(Premium) Technical Market Outlook and December Playbook

November was a good month for investors, as prices for stocks, bonds, and commodities all rose. After the first three quarters of 2022 had us on pace for one of the worst years ever, it was a welcome reprieve. Have we seen the bottom of this bear market?

US Equities

The S&P 500 Index closed above its 200-day moving average for the first time since April. It’s now 16% off the October lows, when prices found support at the former September 2020 highs. Still, we remain cautious on the index. The 161.8% retracement from the entire COVID selloff lies at 4140, and it has proved to be a key turning point several times this year. Until the S&P 500 shows it can get above that level and hold it, we have to assume this downtrend remains intact.

The Dow Jones Industrial Average has been the leader, and it’s clearly the best positioned now. The DJIA has surpassed its August highs.

The value-tilted index is now just 7% from setting a new all-time highs.

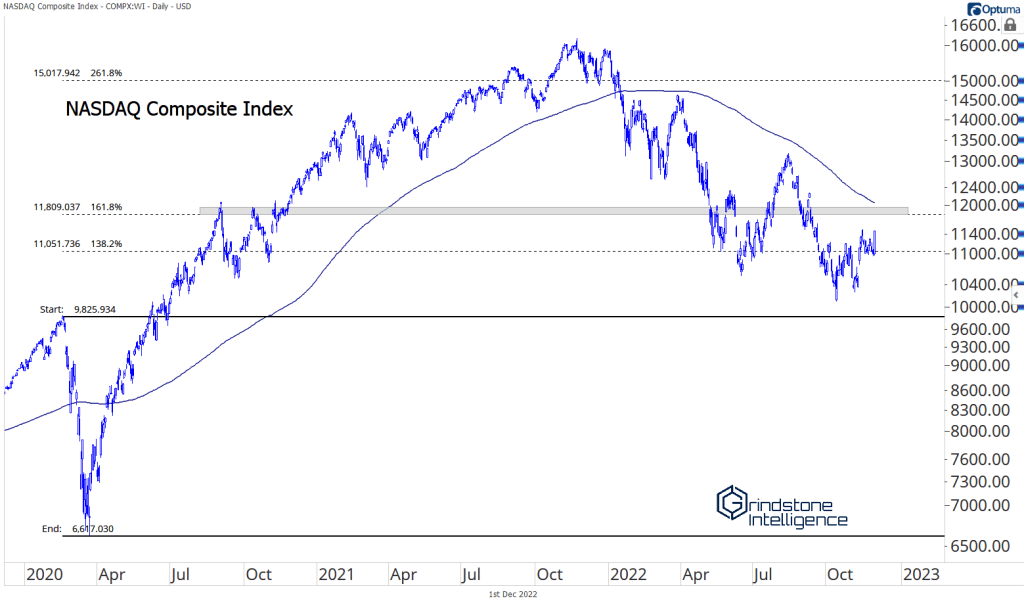

Bringing up the rear is the Nasdaq Composite, still stuck near the June lows. It’s the least constructive of the major indexes and has shown relative weakness all year. Even if this bear market has run its course, there’s no good reason to be heavily involved from the long side until we get back above 12000.

