Top Charts from the Consumer Discretionary Sector

From failed moves tend to come fast moves in the opposite direction. Is that what’s happening here for the Consumer Discretionary sector?

Despite its strong performance so far in 2023, the sector is still more than 25% from its prior bull market peak. For context, only Real Estate has failed to recover more of its decline.

It looked like Discretionary was poised to play catchup when it was the top performing sector in June. So far, though, prices have been unable to absorb resistance from last summer’s highs. That puts a ceiling on near-term gains for the sector.

Fortunately, Consumer Discretionary may be the most diverse sectors in the S&P 500 index, which means there are plenty of opportunities below the surface.

D.R. Horton has been showing relative strength ever since it successfully back-tested its pre-COVID highs last summer.

We think it continues a lot higher. DHI’s 2021 peak coincided with the 261.8% retracement from the entire 2005-2008 decline. The stock then bottomed last June at the 161.8% retracement. Ever wonder why we use these Fibonacci levels? This is why. The market respects them. It doesn’t really matter whether we believe in the merits obscure mathematical ratios. The market does. Longer-term, that puts our target for D.R. at $170, with the $106 breakout level acting as support on any further pullbacks.

We’ve got a similar setup in Lennar, another homebuilder. Its 2021 peak also occurred at a key Fib retracement level, and the ensuing selloff bottomed at those 2005 highs.

Just like DHI, LEN set a year-to-date peak on February 2, then spent a few months gearing up for a breakout above the 2021 highs. We want to own it above those highs at $110 with a target of $170, which is the 261.8% retracement from the 2005-2008 decline.

Lowe’s has joined in recently after the home improvement stocks had been largely left behind all year. It broke out to new 52-week highs and can challenge last year’s highs up near $265. We only want to be long if it’s above $220.

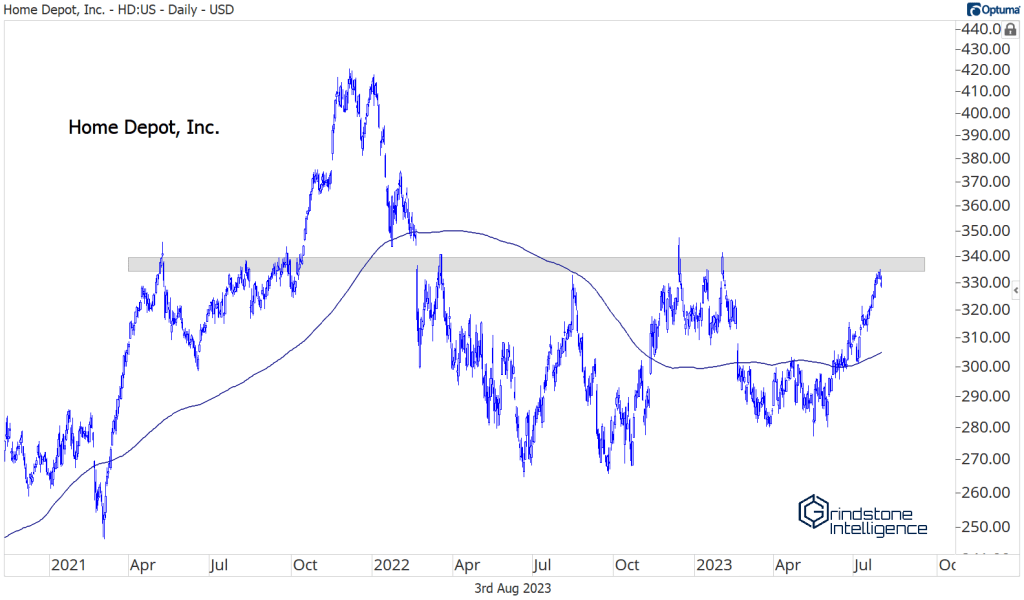

Home Depot could follow with a breakout of its own. We want to be long on a move above $340, with a target of $410, near the former highs.

If the stay-at-home trade doesn’t tickle your fancy, perhaps the travel one will.

Booking Holdings just broke out above its 2021-2022 highs, which was also the 161.8% retracement from the COVID selloff. We want to be buying BKNG on any pullbacks toward $2700, with a target of 3660, which is the 261.8% retracement level from the 2020 decline.

There’s still plenty of upside potential in Carnival Cruise, even after a triple off the lows. We love stocks that are showing strength on both an absolute and a relative basis, and that’s exactly what CCL is doing. Here it is compared to the S&P 500, consolidating above support after a big, rounded bottom.

