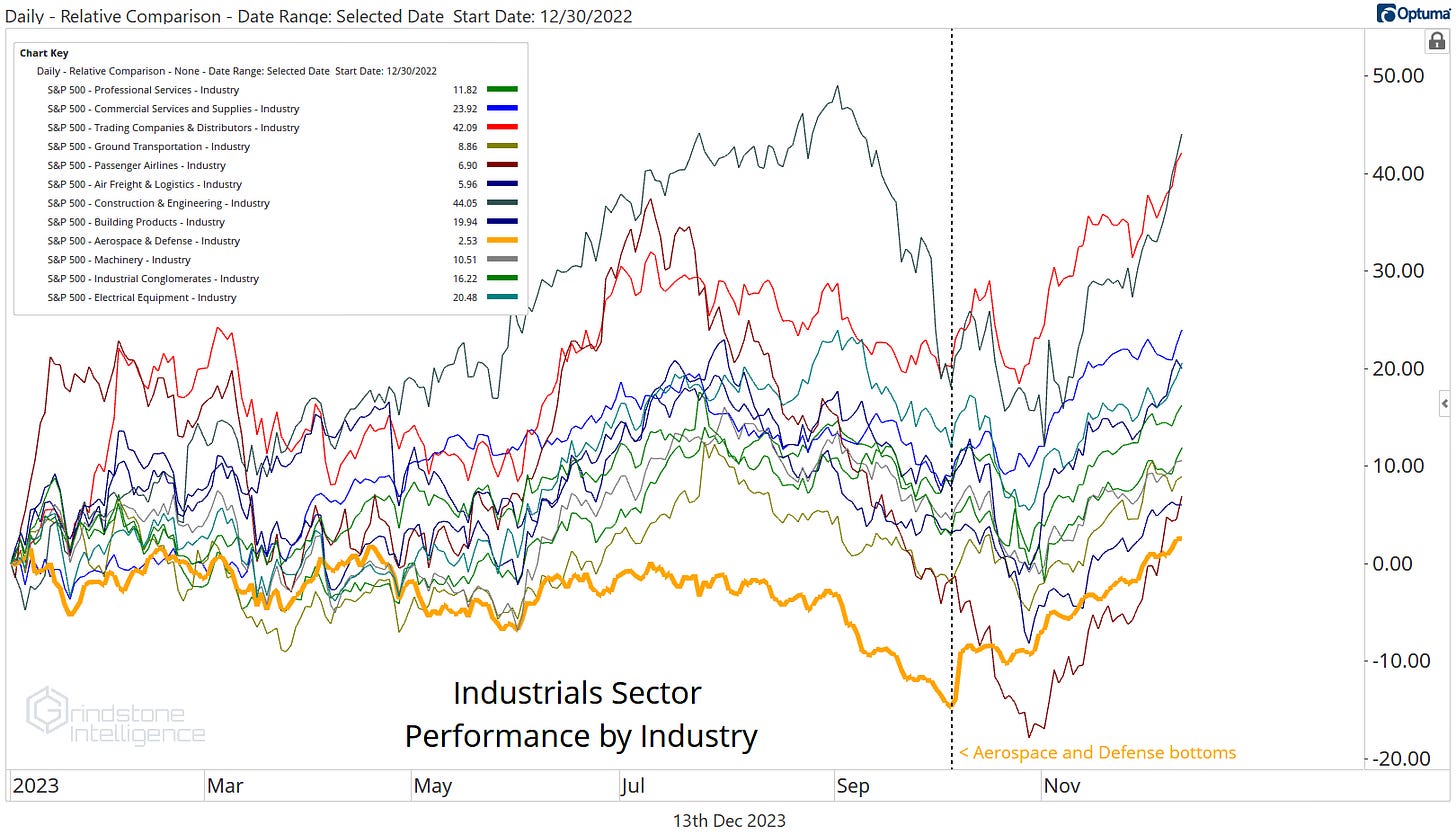

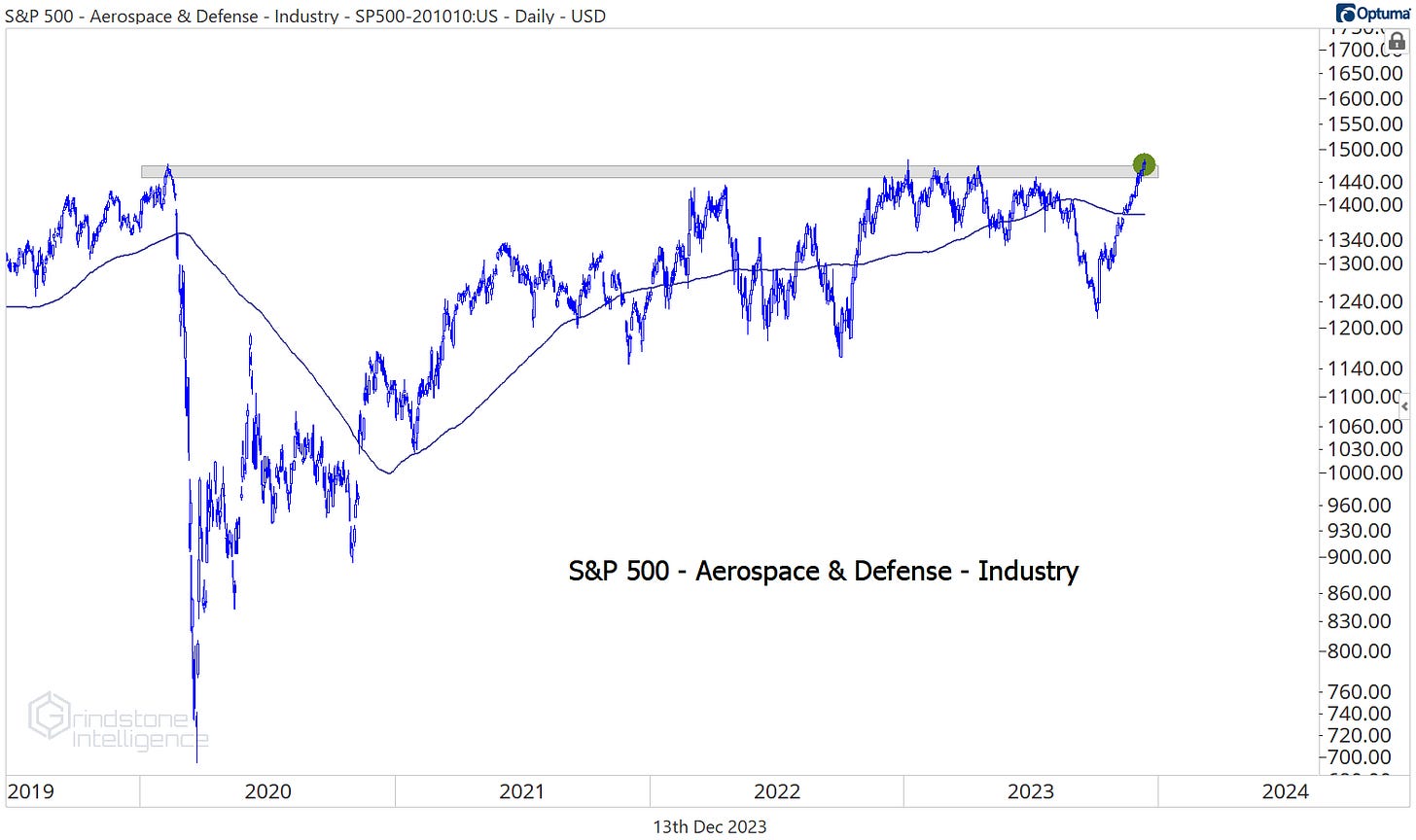

One of the big drags on the large cap sector this year has been the Aerospace and Defense industry. Most of the sector - and most of the US equity market in general - rallied throughout May, June, and July. Aerospace and Defense (in yellow below) did not. The summer divergence is hard to miss.

