The Weekly Grind: May 30, 2023

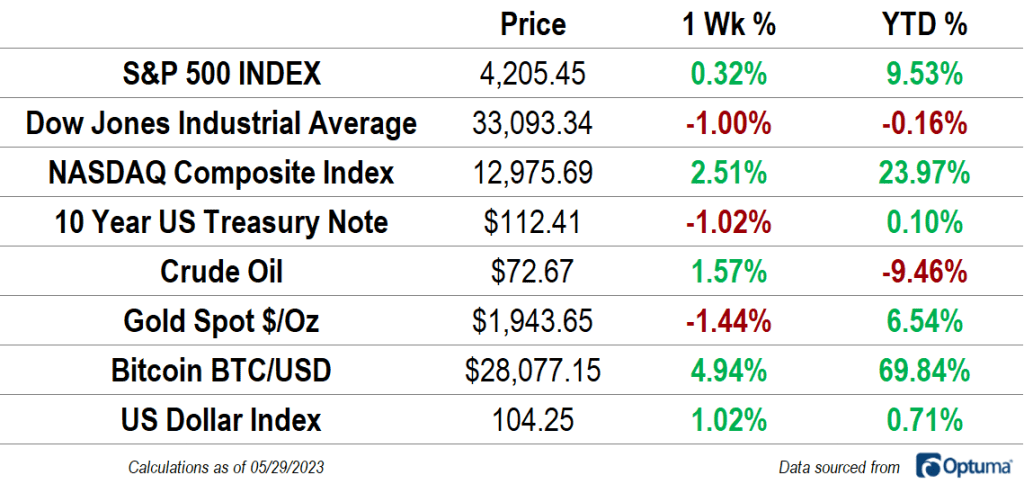

The huge dispersion in performance among equities continues. The Dow Jones Industrial Average dropped 1% last week, pushing its year-to-date return below the flatline. Meanwhile, the NASDAQ rode huge gains from NVIDIA and other tech stocks to its highest level in over a year. The NASDAQ has risen nearly 24% so far in 2023. Surprisingly, growth factor leadership came despite a 1% rise in the US Dollar index, which closed higher for the third straight week. Interest rates also rose again. Last year, higher yields and a strong Dollar were primary drivers of growth’s underperformance.

One Thing to Consider

New highs aren’t bearish. It doesn’t matter which stocks are leading the advance. It doesn’t matter if an AI-fueled speculative frenzy is the proximate cause. It doesn’t matter if a likely recession is still on the horizon. It doesn’t matter if the rally isn’t particularly broad. What matters is that prices continue to rise.

Marty Zweig said it best: The trend is your friend, don’t fight the tape.

Earnings Expectations and Valuation

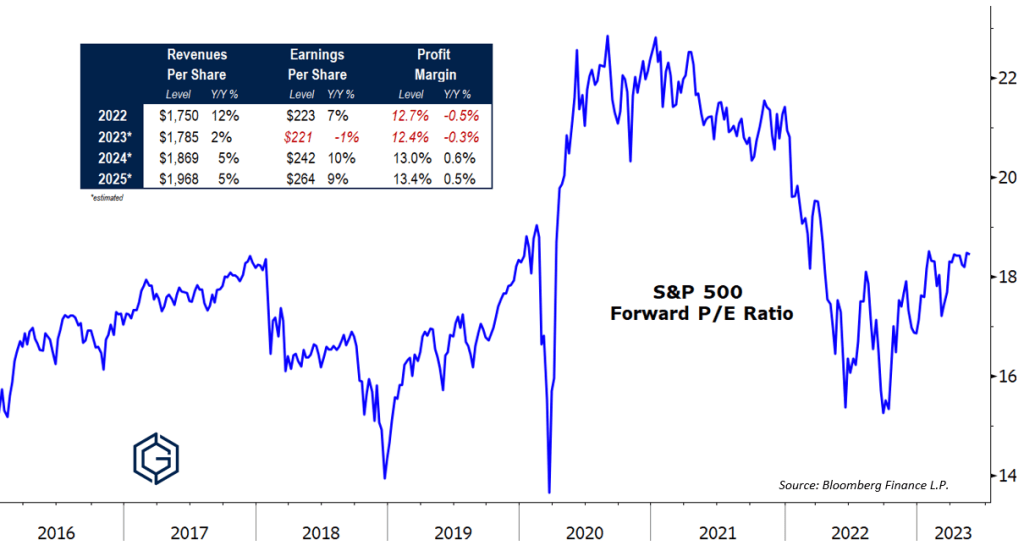

The stock market selloff in 2022 was not driven by a deterioration in corporate earnings. Though stock prices dropped well over 20% from their peak to trough, expected future earnings remained stubbornly high. That divergence pushed the S&P 500 forward price-to-earnings ratio from more than 20x (a level previously seen only during the late-1990s) to 15x (a level in-line with historical averages).

So far, 2023 has been the opposite experience: stock prices are rising, but earnings are not. Profits are set to contract for a second consecutive quarter – an event commonly referred to as an earnings recession. The result is that valuations are elevated once again. The S&P 500 currently trades at a forward multiple of more than 18x.

What’s Ahead

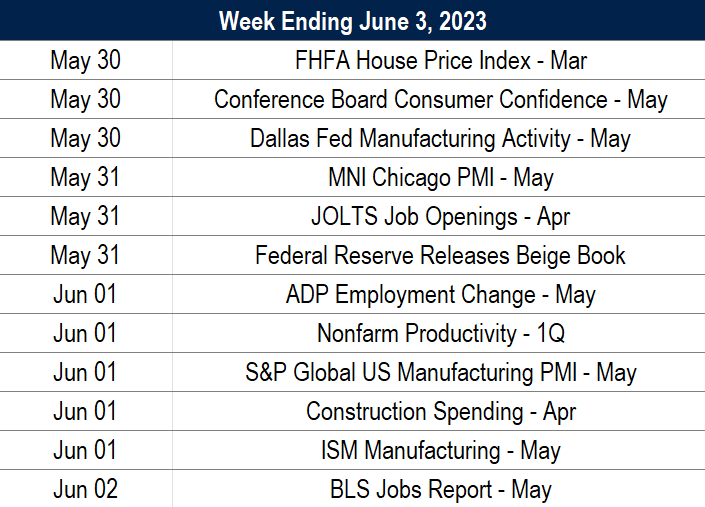

Here’s the economic calendar for the week ahead. Friday’s jobs report will be the primary focus for data watchers.

The post The Weekly Grind: May 30, 2023 first appeared on Grindstone Intelligence.