Top Charts and Trade Ideas from the Industrials Sector - 1/24/2024

Buying breakouts

A surface-level glance at stock market returns over the past year might tell you that gains have been limited to a handful of mega cap growth stocks. Fortunately, our work never stops at the surface, and that’s why we know the ‘only a handful of stocks’ narrative isn't true. It doesn’t take much digging to find out how strong the Industrials sector is.

For the last year, the Industrials on an equally weighted basis have tripled the return of the equal weight S&P 500 and trail only the Information Technology sector.

Here is the equal weight Industrials sector compared directly with the equal weight S&P 500. This is a textbook consolidation within an ongoing uptrend, and highest likelihood outcome from here is a resolution to the upside. We’re looking for more outperformance from within the Industrials sector.

Measures of breadth confirm the underlying strength. Nearly 90% of S&P 500 Industrials sector stocks are above their 50, 100, and 200-day moving averages. Only the Financials sector is better across the board.

And even further beneath the surface, NO sector has been better than the Industrials when it comes to the small cap space. They’ve risen 22% over the last 12 months, 4x that of the benchmark small cap index.

Here’s a closer look at that small cap dominance from the Industrials. The uptrend couldn’t be much cleaner, and although momentum failed to reach overbought territory on the most recent high (creating a bearish momentum divergence), RSI hasn’t dropped to oversold levels in more than a year.

Unfortunately, all that underlying strength hasn’t translated to outperformance in the large cap index. Thanks to the dominance of mega cap Tech, the market cap weighted Industrials sector has trended lower relative to the market cap weighted S&P 500 for most of the last year.

But just because the large cap industrials have lagged of late doesn’t mean they’re doing poorly. Of the 11 S&P 500 sectors, the Industrials are one of just two that have surpassed their 2022 highs:

In this ongoing bull market, we’re looking for stocks to buy in the Industrials sector.

Digging Deeper

Since the bear market bottom in October 2022, one group of stocks stands apart: the Trading Companies & Distributors Industry has risen 76%.

The latest leg higher followed a strong earnings report from Fastenal last week, which pushed FAST above its 2021 highs near $65. We want to be own this one above $61, which is the 423.6% retracement from the 2012-2018 range, with a target of $88.

