The Weekly Grind: June 26, 2023

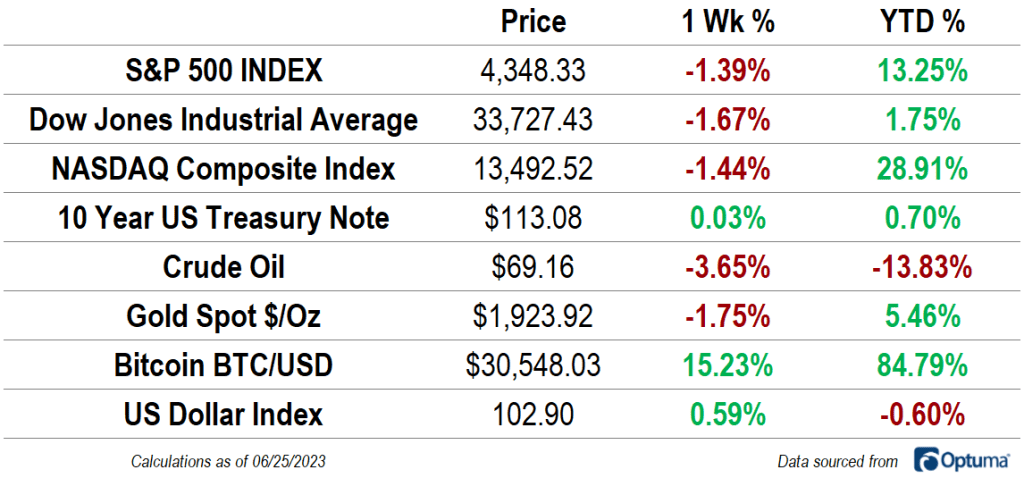

Stock prices suffered there first weekly decline since early May, with each of the three major large cap indexes dropped more than 1%. The US Dollar Index strengthened, even as central banks in Europe and elsewhere in the world continued to raise benchmark interest rates. Crude oil dropped back below $70 per barrel, and gold fell to its lowest level since March. Bitcoin, meanwhile, surged 15% to its highest level in a year.

One Thing to Consider

The technical outlook is decidedly bullish. The fundamental one, however, still poses more questions than answers. Even though the Federal Reserve held rates unchanged at their June meeting, the risk is that they’ve has already gone too far. The nation’s monetary authority has a long and storied history of tipping the economy into recession. Perhaps they’ve done it again? Recession has admittedly been top of mind since last year, and doomsdayers have time and again been forced to push back their expectations of an economic downturn. This year, with the stock market rallying, many economists and strategists have pulled a recession out of their forecasts entirely. The housing market has recovered, unemployment remains low, and consumers are still spending money. All seems well.

At the same time, the Conference Board’s Leading Economic Index has declined for 14 consecutive months. Survey data, both abroad and at home, shows a deepening slowdown in the manufacturing sector. Jobless claims are rising, too. We aren’t predicting a recession. We aren’t ruling it out, either.

Earnings Expectations and Valuation

The stock market selloff in 2022 was not driven by a deterioration in corporate earnings. Though stock prices dropped well over 20% from their peak to trough, expected future earnings remained stubbornly high. That divergence pushed the S&P 500 forward price-to-earnings ratio from more than 20x (a level previously seen only during the late-1990s) to 15x (a level in-line with historical averages).

So far, 2023 has been the opposite experience: stock prices are rising, but earnings are not. Profits contract for a second consecutive quarter – an event commonly referred to as an earnings recession. The result is that valuations are elevated once again. The S&P 500 currently trades at a forward multiple of more than 19x.

What’s Ahead

Here’s the economic calendar for the week ahead

The post The Weekly Grind: June 26, 2023 first appeared on Grindstone Intelligence.