But then something changed. Aerospace and Defense stocks were among the very first to bottom this fall. They troughed on October 4th, more than 3 weeks before the S&P 500 did on October 27th.

And this week, the industry completed the turnaround by finally surpassing the pre-COVID highs.

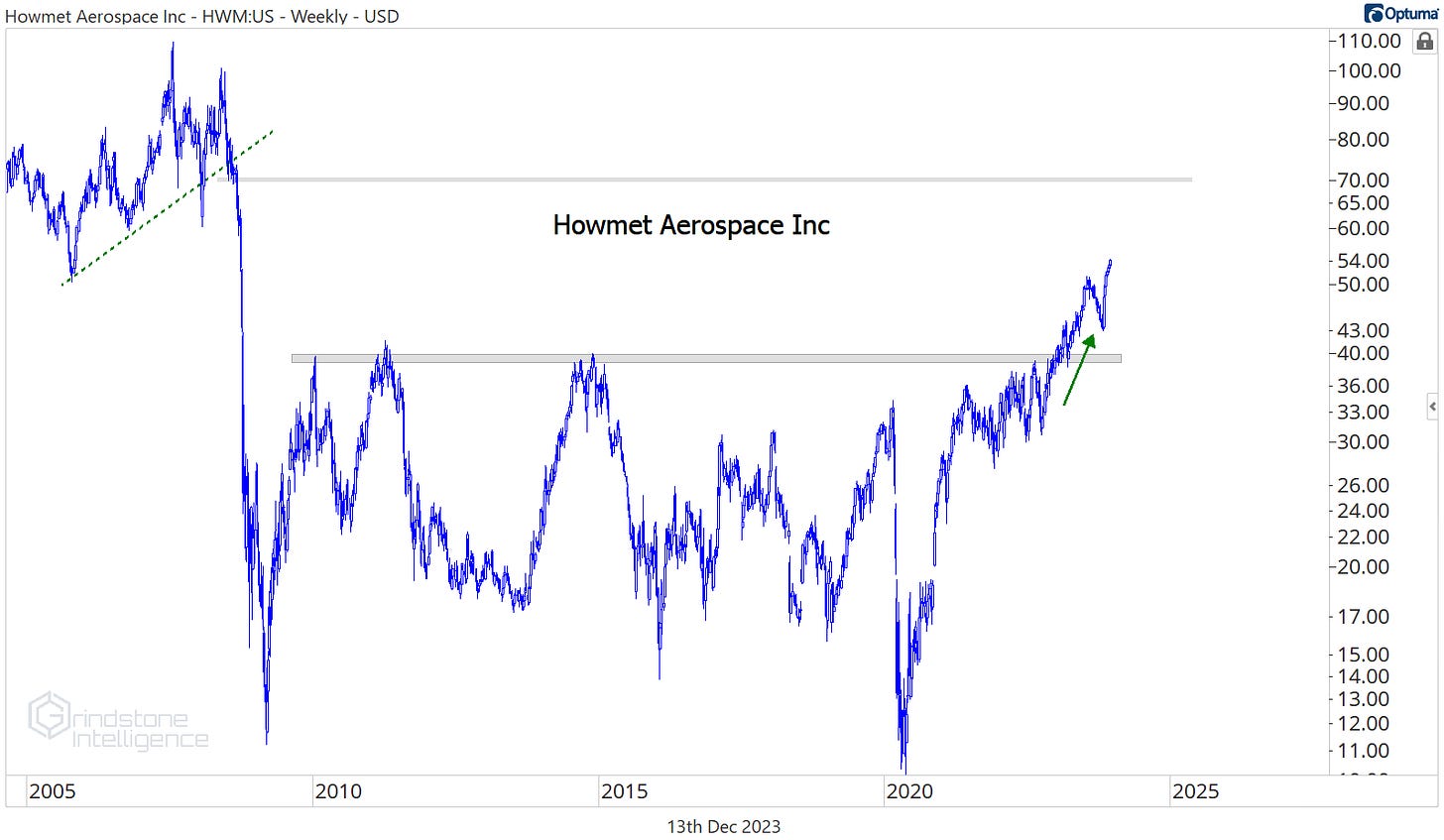

We’ve been big fans of Howmet Aerospace ever since it broke out of this huge, 15-year base at the start of the year, and the added tailwind of the overall industry breaking out should help the stock reach our target of $70.

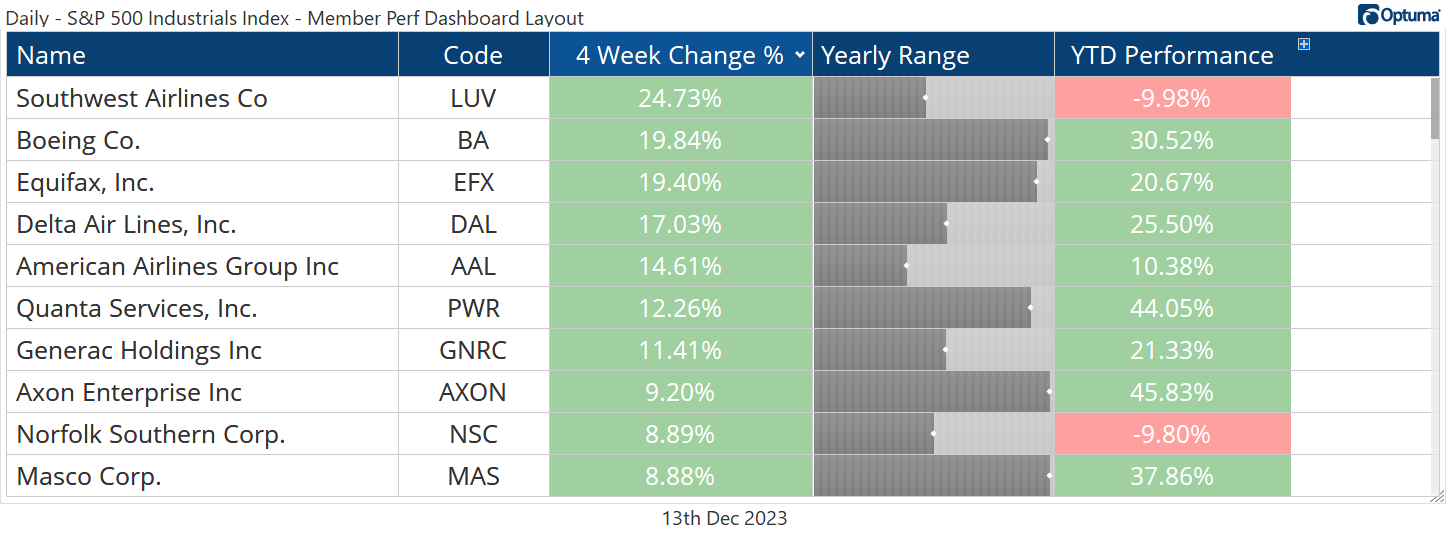

Leaders

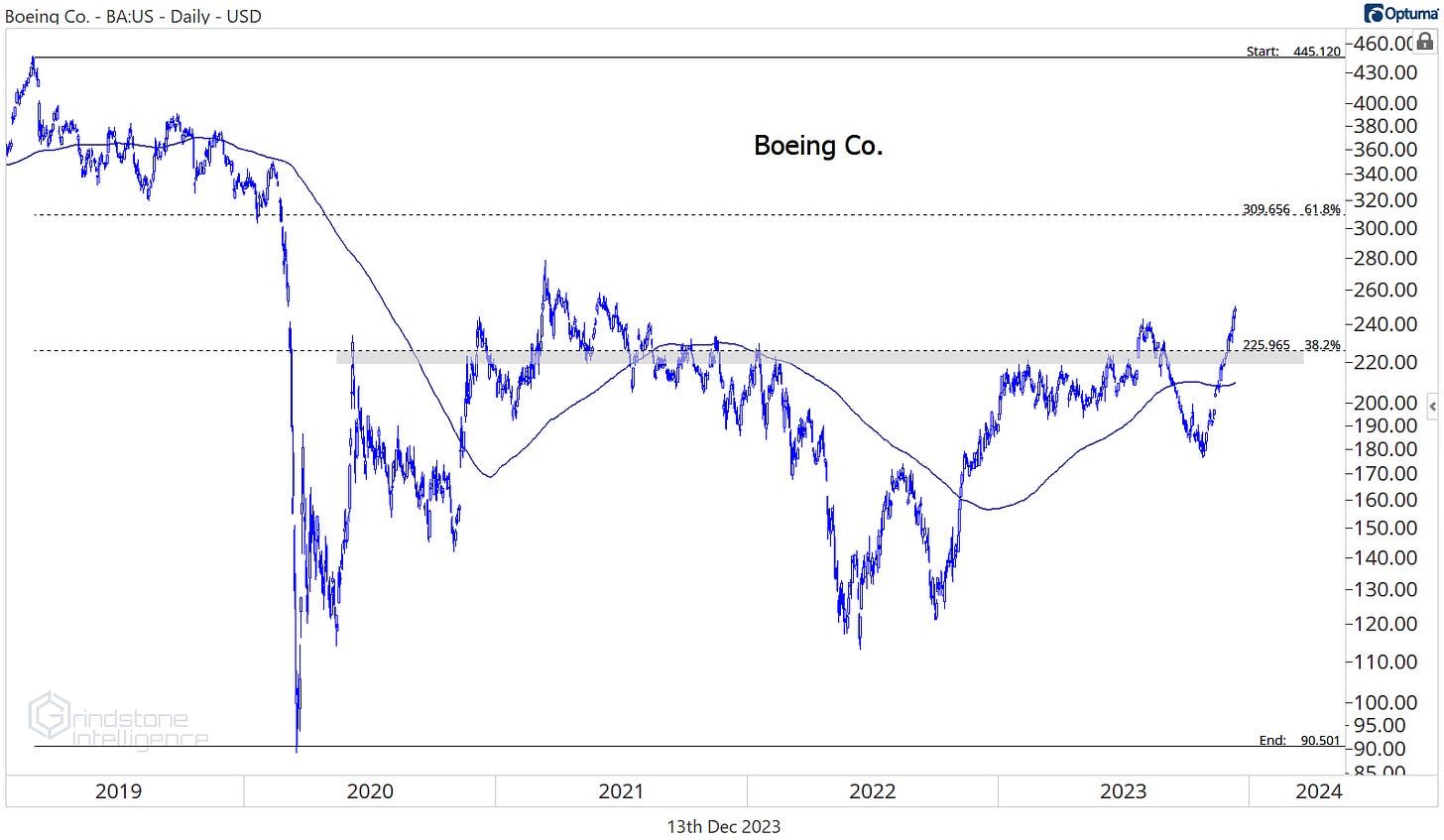

Boeing is another Aerospace and Defense name, and they’re a big driver behind the latest leg of the rally. BA has risen almost 20% over the last 4 weeks.

We like that the stock is breaking out vs. the rest of the sector, further solidifying the relative uptrend that started from the summer 2022 lows.

We want to be buying Boeing as long as it remains above $225 with a target of $310, which is the 61.8% retracement from the 2019-2020 selloff and also the place where downside acceleration began in February 2020.

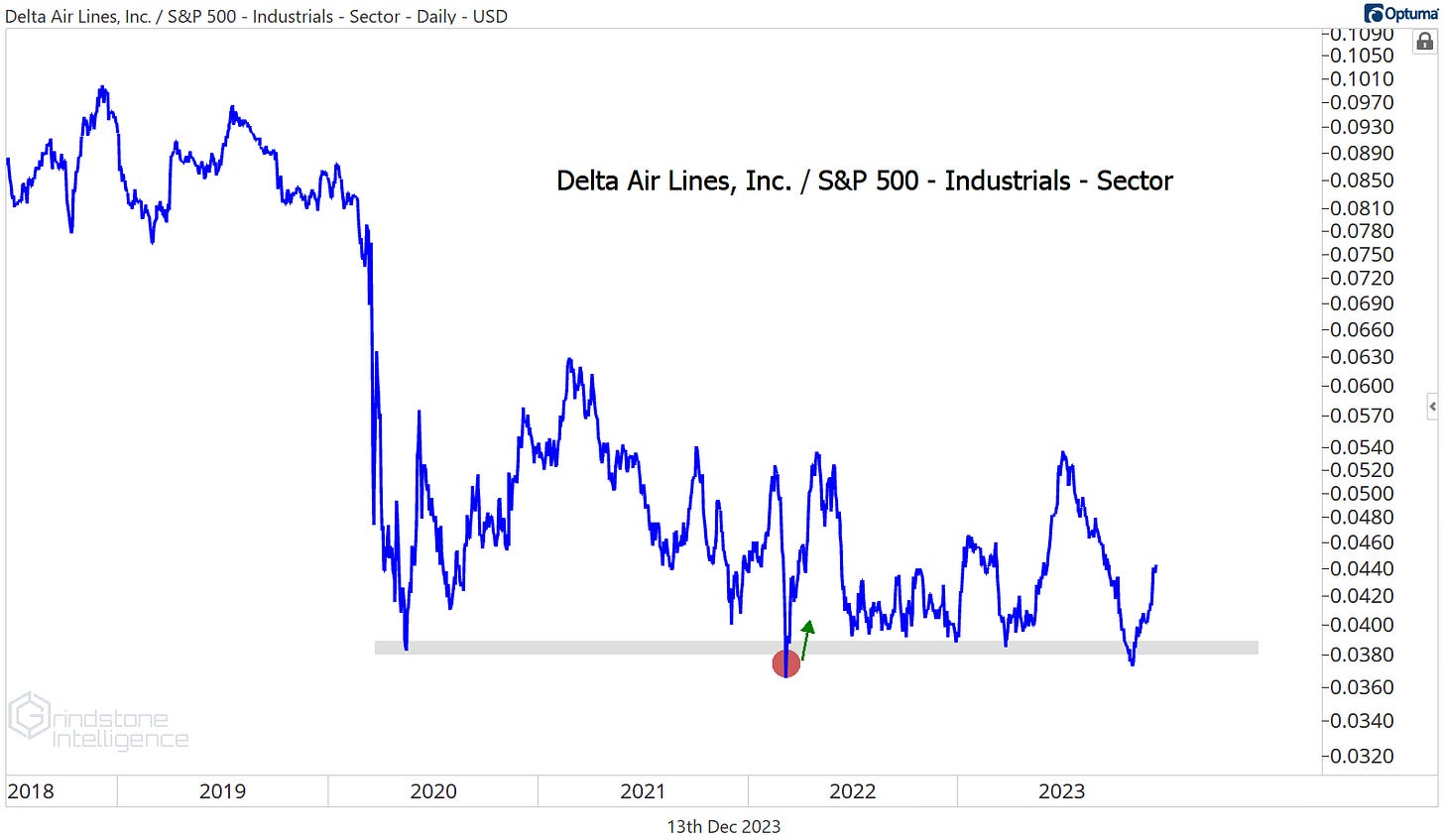

The biggest winners list is riddled with airlines, but most remain stuck in downtrends when compared to relevant benchmarks. Delta is one exception. Relative to the overall sector, DAL continues to hold the lows that were set more than 3 years ago. Eventually, this could become a base to rally from. But there’s more work to do before we’ll have real confidence in approaching DAL from the long side.