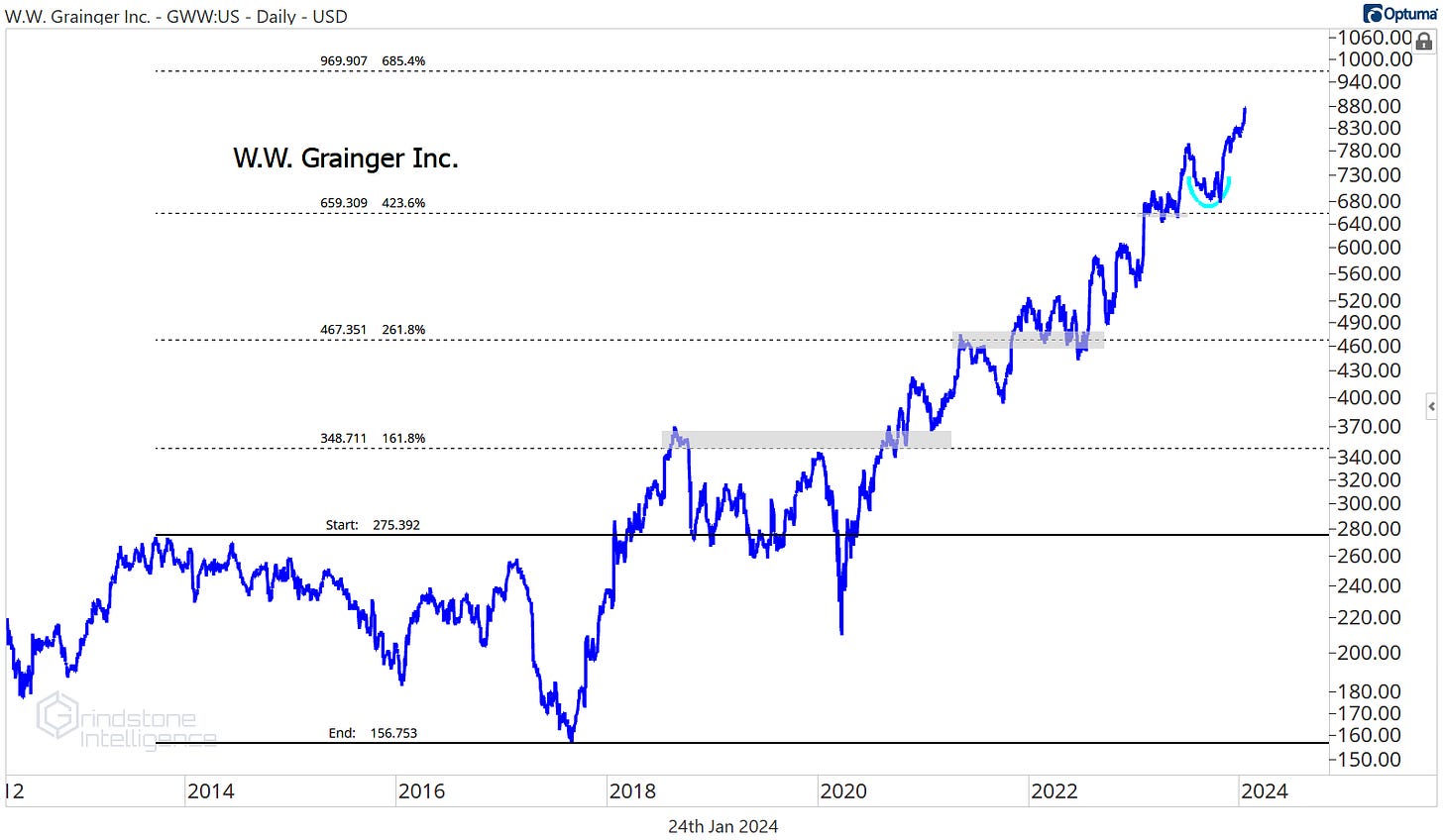

Grainger has been even better. We’ve been targeting $970, which is the next key Fibonacci level from the 2013-2017 decline, and GWW continues to get it done.

What’s most impressive is the relative strength Grainger has shown. Not only is it outperforming the rest of the Industrials sector, it also continues to set new highs against the entire S&P 500 index after breaking out of a decade-long base.

Leaders

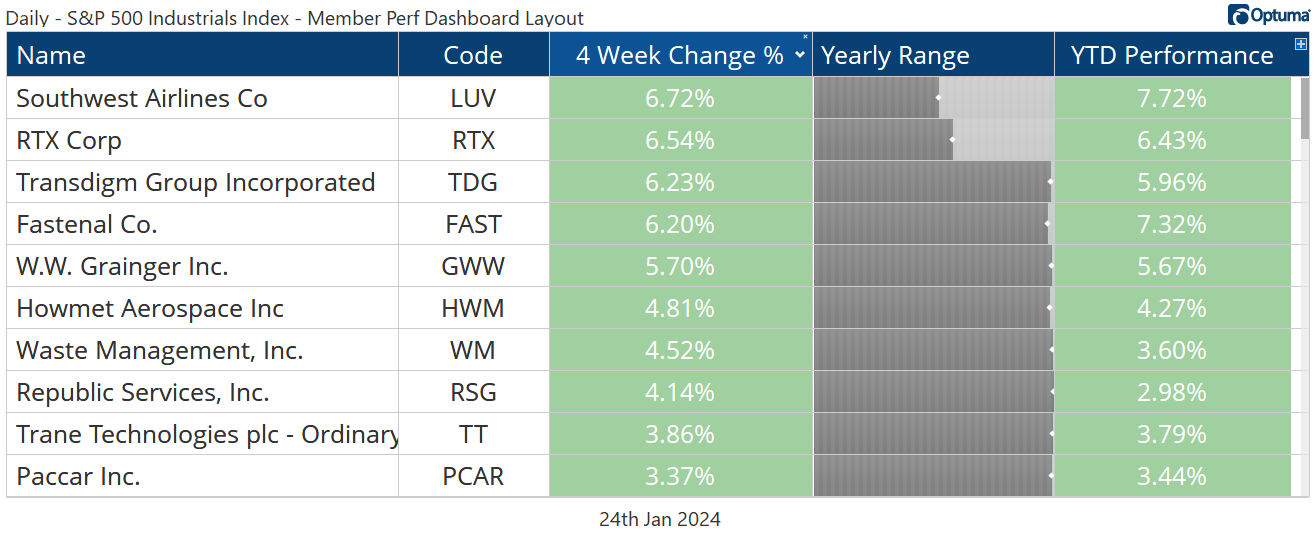

If you don’t quite believe our hype about strength within the Industrials sector, check out out the fourth column in the table above. That grey bar shows where the stock is currently trading in relationship to the 12-month range. Of the 10 best sector performers over the last 4 weeks, 8 of them are at new highs. That’s just not something we’re seeing across every sector in this market.

