The Weekly Wrap: July 25, 2022

Week in Review

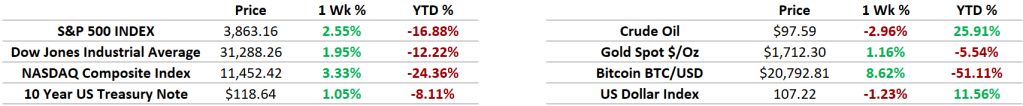

US stocks rose last week, led by the technology and growth-oriented Nasdaq Composite, which climbed 3.3%. The more defensively oriented Dow Jones Industrial Average rose 2.0%, and the S&P 500 split the difference, rising 2.6%. The US Dollar retreated from the prior week’s 20 year high, falling 1.2% despite volatility around the ECB’s monetary policy meeting on Thursday. Commodities managed to shake off early-week declines and finished the week largely unchanged. Ten-year Treasury yields continue to stabilize near 3.00%, with bond prices rising slightly. Bitcoin rallied 8.6% to its highest price in a month.

Second quarter earnings season is underway, with Financials dominating the early reporting schedule last week. Bank earnings faced tough comparisons from the prior year, when they were able to release loan loss reserves that were built up during the pandemic. Because of that, the Financials sector will likely be a large drag on corporate earnings growth this quarter and for the remainder of the year. Energy companies, meanwhile, are benefiting from higher commodity prices and should report strong performances during the quarter.

Earnings Expectations and Valuation

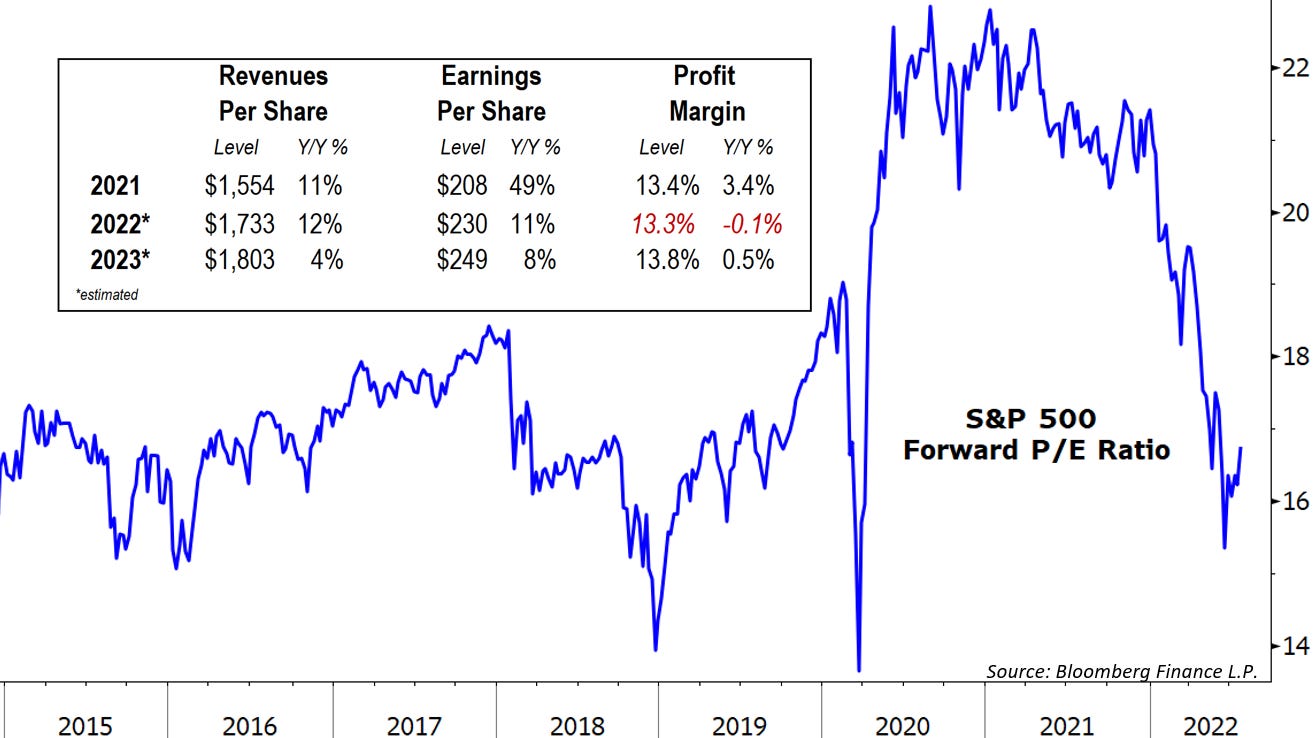

This year’s market selloff has not been matched by a decline in earnings expectations. That’s driven the S&P 500’s forward price-to-earnings ratio from a historically elevated level of 23x to less than 16x, which more closely aligns with the average over the last 30 years.

Earnings growth for large cap US stocks is expected to end the year at 11%, backed by double-digit revenue growth and stable profit margins. In 2023, the consensus expectation is for 8% earnings growth. That’s still above the long-term average, but a notable deceleration from prior years. The estimate relies on significant margin expansion.

What’s Ahead

It’s Fed week. The FOMC’s interest rate decision will be announced on Wednesday afternoon, with Chairman Powell set to speak afterward. Earnings season continues as roughly a third of the S&P 500 index is set to report. There’s plenty of economic data to watch, too. Updates on Consumer Confidence and home prices arrive Tuesday. Wednesday’s slate includes more housing along with durable goods orders. On Thursday we’ll get the first estimate of Q2 GDP, followed by core PCE – the Fed’s preferred measure of inflation – on Friday.

The post The Weekly Wrap: July 25, 2022 first appeared on Grindstone Intelligence.