Top Charts and Trade Ideas from the Communication Services Sector

Growth stocks are once again off to a strong start in 2024, and no sector has been better than Communication Services. Yesterday, it closed at new 52-week highs, bringing its year-to-date gain to 12.5%.

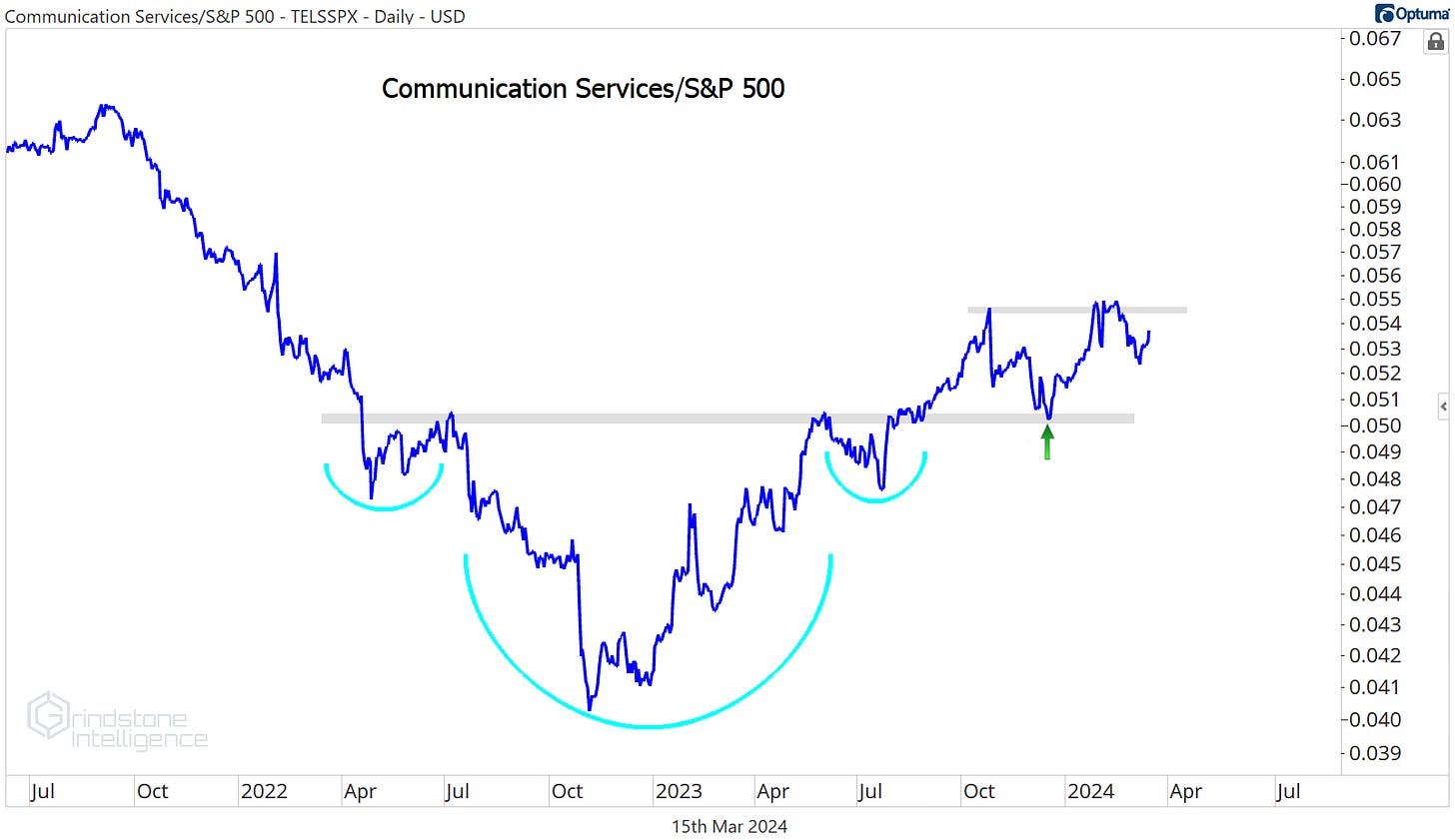

But Communications still has some catching up to do. It was the single worst performing sector in the bear market that endured for 2022, meaning for the complete cycle, the group is still lagging the return of the S&P 500. In fact, since the sector set its all-time high in September 2021, only Real Estate and Utilities have been worse.

