The Recent Rally in Real Estate Stocks: Mean Reversion or Major Reversal? - 11/16/2023

The Real Estate sector has been down in the dumps for most of the last two years. From the start of 2022, when the bear market for stocks began, to today, Real Estate has fallen nearly 30%. By comparison, the next worst sector is Consumer Discretionary, down just 14% from its highs.

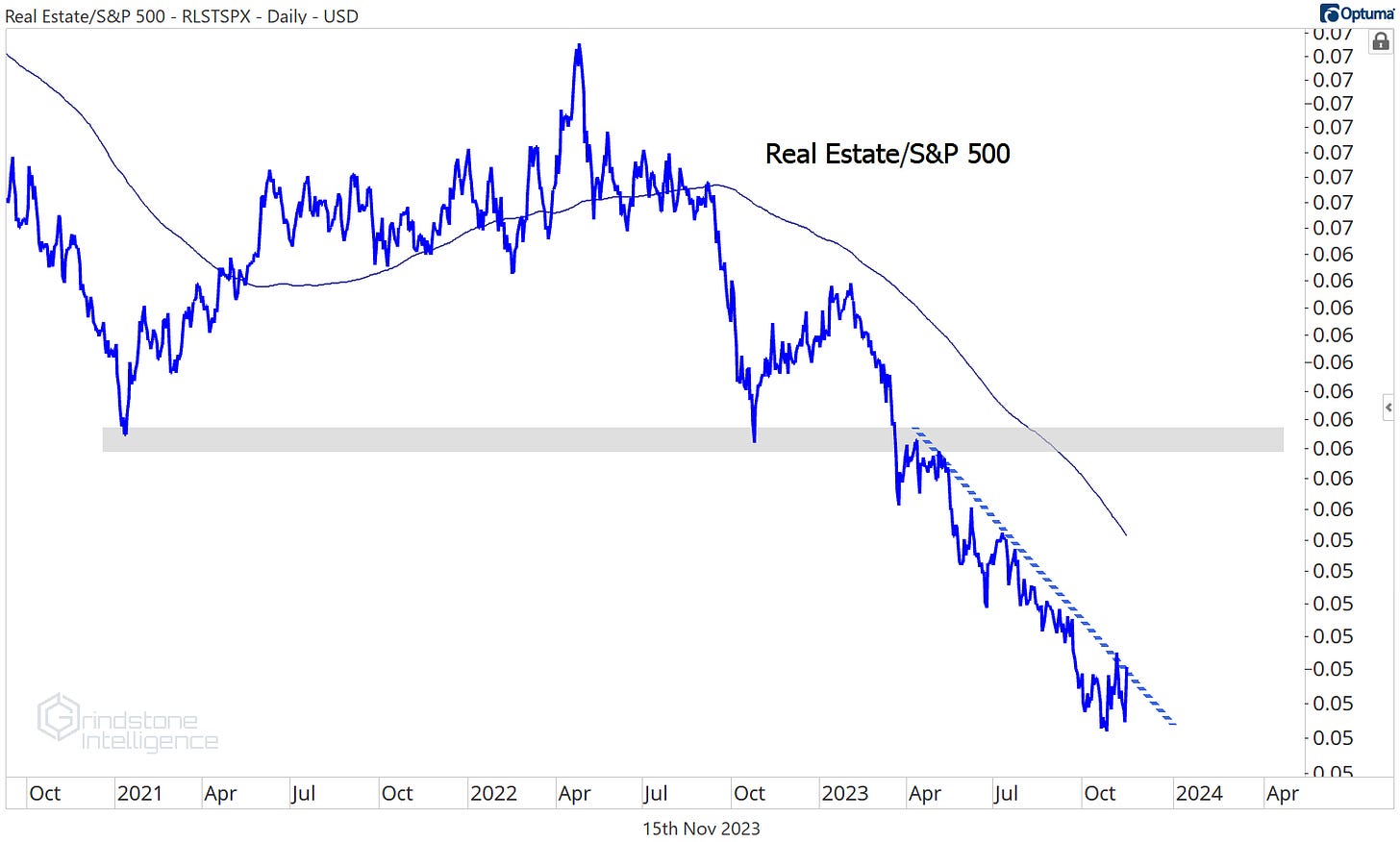

If you’re looking for a reason for Real Estate’s troubles, blame the rise in interest rates. Take the trend of the sector vs. the rest of the market, then overlay that with Treasurys - you’ll find an eerie resemblance. When interest rates go up, RE underperforms.

