The Weekly Grind: September 18, 2023

The US Dollar index has risen for 9 weeks in a row. That’s only happened two other times: 2014 and 1997. Crude oil, meanwhile, has risen 10 of the last 12 weeks, and so has the price of 10-Year Treasury futures. Equity indexes were mostly unchanged for the week, and gold and bitcoin both rose modestly.

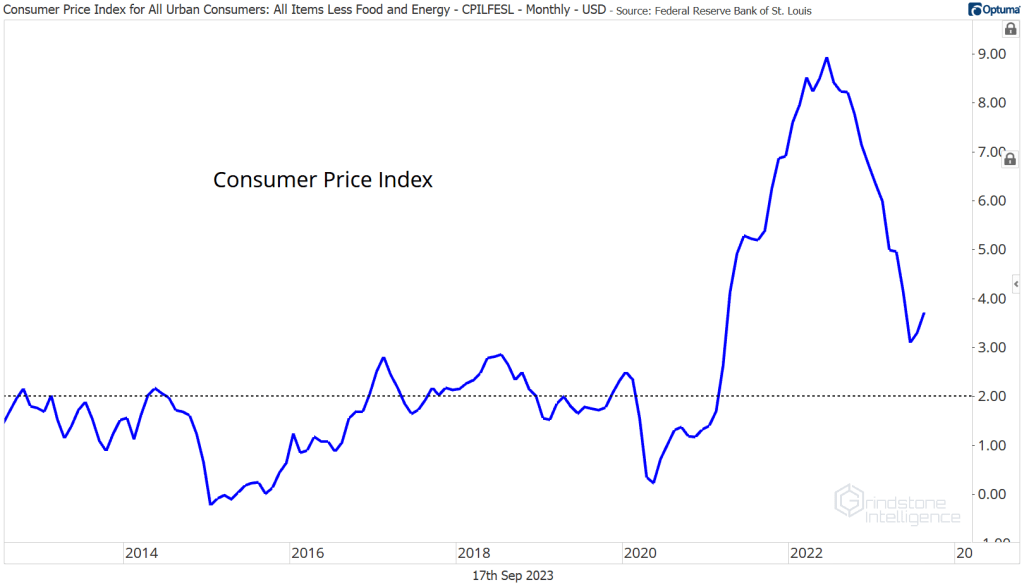

Nobody said getting inflation under control would be easy. After more than a year of decelerating price increases from last summer’s peak inflation rate, prices are heading the wrong way once again. Last week’s data release showed the Consumer Price Index jumped to 3.7% in August, up from June’s 3% annual rate, and still well above the Federal Reserve’s 2% annual target. A rebound in energy prices (thanks in part to the aforementioned rally in crude oil) is largely to blame for the disappointing inflation report, while the contribution from food and services continues to decline.

At this week’s FOMC meeting, Fed officials will have to contend with the troubling reversal in CPI while balancing the risks to economic growth.

Earnings Expectations and Valuation

The stock market selloff in 2022 was not driven by a deterioration in corporate earnings. Though stock prices dropped well over 20% from their peak to trough, expected future earnings remained stubbornly high. That divergence pushed the S&P 500 forward price-to-earnings ratio from more than 20x (a level previously seen only during the late-1990s) to 15x (a level in-line with historical averages).

The first half of 2023 was the opposite experience: stock prices rose, but earnings did not. Profits have now declined for three consecutive quarters. The ongoing correction in stock prices this August has served to dampen valuations a bit, but at nearly 19x next year’s earnings, equities are still far from cheap when compared to historical norms. Next year’s earnings are expected to rebound 11%.

What’s Ahead

Here’s the economic calendar for the week ahead

The post The Weekly Grind: September 18, 2023 first appeared on Grindstone Intelligence.