Structurally, though, the group is clearly in a relative uptrend versus the rest of the index, and only a break of the December lows would change that.

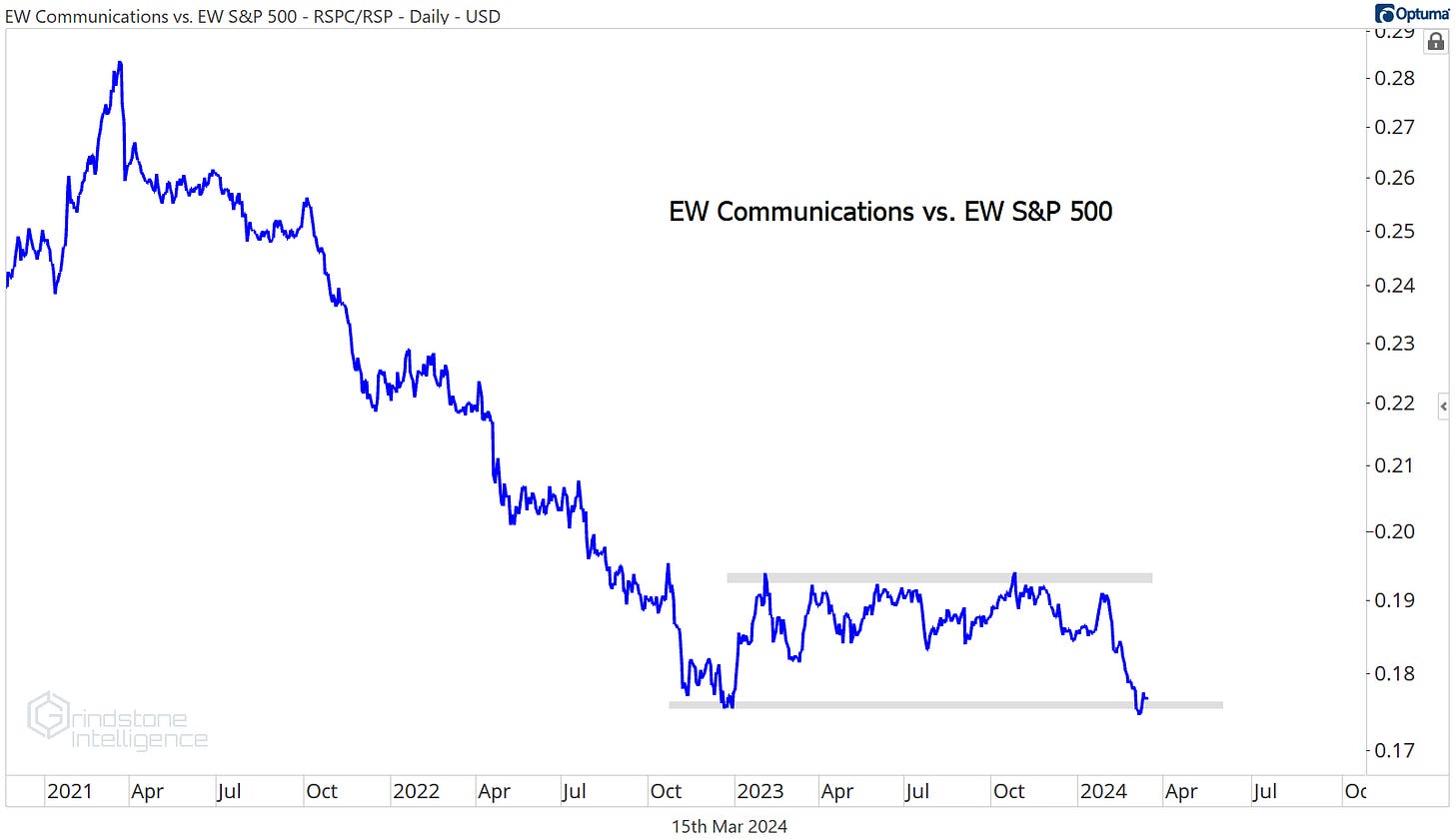

By no means is this a broad move. Unlike the Information Technology sector, where we’ve seen Tech outperforming on both a market cap weighted basis and an equally weighted basis - and even in the small cap space - the majority of Communication Services stocks aren’t doing that well. The equally weighted sector hasn’t even managed to surpass the peak it set at the beginning of last year.