Higher interest rates are a two-fold headwind. One, they make fixed income more attractive to investors and lower the relative appeal of stocks with high dividend yields. Consider this: Two years ago, 10- year Treasury rates were just 1.5%, while the dividend yield on Real Estate stocks was among the highest in the S&P 500 at about 3%. Today, the risk-free Treasury yield is more than 4.5%, while Real Estate pays the highest dividend yield of any sector at just 3.5%. For income-focused investors, there’s little comparison.

Second, rates are a problem for the business activities of real estate stocks, which tend to have high debt loads. Real Estate has just a 2.5% market cap share of the S&P 500’s, but it has a 5.5% share of net interest expense. By that measure, Real Estate stocks are already paying 2.5x more interest than the average S&P 500 company. Only the Utilities compare, and they’re even worse, with a ratio interest expense to market cap share of 6x.

The Utilities have one distinct advantage, though. The average weighted average maturity for Utilities stocks is more than 13 years - double that of Real Estate at 6.7x. That means Real Estate companies will be repricing their high debt loads at higher interest rates at a much faster pace.

To sum it all up, higher interest rates = bad news for real estate.

What about lower rates, though?

Following last week’s soft economic data and Tuesday’s cooler-than-anticipated inflation report, Treasury rates have already dropped nearly 50 basis points from their peak. And Real Estate stocks have responded accordingly, jumping more than 10% from their October lows. That’s got the sector back above its October 2022 lows and threatening to challenge the 15-month downtrend line.

How the sector responds to that potential area of resistance would go a long way towards answering our question of whether this is just a mean reversion following a bullish momentum divergence and a failed breakdown, or whether this is the start of a major trend reversal. We’d be very impressed if the sector breaks the downtrend line that’s been in place for the group relative to the S&P 500. That alone wouldn’t be enough progress to make us excited about owning a bunch of the sector (we’re still looking at a ratio stuck below the 2021-2022 lows), but it would be an important first step.