A handful of our favorites are scattered across this month’s leaderboard.

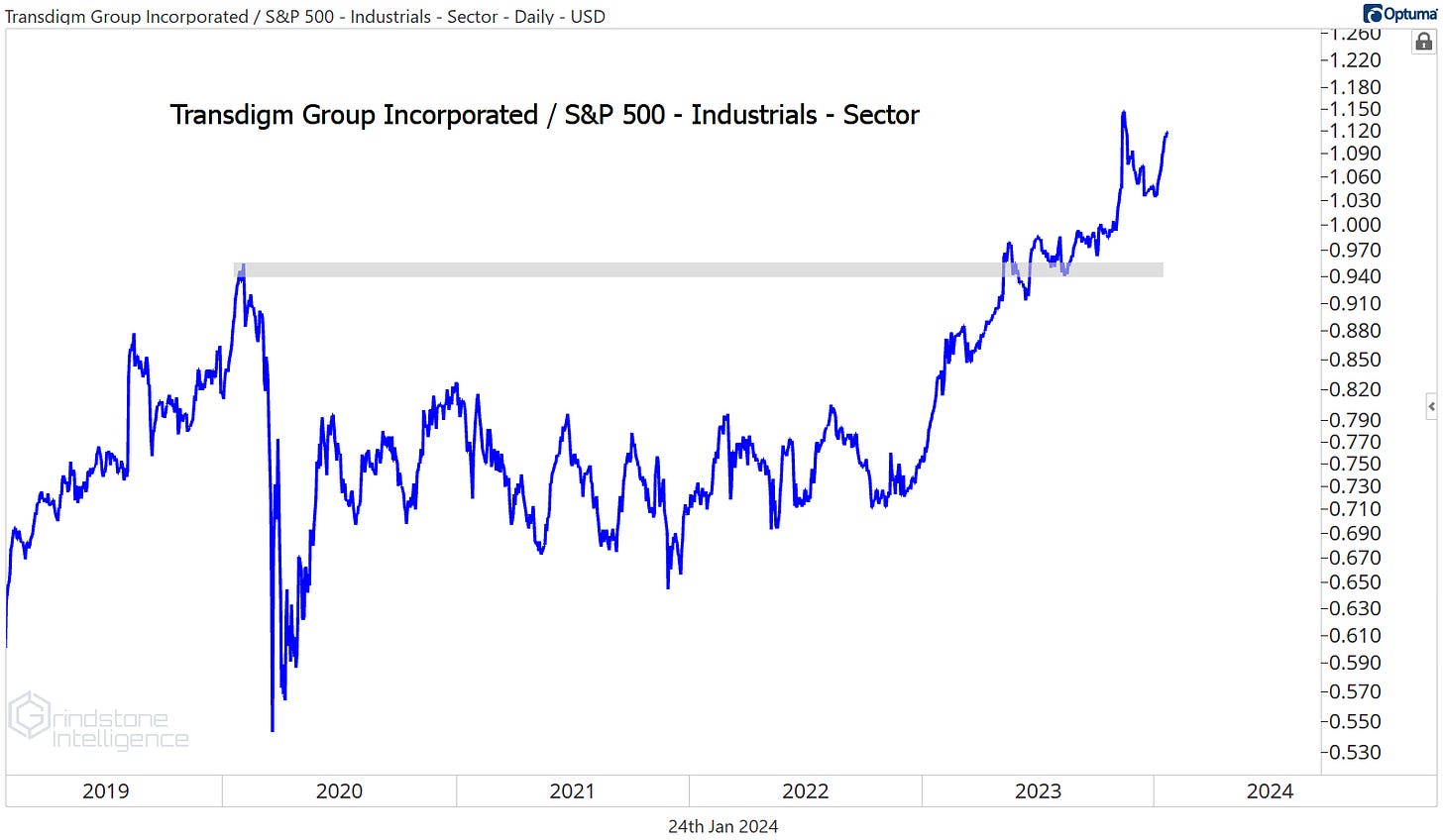

For Transdigm, our target is still the 261.8% retracement from the 2020 selloff, which is up near $1300. If we get any pullbacks towards $930, we want to take advantage.

