Top Charts from the Consumer Staples Sector - 12/8/2023

Not much going for the Staples. But that's not so bad.

The Consumer Staples sector has been one of the worst performers all year, and things aren’t likely to get better any time soon.

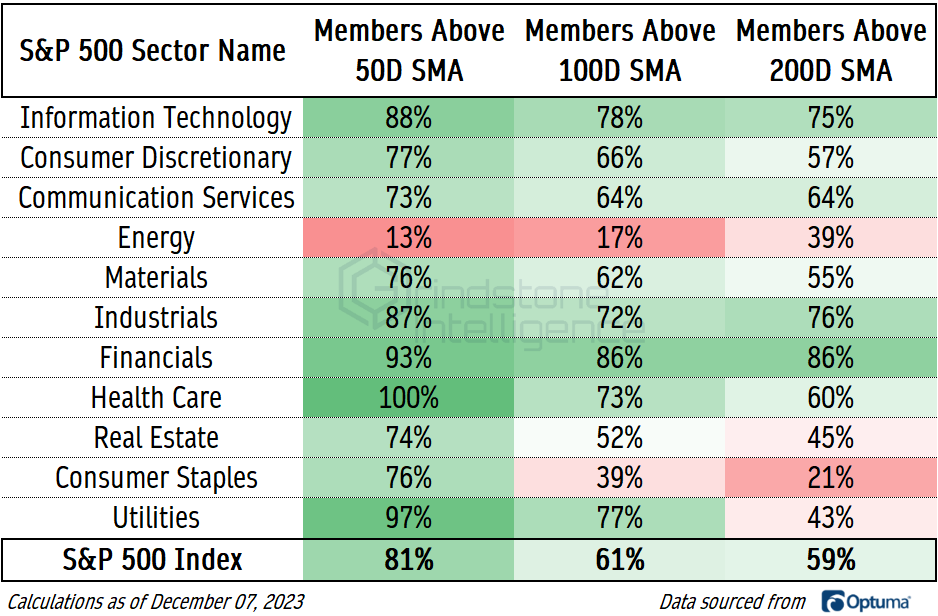

As things stand today, no S&P 500 sector has fewer members in long-term uptrends. Just 21% of Consumer Staples stocks are above their 200-day moving average, roughly half the number of the next-worst sector (Energy at 39%) and just one-third of the mark set by the S&P 500 ex-Staples.

A look at the sector’s performance over the last few years is uninspiring. Price is rangebound between support at the December 2020 highs and resistance at the January 2022 peak.

Stripping away the outsized influence of the largest components, paints a somewhat darker picture. The equally weighted Consumer Staples sector is rebounding after breaking to multi-year lows, but is stuck below former support. We have to treat this group as guilty until proven innocent.

It doesn’t help that the sector is about to enter its weakest seasonal period. The Staples have lagged the benchmark index by an average of 1.3% in Januarys since 1990 and outperformed the index just 32% of the time during that month.

To be clear, a Consumer Staples sector that’s underperforming isn’t a bad thing. Staples tend to lag during bull markets, when investors favor more expensive stocks with higher earnings growth potential. When the money starts flowing disproportionately into boring companies that sell diapers and toothpaste, it’s a sign that investors are becoming more risk-averse.

Since we’re in the midst of a bull market in stocks, the Staples should be lagging. And they should continue doing so. We’re watching the chart below, which compares the sector to the benchmark index. If investors continue to favor risk-on areas of the market, we expect this ratio to break to new lows. A significant rally from support, though, would force us to question how much risk-appetite investors really have.

Digging Deeper

Nearly every sector sub-industry has underperformed the S&P 500 this year, with only the Brewers managing to keep pace with the benchmark’s 20% YTD gain. The Brewers, though, peaked back in July. Lately, we’ve been impressed by the relative strength we’ve seen in the Merchandise Retail sub-industry.

Costco is the one that really stands out.

For COST, we were watching the key resistance level near $575, which lines up with the 685.4% retracement from the 2018 selloff. That area has now turned into support, and we want to own the stock above that level with a target of $800.

COST is already at all-time relative highs compared to the rest of the sector, but now we’re looking for a bullish resolution vs. the rest of the market, too. We wouldn’t be surprised to see a breakout next week.

