The Weekly Wrap: October 3, 2022

Week in Review

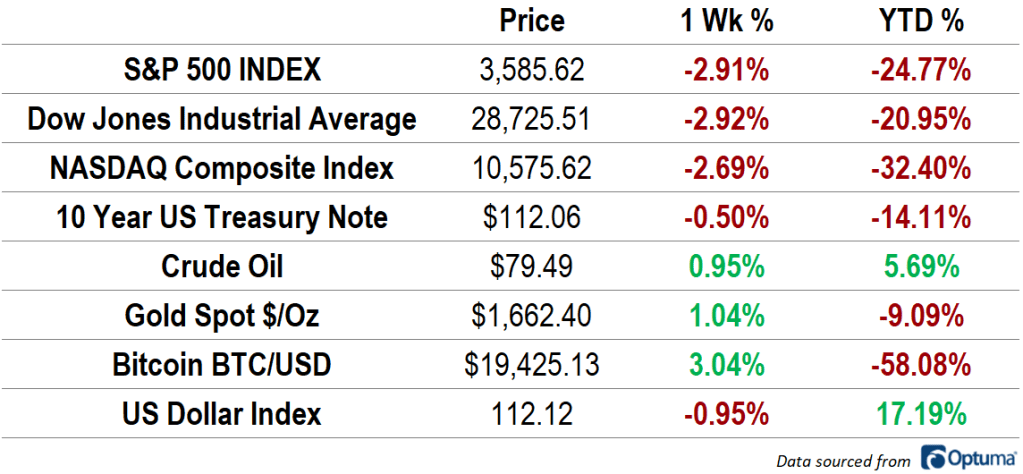

Stocks fell for the sixth time in seven weeks, finishing the week at the lowest levels since 2020. The S&P 500 Index is now down almost 25% for the year, and the Nasdaq is down more than 30%. Notably, stocks fell even as the US Dollar weakened almost 1% – the Dollar is still 17% higher in 2022. Commodities did well on the week, with Crude oil rising 1% to just under $80 per barrel. Gold climbed 1% as well. Bitcoin jumped 3%, but remains one of the worst-performing asset classes on the year. Treasury yields rose, with 10-year Treasury Notes falling 0.5%.

