The Weekly Wrap: August 8, 2022

Week in Review

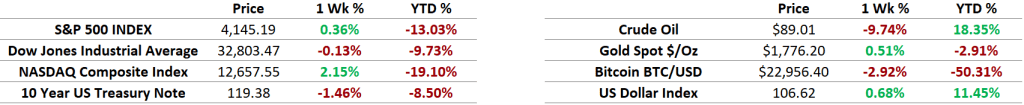

S stocks were mixed last week as the Dow Jones Industrial Average fell 0.1%. The Nasdaq Composite outperformed, climbing for a third consecutive week, but it remains 19% lower for the year. Treasury yields rose moderately. Commodity prices were weak in the face of renewed strength from the US Dollar. The Dollar index gained 0.7%, while oil dropped 9.7% for its worst close since January. Gold managed to gain 0.5%. Bitcoin declined 3%, giving back most of the prior week’s gains. It’s still the worst performing asset on our year-to-date dashboard, down 50%

Relatively Speaking

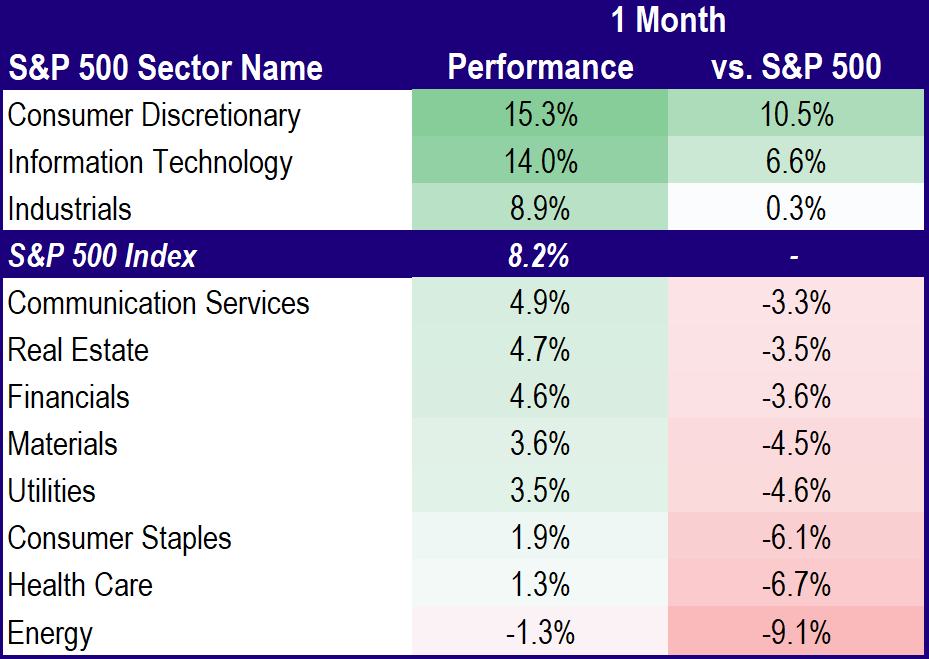

Growth-focused sectors have led over the last month, while less cyclical groups lagged. Notably, eight of the S&P 500’s eleven sectors underperformed over the period. Investing anywhere other than Consumer Discretionary, Information Technology, or Industrials yielded considerably less than the benchmark return.

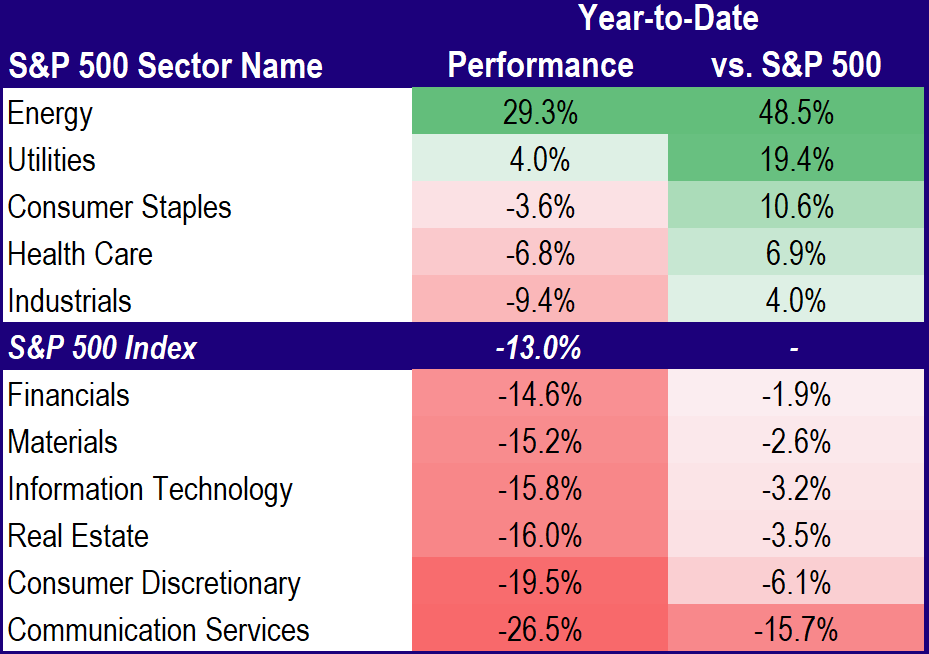

For the year, Energy is still the top performing sector, up nearly 30%. That’s bucked the trend set by other cyclical sectors, most of which are down double-digits in 2022. Technology and tech-like groups have seen the most damage, while sectors that are less exposed to economic activity have outperformed.

What’s Ahead

We get a slight reprieve this week on the earnings front – only 5% of S&P 500 companies are set to report, after roughly one-third did so last week. The data schedule starts off slow, with no major releases set for Monday. On Tuesday, we’ll get the monthly NFIB Small Business Optimism index, followed by a preliminary estimate of second quarter productivity. Wednesday’s CPI report will give us an update on the Fed’s battle with inflation, and on Friday, we’ll see whether people are still depressed about prices when the University of Michigan publishes their Consumer Sentiment Index.

The post The Weekly Wrap: August 8, 2022 first appeared on Grindstone Intelligence.