Here’s a look at the relative strength profile of TDG: It’s in a clear uptrend after breaking out of a 3 year base relative to the rest of the sector.

We’ve been big fans of Howmet Aerospace ever since it broke out of this huge, 15-year base at the start of the year, and it’s still trekking toward our long-term target of $70.

Just like Transdigm, what impresses us most is the relative strength in Howmet, After being a serial laggard from 2008 to 2022, HWM has managed to set multi-year highs relative to the rest of the Industrials space.

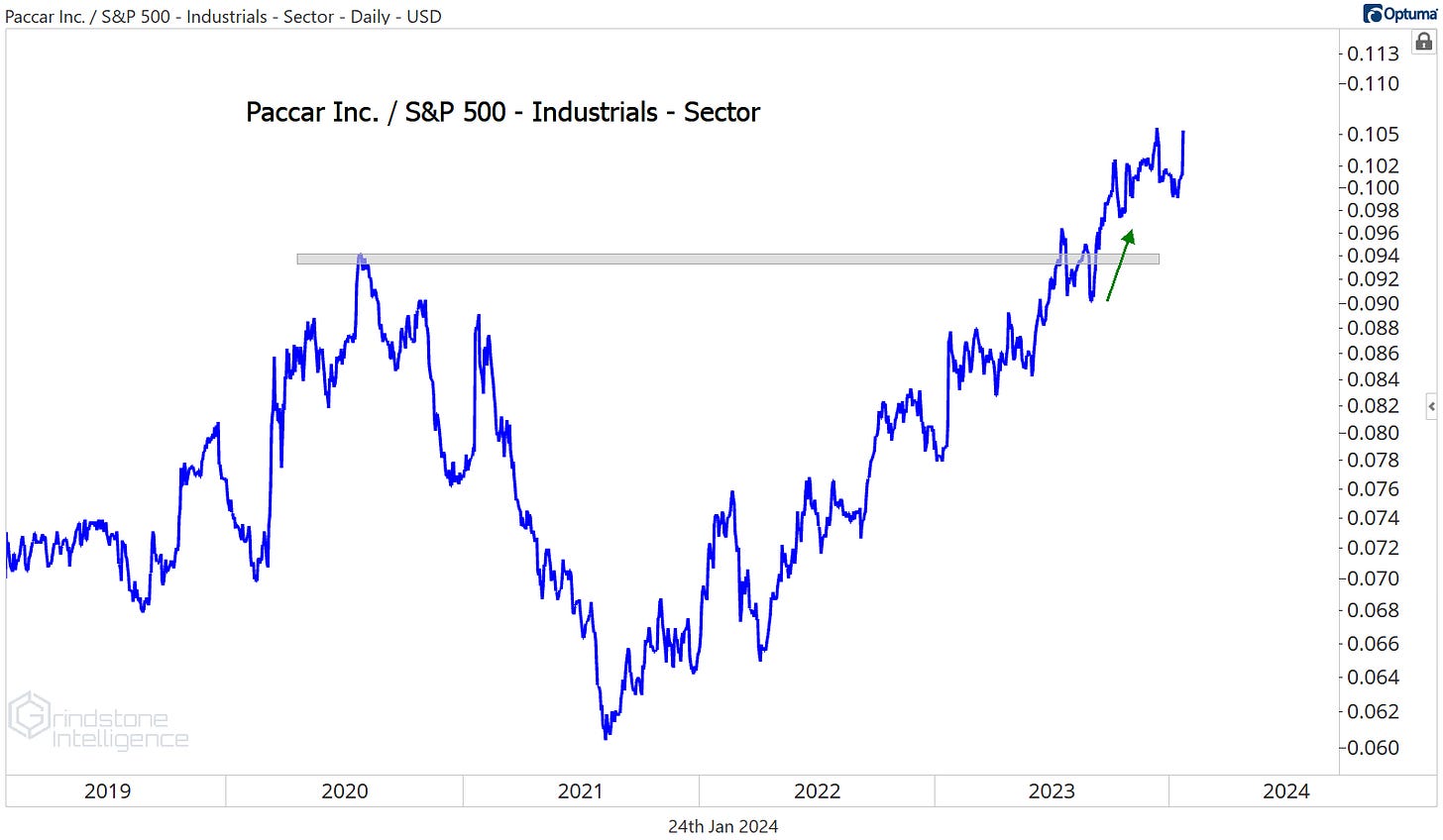

Speaking of relative strength, how about this breakout in Paccar?

