The Weekly Wrap: December 27, 2022

Week in Review

Stock market returns were mixed entering the long holiday weekend. The Dow Jones Industrial Average rose 0.86% on the week, while the S&P 500 index fell modestly, and the Nasdaq Composite dropped 1.9%. The 10-year rate closed near 3.75%, its highest level in a month. A falling US Dollar index provided a tailwind to commodities – gold prices climbed 0.3%, while crude oil jumped more than 7%. Oil prices are still lower for the month of December. Bitcoin continued to struggle, dropping another 3%.

Relatively Speaking

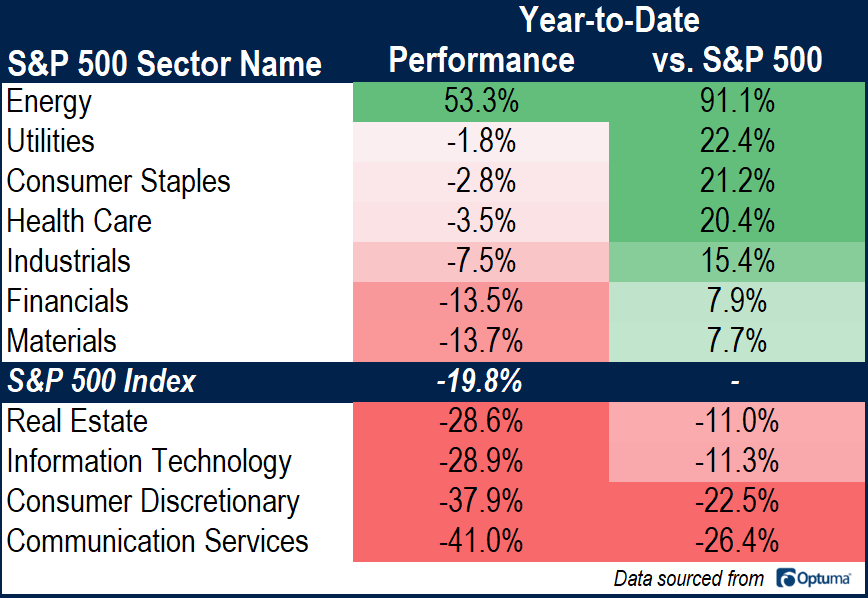

Risk-off sectors of the market outperformed over the last month as stock prices fell. Utilities and Health Care were the lone positive sectors over the period. Energy stocks declined almost 9%, reversing some of their year-to-date gains, while Discretionary, Technology, and Communications all continued to lag.

For the year, Energy is only sector in the green, up more than 50%. It’s outperformed the broader index by 91% since last December. Technology and tech-like groups have seen the most damage, while sectors that are less exposed to economic activity, like Consumer Staples and Health Care, have outperformed.

What’s Ahead

It’s the final trading week of the year, and it’ll be shortened one. Markets are closed Monday in the US and many countries around the world in observance of the Christmas holiday. National home price indexes are updated on Tuesday morning, and pending home sales are released on Wednesday. Business survey results from the Dallas, Richmond, and Chicago Federal Reserve districts are published on Tuesday, Wednesday, and Friday, respectively. The US Treasury will also auction 2-year, 5-year, and 7-year notes during the week. Then it’s on to 2023.

The post The Weekly Wrap: December 27, 2022 first appeared on Grindstone Intelligence.