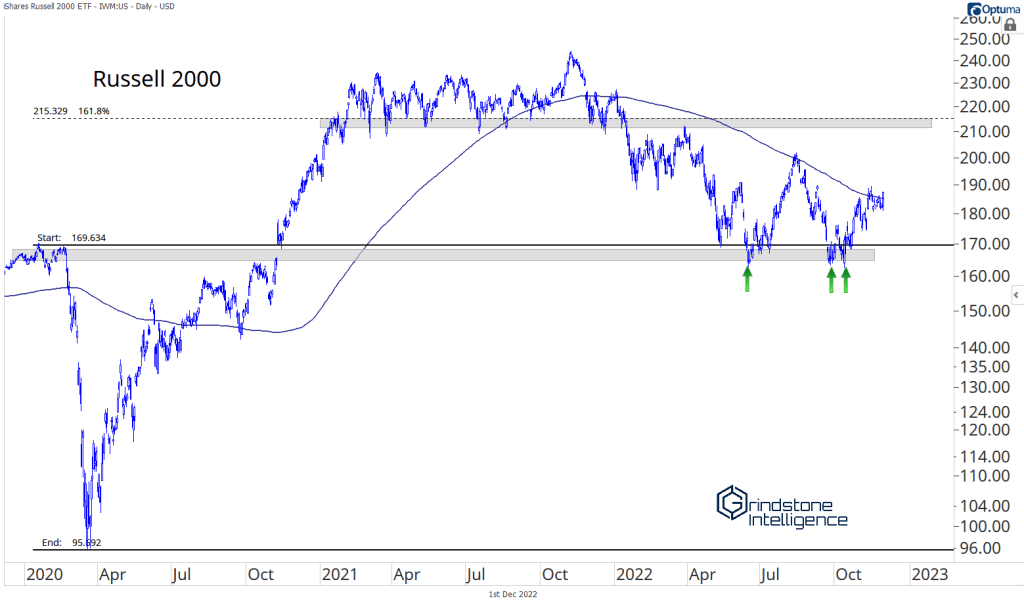

Small cap stocks found support at their pre-COVID highs, bottoming before any of the other major US indexes. The bounce from those lows has been lackluster, though, and the Russell 2000 has struggled to set a higher high or meaningfully exceed its 200-day moving average.

Click on each section below to see the rest of our December outlook:

Fixed Income, Currencies, and Commodities – UNLOCKED Communication Services Sector Consumer Discretionary Sector Consumer Staples Sector Energy Sector Financials Sector Health Care Sector Industrials Sector Information Technology Sector Materials Sector Real Estate Sector Utilities Sector

Premium members can log in to see our sector outlook and US Equity Model Portfolio below:

Playbook and Model Portfolio

Sector Outlook

The Grindstone Intelligence Sector Outlook is based on our top-down technical approach. These ratings are based on our views over the next month but are subject to change with incoming data. If we feel the need to adjust our ratings before the next scheduled newsletter, we will notify subscribers via email with updated views and our justification.

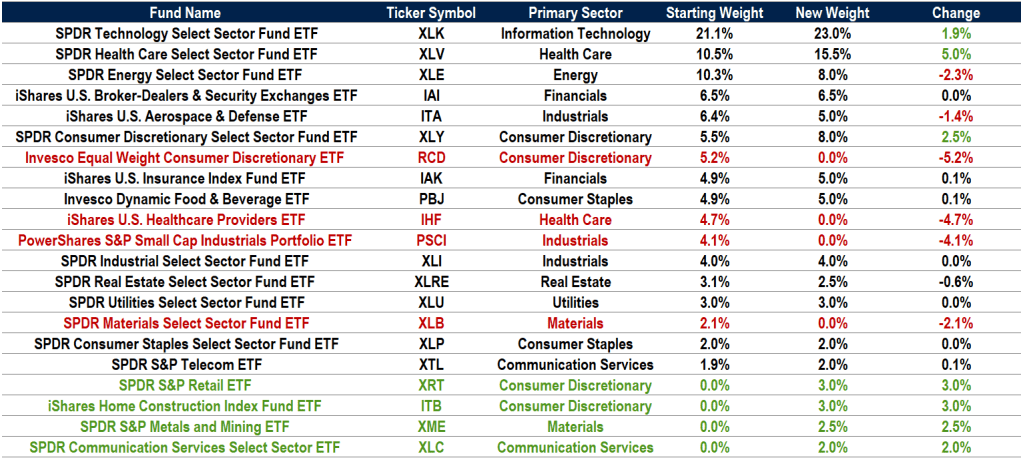

We’re raising our view on Consumer Discretionary to Overweight and reducing our rating on Industrials to Equalweight. We’ll look to resume our Overweight rating on Industrials if they can successfully move through the 2021 relative highs.

Grindstone Model Portfolio

The Grindstone US Equity Model Portfolio is a hypothetical allocation designed to align with our Sector Weightings View and seeks to outperform the S&P 500 Index over the long-term. The Model will invest only in exchange-traded funds that track sectors, industries, or categories of stocks. No individual stocks or cash positions will be used in the Grindstone US Equity Model Portfolio. Changes to the model portfolio will be communicated via email to subscribers, and official ‘trades’ will be executed at the next closing price. Fund performance will cause portfolio weights to drift between updates.

We’re making several changes to the model portfolio to reflect our sector ratings changes and the increased odds of a new bull market having begun. These will be effective at the close of day on December 2nd. The table below summarizes the adjustments and the new positioning.

Please reach out with any questions. We’re happy to clarify any of our opinions, but the nature of our publication prevents us from providing personalized advice. For those questions, please contact your financial advisor.

The post (Premium) Technical Market Outlook and December Playbook first appeared on Grindstone Intelligence.