The Worst of the Worst

Avoiding downtrends in a bull market

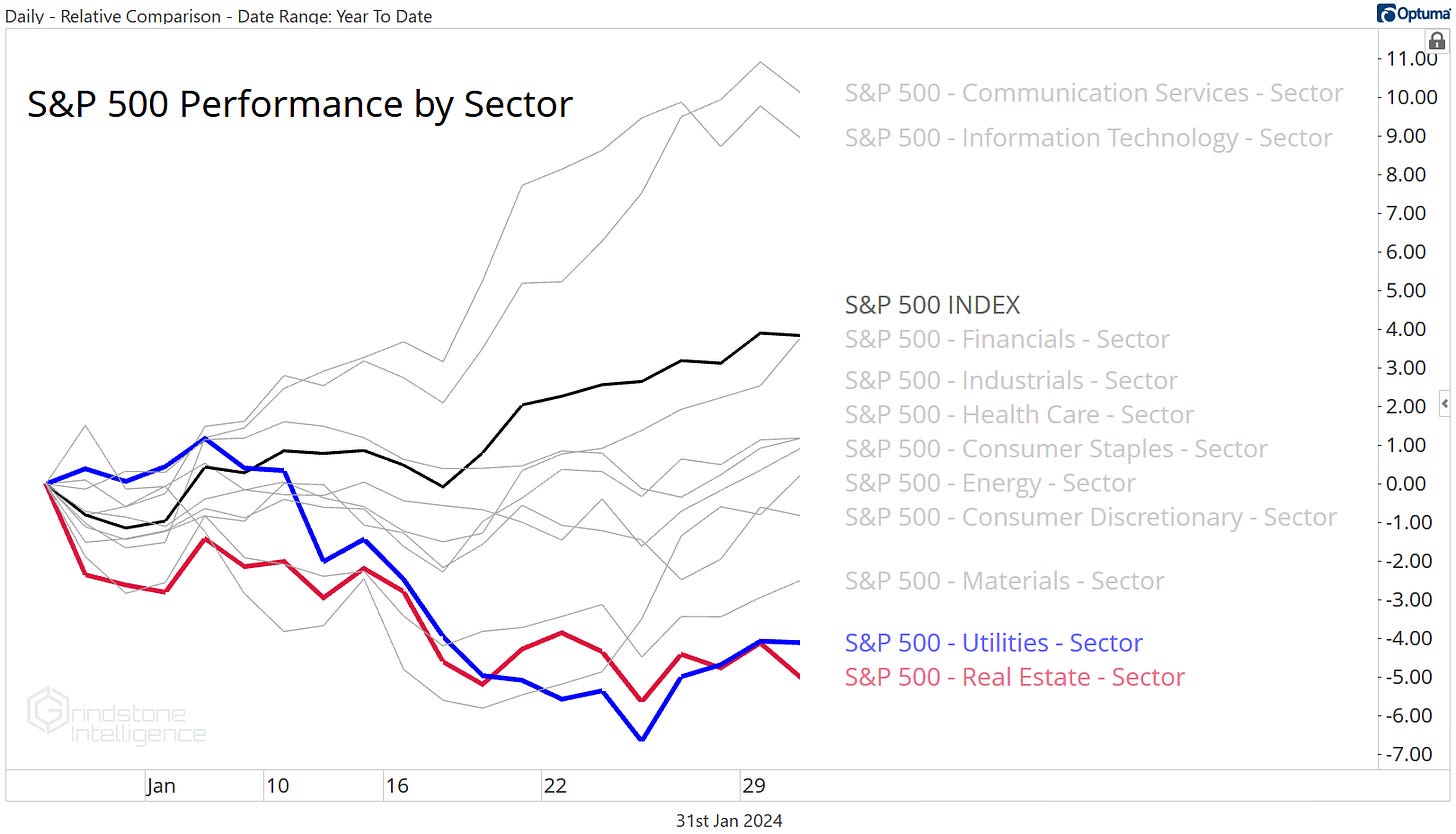

We’ve got a familiar theme surfacing in January: The Communication Services and Information Technology sectors are off to hot starts, while everyone else is lagging the benchmark return. Two sectors stand out on the downside, though. Utilities and Real Estate are at the bottom of the barrel, down 4% and 5%, respectively.

We don’t expect them to stop lagging anytime soon.

