There’s Always a Bull Market Somewhere

U.S. stocks have had a tough start to the year. Since setting a new all-time high on the first trading day of 2022, the S&P 500 Index has fallen more than 8%, its largest decline since September 2020. Momentum failed to confirm the year-end rally and now has fallen into oversold territory for the first time in nearly two years – a sign that returns over the coming months are likely to be volatile.

If Fibonacci levels are your thing, the selloff is occurring near a key extension from the 2007-2009 collapse. The last two times we ran into extensions from that decline, the market didn’t waltz through unscathed, so it wouldn’t be surprising to see prices respect this level, too. There’s also a tiny bearish divergence shaping up in the weekly RSI.

The tech-heavy Nasdaq Composite has dropped 14% from its own high set back in November and is resolutely below both the 200-day moving average and the early 2021 peaks near 14,000.

And the Russell 2000 small cap index is even worse. Prices are setting new 52-week lows, and momentum is in a bearish range (reaching oversold on declines, and not getting close to overbought on rallies).

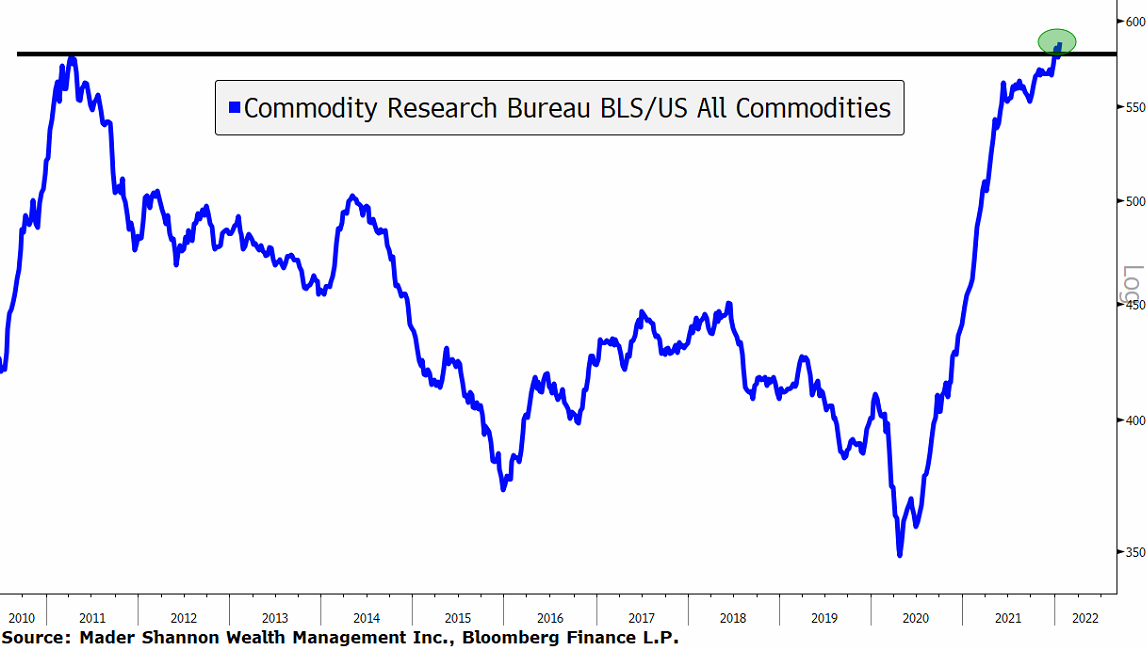

But just because stock indexes are falling doesn’t mean everything has to. The CRB Commodities index is breaking out above its 2011 highs.

Oil prices, discussed last week, are certainly a big factor, but there is strength elsewhere, too.

Agriculture and Livestock prices gains are helping to lead the way, this week breaking out above highs that had been in place for nearly a year.

Base metals have had a strong start to the year, as well. They peaked in the spring of 2021 at the 161.6% extension from the 2018-2020 decline, but have since broken out and successfully back-tested that same level. Momentum for this index is in a bullish range, having failed to get oversold in almost 2 years.

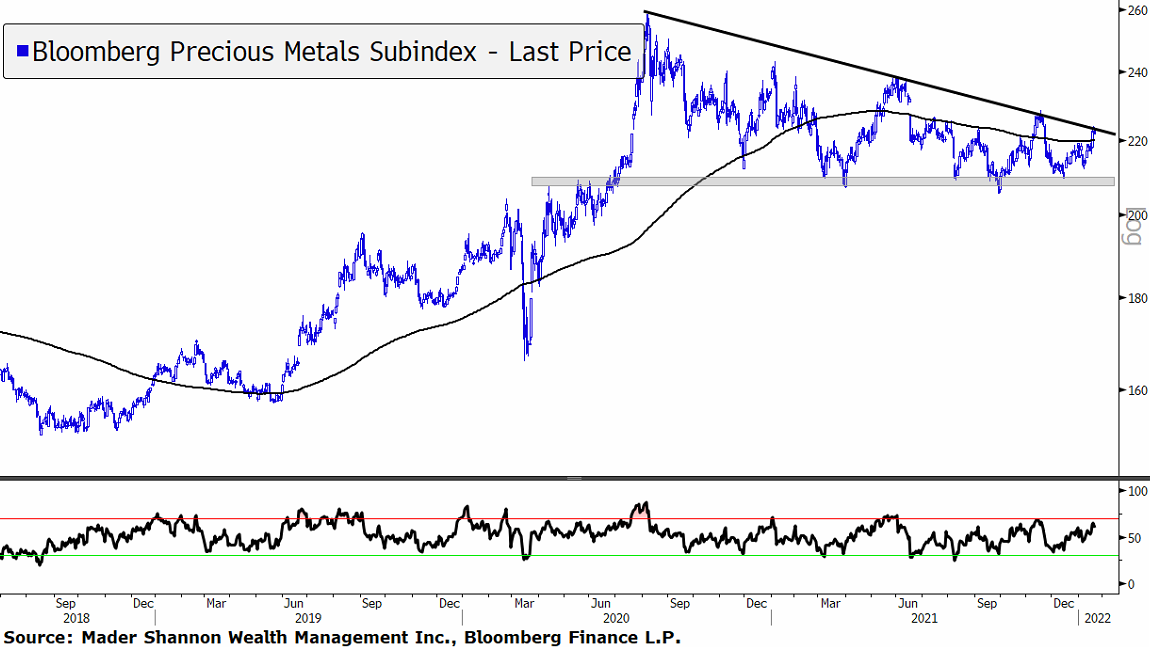

And Precious Metals, which led in the immediate aftermath of the pandemic’s onset but have largely languished since, are threatening to join the party. They’re challenging the downtrend line from the highs after holding the $210 level for most of the last year.

Equites have had a great run over the last year and a half. It’s too soon to write an obituary – this could just be a hiccup before the meteoric rise continues – but even if this seemingly run-of-the-mill selloff is the start of a bear market in U.S. stocks, rest assured there’s always a bull market somewhere.

And don’t forget: Even the most certain outcomes can change at the drop of a hat. Sometimes in as few as 13 seconds.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post There’s Always a Bull Market Somewhere first appeared on Grindstone Intelligence.