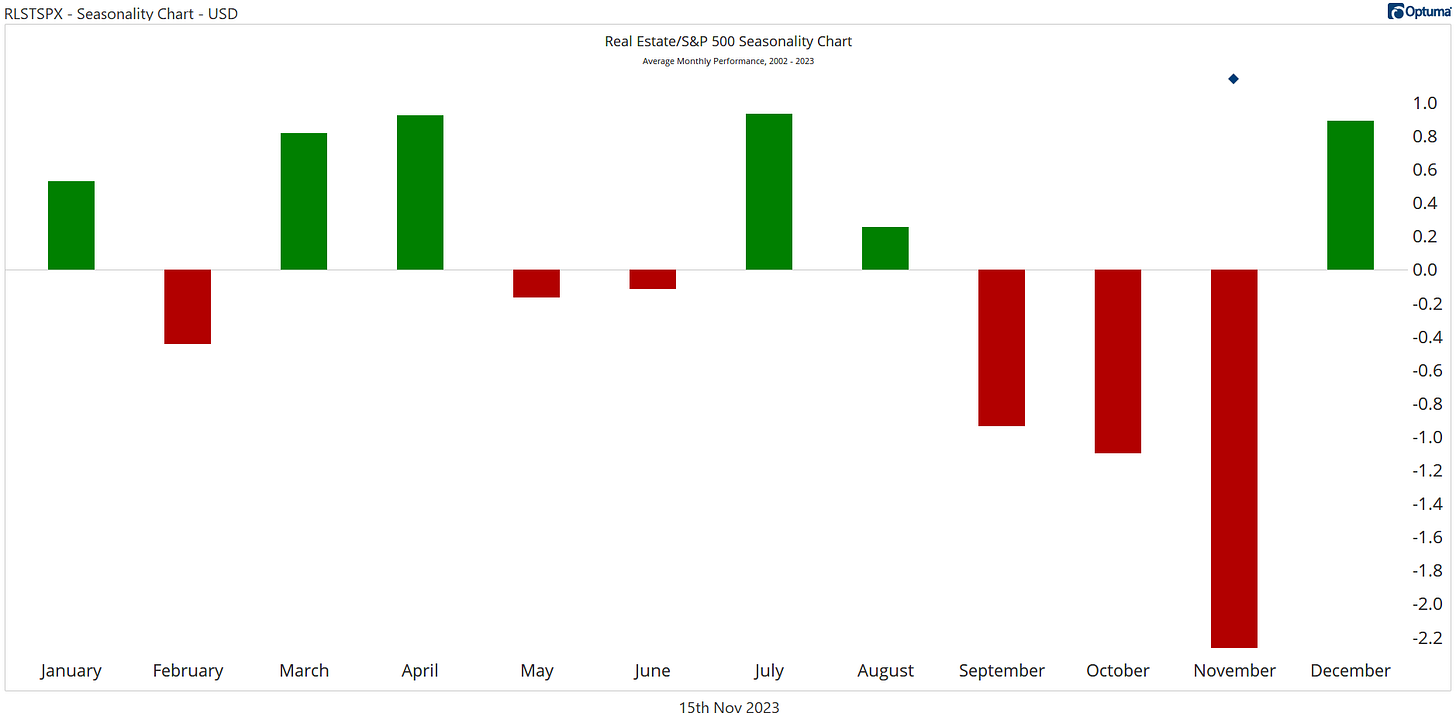

If that first step comes over the next few days, it would be in spite of a huge seasonal headwind. Historically, November has been the absolute worst month to own Real Estate.

It’s my belief that seasonality often gives the best information in hindsight - when prices don’t follow seasonal patterns, that’s when it’s time to really pay attention. If Real Estate continues outperforming during its worst month, what do you think it’s capable of in December, a historically bullish month? It’ll be really hard to ignore.

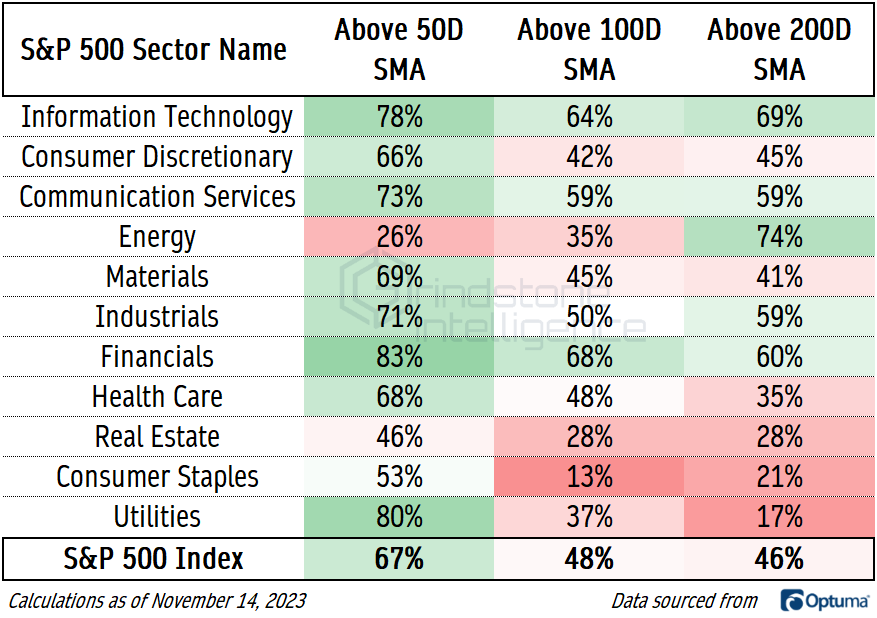

We’re still skeptical that it can close out the month, given the weak breadth that permeates the group. Less than one-third of stocks in the sector are above their 100 and 200-day moving averages, a share that is significantly below the index average.

