The Weekly Wrap: October 17, 2022

Week in Review

Stocks were mixed last week as growth-oriented names continued to face selling pressure, while value outperformed. The Dow Jones Industrial Average rose 1.2%, the Nasdaq Composite cratered 3.1%, and the S&P 500 dropped 1.6% to its lowest weekly close of the year. The US Dollar rose along with interest rates, a recurring theme this year. The Dollar is up 18.4% year-to-date, while 10-year Treasury notes have fallen 15.2% Crude oil gave back some of last week’s rally, dropping 7.6% to near $85. Gold also fell, erasing gains from the prior two weeks. Bitcoin remains an asset without a trend, stuck near $19,000.

Thursday’s CPI report indicated that inflation pressures are persisting in the US economy. Consumer prices rose 0.4% in September and 0.6% after stripping out volatile food and energy components. Housing costs, which comprise roughly a third of the headline CPI number, continued to rise at an elevated rate, and deflation in the cost of goods was more than offset by a rise in the price of services. That helped solidify expectations for another 75 basis point hike at the November FOMC meeting. Long-term rates pressed higher on the news too, with additional tailwinds coming from higher yields internationally given ongoing turmoil in the UK.

Earnings Expectations and Valuation

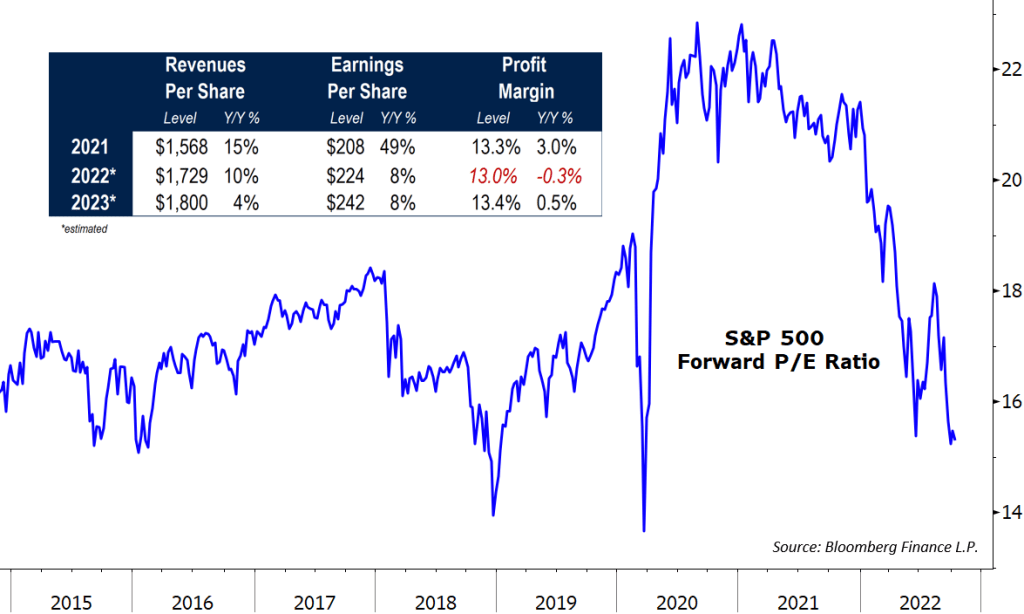

This year’s market selloff has not been matched by a proportionate decline in earnings expectations. That’s driven the S&P 500’s forward price-to-earnings ratio from a historically elevated level of 23x to less than 16x, which more closely aligns with the average over the last 30 years.

Earnings growth for large cap US stocks is expected to end the year at 8%, backed by double-digit revenue growth and stable profit margins. That’s near the long-term average, but a notable deceleration from prior years. In 2023, the consensus expectation is for 8% earnings growth again, but that estimate relies on meaningful margin expansion.

What’s Ahead

Third quarter earnings season is underway, with bank companies dominating the early reporting schedule and more than 60 companies set to report. It’s a lighter weak on the economic front. Industrial production is released on Tuesday morning, followed by an update on real estate with the NAHB Housing Market index. Housing starts and building permits are reported Wednesday, with the Fed’s most recent Beige Book coming out that afternoon. On Thursday, we’ll get existing home sales for September and an update from the Philadelphia Fed on manufacturing activity.

The post The Weekly Wrap: October 17, 2022 first appeared on Grindstone Intelligence.