The Morning Grind - 1/16/2024

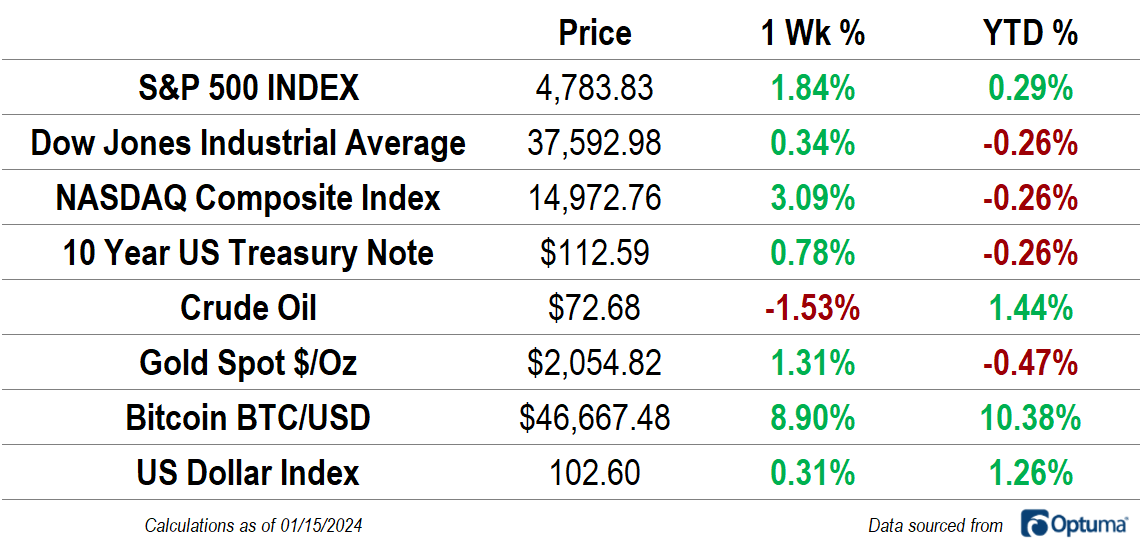

Ahead of a long weekend, growth stocks bounced back in a big way, with the NASDAQ Composite gaining 3.1% and the S&P 500 gaining 1.8%. The more value-oriented Dow Jones Industrial Average rose a modest 0.3%, but all three major indexes are all roughly in the same position year-to-date: near the flatline. Bitcoin has continued to perform well, now up 10% for the year after more than doubling in 2023. Oil prices fluctuated between $70 and $76, ending the week 1.5% lower, while gold climbed back above $2000.

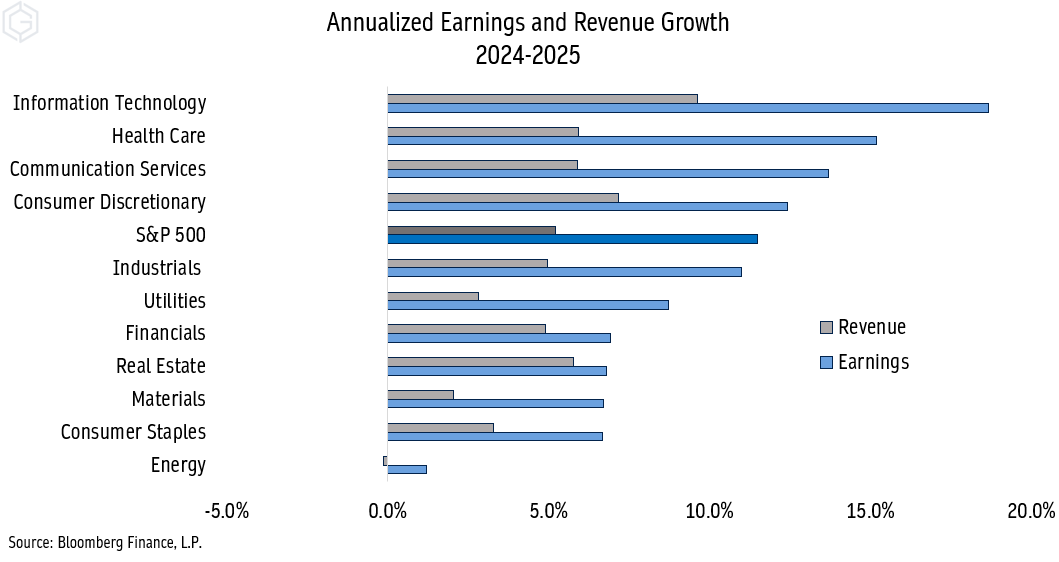

Earnings season got under way last week, and this week things pick up more steam. By now, investors and analysts are looking past the Q4 results that companies will be reporting and instead will focus on the outlook for 2024. Expectations aren’t low. After a year in which S&P 500 index earnings growth was roughly flat, net income is expected to grow by 11% on average over the next 2 years. Information Technology, Health Care, Communication Services, and Consumer Discretionary stocks are set to lead the way.

Macro Dashboard

The US economy proved to be more resilient than most economic forecasters thought possible in 2023, including a 4.9% GDP print in Q3. A strong US consumer is to thank. Retail sales in November rose 4.1% year-over-year, even as excess savings from the pandemic dry up and student loan payments were resumed. This week, we’ll see how strong much appetite there was for spending in the final month of the holiday season, when December retail sales are reported. Spending has the backing of a strong labor market: unemployment fell back to 3.7% to end the year.

Still, recession in 2024 is possible, as the effects of Federal Reserve policy actions come into full force. Inflation has decelerated significantly from last year’s peak, but it’s still above the Federal Reserve’s 2% annual target. With consumer demand holding up, further improvements in price trends could be harder to come by - but that hasn’t stopped the Fed from putting an end to its hiking cycle. Rate cuts are on the table as early as the spring.

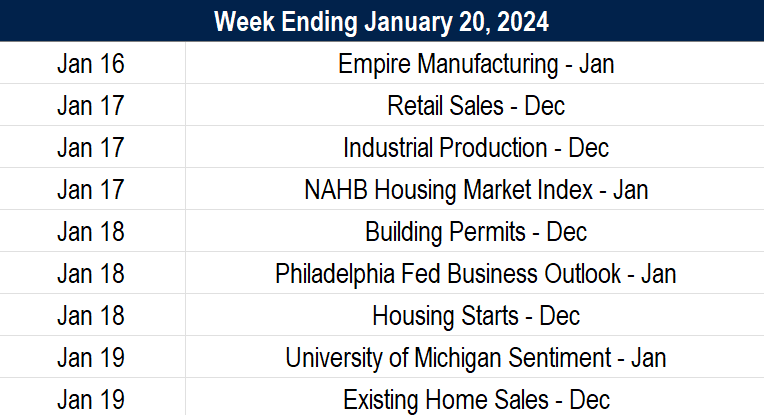

What’s Ahead

Here are the key data releases to keep an eye in the upcoming week: