The Weekly Wrap: September 6, 2022

Week in Review

Stocks fell last week, as financial markets continued to digest Powell’s Jackson Hole speech, and last week’s plethora of jobs data did little to change the tight labor market narrative. The DJIA outperformed the NASDAQ’s 4.2% decline, but still dropped nearly 3%. Treasuries fell, too, with the 10-Year Treasury note down 0.8%. Crude oil closed at its lowest level since January after falling 6.7%, and Gold and Bitcoin each declined for the third consecutive week. The US Dollar Index rose again, reaching its highest point since 2002.

Relatively Speaking

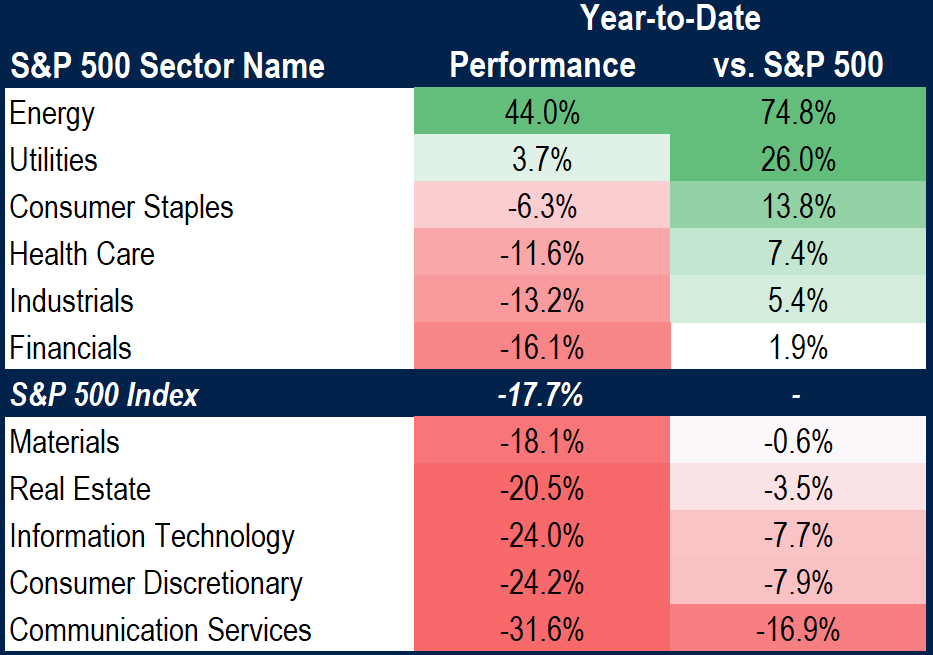

It was hard to generate positive returns over the last month, with only the Energy and Utilities sectors closing in the green. Information Technology was the worst performing sector over the period, falling more than 7%, while Real Estate, Health Care, Consumer Discretionary, and Communication Services all lagged the index.

For the year, Energy is still the top performing sector, up 44%. That’s bucked the trend set by other cyclical sectors, most of which are down double-digits in 2022. Technology and tech-like groups have seen the most damage, while sectors that are less exposed to economic activity have outperformed.

What’s Ahead

We kick off a shortened trading week with some PMI survey results: both S&P Global and the Institute for Supply Management release Services data on Tuesday. The Federal Reserve will publish its Beige Book on Wednesday afternoon, and then we’ll get weekly jobless claims and consumer credit reports on Thursday. There’s a full slate of central bankers scheduled to speak, too, but the most important will be Fed Chairman Jerome Powell’s remarks at a monetary policy conference hosted by the Cato Institute on Thursday morning.

The post The Weekly Wrap: September 6, 2022 first appeared on Grindstone Intelligence.