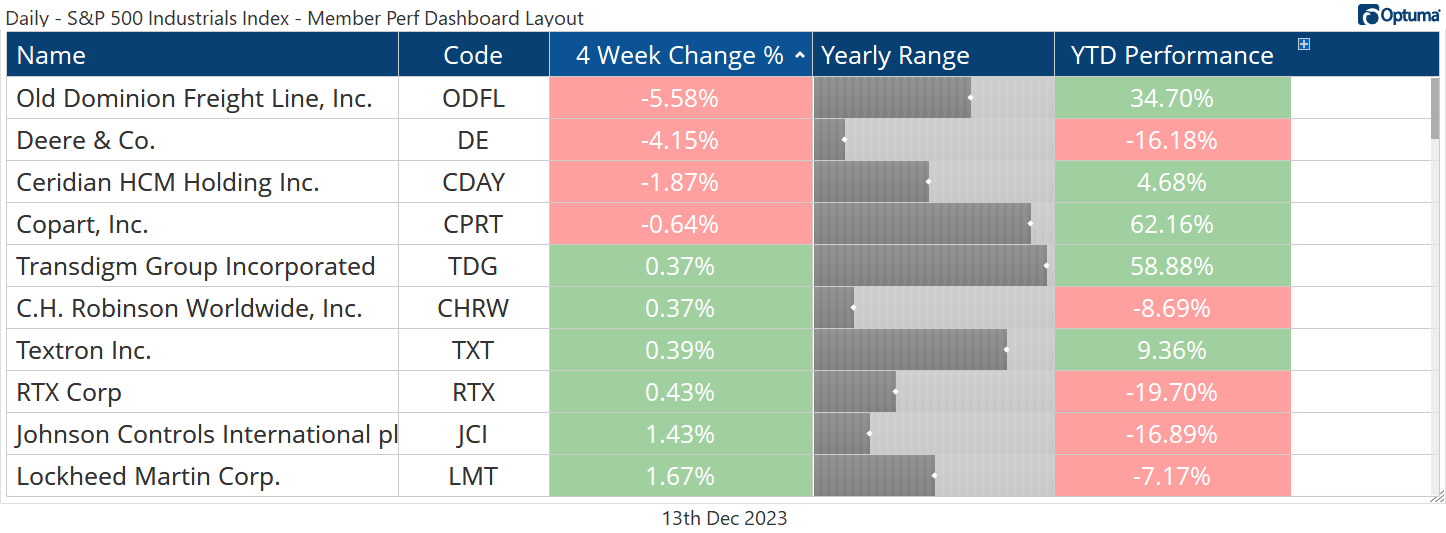

Losers

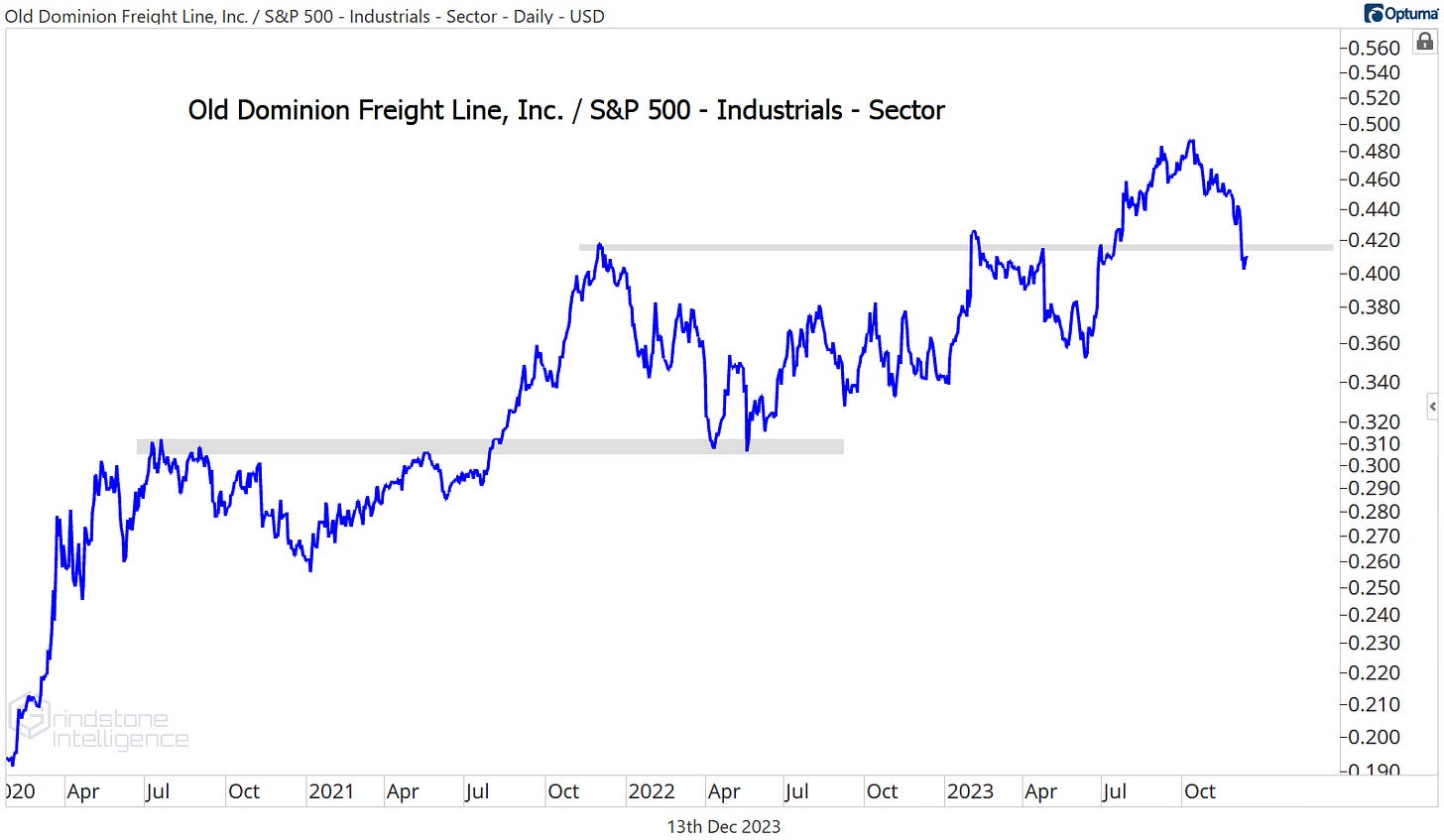

Old Dominion has struggled over the last month, but the stock is still in a structural uptrend. The trend is intact as long as prices are above $360, so we want to be buying any pullbacks towards that level with a target back to the highs of $440. We think it eventually goes to $570 - but we only want to own it above the brim of the 2021-2023 cup and handle pattern.

The only thing we don’t like about ODFL is this potential breakdown relative to the rest of the sector. We need to see the relative strength stabilize here near these former highs. Otherwise, we want to spend our time looking elsewhere.