We want continue buying this relative strength in PCAR above $92 (which is the 261.8% retracement from the 2019-2020 decline) with a target at the next key Fibonacci retracement level at $127..

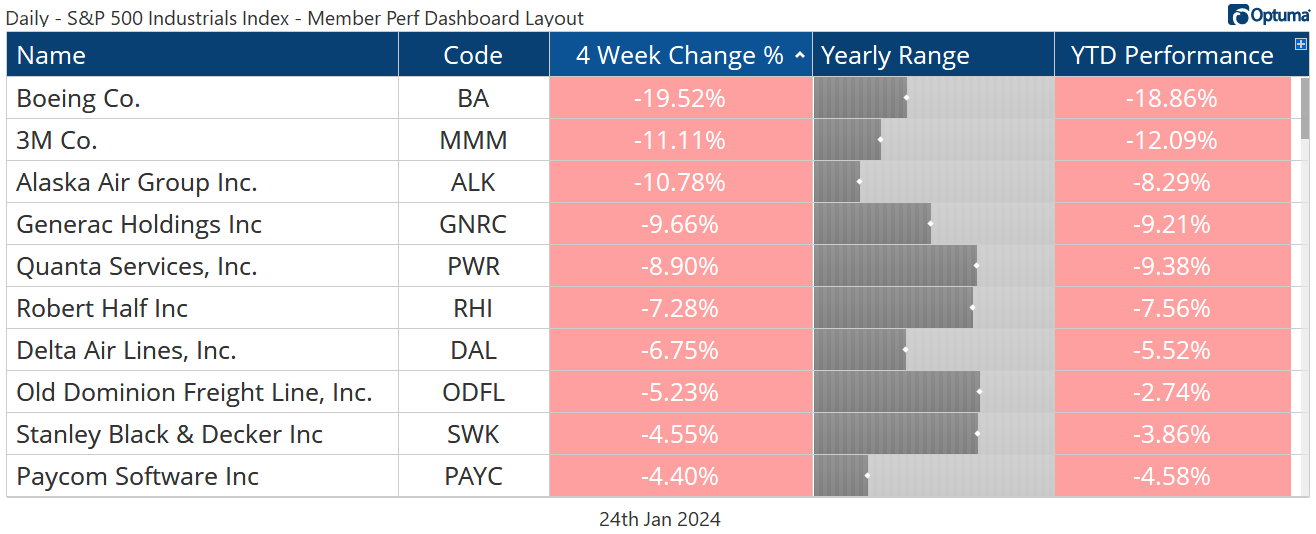

Losers

You know what we don’t want to be buying? Relative weakness. Compared to the rest of the sector, 3M has been trading below a downward sloping 200-day average for most of the last 6 years. Not an uptrend.

On an absolute basis, MMM is trying to hammer in a bottom here. What better place for buyers to step in than the 2007 and 2011 highs?

3M finding a bottom here would absolutely be consistent with a continued bull market in stocks, so we don’t want to be shorting it at such a logical level of support. But there’s a big difference between ‘not shorting’ and ‘buying’. There’s just no reason to be involved.

The same goes for Boeing. A month ago, it looked like Boeing had put years of frustration in the rearview mirror when it broke out to new multi-year highs relative to the rest of the sector. Then a door blew off a plane.

Again, there’s no reason to be involved unless BA is back above $225, and even then it’s not hard to find better places to be.