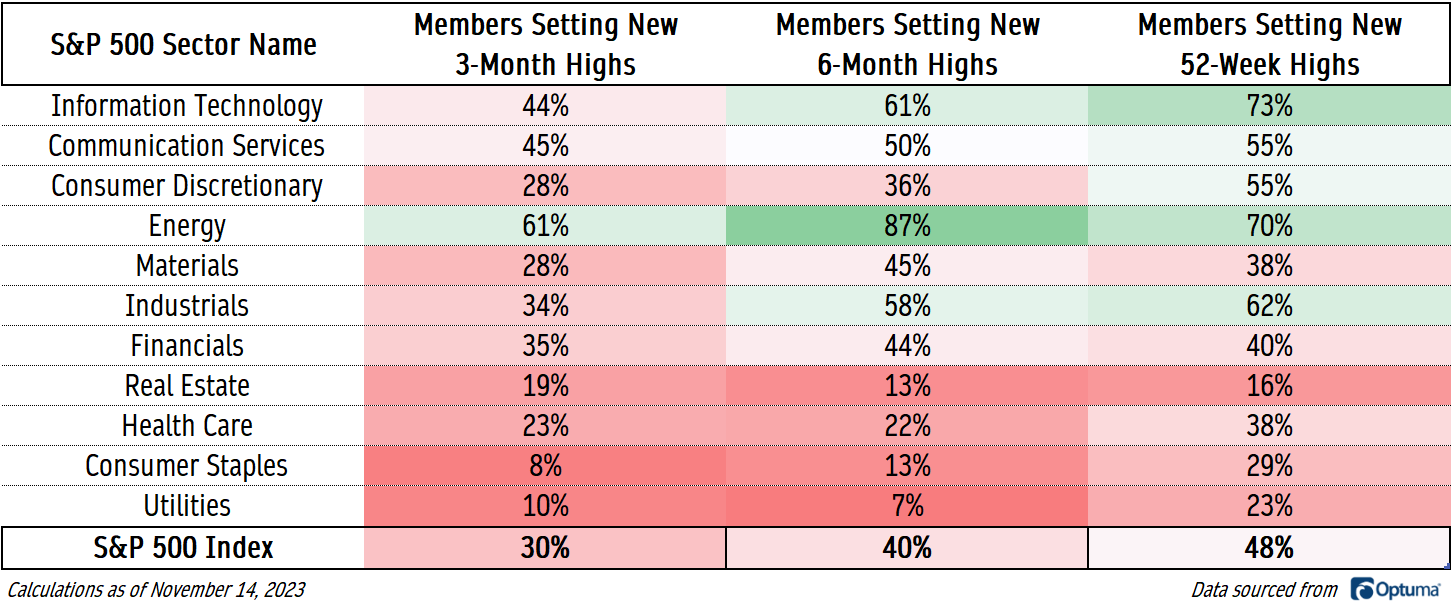

And fewer Real Estate stocks have set a new 52-week high than in any other sector, with 84% still stuck in a long-term, lower-lows regime. Perhaps it’s not fair to expect a bunch of new 52-week highs within a sector that just came out of a big failed breakdown, but shorter-term trends aren’t much better. Just 19% of the sector has so far managed to set a new 3-month high.

It’ll take more progress from interest rates and improvement beneath the surface before we’ll have much confidence in Real Estate as more than a short-term leader.

We’ve had an Underweight rating on Real Estate since July, and we won’t revisit that until the beginning of next month. Below, we’ll look to see whether any individual names are worth owning in spite of our skeptical outlook.