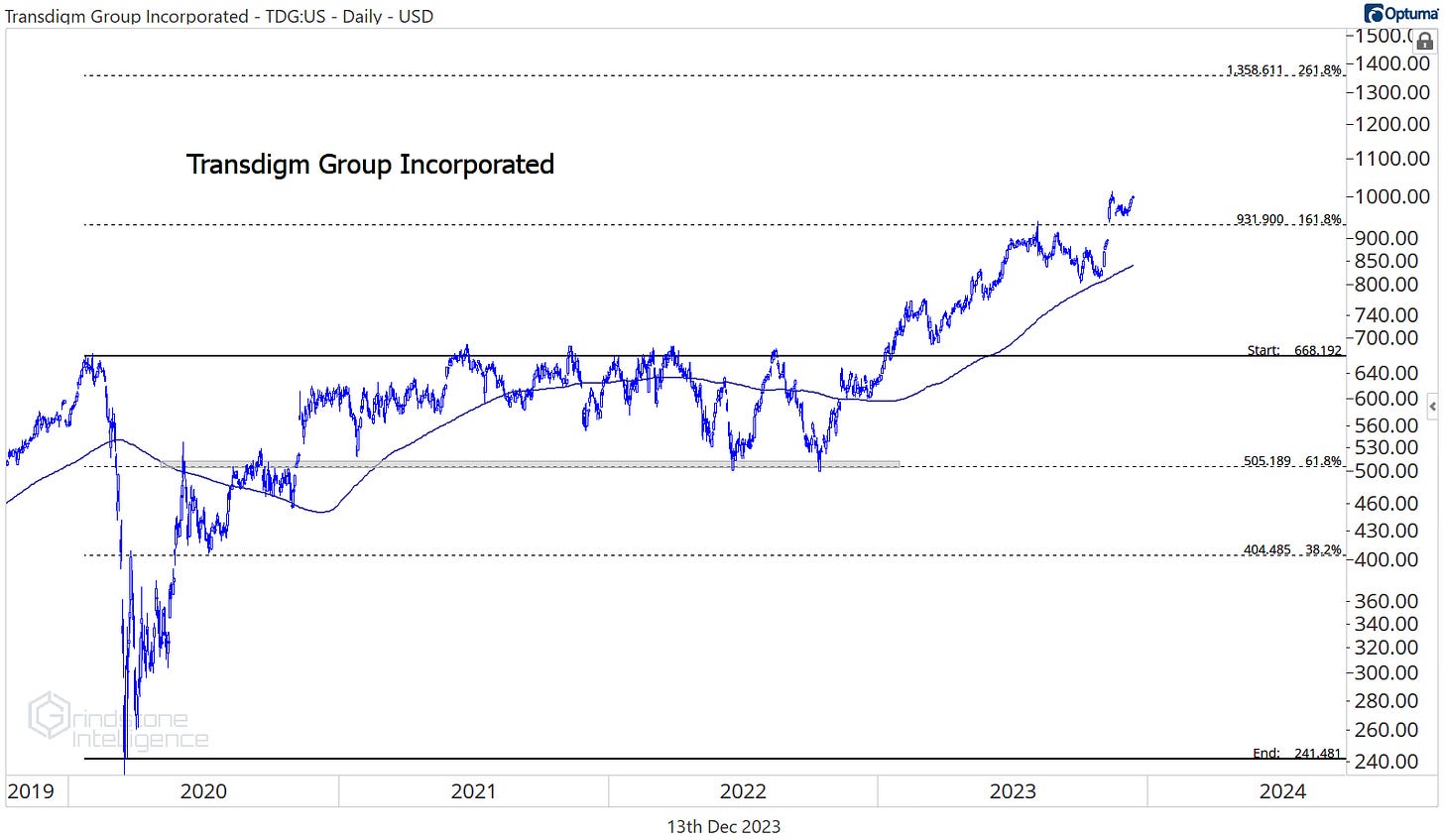

Copart and Transdigm have both gone nowhere over the past month, but both are uptrends worth buying. For CPRT, we want to be long above $45 with a target of $65, which is the 423.6% retracement from the 2020 decline.

For TDG, our target is the 261.8% retracement from the 2020 selloff, which is up near $1300.

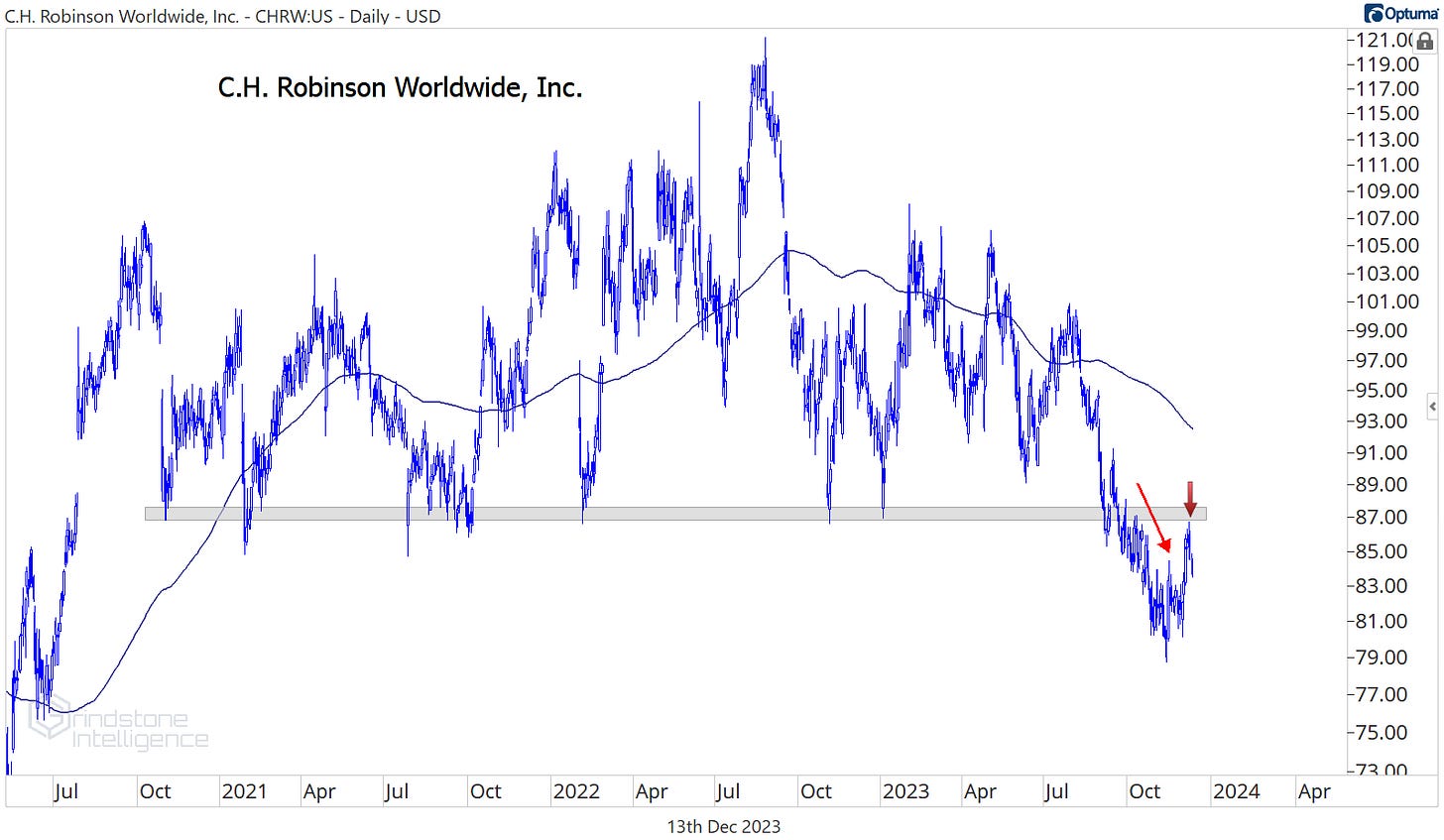

CH Robinson is one we want to leave alone. It broke down to multi-year lows over the summer, and last week got rejected by that former area of support. We can’t approach CHRW from the long side as long as it’s below $88, and we aren’t really interested in looking for short opportunities in a bull market.

Other Notable Charts

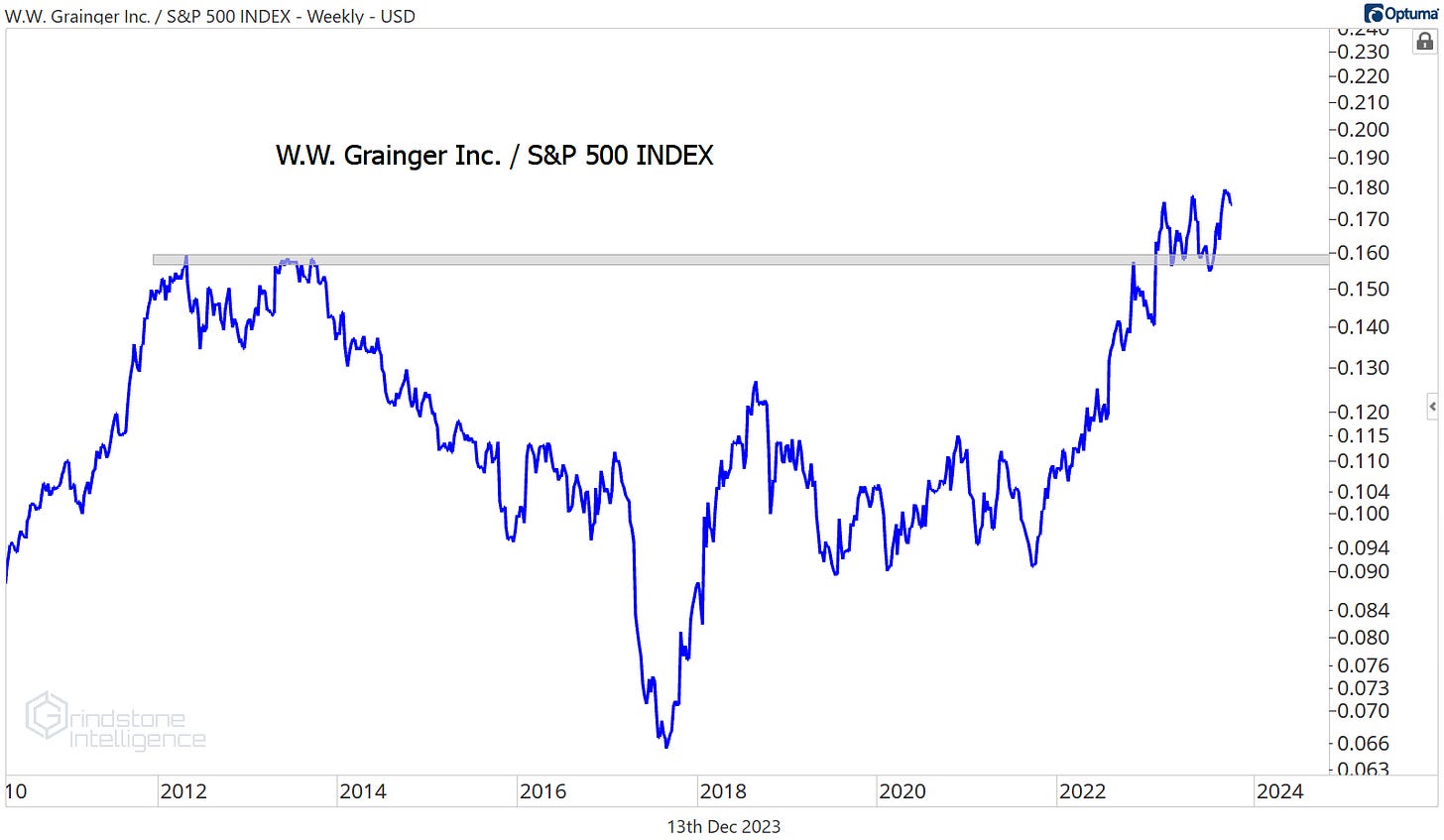

We love that GWW just broke out of a 10 year base relative to the S&P 500. It failed at those 2012 highs last October, then pushed above them in January, and successfully backtested them in April, May, and again in September. Now that it’s digested the breakout, Grainger is setting new relative highs again.

It won’t get there overnight, but with the stock in a long-term uptrend on both an absolute and a relative basis, we think GWW eventually heads to $970, which is the 685.4% retracement from the 2013-2017 decline.

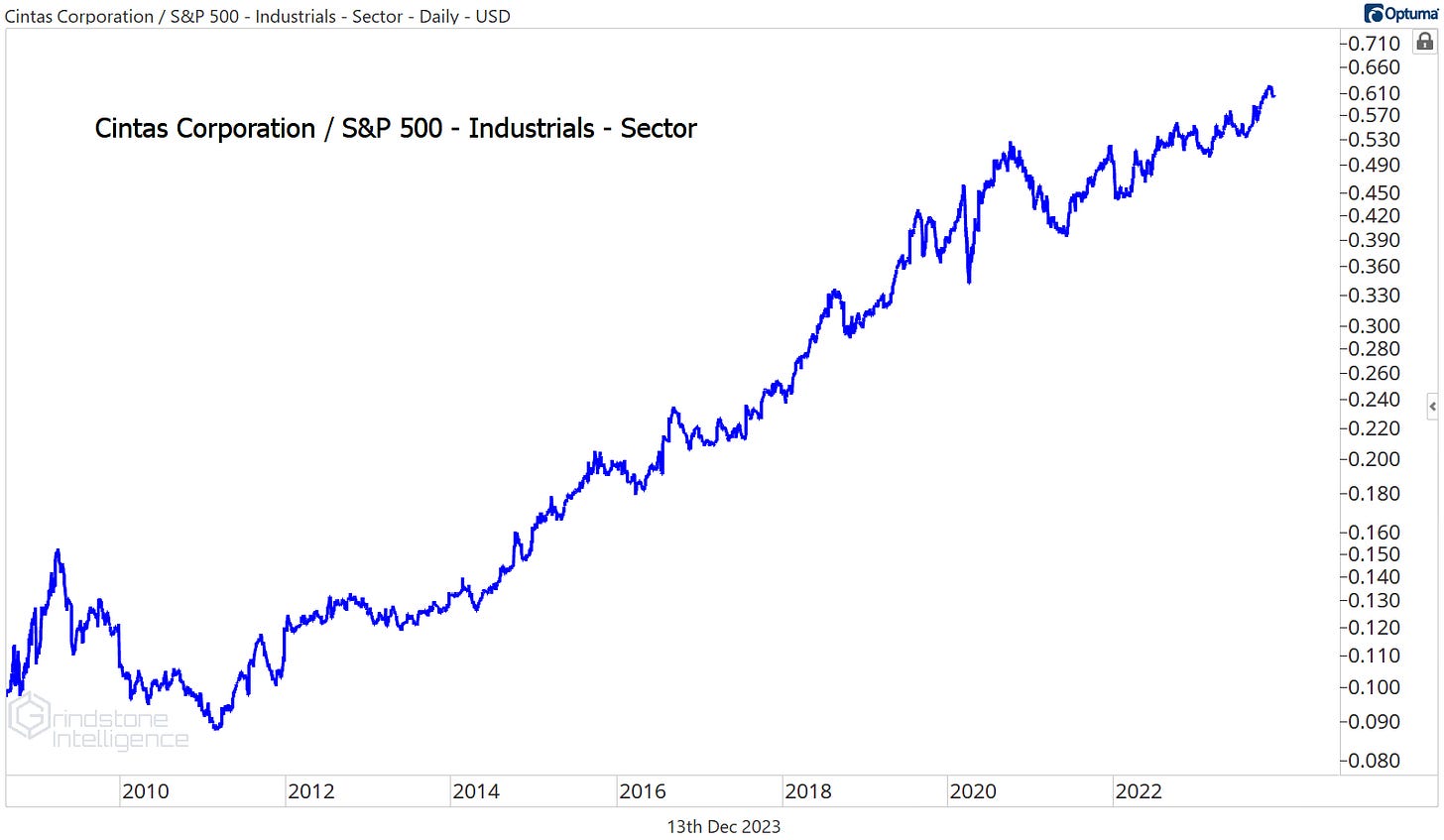

CTAS broke out of a 4-month base in November, then spent 3 weeks in a textbook flag pattern before breaking out to new highs again over the past few days. Our target here is $625.

It’s not just that Cintas is setting new highs. We want to be focusing our attention on the companies that are showing relative strength by outperforming the alternative assets that we could own. That’s exactly what CTAS is doing. It just set new highs vs. the rest of the sector.

