The Weekly Wrap: August 22, 2022

Week in Review

Growth stocks led last week’s equity decline, with the Nasdaq Composite falling 2.6% for its worst week since the end of June. The S&P 500 fell 1.2%, while the Dow Jones Industrial Average was relatively unchanged for the week. Rates rose for the third straight week as 10 year Treasury notes fell nearly 1%. The US Dollar Index climbed the most since March 2020, rising 2.4%. Crude oil’s late week rally wasn’t enough to offset declines on Monday and Tuesday. It fell 1.4% to close at $90.77. Gold and Bitcoin each fall 3.1% on the week. For both, that’s the fifth straight weekly decline.

Throughout 2022, rising rates and a strong Dollar have been headwinds for higher stock prices. The Dollar Index is on track for its best year since 1997, and with each new upturn, equities have retrenched lower. Treasuries are off to a horrid start, already down more than any full year since 1999. The good news? Stocks bottomed the same week that rates set their peak in the middle of June. The bad news? It might not last. Ten year US Treasury yields have jumped nearly 50 bps since August 2. With a Fed committed to breaking the back of inflation, rates could have further to go. And that’s trouble for stocks.

Earnings Expectations and Valuation

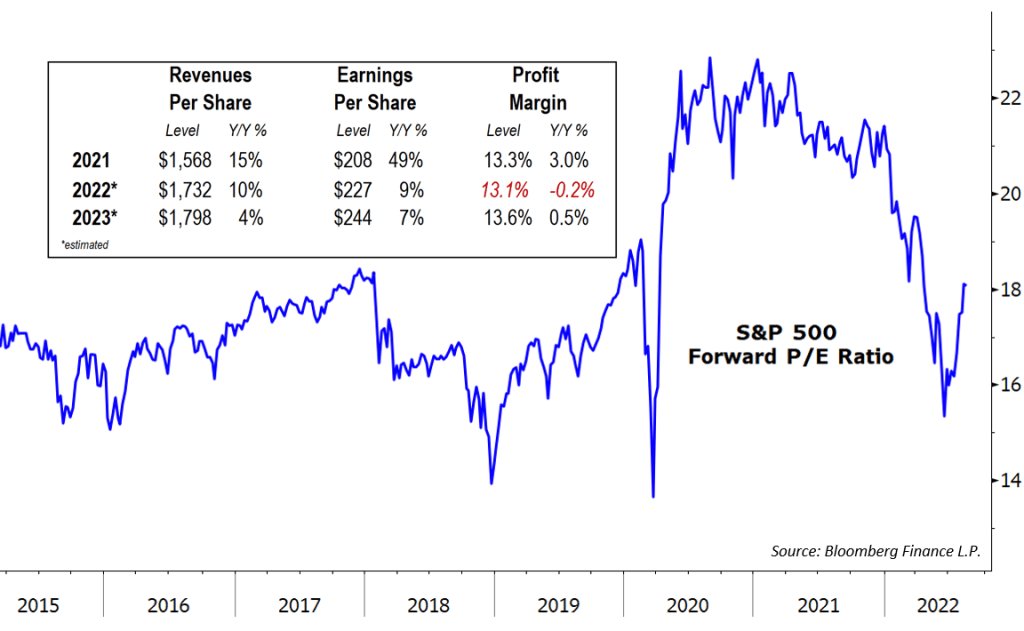

This year’s market selloff has not been matched by a decline in earnings expectations. That drove the S&P 500’s forward price-to-earnings ratio from a historically elevated level of 23x to less than 16x, which more closely aligns with the average over the last 30 years. Valuation now hovers near 18x.

Earnings growth for large cap US stocks is expected to end the year at 9%, backed by double-digit revenue growth and stable profit margins. In 2023, the consensus expectation is for 7% earnings growth. That’s still near the long-term average, but a notable deceleration from prior years. That estimate relies on meaningful margin expansion.

What’s Ahead

It’s Jackson Hole week. Each year in August, the Federal Reserve Bank of Kansas City hosts an economic symposium near Jackson Hole, Wyoming. Many of the world’s most influential economists are in attendance, and Fed officials often use the event to update their thoughts on monetary policy. Jerome Powell is the one to watch – he speaks on Friday. We’ve also got plenty of economic data to look forward to. On Tuesday we’ll get new home sales, along with S&P Global’s preliminary read on August PMIs. Pending homes sales and durable goods orders are out on Wednesday, and then GDP on Thursday. Friday morning we see PCE inflation and Michigan Consumer Sentiment.

The post The Weekly Wrap: August 22, 2022 first appeared on Grindstone Intelligence.