Digging Deeper

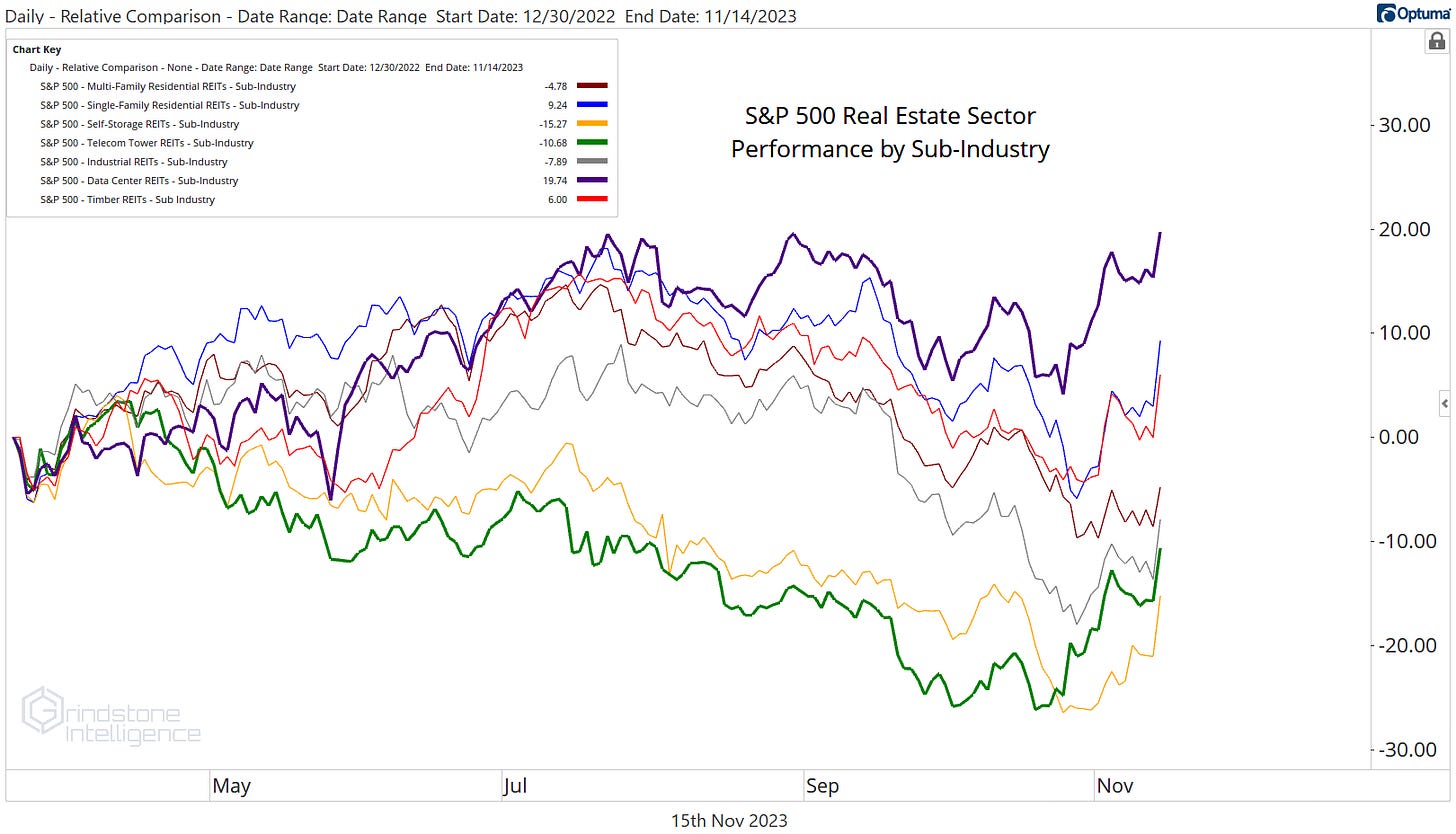

Only a few Real Estate stocks are knocking on the door of new 52-week highs, but one sub-industry is. Data Center REITs have been a leader all year, and they’ve jumped 15% from their October lows.

Digital Realty Trust is the big winner there, as it just climbed past the 50% retracement level from the entire 2022 decline. We like owning DLR above $130 with a target of $142, which is the 61.8% retracement from last year’s selloff.

We like the relative strength in DLR even more. Compared to the S&P 500, it successfully challenged former resistance from last fall, and it’s continued setting higher highs and higher lows.