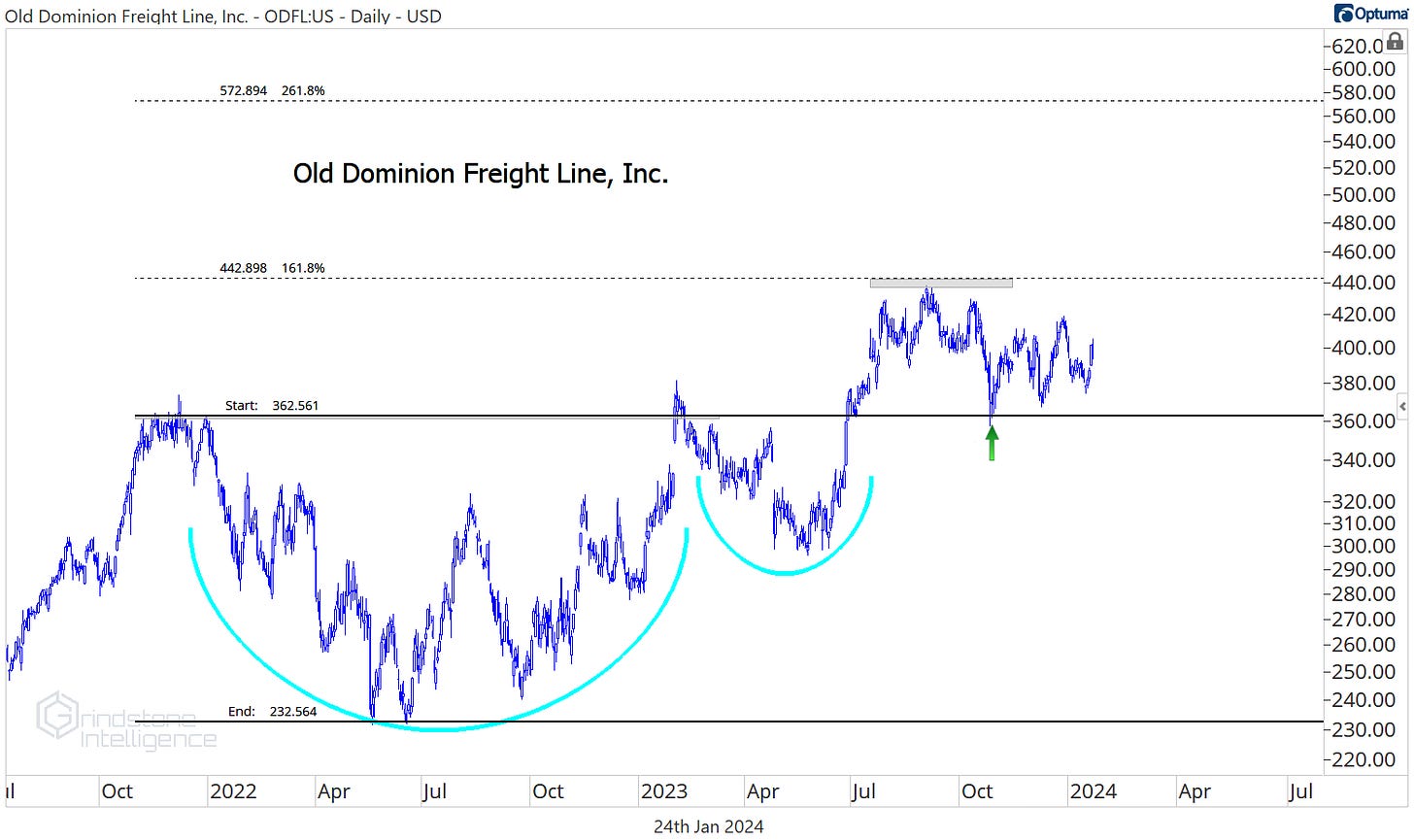

We aren’t giving up on ODFL, which is still in a long-term relative uptrend.

Old Dominion has struggled over the last month, but the stock is still in a structural uptrend. The trend is intact as long as prices are above $360, so we want to be buying any pullbacks towards that level with a target back to the highs of $440. We think it eventually goes to $570 - but we only want to own it above the brim of the 2021-2023 cup and handle pattern.

More Stocks to Watch

United Rentals is setting new highs versus the sector.

And on its own, URI just broke out of a 9 month base. We continue to like it above $500 with a target all the way up at $800.

Copart is still an uptrend worth buying into, and the risk-reward setup here is really clearly defined. We want to be long CPRT above $45 with a target of $65, which is the 423.6% retracement from the 2020 decline.

JB Hunt is one worth watching, especially given the improving sentiment about US freight rates as we get into 2024. We want to be buying a breakout in JBHT above $207 with a target of $283, which is the 423.6% retracement from the 2018-2019 selloff.

And if JB Hunt breaks out, pay attention to the rest of the transportation space - the rails are looking constructive.

That’s all for today. Until next time.