When Will Tech Stocks Lead Again?

It’s been more than 6 months since Tech stocks peaked relative to the market. In the nearly two years prior to last September, the Information Technology sector – and especially its large components – were the darlings of Wall Street. Throughout the turbulence of trade wars and uncertainty of a pandemic, it seemed these leaders couldn’t be stopped.

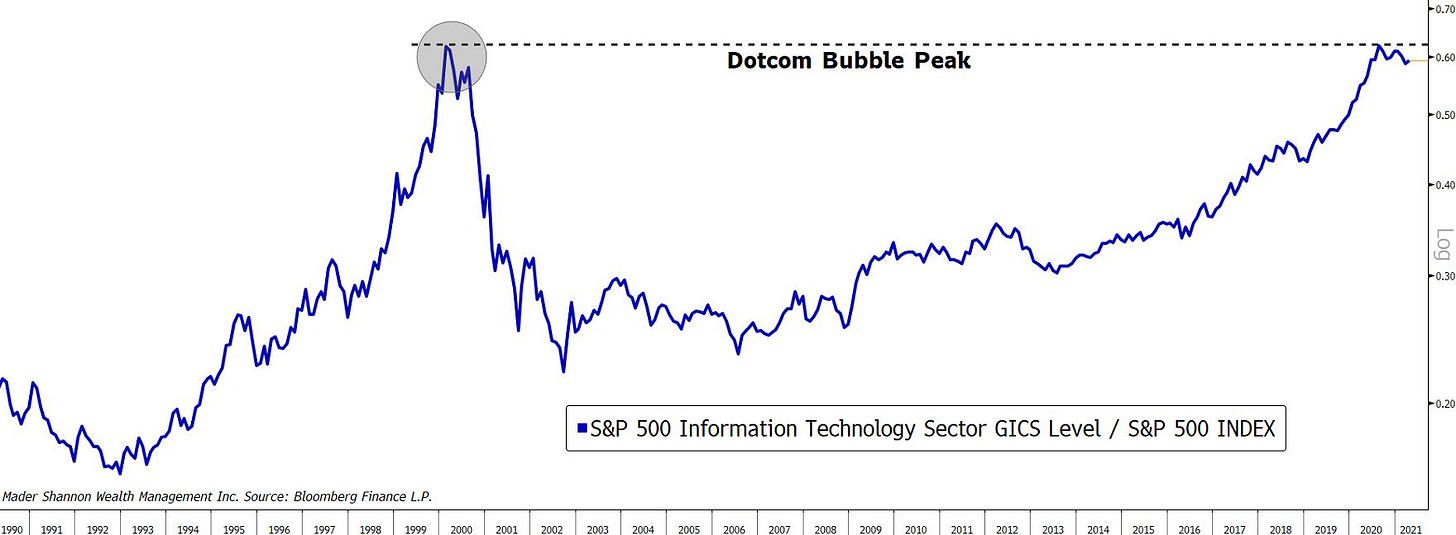

For some, the dominance might have been reminiscent of another certain tech-fueled rally, one that ended in dramatic fashion at the turn of the century. It’s fitting, then, that this most recent rally stopped at the same place it did more than two decades ago.

The theories behind support and resistance in technical analysis are grounded in investor psychology. In a simplified scenario, consider someone who owns a stock that trades to a high of $20 per share. The price subsequently falls to $10. The owner, disappointed with the depressed value of his investment, wishes he had sold at the high price of $20. When the stock finally recovers to $20, the investor, remembering the feeling of loss when prices were at their low of $10, thankfully sells his shares for the previous high price of $20. The shares he is willing to supply at that price (and the shares of other investors with a similar experience) create ‘resistance’ – a price level that is difficult to break above.

Alternatively, consider another investor that monitored, but did not own, the same stock. He watched as prices fell from $20 to $10, and then rose back to $20. Seeing the high price, he wishes he’d had the courage to buy when prices were much lower. When the price falls back to $10, he thanks his lucky stars for the second chance and buys the stock. His demand for shares (and the demand of other investors dealing with the same emotions) creates ‘support’ – a price level that is difficult to break below.

