The Weekly Wrap: November 14, 2022

Week in Review

Stock prices surged last week, with the Nasdaq Composite leading the charge, up 8%. The S&P 500 rose nearly 6%, and the Dow Jones is now down only 7% for the year. Interest rates provided a catalyst, as the rate on 10-year Treasuries fell from 4.2% to 3.8% – even with the holiday shortened week in the US bond market. Currency volatility continued, with the US dollar index posting its third largest weekly decline in the last 40 years. That, along with an implosion in cryptocurrencies that pushed Bitcoin prices down 13%, helped Gold to its best day since 2020. Crude oil fell 4%, reversing some of last week’s large gain.

Markets rallied after last Thursday’s lower-than-expected CPI report. Core inflation, which strips out volatile food and energy components from the headline rate, was 6.3% year-over-year, a marked decline from last month’s 40-year high reading of 6.6%. With peak inflation potentially in the rearview mirror, markets are now trying to price in a potential slowdown in Federal Reserve tightening actions. A 50 basis point hike in December is now the consensus expectation, a step down from the 75 basis point increases implemented after each of the last 4 FOMC meetings. Less tightening reduces the risk of recession in the coming quarters.

Earnings Expectations and Valuation

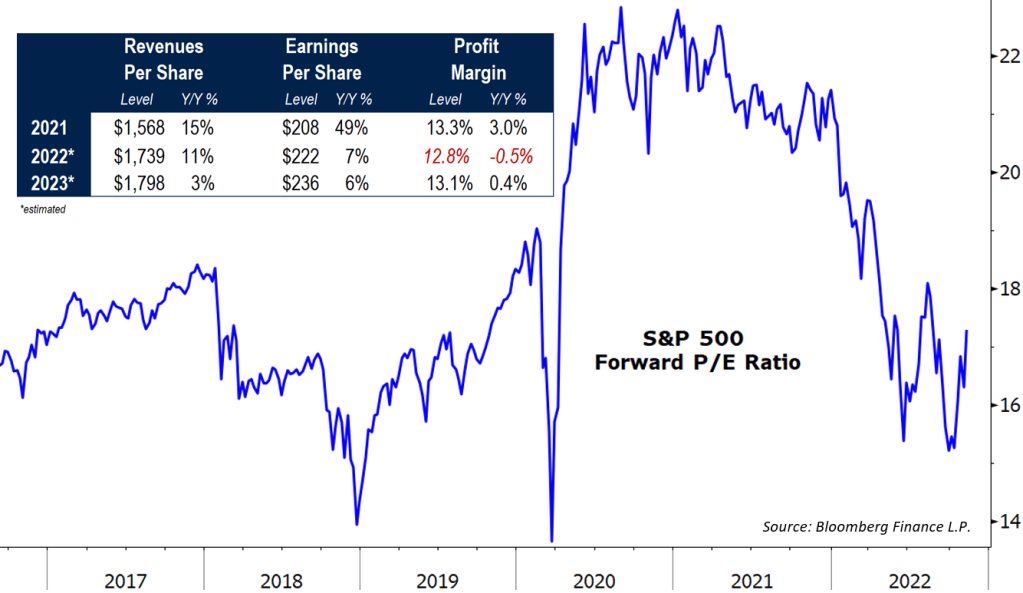

This year’s market selloff has not been matched by a proportionate decline in earnings expectations. That’s driven the S&P 500’s forward price-to-earnings ratio from a historically elevated level of 23x to 17x, which more closely aligns with the average over the last 30 years.

Earnings growth for large cap US stocks is expected to end the year at 7%, backed by double-digit revenue growth and stable profit margins. That’s near the long-term average, but a notable deceleration from prior years. In 2023, the consensus expectation is for 6% earnings growth, but that estimate relies on meaningful margin expansion.

What’s Ahead

We’ve got a full economic calendar this week, but we start off slow, with no major releases set for Monday. We’ll get another read on inflation as October producer prices are published on Tuesday. Retail sales, industrial production, import/export prices, and the NAHB Housing Market Index will give us plenty to watch on Wednesday, and we’ll get updates on housing starts Thursday morning. We close the week with existing home sales data on Friday. A handful of regional Fed business survey results are scheduled throughout the week, and virtually every FOMC member will make an appearance at some point.

The post The Weekly Wrap: November 14, 2022 first appeared on Grindstone Intelligence.