The Weekly Wrap: October 31, 2022

Week in Review

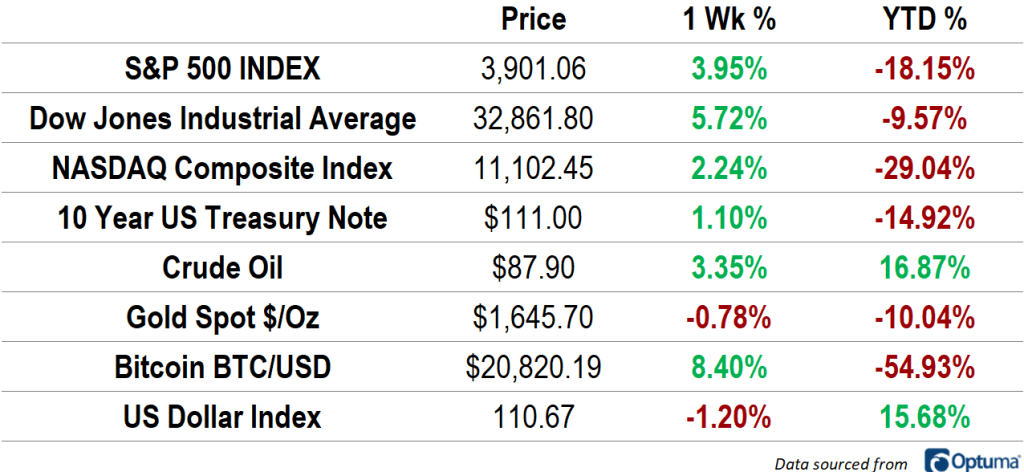

Markets shook off major selloffs in some of the largest companies to close higher for the second straight week. The Dow Jones Industrial Average led by a wide margin, gaining 5.7%, while the Nasdaq Composite climbed 2.2%. Treasury yields fell for the first time in 3 months, with the 10-year rate ending the week near 4.0%. The US Dollar gave back some of its year-to-date gains, dropping 1.2%. Bitcoin rose 8.4% to reach its best level in over a month, and gold prices were down slightly. Crude oil added to an already strong year, gaining 3.3%.

Relatively Speaking

The S&P 500 posted strong returns over the trailing month, led by traditionally cyclical sectors like Energy (+23%), Industrials (+11%), Materials (+8%), and Financials (+10%). Consumer Discretionary was the worst sector over the period, falling 4%. Communication Services and Utilities also lagged.

For the year, Energy is still the top performing sector, up more than 60%. It’s outperformed the broader index by 98% since December. Technology and tech-like groups have seen the most damage, while sectors that are less exposed to economic activity, like Consumer Staples and Health Care, have outperformed.

What’s Ahead

It’s Fed week and jobs week. The FOMC will likely raise interest rates by another 0.75% at their meeting on Wednesday, then we’ll see how the labor market is responding to previous hikes with Friday’s payrolls report. PMI surveys from ISM and S&P Global are released on Tuesday (manufacturing) and Thursday (services), and we’ll get early reads on labor with job openings and the ADP employment change on Tuesday and Wednesday, respectively. It’s also earnings season, with one-third of S&P 500 companies set to report third quarter results.

The post The Weekly Wrap: October 31, 2022 first appeared on Grindstone Intelligence.