And just last week it was at all-time lows relative to the equally weighted S&P 500.

We can see that weakness quite clearly on the weekly Relative Rotation Graph. RSPC is in the ‘Lagging’ quadrant and trending steadily toward the lower left corner.

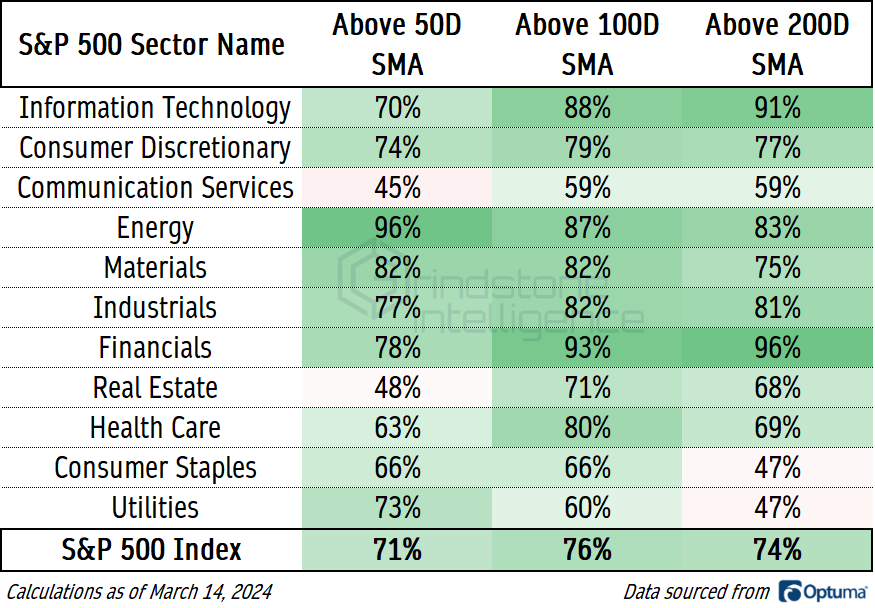

If we look at moving average breadth, no sector has more stocks below their 50-day or 100-day than Communication Services. And only Consumer Staples and Utilities are weaker on a long-term basis.

So how can Communications be leading the market in returns when there’s such weakness beneath the surface? Thank the mega caps. Together, Alphabet and Meta comprise more than two-thirds of the weighting of the entire sector.

Digging Deeper

Both Meta and Alphabet are housed in the Interactive Media & Services sub-industry. That subset has gained 78% over the last 12 months.

Meta stands apart even from there. It’s already up 39% in 2024, thanks in large part to a gap higher after earnings results.

In bull markets, we don’t just want to own things that are going up in price. We also need to be thinking about the opportunity cost of what we’re owning - we want to own the things that are going up the most. So META breaking out to new all-time highs relative to the rest of the market is even more eye-catching than the breakout on an absolute basis.

Here’s what the alternative looks like. Back in December we pointed out the failed breakout in the ratio of GOOGL vs. the S&P 500 index, and noted that even in a bullish outcome it would take time to repair the damage. Last week, Alphabet hit 10-month lows relative to the benchmark S&P 500.

That doesn’t mean the stock is in a major downtrend. Alphabet’s structural uptrend is still very much intact following the January failed move and ensuing mean reversion. The price is still above a rising 200-day moving average and just a few percent away from all-time highs.

But the relative strength profile tells us there are better places to be. At least as long as GOOGL is below the 2021 highs.