Whether you believe those two scenarios are accurate representations of investors’ emotions and actions is neither here nor there. What’s most important is that support and resistance are real. It’s not mere coincidence that Information Technology stocks stopped outperforming at exactly the same spot that they did in 2000. Prices have memory. And until Tech can absorb the overhead supply created by the Dotcom bubble, they won’t be leading this market higher. Here’s a closer look at the recent price action:

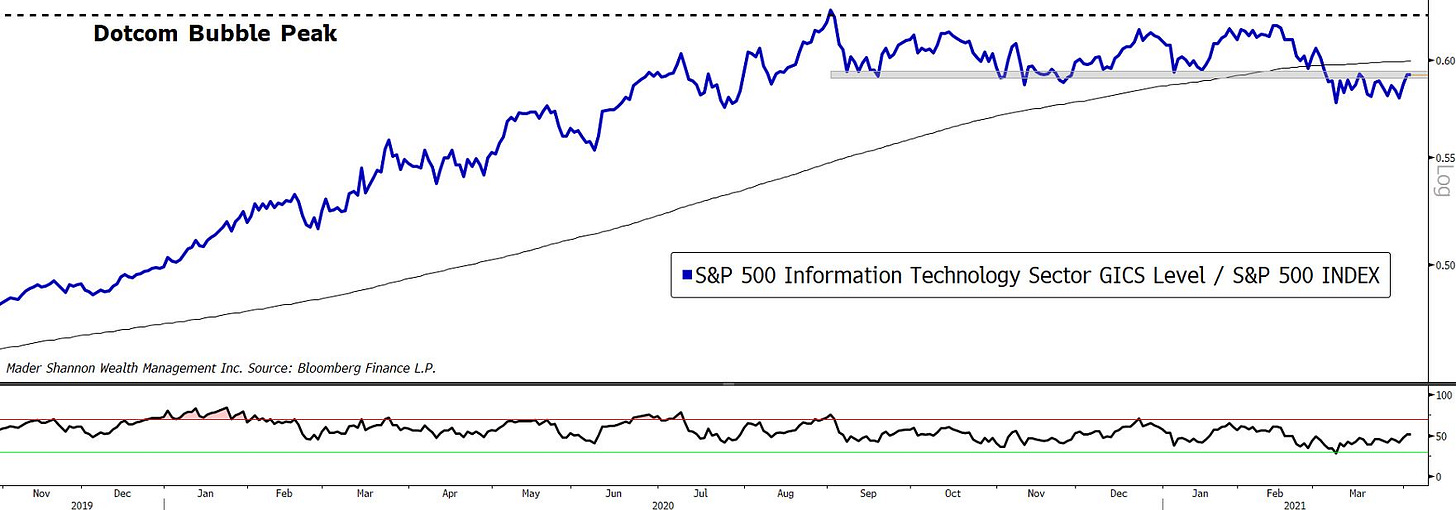

Relative to the S&P 500 Index, Tech has moved sideways since the September 1st peak. Swing lows from later in September had provided support in October, November, and again in January, but the selloff in early March pushed the ratio to new lows. Additionally, it drove prices below the 200-day moving average for the first time in 2 years and sent momentum into oversold territory for the first time since 2017. In the weeks since, not much has changed. Bulls have yet to regain control, but the bears have been unable to capitalize on the breakdown by pushing prices even lower.

Value stocks are back in vogue these days, and could stay in the spotlight with this ratio stuck in consolidation mode. Sideways action is healthy after long uptrends. But watch carefully for a resolution. If it turns lower, stocks overall could be under pressure. But if Tech surpasses the Dotcom highs, Value’s stardom could be short-lived.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post When Will Tech Stocks Lead Again? first appeared on Grindstone Intelligence.