And on an absolute basis, the stock just got more overbought than it had been at any time since 2004! In the mid-point of the multi-year range, this isn’t a great setup right now, but we want to be buying pullbacks toward $14 with a target back at the 2021 peak near $30.

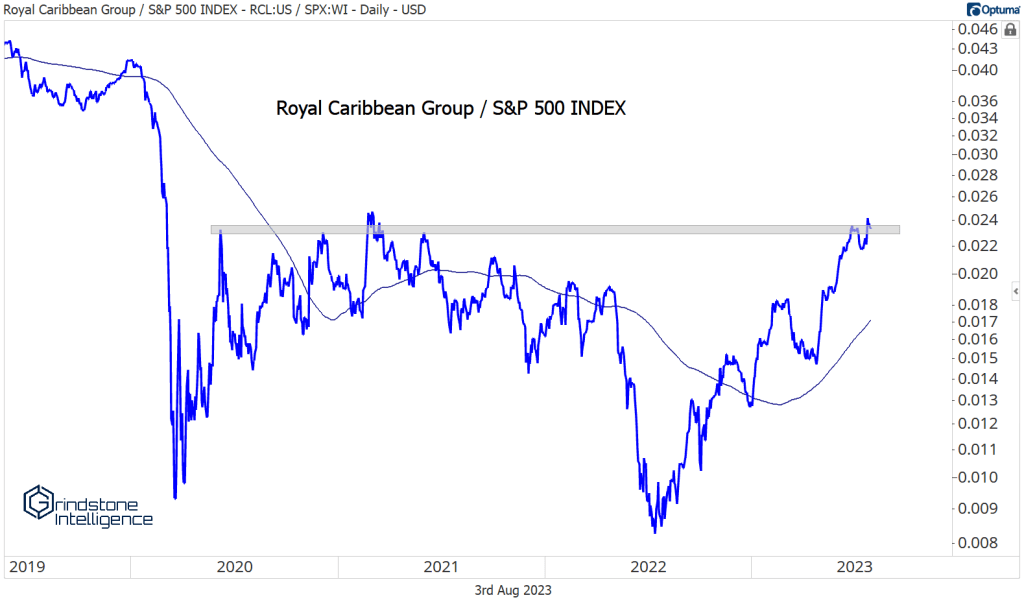

Royal Caribbean offers a much better risk level to work with in the near-term. We can be buying RCL above $100, with a target of $130, which is the January 2020 high.

Just like CCL, Royal Caribbean is showing strength on a relative basis, too. You can’t outperform the market if you don’t own the things that are outperforming.

Sticking with the travel theme, Marriott is outperforming, too. It just broke out to its highest level vs. the S&P 500 since the COVID collapse in 2020.

And it’s touching new all-time highs on an absolute basis, too. Now isn’t a great time to be adding new positions as MAR approaches potential resistance at the 161.8% retracement from the 2020 decline, but we respect the relative strength we’ve seen. We want to own it above $212 and would use that level to manage our risk, with a target above $300.

We don’t have to wait for an improved risk/reward setup with Garmin -we’ve already got it. It’s barely above its 2020 peak, which had been resistance all year. We’re targeting $132, which is the 161.8% retracement from the COVID collapse, but we only want to be long if it’s above $105.

With so many bullish setups, why shouldn’t we be more constructive on the sector as a whole? Because two behemoths, Tesla and Amazon, are struggling to make headway. Those two together comprise 40% of the sector’s weight.

Tesla hit a high of $299.29, just a hair shy of the $300 target we set in early June. Since then, it’s been unable to gain any more ground. That $300 level was also the peak last summer and in 2021, so there’s a lot of memory there. There’s no reason to have a position until Tesla breaks out of the this big, choppy range.

Amazon is stuck below resistance, too. Those swing lows from last spring at $140 are the ceiling for now, so there’s no reason to be long.

And the opportunity cost of holding Amazon over the last few years has been high. Here it is compared to the S&P 500 index, still stuck below the downtrend line from the 2020 peak.

That relative weakness isn’t limited to Amazon. Other internet retailers have struggled, too. Ebay just fell to decade lows against the benchmark index.

With the sector likely stalled out for the time being, we’d rather focus our attention on the stocks showing relative strength and breaking out to new highs. Not the ones that are lagging and breaking to new lows.

The post Top Charts from the Consumer Discretionary Sector first appeared on Grindstone Intelligence.