The Weekly Wrap: February 27, 2023

Week in Review

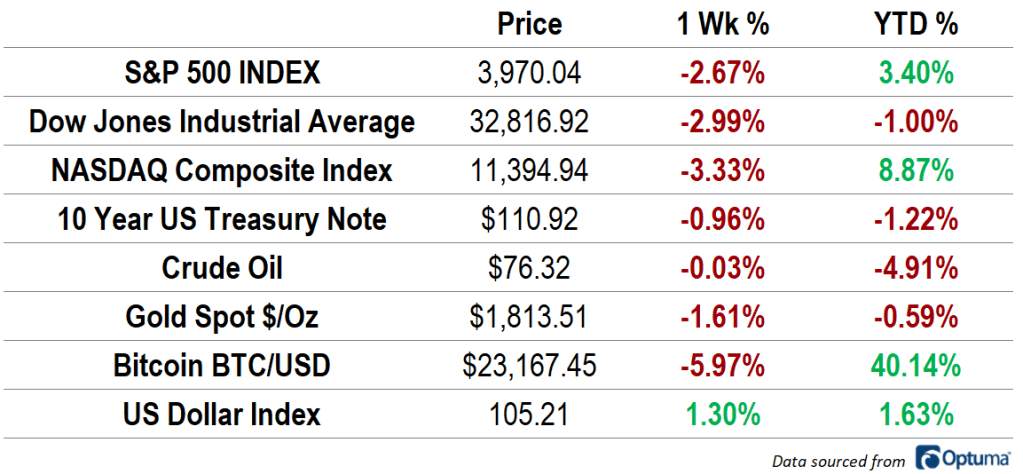

The S&P 500 had its worst week since December and the Dow Jones Industrial Average dropped 3%, falling into negative territory for the year. The NASDAQ Composite led equity declines for the week, but the growth-focused index is still the best performing major index in 2023, up 8.9% since December. The US Dollar Index jumped 1.3%, its largest 1-week gain in 5 months, and bond returns continued to disappoint as 10-year Treasury bonds fell 1%. Crude oil was flat, and gold prices fell. Bitcoin dropped 6%.

Inflation data released in the month of February consistently disappointed market participants and Fed-watchers alike, as disinflationary trends from November and December slowed. Last week, market declines accelerated when the BEA published updated GDP estimates for Q4 2022 and the PCE Price Index for January. Together, the reports painted a rather bleak picture: growth from consumer spending is slowing and will face even more pressure as excess savings are depleted. Meanwhile, the disinflationary benefit from goods deflation is dissipating, while services inflation continues to creep higher. One month of data does not make a trend, but anyone hoping for evidence that the Fed can achieve a ‘soft-landing’ was surely disappointed by last week’s news.

Market Internals

Despite February volatility, more than half of all stocks in the S&P 500 are in long-term uptrends, as indicated by their positions relative to a moving average price. Between 50% and 60% of issues are above 100 and 200-day moving averages. Short-term trends, though, are significantly weaker. More than 80% of stocks companies are trading below a 20-day moving average.

Uptrend breadth is strongest in risk-on areas of the market. Three-quarters of stocks in the Financials and Consumer Discretionary have healthy, long-term technical structures, while more than 60% of members in the Materials and Industrials sectors are similarly strong. The Utilities and Real Estate sectors are in the weakest technical positions.

What’s Ahead

We’ve got a full week of economic releases ahead, but it’s mostly second-tier data. On Monday, we’ll get January numbers for durable goods and pending home sales. The Dallas Fed will release February numbers for their Manufacturing index as well. On Tuesday, it’ll be home prices, Consumer Confidence from the Conference Board, and three more Federal Reserve bank activity surveys: Chicago, Richmond, and Dallas (services). February manufacturing PMIs from both S&P Global and the Institute for Supply Management are set for Wednesday, and the services portion will come out on Friday. The final read on Q4 unit labor costs and productivity is slated for Thursday.

The post The Weekly Wrap: February 27, 2023 first appeared on Grindstone Intelligence.