Leaders

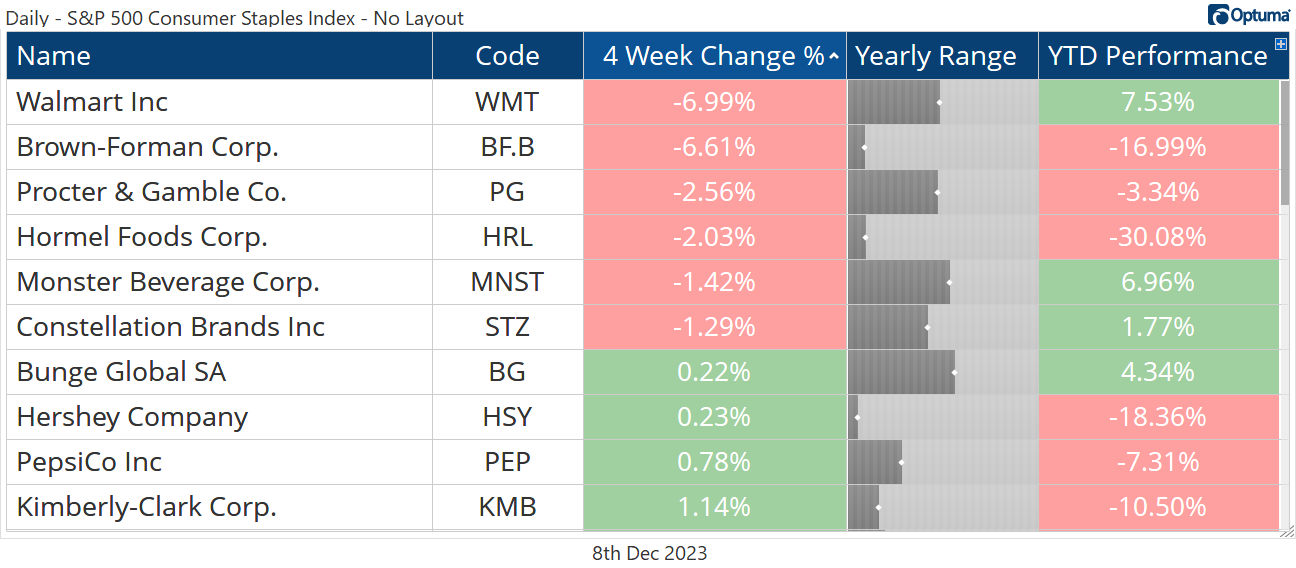

Scan the list of the last month’s biggest winners, then compare it to the list of the year’s biggest losers. You’ll find some overlapping names. Since the broader market troughed in late October, money has poured into the most beaten down stocks with the hope that they’ll provide the biggest future returns. That tells us a lot about the type of market environment we’re in - chasing the bottom dwellers is not something investors do when they’re scared.

We’re not convinced that all these stocks will continue to rally - losers have an unfortunate tendency to keep on losing. Estee Lauder has bounced all the way back to the COVID lows. Those looking for tactical shorts can do so as long as EL is below $140.

The same goes for Dollar General. It’s possible that DG just blows right past the COVID lows in an attempt to fill the gap from the summer, but some backing and filling here is the higher probability outcome. This definitely isn’t a place where we want to be initiating new longs.

Looking for shorts isn’t really our goal these days, though. Not when a bull market in stocks is at hand. Our preference is to simply avoid names like these where the risk/reward isn’t skewed in our favor, and instead look for names that still have ample room to run.

Walgreens is one of the former losers that hasn’t run away yet, and the setup couldn’t be much cleaner. We started watching this one a couple months ago, we still think it’s worth keeping an eye on. Here it is trying to find support all the way back at the financial crisis lows from 15 years ago.

Momentum has put in a big bullish divergence over the last couple months, and didn’t even approach oversold territories on the most recent stock price low. This is a prime candidate for mean reversion, and we think it could go back to almost $30.

We’ve got the same bullish momentum divergence shaping up for WBA when we compare it to the S&P 500.

It looks like the stars are aligned for a nice mean reversion rally. However, we always need to take caution when trying to catch falling knives. We only want to be long WBA if it’s above $21.

Losers

Hershey hasn’t given us much to be excited about this year after it was a big winner in 2022. But at least it stopped going down over the last 4 weeks. It was a logical place to do so, as it approached the Fibonacci 138.2% retracement from the 2020 decline. That’s also where prices stalled out in mid-2021.

We really like the risk/reward setup for HSY when compared to the rest of the Staples. Last year, the Hershey/Staples ratio broke out of a HUGE cup and handle base. It’s reversed sharply over the last 6 months, but now that we’re backtesting the initial breakout level, we’re watching for signs that a new leg higher is beginning. We want to be long HSY above $190 with an initial target of $215.

Walmart is another where the risk/reward is skewed in our favor. We want to be buying the dip in this long-term uptrend with a target near $200, which is the 423.6% retracement from the 2018 decline.

However, we only want to be long above $155. Otherwise, WMT could get stuck back in the multi-year range between $125 and $150. And the opportunity of owning rangebound stocks during a bull market is just too high.

That’s all for today. Until next time.