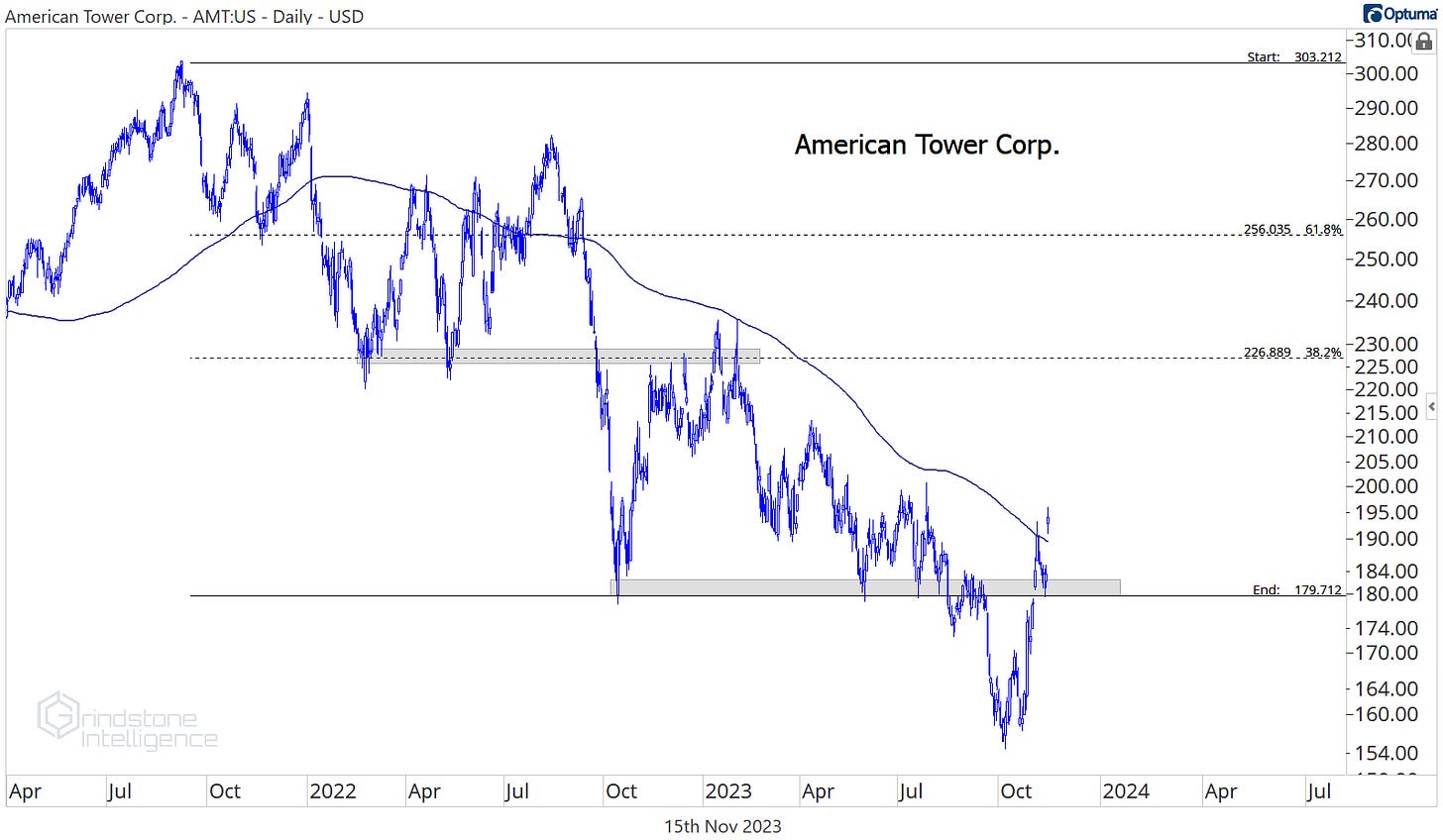

The Telecom tower REITs are worth watching, too. That sub-industry was the worst-performer for most of the year, but it was the first to find a bottom in October. The ensuing rally has pushed American Tower back above last year’s lows and above its 200-day moving average for the first time in over a year. We think AMT is worth owning above $180 with a target of $225, which is the 38.2% retracement from the 2022 decline and also has been a key rotational level for the last 18 months.

