The Weekly Wrap: January 3, 2023

Week in Review

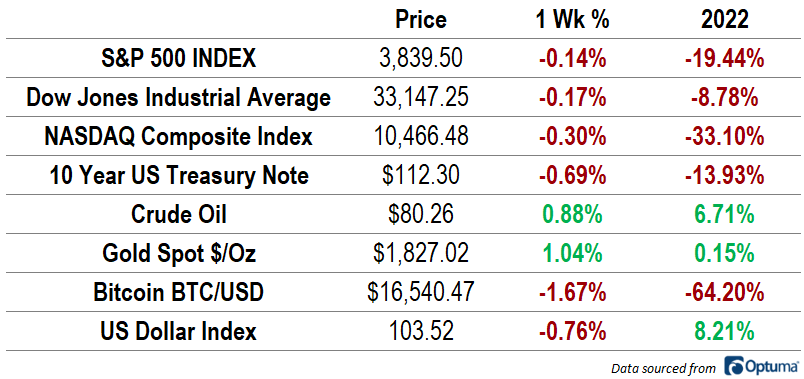

Stock prices fell modestly in the final week of 2022. It was the first year since 2018 in which stocks finished a calendar year in the red. The S&P 500 dropped 19.4% for the year, the Dow Jones Industrial Average declined 8.8%, and the Nasdaq Composite fell 33.1%. Treasury yields rose again, with the benchmark 10-year rate ending the year near 3.9%, more than double the 1.5% seen at the end of 2021. Crude oil ended 2022 just above $80 per barrel, 6.7% higher than last December, while gold prices rose last week to end the year unchanged. The US Dollar gave up some ground, but still rose more than 8% for the 12-month period. Bitcoin rounded out a disappointing year with another 1.7% drop.

The final week of the year largely mirrored the previous 51: Mega cap tech and tech-like stocks faced heavy selling pressure, as rising interest rates forced investors to recalibrate how they value future growth prospects. 2022 will long be remembered as one of the worst years ever for investors, as the traditional 60/40 portfolio fell by double-digits. Let’s hope 2023 offers better outcomes for all.

Market Internals

Just under half of all S&P 500 stocks are in long-term technical uptrends, based on their relationships with a 200-day moving average. Breadth is similarly mixed on 50 and 100-day timeframes, but somewhat weaker in the shorter term: Less than a third of stocks are above their 20-day moving average price.

Long-term breadth is strongest in Energy stocks, as it was for nearly all of 2022. Seventy percent of the sector’s members are above 200-day averages. It’s also the strongest sector on shorter timeframes, three quarters of its members are above their 20-day average. The Real Estate sector stands out for its relative weakness – nearly all of its constituents are in technical downtrends on 20-day and 200-day timeframes.

What’s Ahead

We’ve got a holiday-shortened week to start the year. Markets are closed on Monday to celebrate the new year. On Tuesday, S&P Global publishes Manufacturing PMI results for December, followed by the equivalent survey from the Institute for Supply Management on Wednesday. The services components of those surveys come out on Thursday and Friday. We’ll also get FOMC Minutes on Wednesday, along with job openings for November, before the most important data arrives to close out the week: ADP employment change estimate on Thursday, and the BLS Labor report on Friday.

The post The Weekly Wrap: January 3, 2023 first appeared on Grindstone Intelligence.