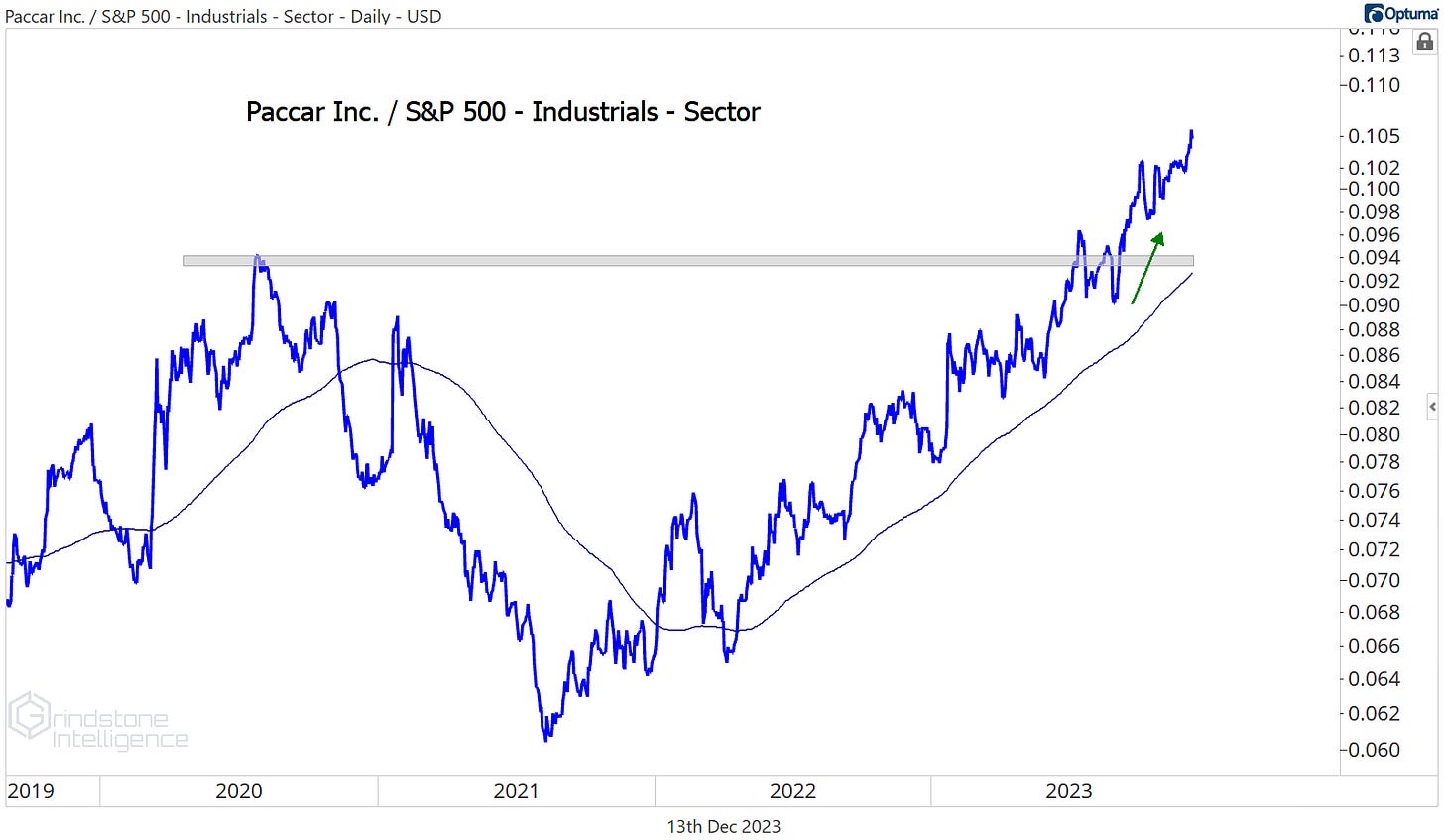

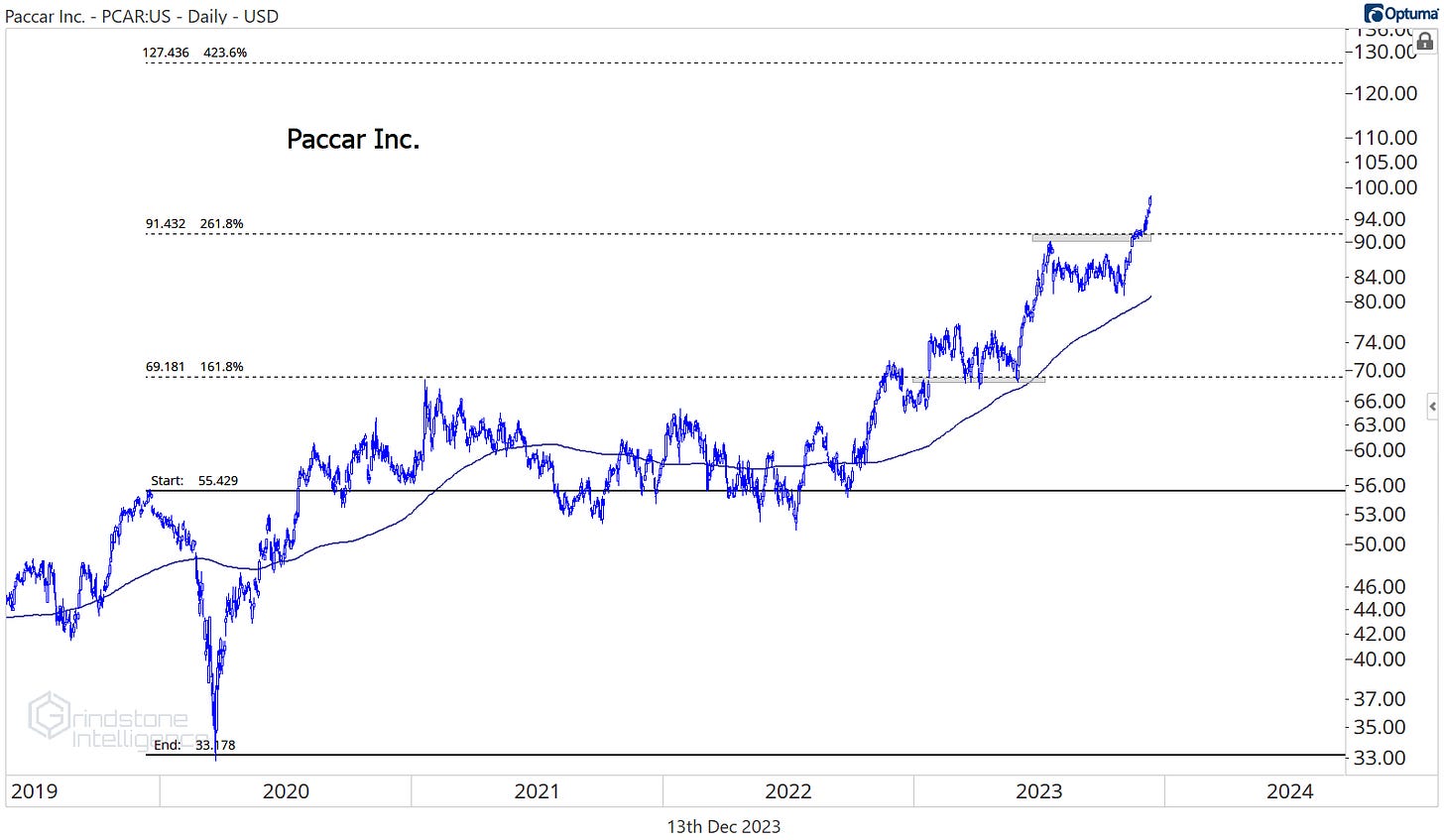

Paccar did, too. This one has trended steadily higher relative to the Industrials sector ever since setting a bottom 2 years ago.

And with relative strength comes absolute breakouts. PCAR is at all-time highs, and we want to be buying the stock above $92 (which is the 261.8% retracement from the 2019-2020 decline) with a target at the next key Fibonacci retracement level at $127..

