The Weekly Wrap: September 26, 2022

Week in Review

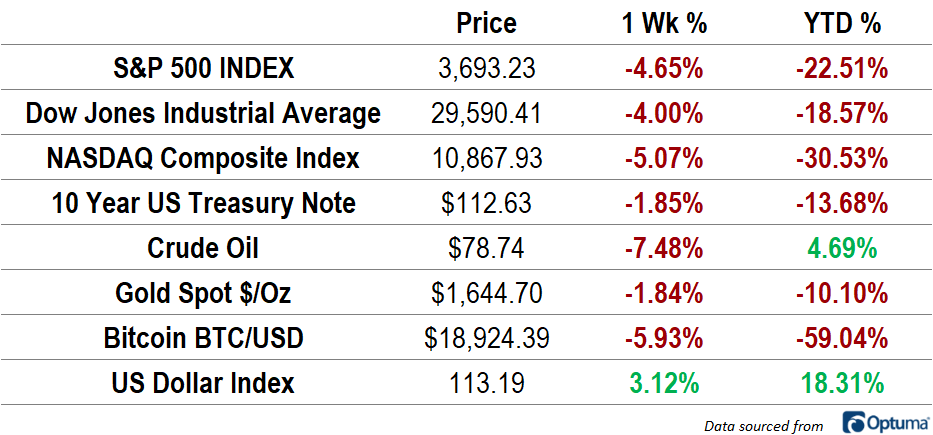

Risk assets had one of their worst weeks of the year. The Dow Jones Industrial Average fell 4% to undercut its June lows. Down 18.6%, it’s still the best-performing large cap index in 2022. The S&P 500 fell 4.7%, and the Nasdaq Composite dropped more than 5%. Ten-year Treasury yields jumped to the highest level since 2010, pushing bond prices down another 1.9%. The US Dollar Index rose 3.1%, its strongest weekly performance in two years. Gold and Bitcoin both fell. Crude oil collapsed 7.5%, reaching eight-months lows.

The Federal Reserve hiked interest rates by 75 basis points for the third consecutive meeting as it continues its efforts to subdue elevated price pressures. Chairman Jerome Powell reiterated the message he delivered at Jackson Hole: rates will need to be elevated for an extended period to bring inflation down and some economic pain should be expected. The Fed’s own projections show rates reaching 4.4% by year-end and 4.6% in 2023. They see unemployment rising to 4.4% and inflation returning to target by 2025.

Monitoring Macroeconomics

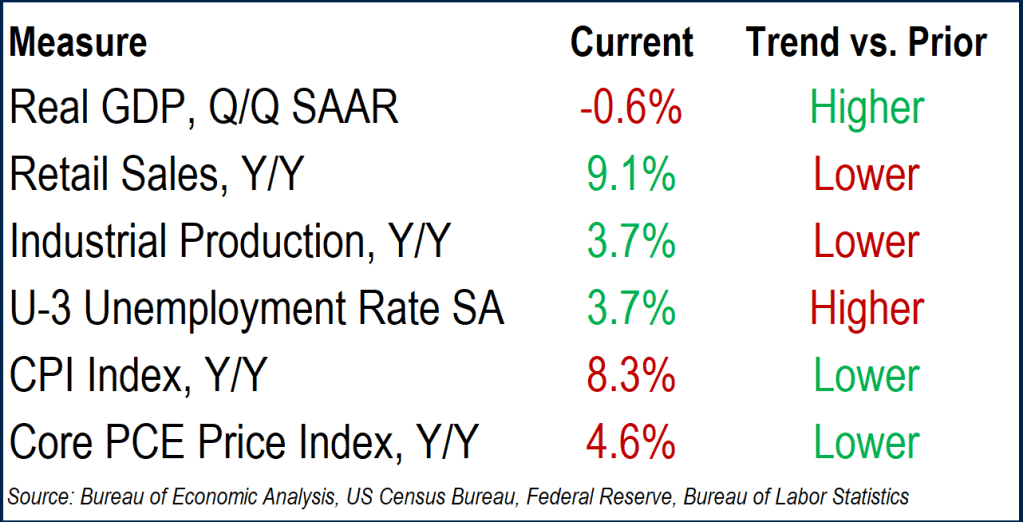

GDP has fallen for two consecutive quarters, satisfying a widely used rule of thumb for defining recessions, but we still don’t have confirmation of the downturn from the NBER, the nation’s official arbiter of recessions. Notably, 2Q GDP was revised significantly higher on the back of strong consumer spending.

Measures of inflation remain well above the Federal Reserve’s 2% target, but both CPI and PCE decelerated in the most recent month. Unemployment ticked up to 3.7%, but despite recession fears, consumer spending, as measured by retail sales, remains robust.

What’s Ahead

It’s a slow start to a packed week of economic data. Only the Dallas Fed Manufacturing index is worth watching on Monday, before factory orders, home prices, consumer confidence, and new home sales all come out on Tuesday morning. Pending home sales are released on Wednesday. On Thursday, revisions to second quarter GDP are published, and the week closes up with August PCE and University of Michigan sentiment on Friday. There will be plenty of Fed speakers throughout the week. Jerome Powell speaks on digital currencies Wednesday morning and will give opening remarks at a Thursday community banking conference.

The post The Weekly Wrap: September 26, 2022 first appeared on Grindstone Intelligence.