This Isn’t a Bull Market

Resistance levels getting broken. Prices above moving averages. Risk-on groups outperforming the index. Lots of stocks setting new highs.

Those are the types of things you see in a bull market. This isn’t that.

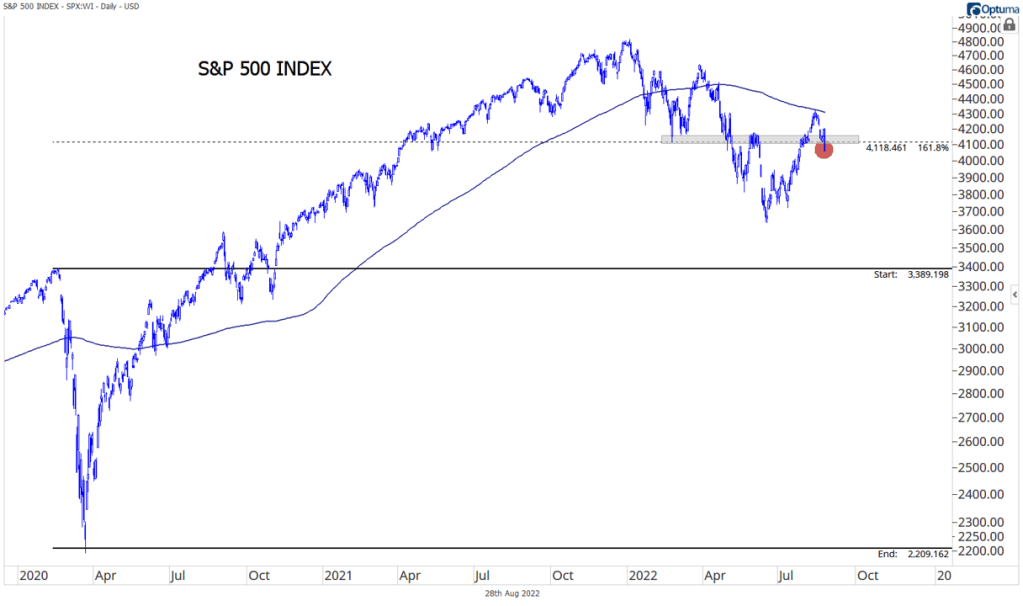

Instead, support levels are failing to hold. The S&P 500 index dropped below 4100 on Friday. That level marked a bottom in February and was the starting place for the March rally. It marked a peak in late May and early June, setting the stage for a collapse to the 3666 lows. It also happens to be the 161.8% retracement from the entire COVID selloff. The level matters, and in a bull market, it should have acted as support. But it didn’t.

Stock prices are below moving averages. Only one-third of the S&P 500 index is above its 200-day moving average after last week’s drop. Just as meaningful, even after an 18% rally in the index off of the June lows, we never saw more than half of index members get back above that level. Prices rise in a bull market, but the majority of stocks are still in downtrends.

Risk-on groups are underperforming. The Information Technology sector was the unquestioned leader of the last bull market. But compared to the overall index, Tech hasn’t gone anywhere since September 1, 2020, when it came into contact with the all-time monthly highs it set at the height of the internet bubble. A few weeks ago, it looked as though Tech might surpass that level as it tested it once again, but the ratio faltered. Tech arguably isn’t lagging. It definitely isn’t leading.

And neither is Consumer Discretionary, another risk-on leader in the last bull market. Discretionary peaked relative to the S&P 500 in late 2020, and for most of the last 8 months, it’s been setting multi-year relative lows. The ratio rallied from its May trough, but it’s been unable to absorb overhead supply in August. Consumer Discretionary is below resistance and beneath a falling 200-day moving average – it’s anything but a leader.

Leadership instead is coming from risk-off sectors, like Utilities. Can you see the difference between this and Consumer Discretionary? Utilities are above a rising 200-day, and they’re testing 52-week relative highs after a healthy consolidation. New relative highs are great for Utilities, but they aren’t indicative of a bull market in stocks.

And more stocks are setting new 52-week lows. Since 1990, the net percentage of S&P 500 stocks setting new one-year highs has been positive on more than 80% of days. That makes sense since stocks have spent most of the last 30 years in bull markets. Today, though, more stocks are setting new lows. That’s something we rarely see in bull markets. More damning is that fewer and fewer stocks are setting new highs on each rally. Remember, the index just rallied nearly 20% from its lows. Despite that, on no day did the number of new highs outpace the number of new lows by more than 5%. During 2008 alone, stronger readings were recorded on 4 separate rallies – all of which failed.

Those aren’t characteristics of a bull market.

Don’t get me wrong. It’s entirely possible that stocks have already bottomed, and we’re headed for new highs by year-end. We’re still well above the mid-June lows, and the technical picture has certainly improved since then. The downtrend has stalled, but do we have enough evidence that a new uptrend has begun?

What if the S&P 500 is back above 4100? Yeah, ok. What if more than 50% of stocks are above their long-term moving average? Sure. What if risk-on areas are leading? Now we’re talking. What if we see an increasing number of new highs and fewer new lows? Great. If all those things are happening, it’s a different story. Right now, they’re not.

We know what a bull market is supposed to look like. This isn’t it.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts on Means to a Trend are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.

The post This Isn’t a Bull Market first appeared on Grindstone Intelligence.