The Weekly Grind: August 14, 2023

Week in Review

The selloff in growth stocks continued last week, driving the NASDAQ to its first back-to-back weekly losses of the year. The Dow Jones Industrial Average managed to close higher for the week, but it’s still the laggard of the large cap indexes in 2023. The US Dollar Index rose for the fourth straight week, as did long-term Treasury yields. Crude oil also continued its recent run, rising for the seventh straight week to end at its best level since November.

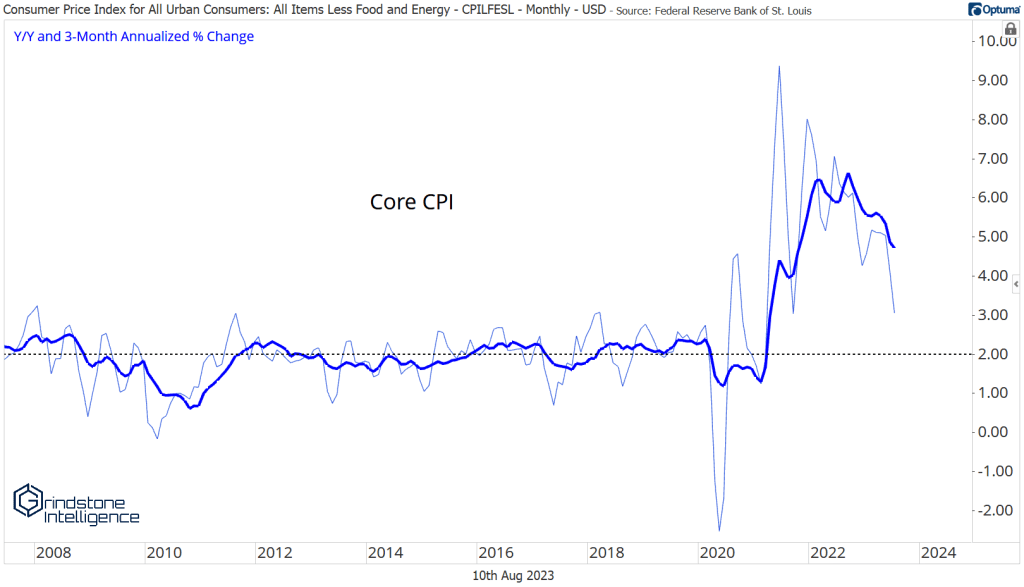

Inflation data continued to show positive developments in last week’s report. Even though CPI rose modestly from the prior month’s 3.0% year-over-year print, the 3.2% reading was still better than most analysts had forecast. The increase didn’t shift expectations for short-term interest rates, either. Futures markets indicate that the Federal Reserve will almost surely hold rates constant at next month’s FOMC meeting and that they’re most likely finished hiking interest rates for the year. Still, there’s quite a bit more data to come before the Committee meets again. Hawks argue that core inflation is still well above the Fed’s 2% annual target. Doves can point toward shorter-term measures of core prices: the 3-month annualized Core CPI dropped all the way to 3% in June.

Market Internals

Breadth was a concern for most market watchers throughout March, April, and May, as the rally in growth stocks obscured lackluster performances from value-oriented names during the spring. In June, though, the advance began to broaden considerably. More than half of all stocks in the S&P 500 are above 50-day, 100-day, and 200-day moving averages. That indicates a relatively broad advance for the market. Near-term trends are considerably weaker, though: only 36% of stocks are above a 20-day average price.

Trends are healthiest in the Energy sector. More than 90% of members are above moving average prices – no matter the timeframe. Risk-off areas like Utilities, Consumer Staples, and Health Care are the most weakly positioned. Compared to their long-term averages, the majority of stocks in each of those sectors are in technical downtrends.

What’s Ahead

Here’s what to watch in the week ahead

The post The Weekly Grind: August 14, 2023 first appeared on Grindstone Intelligence.