The Weekly Wrap: December 5, 2022

Week in Review

Stock prices rose last week, led by a resurgence in growth stock as markets continue to price in expectations of a pivot in monetary policy. The Nasdaq Composite rose 2%, but it’s still the worst-performing of the major indexes year-to-date. Bond prices rose more than 1%. The yield on 10-year Treasuries ended the week below 3.5% for the first time since September. Commodities performed well, with crude oil jumping back above $80 and gold closing above $1800. They were aided by a weak US Dollar, which fell to June levels.

Jerome Powell pleased investors when he all but confirmed plans to slow the Fed’s path of rate hikes to 0.50% at the upcoming FOMC meeting. The Federal Reserve chair spoke at a Brookings event and noted that the pace of hikes is now less important than the level. Friday’s payroll report seemed to confirm that a higher terminal rate is needed: the economy continues to add jobs at a healthy pace, and wages continue to grow much faster than is consistent with the Federal Reserve’s 2% inflation target.

Market Internals

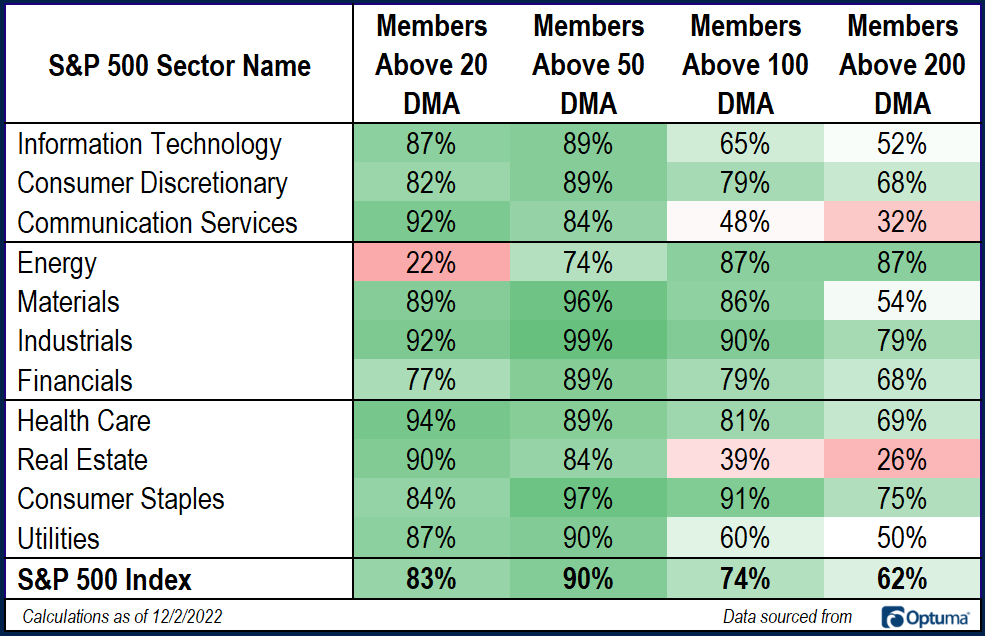

The majority of stocks are in uptrends across short, intermediate, and long-term timeframes, as 62% of stocks are above their 200-day average, and 83% are above their 20-day average.

Long-term breadth is strongest in Energy stocks, where 87% of members are above 200-day averages. Energy is the weakest sector on shorter timeframes, though – less than a quarter of its members are above a 20-day average. The Real Estate and Communication Services sectors sustained the most trend damage, and they still have the most to repair. Less than a third of each group has recovered above its long-term average price.

What’s Ahead

We start the week with survey data from S&P Global and the Institute for Supply Management. Both are set to publish November services numbers on Monday. On Wednesday, we’ll see the latest estimates for Q3 labor costs and productivity, and we’ll also get consumer credit data that afternoon. Producer prices are reported on Friday, along with University of Michigan sentiment data.

The post The Weekly Wrap: December 5, 2022 first appeared on Grindstone Intelligence.