The Weekly Wrap: February 6, 2023

Week in Review

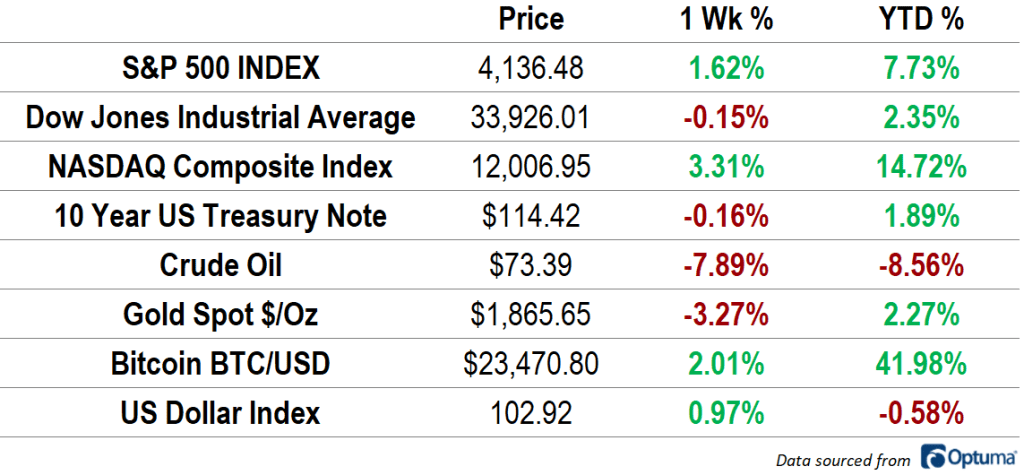

The NASDAQ Composite rose another 3.3% last week, bringing its year-to-date rise to 14.7%. The S&P 500 index rose 1.6%, while the Dow Jones Industrial Average, which has less exposure to the high-flying tech stocks that led the markets this year, fell slightly. The Dollar index rose 1%, putting pressure on commodity prices. Gold dropped 3.3%, and crude oil prices fell 7.9%. Interest rates rose modestly, pushing bond prices lower. Bitcoin continued its strong start to 2023 by climbing another 2%.

The Federal Reserve hiked interest rates another 0.25% last Wednesday, taking their targeted overnight lending rate to a range of 4.50% to 4.75%. That’s the highest their policy rate has been since 2007. At his post-meeting press conference, Fed Chair Jerome Powell reinforced previous guidance for continued hikes and a terminal rate above 5%. He’s encouraged by recent inflation data and the resiliency of the labor market, but said it’s premature to declare victory. When confronted with the reality that markets are pricing in rate cuts in the latter half of the year, Powell repeated that rates will likely need to remain elevated for ‘some time’ in order to achieve the Fed’s mandate of price stability.

Earnings Expectations and Valuation

The equity selloff in 2022 was not driven by a deterioration in corporate earnings. Though stock prices dropped well over 20% from their peak to trough, expected future earnings remained stubbornly high. That divergence pushed the S&P 500 forward price-to-earnings ratio from more than 20x ( a level previously seen only during the late-1990s) to 15x (a level in-line with historical averages).

So far, 2023 has been the opposite experience: stock prices are rising, but earnings are not. In fact, consensus expectations for future earnings are falling. At the beginning of the year, analysts expected 7% EPS growth in 2023. Now they expect earnings to be flat. The result is that valuations are elevated once again. The S&P 500 currently trades at a forward multiple of more than 18x.

What’s Ahead

The Q4 reporting period continues this week. About half of S&P 500 constituents have reported so far, and nearly 100 more will released results for the quarter in the week ahead. The economic calendar is virtually empty – aside from NFIB Small Business Optimism on Tuesday, the only top-tier release will come on Friday when the University of Michigan updates its consumer sentiment index. The void will be filled by Fed-speak. Jerome Powell talks at a conference in Washington on Tuesday, and most other FOMC participants will update the markets on their own views throughout the week.

The post The Weekly Wrap: February 6, 2023 first appeared on Grindstone Intelligence.