Leaders

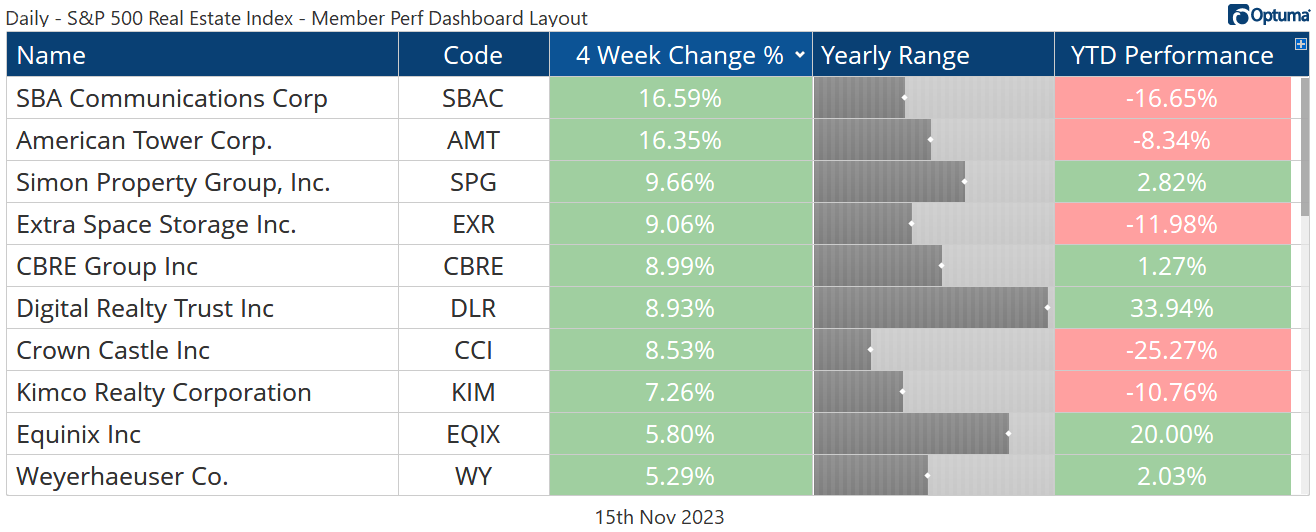

SBA Communications was the top performer over the last 4 weeks after being one of the worst heading into October. We’re keeping a close eye on SBAC because we think how it handles this key area of former support will have big implications for the future of the Real Estate sector overall.

If this surge in Real Estate stock prices is just a mean reversion, then SBAC has done exactly that. It just kissed its 200-day moving average, which is, by definition, the mean. So if prices keep rising past the 200 and above the major lows from 2021-2022, then we’re no longer talking about a mean reversion. That would be something bigger.

