The Weekly Grind: October 16, 2023

The S&P 500 index rose for the second straight week, despite steep intraday selloffs on both Thursday and Friday. Interest rates fell sharply to start the week, with the 10-Year Treasury dropping from the previous Friday’s high of 4.9% to just 4.5%. However, Thursday morning’s hotter than expected inflation report marked the trough, and rates ended the week above 4.6%. Commodities were the big winners, as Gold prices surged 5.5% and oil jumped 5.9%.

One year ago, CPI inflation was at 8.2% per year, just off its highs. At the same time, though, inflation excluding the cost of housing, was dropping below 2% on a 3-month annualized basis. Housing costs matter, of course, but the government’s method for measuring housing costs notoriously lags the real-world experience. So when this pared-back measure of inflation reached the Federal Reserve’s target, equity markets responded by putting in their bear market lows. Today, the ex-housing measure has fallen perfectly to the Fed’s target – it’s at 1.98% over the past year. The shorter-term measure, however, is showing signs of reacceleration – it’s back up to 4.5%

Energy prices are to blame for the reversal. The cost of energy has jumped at an annualized rate of more than 30% over the past quarter.

Earnings Expectations and Valuation

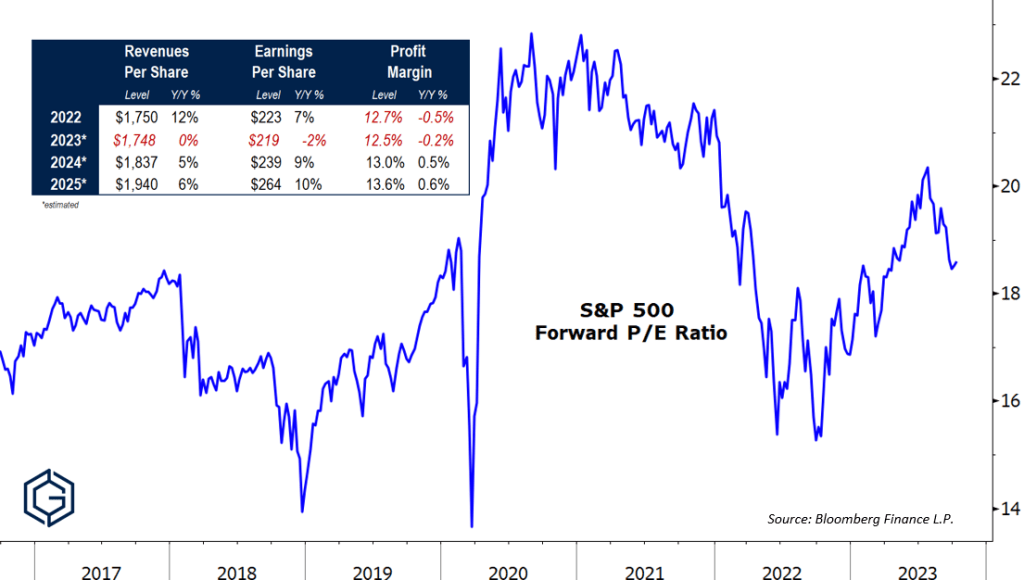

Last year’s bear market decline was not driven by a deterioration in corporate earnings. Though stock prices dropped well over 20% from their peak to trough, expected future earnings remained stubbornly high. That divergence pushed the S&P 500 forward price-to-earnings ratio from more than 20x (a level previously seen only during the late-1990s) to 15x (a level in-line with historical averages).

The first half of 2023 was the opposite experience: stock prices rose, but earnings did not. Profits have now declined for three consecutive quarters. The market correction over the past few months has served to dampen valuations a bit, but at nearly 19x next year’s earnings, equities are still far from cheap when compared to historical norms.

What’s Ahead

Here’s the economic calendar for the week ahead

The post The Weekly Grind: October 16, 2023 first appeared on Grindstone Intelligence.