The Battle Lines are Drawn: Growth vs. Value

The battle lines have been drawn, and a showdown is at hand. I’m not talking about the Ukrainian border. I’m talking about a war raging here in the United States – one that’s carried on for decades and will be waged for decades to come. I’m talking, of course, about Growth vs. Value.

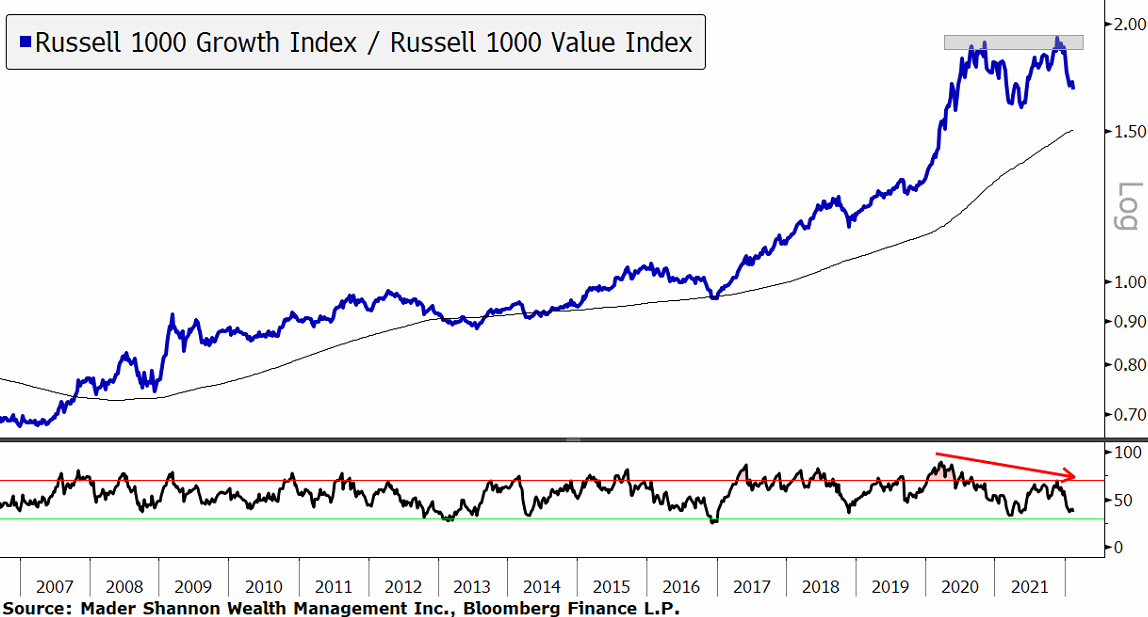

For the last 15 years, the battle has been one-sided – Growth stocks have dominated at every turn, thanks to technology juggernauts like Apple, Microsoft, Alphabet, and Amazon. That strength pushed the Russell 1000 Growth index to all-time highs vs. the Russell 1000 Value index in 2020, surpassing the previous peaks set during the internet euphoria of 1999 and 2000.

In September 2020, the run came to a sudden halt as Information Technology and Communication Services slowed, and sectors like Energy, Financials, and Industrials began to find their legs. But what started as a seemingly healthy consolidation could be turning into something more. The reign of Growth could be coming to an end.

The ratio failed on its most recent breakout attempt, and momentum has weakened considerably. A break of the 2021 lows would be a sign of trouble.

If this is indeed a double-top in the making, it’s likely we’ll see a similar failure for Information Technology vs. the S&P 500. Tech has been contesting its own internet peak, but overhead supply has proven difficult to overcome.

Let’s zoom in to the last few years. Prices reached the all-time monthly high from 2000 in September 2020, and the ratio took more than a year to digest the level. But then the all-time weekly highs came into focus, and progress has stalled once again.

For now, Tech vs. the S&P 500 is still holding the monthly highs from 2000, and as long as that’s the case, we should assume the long-term uptrend remains intact. Below that, the risk is to the downside.

The absolute trends in growth-oriented sectors have weakened this year, as more than half of the members in each Tech, Communication Services, and Consumer Discretionary, are below their 200-day average price. That should be concerning for Growth investors.

Relative weakness in Growth or Information Technology doesn’t have to mean falling prices for everyone else, though. The Energy sector was the biggest winner in 2021 and has continued to rise in 2022. All of its members are above both long and short-term moving averages.

Compared to the benchmark U.S. index, it’s convincingly broken above an area that acted as stubborn resistance for the last 2 years.

And Financials, another Value-oriented sector, is hanging up near all-time highs this year despite the broader selloff in equities. Their relative strength began in late 2020, after the sector’s performance vs. the S&P 500 found support at the 2009 financial crisis lows.

With Financials and Energy making moves, maybe Value’s time in the sun has finally come.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post The Battle Lines are Drawn: Growth vs. Value first appeared on Grindstone Intelligence.