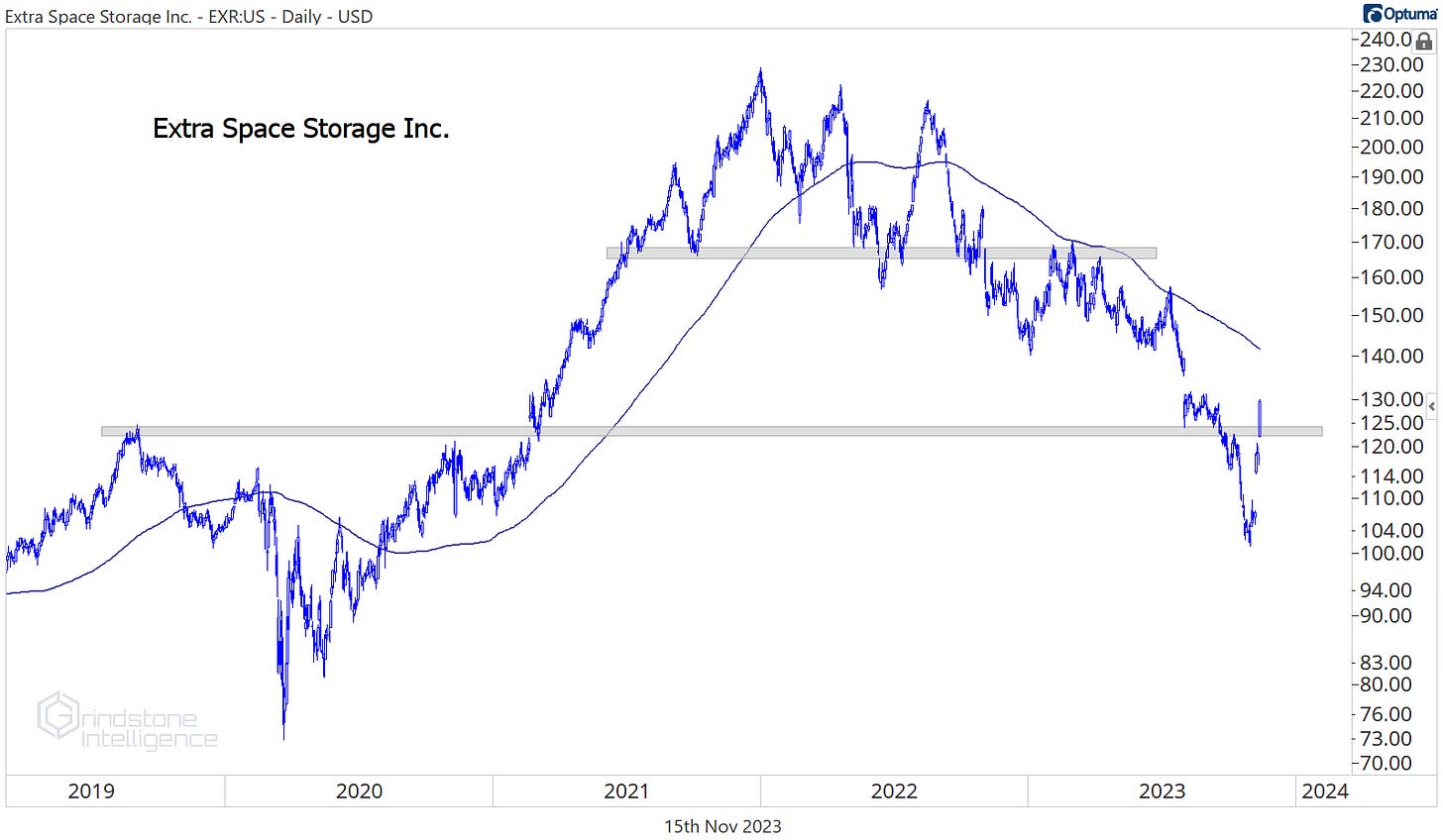

Extra Space Storage is already back above a key former support level of its own. The 2019 highs should act as support again going forward.

When compared to the S&P 500, though, EXR still has some work to do. It’s stuck below a level that was support from 2018-2021 and now will likely act as stiff overhead supply. We only want to approach EXR from the long side if it’s above these former lows on a relative basis.

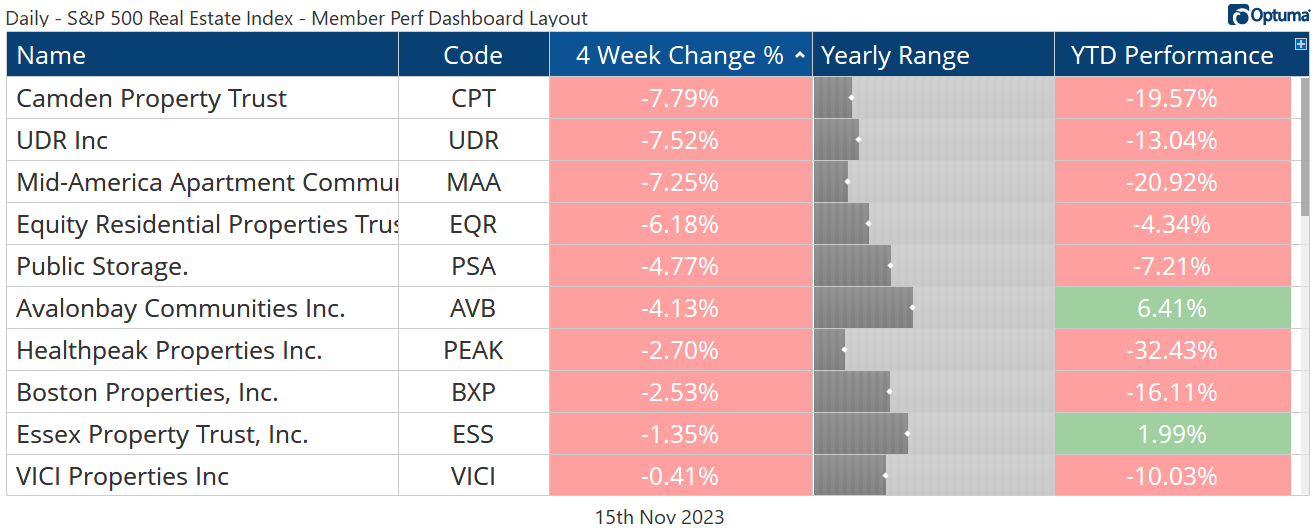

Losers

One stock that hasn’t participated in the rally is Healthpeak Properties. This one’s been stuck below a falling 200-day moving average for the better part of 2 years, momentum is in a bearish range, and it’s beneath the major lows that were set back in March 2020. Nothing about this chart says ‘uptrend.’

Even with momentum working on a bullish divergence, we want to leave this chart alone. Most other stocks in the sector bottomed and started their rally 2 weeks ago, but PEAK is still near its lows. That’s what we call relative weakness - and relative weakness is something we prefer to short on rallies, not buy on dips.

Until next time.