The Weekly Wrap: April 3, 2023

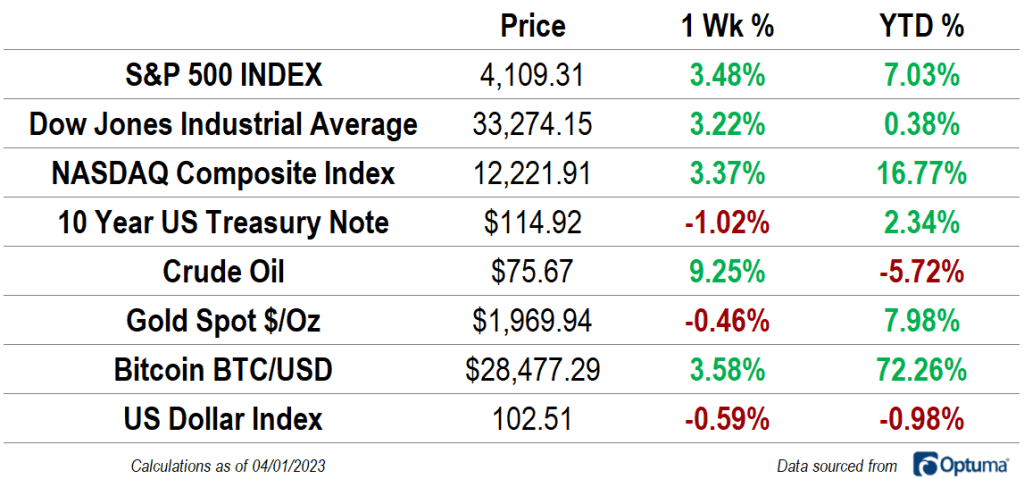

Stock prices soared last week, ending the first quarter on a high note. All three of the major US indexes are in positive territory for the year, led by the NASDAQ Composite, which is up 16.8%. Crude oil volatility continues, as prices jumped 9.25% to $75 per barrel. Bitcoin jumped 3.6% to close near its highest levels of the year, while gold gave back some of last week’s gains. The US Dollar Index fell for the third straight week, and interest rates rose.

One Thing to Consider

Is a 2023 recession inevitable? Recent bank failures and the resulting outflow of deposits into money markets and other short-term investment instruments has economists concerned about the risks of disintermediation. Large deposit outflows force banks to pull back on credit issuance, and those types of credit crunches often lead to economic downturns. The Federal Reserve’s response to that risk remains the biggest wildcard. If they continue to increase short-term interest rates, the threat of disintermediation will grow. Pausing their pursuit of tighter financial conditions would mitigate those threats, but could also serve to reignite the inflationary pressures that forced the Fed down this path in the first place. Friday’s jobs report will offer early clues as to how employers are responding to risks and uncertainties in the economic outlook – and that could tip the scales at the next FOMC meeting.

Earnings Expectations and Valuation

The stock market selloff in 2022 was not driven by a deterioration in corporate earnings. Though stock prices dropped well over 20% from their peak to trough, expected future earnings remained stubbornly high. That divergence pushed the S&P 500 forward price-to-earnings ratio from more than 20x (a level previously seen only during the late-1990s) to 15x (a level in-line with historical averages).

So far, 2023 has been the opposite experience: stock prices are rising, but earnings are not. In fact, consensus expectations for future earnings are falling. At the beginning of the year, analysts expected 7% EPS growth in 2023. Now they expect earnings to decline. The result is that valuations are elevated once again. The S&P 500 currently trades at a forward multiple of more than 18x.

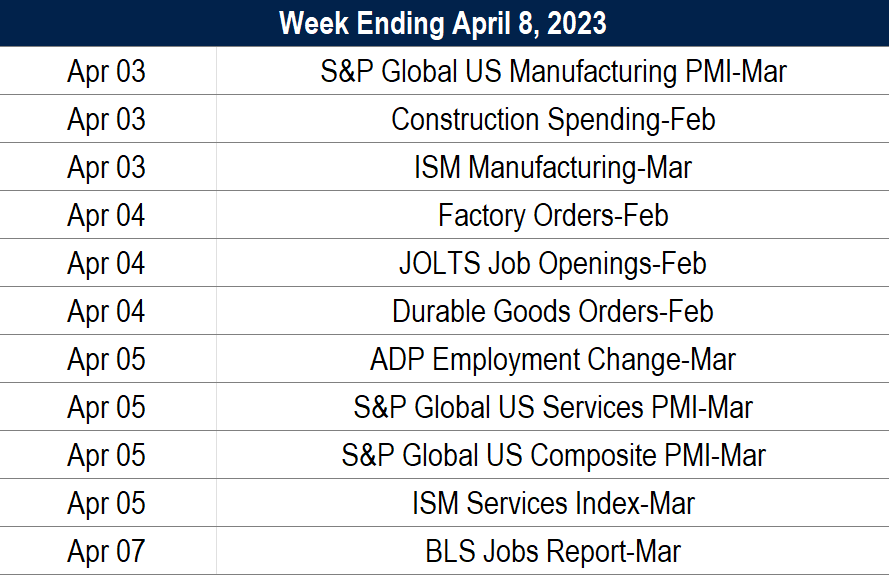

What’s Ahead

Here are the key data releases to keep on eye on in the coming days. Despite a Fed hiking cycle that’s now more than a year old, the labor market has shown few signs of weakness. This week, we’ll see whether that’s changed in recent weeks.

The post The Weekly Wrap: April 3, 2023 first appeared on Grindstone Intelligence.