Leaders

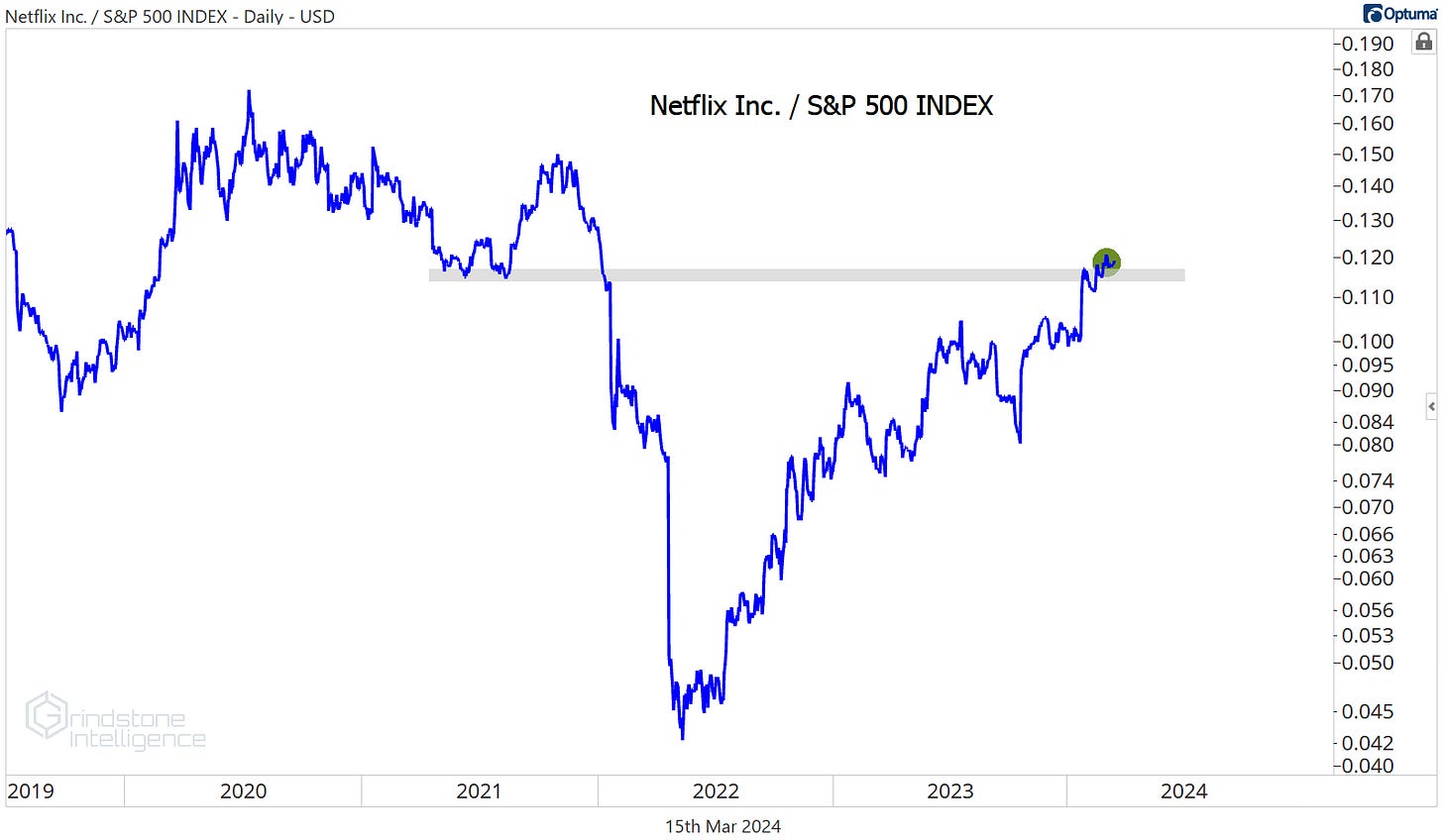

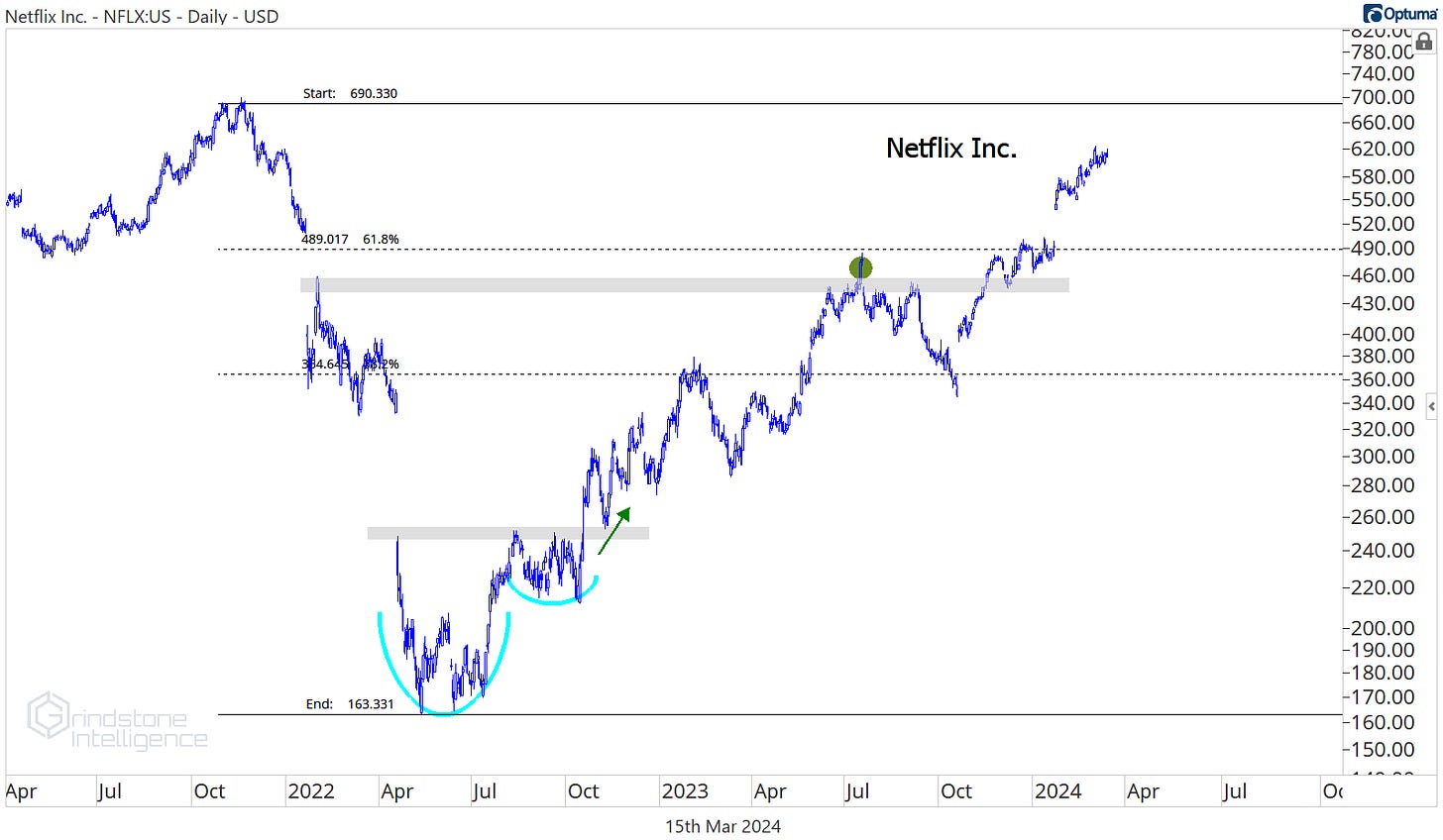

Netflix just set new multi-year highs relative to the S&P 500. That’s nothing to sneeze at.

The risk/reward profile isn’t particularly attractive for new entries as it nears the former highs at $700, however. On any broader market pullback, we’d be looking to get involved with NFLX closer to support near $500, but for now it’s better left alone.

Charter Communications managed to sneak on the last month’s biggest winners list with a 1% gain, but we’re far from convinced. Just last week, it was setting 11-year lows relative to the S&P 500 index.

For the bottom fishers out there who just can’t help themselves, we’ll point out this potential failed breakdown below the 2022 lows. With momentum putting in a bullish divergence at the most recent lows, you’ve got at least one tailwind working in your favor.

Don’t forget that this is a downtrend, though. If we’re buying CHTR above $300, we’re doing it for a mean reversion trade only, with a target of $350. We aren’t betting on a long-term uptrend until we have some clear and convincing evidence that the long-term downtrend has run its course.

Losers

Why are we so adamant about avoiding stocks in downtrends? Because losers tend to keep on losing. Last month we pointed out the new relative lows in Warner Brothers and said “There’s no reason to waste time on garbage like this when we’re in the midst of a bull market.” Harsh words, perhaps, but deservedly so. WBD fell 16% over the last 4 weeks and hit its lowest level since 2009.

Electronic Arts isn’t garbage, as it’s just 10% below its all-time highs. But those all-time highs were set in 2018. It’s been consolidating just below those highs for the last 4 years.

In the meantime, the rest of the stock market has been rallying. That’s what we mean by opportunity cost. EA just broke to new relative lows.

