That Was One Wild Week

I hope you were wearing your seatbelt, because that week was one for the books.

The reaction to Thursday’s CPI report alone was worthy of its own lengthy analysis. A decline in used car prices and a deceleration in the price of medical care services helped drive core CPI down to 6.3%, 0.3% lower than last month’s 40-year high. The updated inflation data reinforced a growing consensus that the Fed will deliver a 50 basis point hike at next month’s policy meeting, a decrease from the 0.75% increase we’ve gotten after each of the last four.

Interest rates cratered on the news, dropping almost 30 bps on Thursday alone and 40 bps for the week. Round numbers can act as psychological areas that offer support or resistance, and for rates, those levels have often been the site of significant reversals. After the drop last week, 10-year Treasury yields are back below 4%.

Lower rates, of course, are a tailwind for equity valuations, especially for companies with high expected earnings growth rates. That helped Growth stocks have their best week relative to Value in 4 months. The new relative lows we were seeing to start the month are now starting to look more like a failed breakdown. From failed moves often come fast ones in the opposite direction, so it wouldn’t be surprising to see the ratio revert back to the mean, near the 2021 lows.

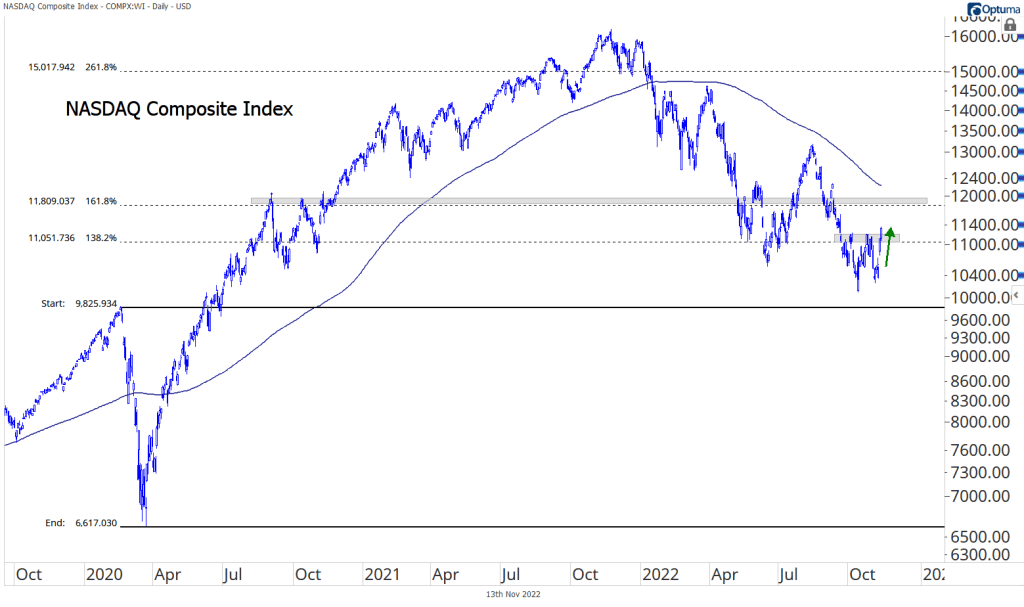

The Nasdaq Composite, filled with growth-oriented tech stocks, jumped 8%, it’s best week since March. The index is now back above 11000, which marked the 131.8% retracement from the COVID decline.

Other areas that stand to benefit from lower interest rates saw major rallies, too. Homebuilders jumped 12% on Thursday alone, rising on the hopes that lower mortgage rates can resurrect stalled demand for new homes. The strong performance has the S&P 500 Homebuilding index back above its 200-day moving average for the first time since January.

With US rate expectations coming down, the US Dollar was under pressure. Strike that. The US Dollar got crushed. In two days, it dropped by 3.9%, an amount not seen since March 2009. It’s 1-week decline of 4.1% has been exceeded only twice in the last 40 years. The Dollar index is still above a rising 200-day moving average, but that uptrend looks a lot less healthy than it did a few days ago.

And with the Dollar breaking down, Gold rallied. Earlier this month, the yellow metal was stranded below overhead supply at 1700 after failing once again to break its year-to-date downtrend line. Then it jumped nearly 10% in just 6 trading days.

Wild moves in rates, equities, and commodities gave us all more than enough to look at, but we haven’t even touched on last week’s most interesting story. FTX, one of the world’s largest cryptocurrency exchanges, collapsed under the weight of leverage, unforeseen outflows, and hubris.

The details of the collapse are still murky, but the immediate impacts were clear. Bitcoin fell below the December 2017 highs, a support level that that had held since June. Then it dropped to its lowest level in two years. At one point, Bitcoin was down as much as 25% for the week and more than 75% from last year’s peak.

And as the ‘safe’ cryptocurrency, it held up better than most. Ethereum dropped more than 30%, and Dogecoin more than 40%.

The damage to crypto was about more than just falling prices, though. FTX was supposed to be one of the good ones, at least that’s what we were told. It had institutional partners, Super Bowl ads, naming rights to the home arena of the Miami Heat, and a CEO beloved by the media. Now the company is in bankruptcy proceedings, that same CEO could be facing jail time, and millions of people have to rethink their relationship with digital currencies. If FTX couldn’t be trusted, who can?

Political backlash and knee-jerk regulatory action seem the inevitable consequence. If nothing else, details of what went wrong should offer plenty of entertainment in the weeks and months ahead – at least for those whose investments weren’t wiped out.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

Questions or comments? Let me know what you think

Thanks for reading!

The post That Was One Wild Week first appeared on Grindstone Intelligence.