To be fair, the Real Estate sector isn’t so bad. Even though they were among the worst performers in 2022 and failed to participate during most of the 2023 rally, Real Estate is making progress on reversing this multi-year downtrend. Last fall’s failed breakdown below the October ‘22 lows was the catalyst we needed for a big rally higher.

The ensuing breakout above the above the summer highs confirmed that it was more than just a mean reversion. As long as that key support level at 240 remains intact, we can call this a new uptrend in the Real Estate sector.

But an uptrend is exactly what we should be seeing in Real Estate. This is a bull market after all - almost everything goes up in a bull market. That’s the definition of a bull market.

We don’t have the capacity to buy every uptrend we see, though, so instead we have to focus on relative strength. When everything is going up, we want to own the things that are going up the most. And that’s not Real Estate. Compared to the S&P 500, the Real Estate sector has been stuck below a falling 200-day moving average for most of the last 18 months.

It’s not that we want to be shorting Real Estate (we just saw that the sector is in the early stages of a new uptrend), it’s just that we don’t want to be buying them. Until we see some evidence of stabilization in the ratio above, we’d rather spend our time and resources looking for opportunities elsewhere.

The Utilities are a different story. They’re definitely in a downtrend relative to the rest of the market. The Utilities/SPX ratio is below a falling 200-day moving average, and momentum has been stuck in a bearish range for the last year. Oh, and did we mention that it’s at ALL-TIME LOWS? Not something you see in an uptrend, that’s for sure.

But it’s more than that. The Utes aren’t just lagging - they’re falling outright. The S&P 500 bottomed more than a year ago, yet these guys are closer to setting new lows than they are to setting new 52-week highs.

Things are a bit better for the Utes beneath the surface - the equally weighted sector has been outperforming the market cap weighted sector for the last 3 years, and momentum for the equally weighted/cap weighted ratio has been in a bullish range for the last 18 months.

But that still isn’t enough. The equally weighted Utilities just hit new lows vs. the market, too.

We aren’t expecting a turnaround in February. The Utilities have lagged the rest of the market 71% of the time in Februarys since 1990, the worst win rate any month. The average underperformance has been 1.5%:

Now, does that mean we can’t see the Utes bottom today and become a leader for the next year and a half? Of course not. The market doesn’t care what we think, and no trend lasts forever. But the higher likelihood outcome is further underperformance. We’re not talking about trying to reverse a trend in one or two stocks. We’re talking about 80% of the sector’s members being below a falling 200-day moving average.

That’s a lot of downtrends to fight. And owning downtrends during a bull market doesn’t sound like much fun.

Stocks to Watch

What about that 7% of stocks that are above a rising 200DMA?