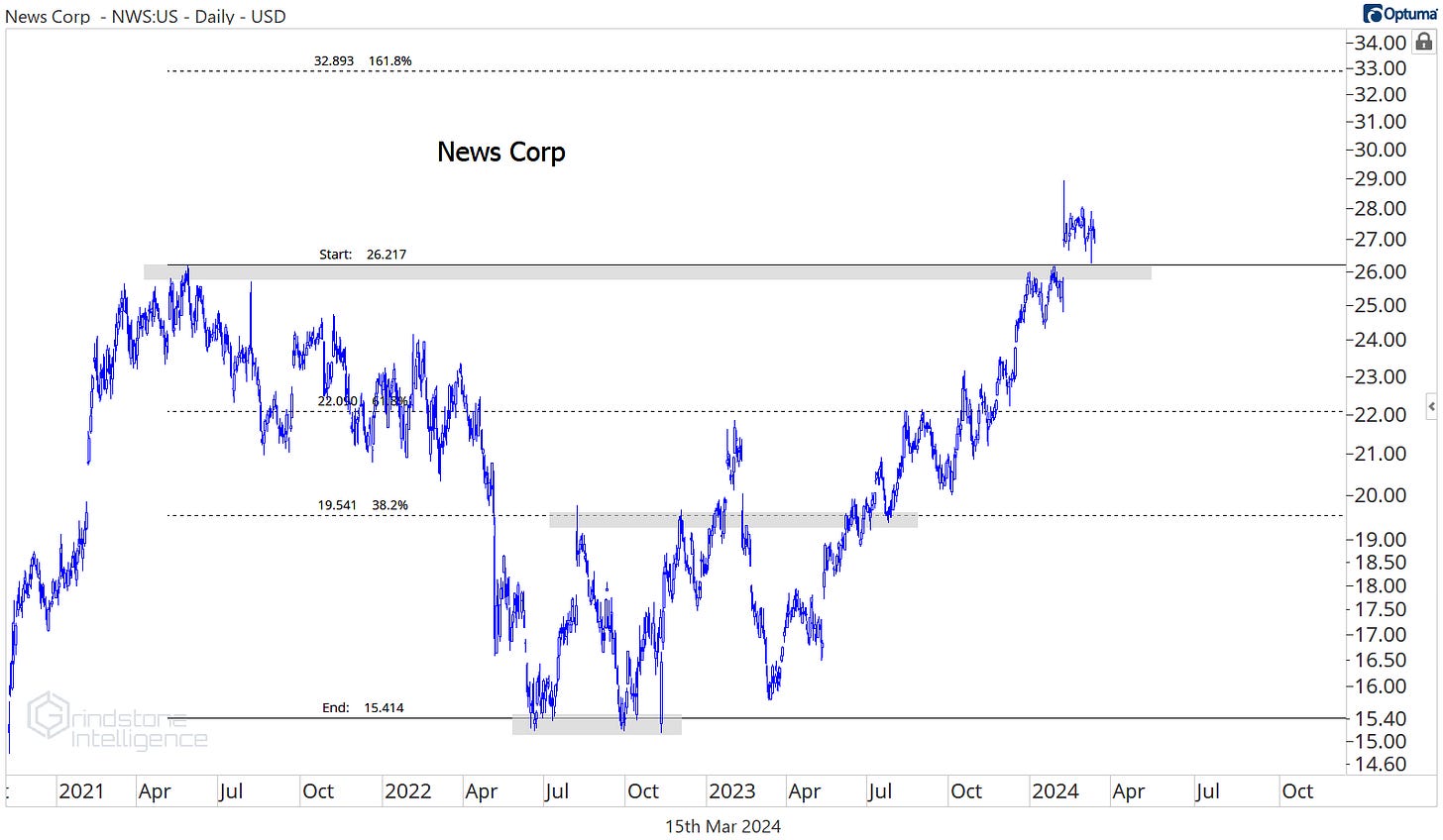

News Corp is a different story. We don’t see anybody talking about it, but they should be. NWS just broke out of a 3 year base to hit new highs:

And check out this bottoming action for the stock relative to the rest of the market:

We want to be buying NSW above the 2021 highs at $26 with a target near $33.

One more to watch

Speaking of bottoming action, how about Disney? This was one of the worst stocks out there from 2021-2023, but here it is breaking a 3-year downtrend line relative to the SPX:

We don’t believe DIS just goes straight up from here - bottoms are a process - but we can begin approaching this one from a more bullish long-term perspective. We like the risk/reward above $110 with a near-term target of $125.

That’s all for today. Until next time.