The Weekly Wrap: August 1, 2022

Week in Review

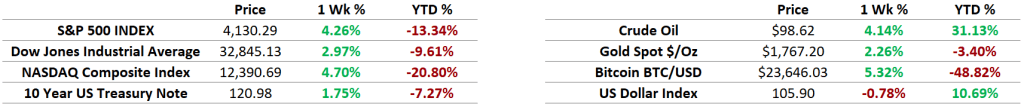

US assets turned in a strong performance last week. The growth-focused Nasdaq Composite rose 4.7%, while the somewhat more defensive Dow rose nearly 3%. The Dow is down less than 10% for the year. The S&P 500 index climbed 4.3%. Bond prices jumped as 10-year yields closed below 2.7%. The US Dollar continued to weaken, providing support for commodity prices: Gold prices rose 2.3%, while Crude Oil rebounded 4.4% from its worst weekly close since February. Bitcoin rallied more than 5%, the third positive week in the last 4.

The Federal Reserve raised interest rates another 0.75% last week as they continue their efforts to tame inflation. Chairman Jerome Powell said this hike brings the Federal Funds target rate in-line with most estimates of the neutral rate, allowing the Fed to move to a restrictive policy at the September meeting. Upcoming inflation and jobs data will help determine exactly how restrictive policy actions need to be. Notably, Powell doesn’t believe the US is already in a recession, but he did say demand is clearly slowing in response to tightening actions.

Monitoring Macroeconomics

Last week’s GDP report showed that the US economy fell for a second consecutive quarter. That satisfies a widely used rule of thumb for defining recessions, but we still don’t have confirmation of the downturn from the NBER, the nation’s official arbiter of recessions.

Measures of inflation continue to rise, with even core PCE, which strips the volatile food and energy components from the Fed’s preferred measure of prices, sitting well above their 2% inflation target. Unemployment, however, remains low, and consumer spending remains healthy.

What’s Ahead

We start this week with some survey data. First, we’ll get updates on manufacturing PMIs from the Institute of Supply Management and S&P Global. Their sister reports on the services sector come out on Wednesday. Friday is jobs day, where we’ll see whether the slowdowns shown in GDP have spread to the labor market. Tuesday’s report on job openings could give some earlier insight into that question, but keep in mind that JOLTS data is stale – we’re getting readings for June, not July. The New York Fed’s Loan Officer survey typically doesn’t get much attention, but Monday afternoon’s release could show that banks are tightening lending standards as a result of the economic slowdown.

The post The Weekly Wrap: August 1, 2022 first appeared on Grindstone Intelligence.