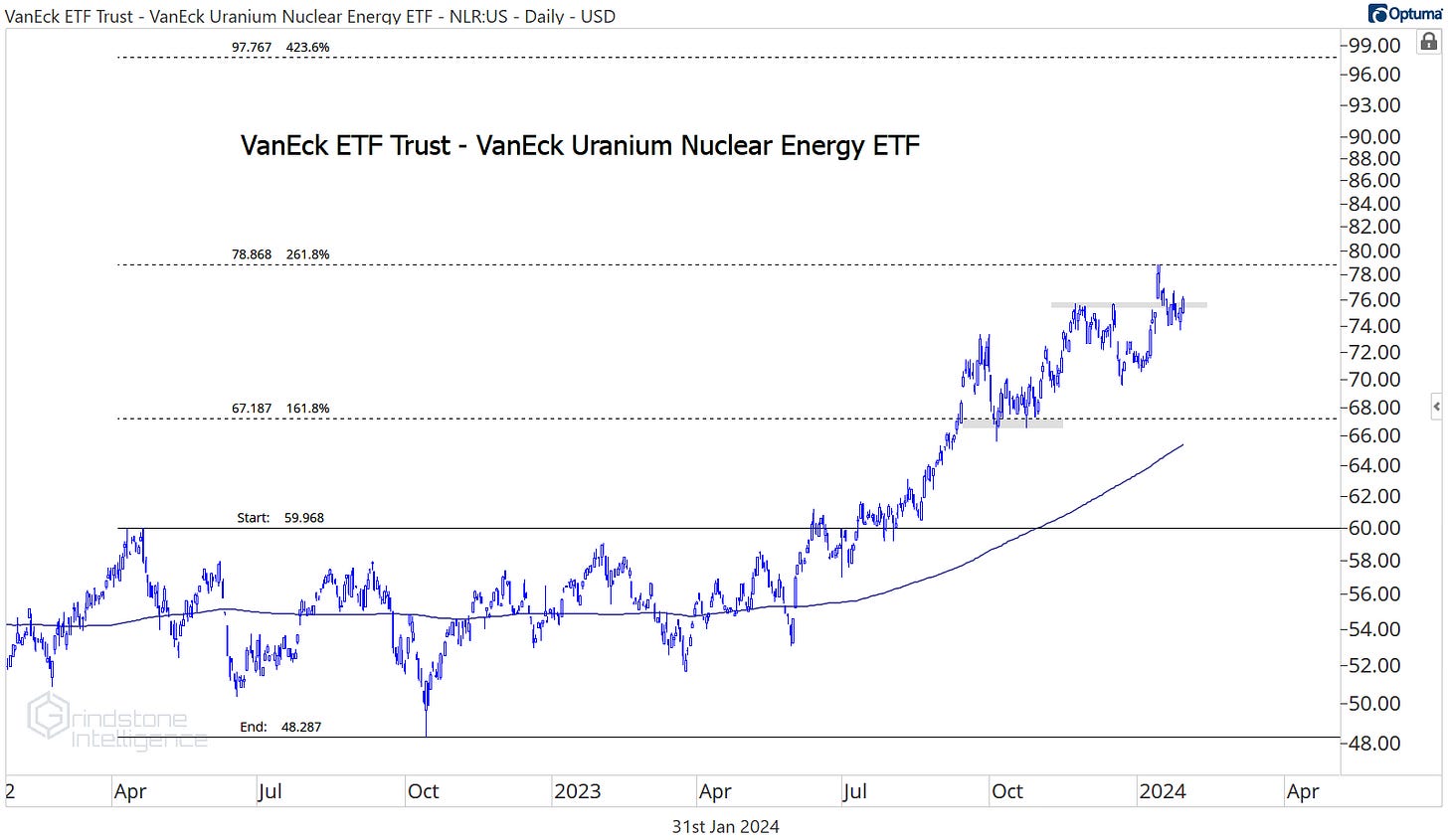

We haven’t completely avoided the Utilities sector. We’ve liked having NLR - a Uranium Nuclear Energy ETF - in the model portfolio for the last few months, because it doesn’t look anything like the rest of the sector.

NLR found resistance at $78, and this isn’t the place to be initiating new longs as it digests the 261.8% retracement from the 2022 decline. But if NLR is above $79, we can be long with a new target of $97.

Within NLR, Constellation Energy stands out. It’s been the best performer over the last 4 weeks.

Constellation has had trouble with the $125 area for the last few months, but the uptrend is still very much intact. We don’t want anything to do with the stock if it’s below the 423.6% retracement from the summer 2022 decline, but we can be buying CEG above $122 with a target of $165.

Cameco Corp has been a big winner, but again, we don’t want to be initiating new longs right here - not with CCJ getting ready to challenge the 2007 highs. There’s a lot of memory at that level, and it’s unlikely we’ll blow right past it.

The same goes for NexGen Energy. we want to see how it responds to potential resistance at the 261.8% retracement from the 2017-2020 decline. On a move above $8, we can buy NXE with a target of $12.75, but we don’t want to be involved if it’s below $8.

For the Real Estate sector, Iron Mountain continues to climb toward our $76 target.

The risk/reward setup for IRM isn’t great here, but we can’t ignore the relative strength it’s shown when compared to the rest of the sector over the last few years. Uptrends don’t get much cleaner.

CBRE is another that catches our eye. Unlike for IRM, the risk/reward setup here is very clean. We want to own CBRE above $87 with a target of $122.

Especially as it tries to come out of this multi-year base relative to the rest of the Real Estate sector.

Here’s one final one.

I know just said a few minutes ago that we weren’t looking to short Real Estate stocks, but we can’t ignore Healthpeak Properties. Down near the lows in November, we wrote this about PEAK:

“Even with momentum working on a bullish divergence, we want to leave this chart alone. Most other stocks in the sector bottomed and started their rally 2 weeks ago, but PEAK is still near its lows. That’s what we call relative weakness - and relative weakness is something we prefer to short on rallies, not buy on dips.”

We got our rally to short, which ended with a final thrust back above the 2020 trough to suck in a few more bulls before the failure crushed everyone’s hopes and dreams. Even though it’s a bull market, we can be short PEAK below $20 with a target down near the former lows.

That’s all for today. Until next time.