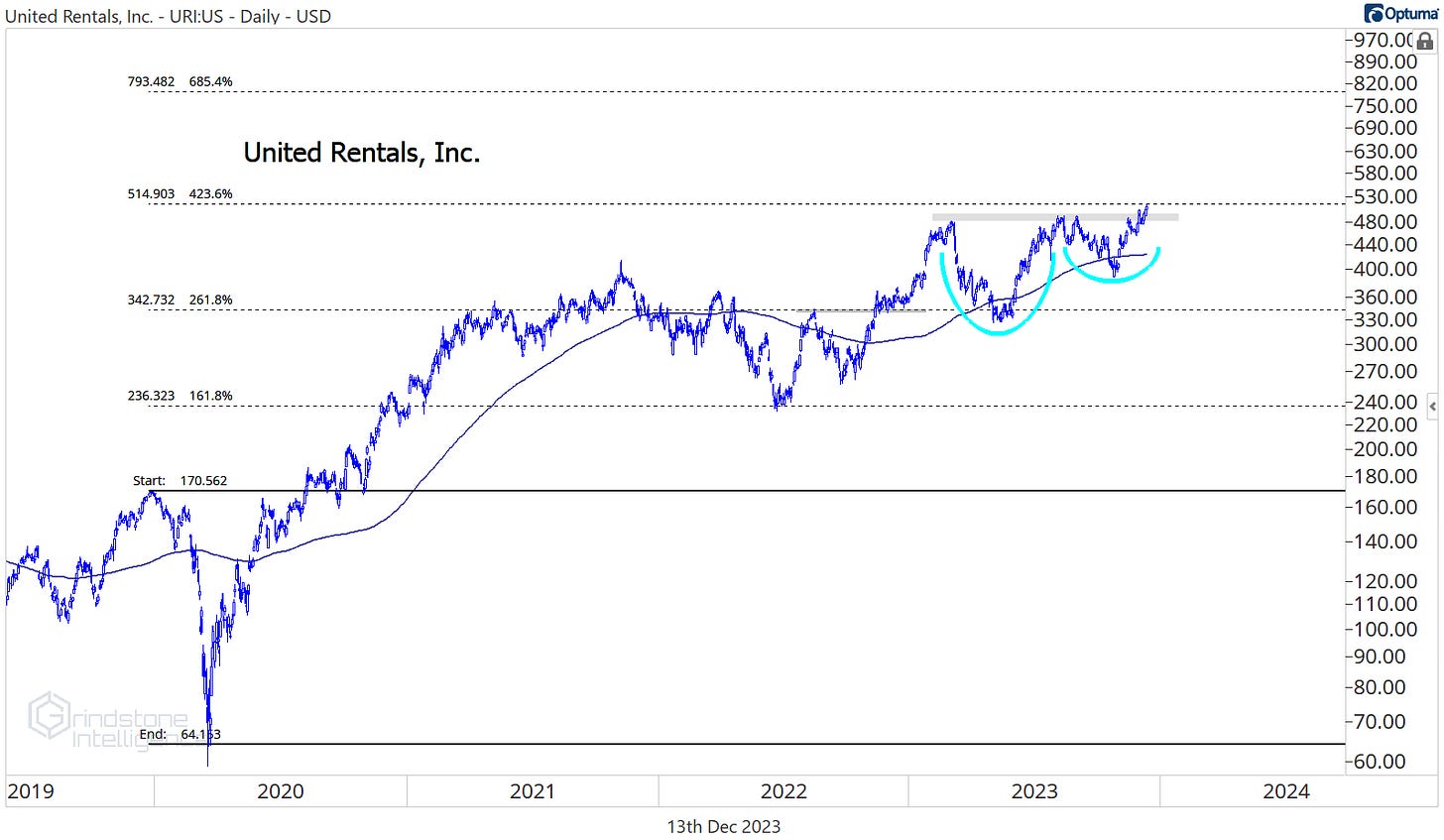

Elsewhere in the machinery space, United Rentals is breaking out of a 9-month base. We want to be buying this one above $500 with a target all the way up at $800.

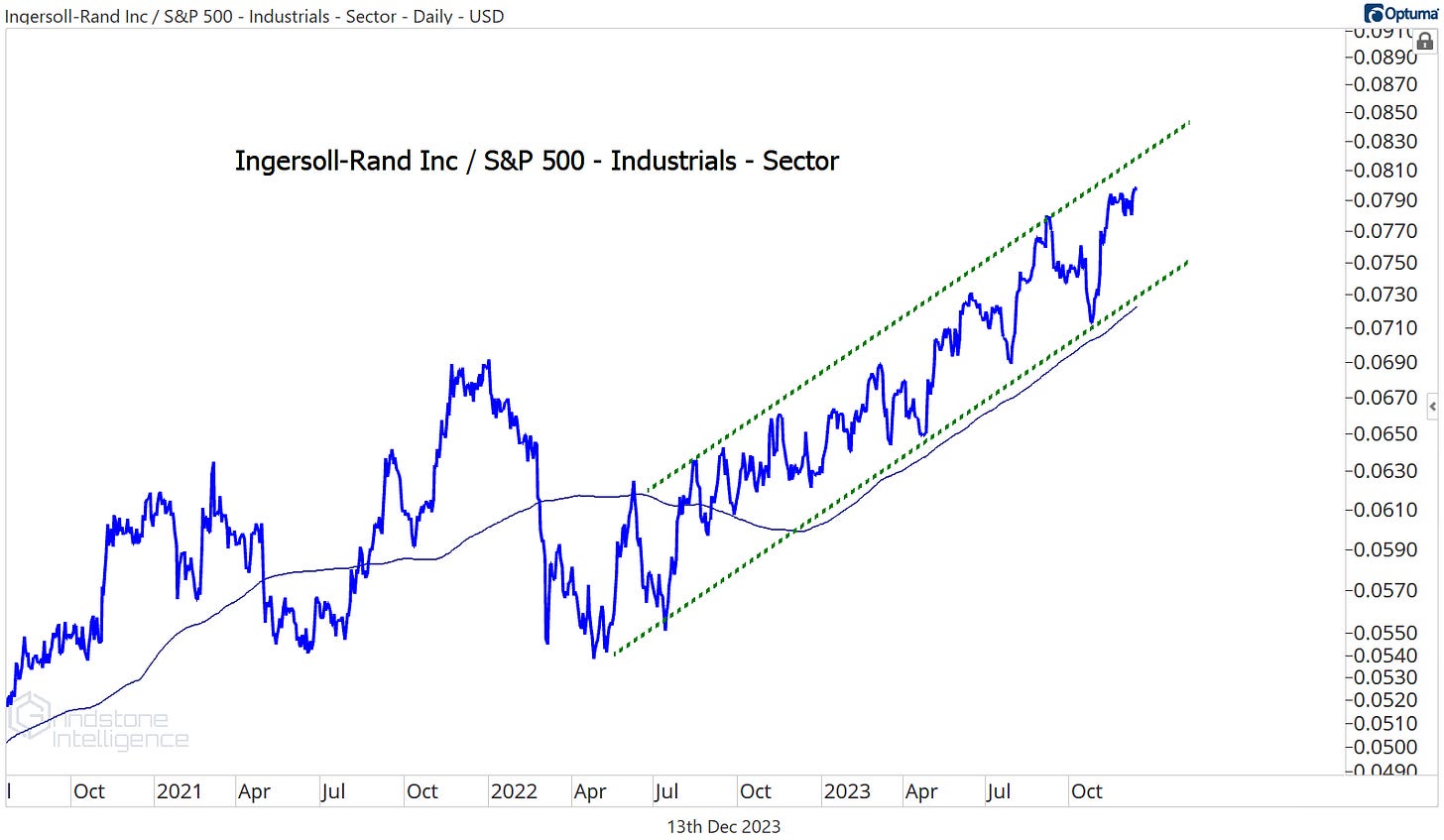

Ingersoll-Rand is nearing the $76 target we set back in June.

We want to see how the stock responds to potential resistance here at the 161.8% retracement from last year’s bear market, but that doesn’t mean we need to completely forget about the stock. It’s still in a clean uptrend relative to the rest of the sector.

If IR is above $77, we can initiate new long positions with a target of $100.

That’s all for today. Until next time.