The Weekly Wrap: February 13, 2023

Week in Review

Stocks suffered their worst week of the year, with the NASDAQ Composite failing to closing higher for the first time since December. Despite its, 2.4% decline, the NASDAQ is still outpacing other US equity indexes year-to-date, with a 12% gain. The Dow Jones Industrial Average was flat, and the S&P 500 Index fell 1%. Crude oil is going nowhere fast – in 6 of the last 10 weeks, oil prices have moved 7% or more. From start to finish, though, the total change has been only 0.3%. Gold prices were flat for the week, despite a strengthening Dollar, and Bitcoin dropped 7.7%.

These days, inflation readings are the most important piece of the economic puzzle. Measures of price increases have steadily declined for the past few months, giving rise to the belief that Federal Reserve rate hikes will soon be at an end. Tuesday’s CPI report for the month of January could reinforce that narrative, or topple it. December’s reading dropped sharply, aided by declines in food, energy, other commodities, and autos. If some of those declines reverse and services inflation remains elevated, markets may respond by pricing in more action from the Fed.

Monitoring Macroeconomics

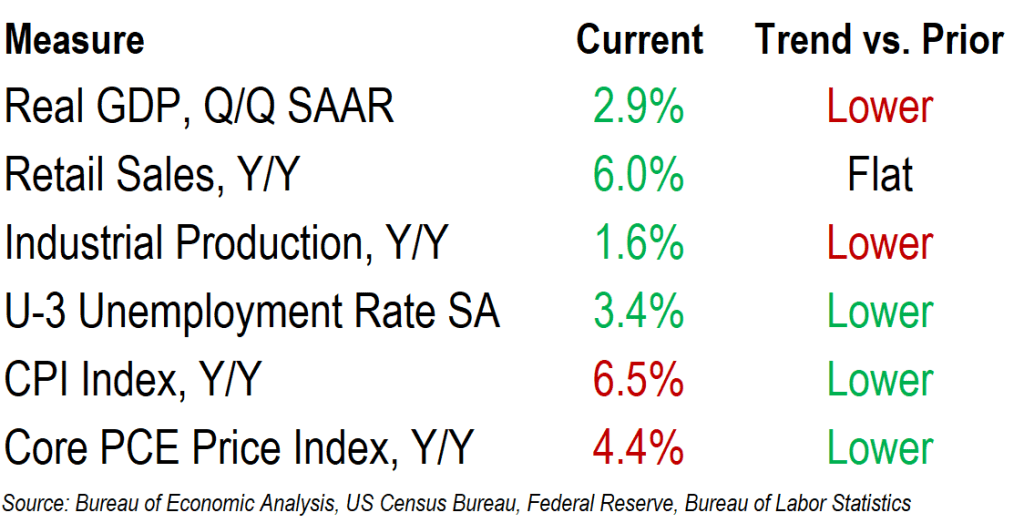

GDP grew at a healthy pace in the final quarter of 2022, helped by a surge in inventories and strong net exports. Economists widely believe that a recession will hit the United States sometime in the latter half of this year, as the Federal Reserve’s battle with inflation heats up and financial conditions tighten. Recent positive surprises in economic data, though, have increased the odds of a ‘soft landing’ – a scenario where the Fed successfully contains prices without creating widespread economic hardship.

Measures of inflation remain well above the Federal Reserve’s 2% target, but CPI has decelerated for 3 straight months, and measures of core price changes dropped below 5%. Unemployment, meanwhile, dropped to its lowest level in almost 70 years in January.

What’s Ahead

All eyes are on Tuesday’s CPI report, where forecasters expect to see inflation decelerate for the seventh straight month. The following day, we’ll see how consumer spending bounced back after a weaker December retail sales report. We’ll also get the January read on industrial production and the Empire State Manufacturing Index. On Thursday, we’ll be watching producer prices, as well as a housing data dump including housing starts, building permits, and the NAHB Housing Market Index. Fourth quarter earnings season also continues.

The post The Weekly Wrap: February 13, 2023 first appeared on Grindstone Intelligence.