The Weekly Grind: October 23, 2023

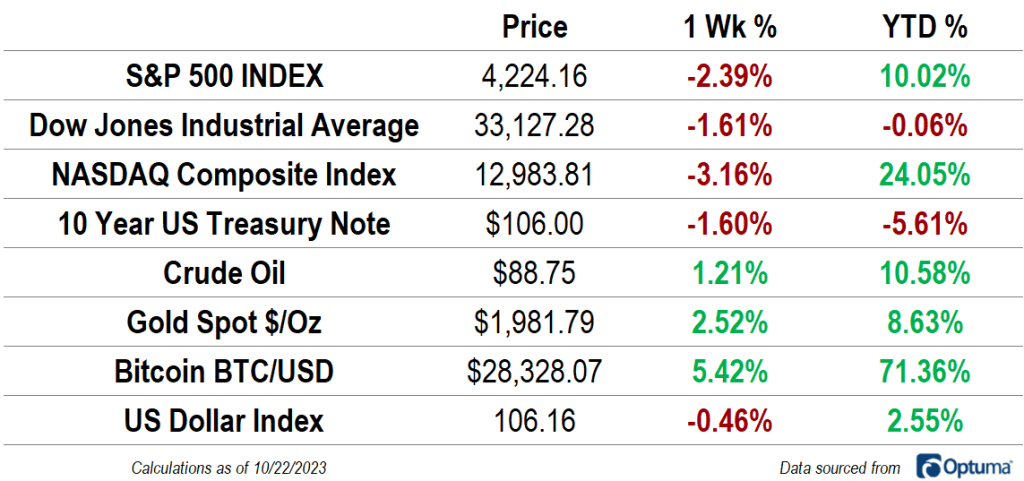

The green shoots that sprouted at the beginning of October are nowhere to be found. The S&P 500 index dropped 2.4% last week, falling to its lowest level since the first of June. The Dow Jones Industrial Average outperformed for the week, falling only 1.6%, but that decline was enough to erase the Dow’s entire year-to-date gain. Interest rates continued to rise, with the 10-Year Treasury yield approaching 10%, and benchmark mortgage rates climbing above 8%. Commodities offered investors a haven, as crude oil prices rose 1.2% and gold prices rose 2.5%.

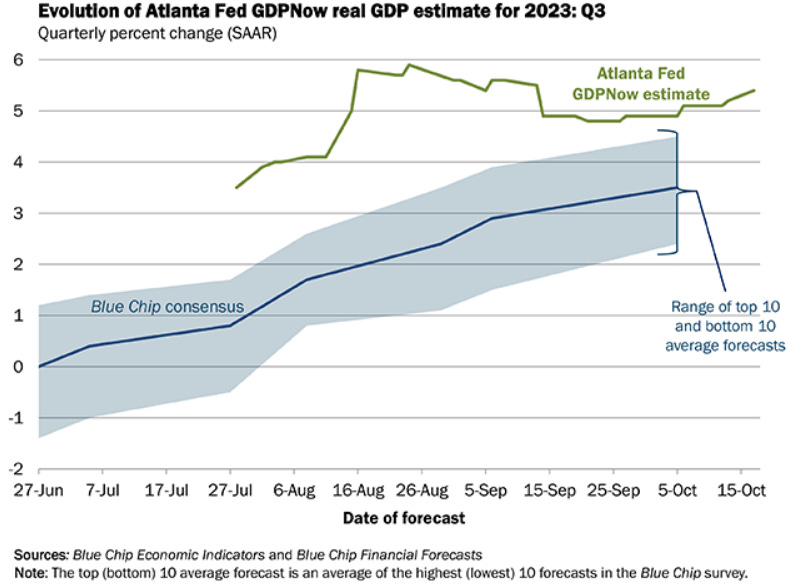

Futures markets are pricing in almost no chance of another interest rate hike at the November FOMC meeting. That comes after Fed Chair Jerome Powell spoke last week, reinforcing the Fed’s resolve to control inflation, but acknowledging the impact that higher long-term interest rates are having on financial conditions. Powell also repeated an oft-mentioned belief: it will likely take a period of below trend economic growth for inflation to reach the Fed’s 2% target. Below trend growth, however, is not what we got in Q3. Retail sales accelerated in September, reaching a 3.8% year-over-year rate, the highest since February. That drove an upward revision to the Atlanta Fed’s estimate for third quarter GDP, which now stands at 5.4%. That would be the fastest rate of growth since the end of 2021, when we were still rebounding from the COVID shutdowns. We’ll get our first official read on third quarter growth this week.

Monitoring Macroeconomics

The US consumer has proven more resilient than most economic forecasters believed possible, non-residential investment is accelerating, and last year’s downturn in residential construction appears to have turned the corner. A ‘soft landing’ – the scenario where the Fed successfully contains prices without creating widespread economic hardship – seems more and more likely with each passing month, and calls for recession are fading.

Inflation has decelerated significantly from last year’s peak, but it’s still well above the Federal Reserve’s 2% annual target. With consumer demand holding up and energy prices reaccelerating, further improvements in price trends will be harder to come by. Fortunately, an unemployment rate of just 3.8% is far better than the 50-year average and below what was considered ‘full-employment’ just a few short years ago.

What’s Ahead

Here are the key data releases to keep an eye on ahead of the long weekend.

The post The Weekly Grind: October 23, 2023 first appeared on Grindstone Intelligence.