Relatively Speaking

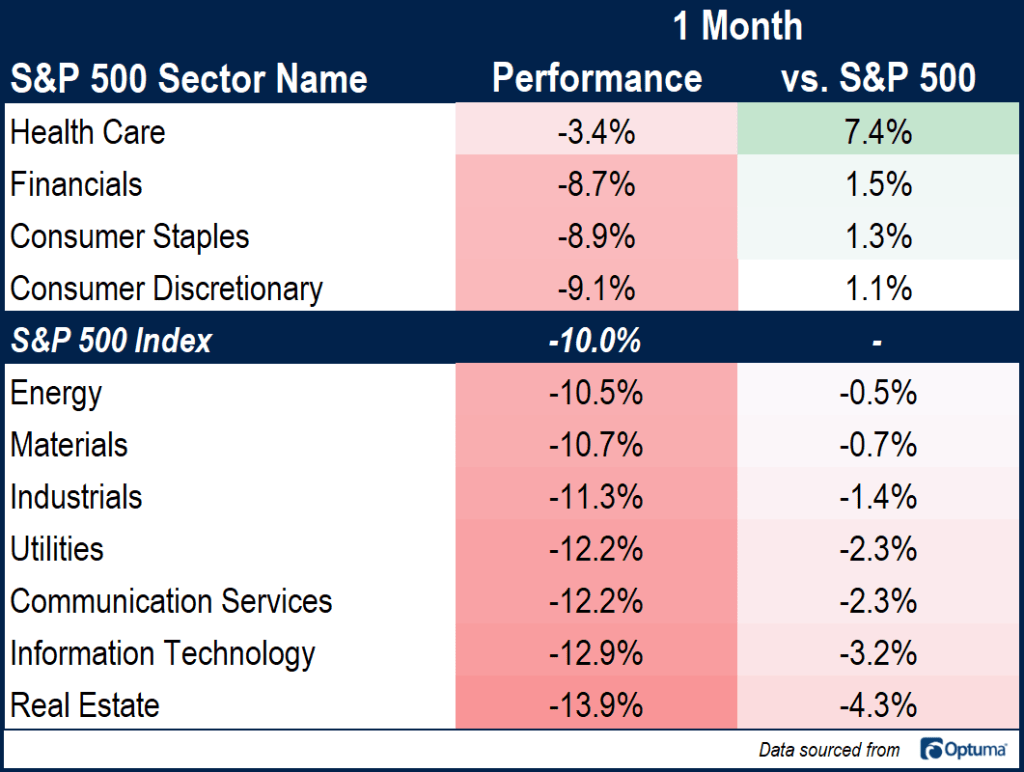

It was hard to generate positive returns over the last month, as no sector turned in a positive performance. Health Care was far and away the best place to hide, as it outperformed by 7%. Financials and Consumer stocks fell less than the index in September, while Real Estate and Information Technology lagged the most.

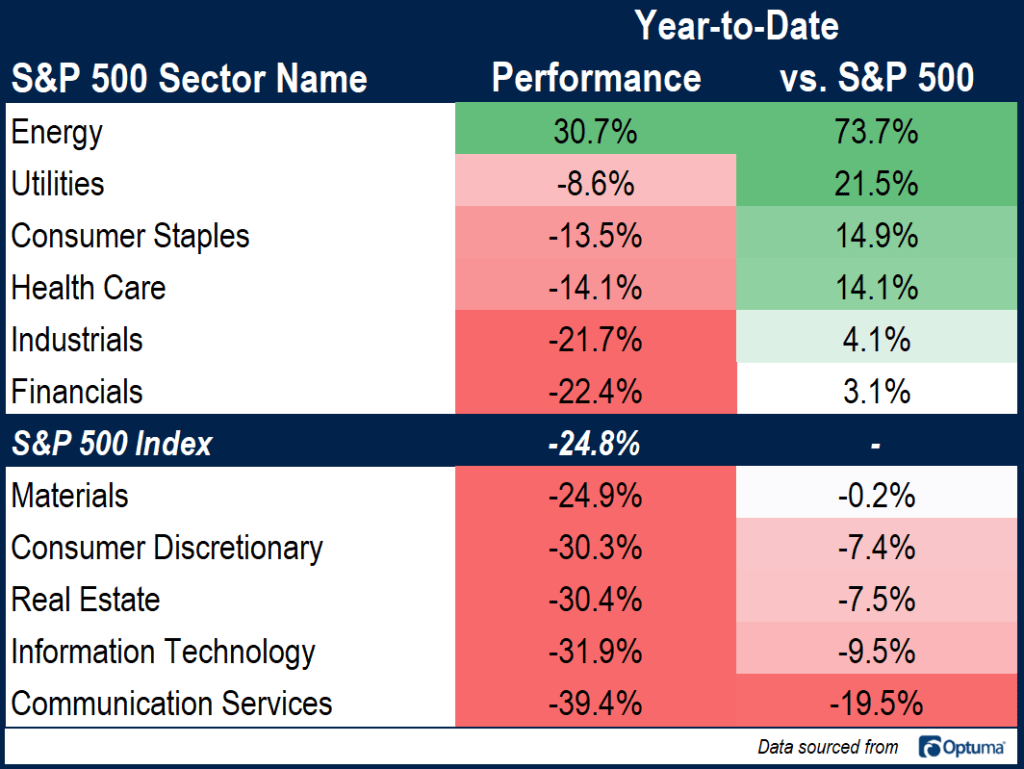

For the year, Energy is still the top performing sector, up more than 30%. That’s bucked the trend set by other cyclical sectors, which are all down more than 20% in 2022. Technology and tech-like groups have seen the most damage, while sectors that are less exposed to economic activity have outperformed.

What’s Ahead

It’s jobs week. The US is believed to have had another strong month of job creation in September, and the Federal Reserve will be watching closely for signs that the labor market is cooling. Before the BLS payrolls report on Friday, we’ll get job openings on Tuesday, and the ADP employment estimate on Wednesday. We’ll see plenty of survey data throughout the week, starting with manufacturing PMIs from S&P Global and the Institute for Supply Management on Monday. The same survey results for the services sector are released on Wednesday. Factory orders arrive on Tuesday, and there are plenty of FOMC speakers throughout the week.

The post The Weekly Wrap: October 3, 2022 first appeared on Grindstone Intelligence.