The Weekly Grind: June 12, 2023

Week in Review

Stocks moved modestly higher last week, led by the Russell 2000 small cap index, which outperformed the large-cap indexes by more than 1% for the second straight week. Crude Crude oil continued to retreat, even after Saudi Arabia’s recent decision to voluntarily reduce production. Interest rates fell and so did the US Dollar index. Bitcoin dropped 3%, but it’s still more than 50% higher for the year. Gold prices have stabilized above support at $1950.

It’s a big week for economists. On Tuesday, we’ll get an update on the most widely followed measure of inflation: CPI. Current expectations are that consumer prices rose at a 4.1% annual rate in May, down from 4.9% in April and at the lowest pace in 2 years. If the data conforms to those expectations, Jerome Powell & Co. will most likely decide to keep interest rates unchanged at this week’s FOMC meeting. At present, money markets imply only a one-in-three chance that the Fed will choose to hike another 0.25%. Still, 4.1% is double the central bank’s target for inflation, and core inflation (which strips out volatile categories like food and energy) is even higher. Any surprise in Tuesday’s release could change the outcome of Wednesday’s interest rate decision.

Relatively Speaking

There’s been a wide dispersion in sector performance over the last month, which has been partially masked by an S&P 500 index that surged 4.4%. Most of the gain was attributable to large cap growth stocks, which dominate sectors like Information Technology (+10.9%), Consumer Discretionary (+9.3%) , and Communication Services (+8.8%). Risk-off sectors fell over that same period, led by Consumer Staples (-4.6%).

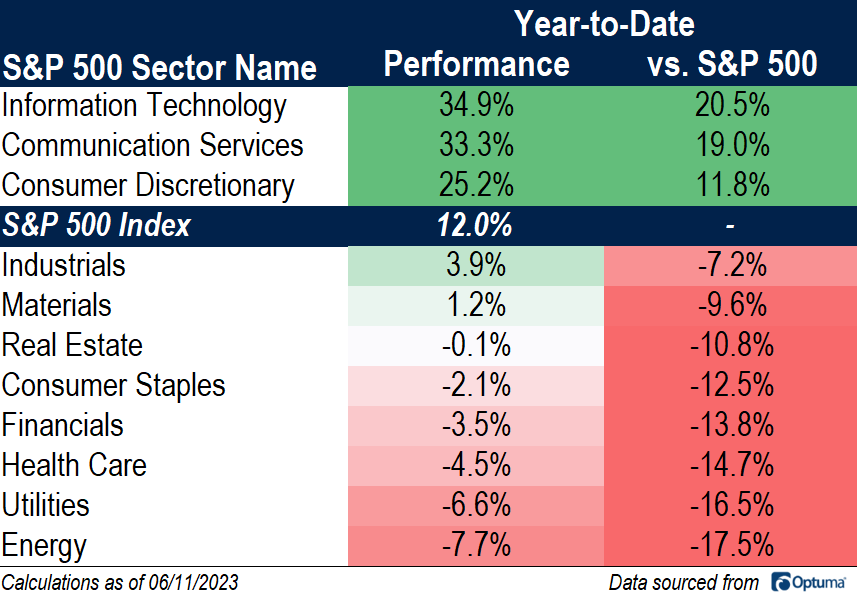

Leadership over the past month mirrors that of the year-to-date period. Information Technology (+34.9%), Communication Services (+33.3%), and Consumer Discretionary (+25.2%) again sit atop the standings. Investing in any other area would have yielded a return well below that of the S&P 500’s 12% YTD gain. Energy (-7.7%) and Utilities (-6.6%) are the worst performers.

What’s Ahead

Here are the key data releases and events to keep on eye on in the coming days.

Check out what you missed last week from Grindstone Intelligence

Tech Stocks Leading the Way

The Myth of the ‘Average’ Return

(Premium) Can the Rally in Communication Services Broaden Out?

(Premium) Consumer Discretionary Moving to the Front of the Pack

Try out a Premium Membership FREE for 30 days!

The post The Weekly Grind: June 12, 2023 first appeared on Grindstone Intelligence.