Weekly Market Wrap: May 1, 2023

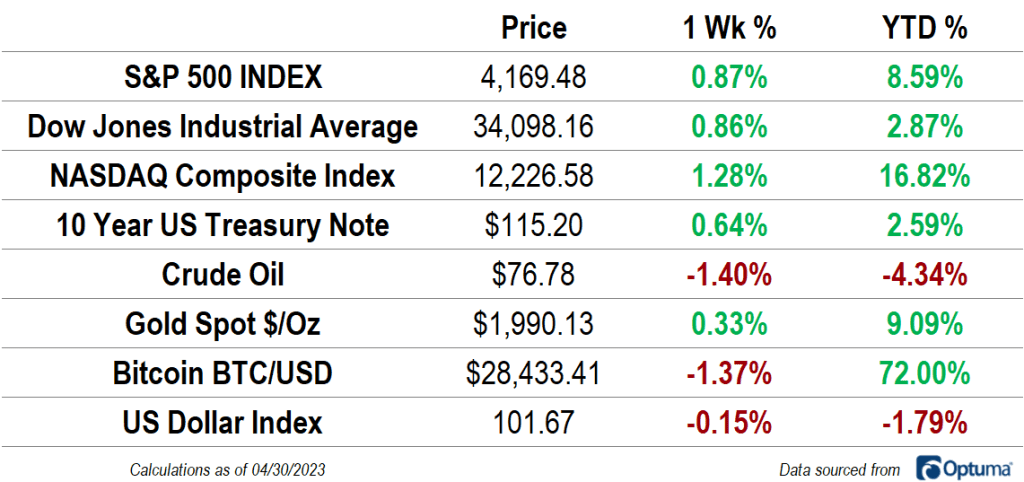

Stocks moved higher last week, led by the NASDAQ Composite, which had its highest weekly close since last August. The NASDAQ is now up 16.8% for the year, nearly doubling the benchmark S&P 500 year-to-date performance. The US Dollar index fell slightly, but that wasn’t much of a tailwind for commodities. Crude oil dropped 1.4%, gold was mostly unchanged, and Bitcoin declined 1.4%. Long-term US Treasury bonds rallied 0.6%.

One Thing to Consider

Last week’s upside surprises for the Employment Cost Index and the PCE deflator all but ensured another interest rate hike at Wednesday’s FOMC meeting. The odds of a 0.25% move by the Fed are roughly 90%. While inflation data remains stubbornly high, GDP in the first quarter missed expectations. The 1.1% growth in the first quarter was the weakest since last spring, thanks to a sharp decline in inventories. Personal consumption, however, remained healthy during the period, and the drag from residential investment moderated. At his post-meeting press conference, Fed Chair Jerome Powell will be forced once again to explain how he views the risk of economic recession, and how that alters his approach in the battle against inflation.

Earnings Expectations and Valuation

The stock market selloff in 2022 was not driven by a deterioration in corporate earnings. Though stock prices dropped well over 20% from their peak to trough, expected future earnings remained stubbornly high. That divergence pushed the S&P 500 forward price-to-earnings ratio from more than 20x (a level previously seen only during the late-1990s) to 15x (a level in-line with historical averages).

So far, 2023 has been the opposite experience: stock prices are rising, but earnings are not. Profits are set to contract for a second consecutive quarter – an event commonly referred to as an earnings recession. The result is that valuations are elevated once again. The S&P 500 currently trades at a forward multiple of more than 18x.

What’s Ahead

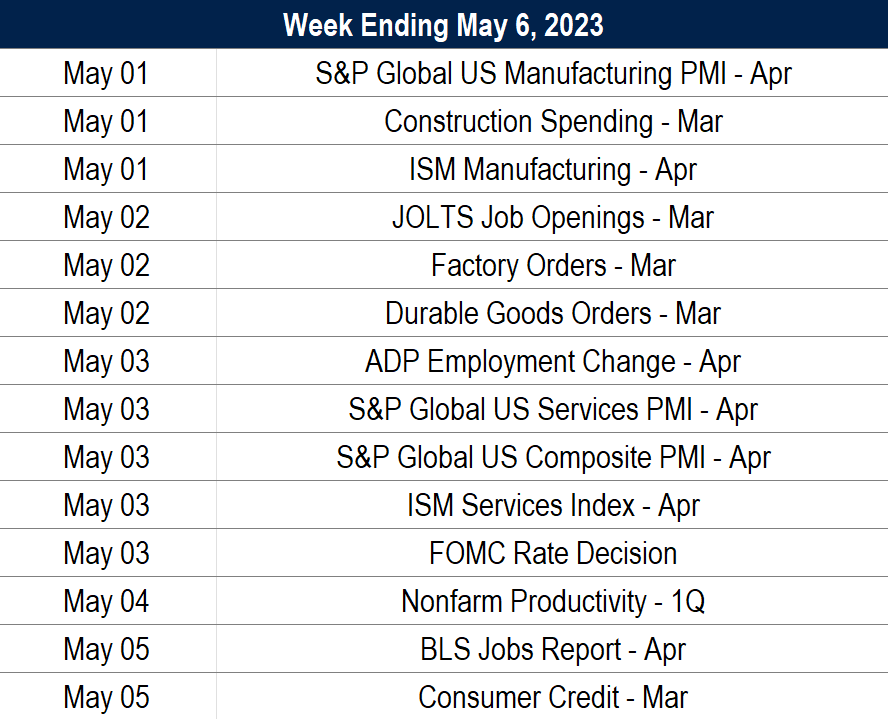

Here’s the economic calendar for the week ahead. It’s jobs week, but that will be overshadowed by Wednesday’s FOMC decision.

The post Weekly Market Wrap: May 1, 2023 first appeared on Grindstone Intelligence.