Top Charts from the Financials Sector

This is a bull market for stocks.

Despite pullbacks in August and an ongoing selloff to start September, the S&P 500, NASDAQ, and Dow Jones Industrial Average are all in uptrends and each recently hit new 52-week highs.

The Financials, however, are not in an uptrend. They’re stuck below last summer’s highs.

Like we said in our previous update, we can’t be overweight a sector that isn’t going up while the rest of the market is. Why make things more complicated than they need to be?

That said, we’re seeing some clear positive signs for the group, and a breakout above last summer’s highs would have us re-evaluating our sector rating.

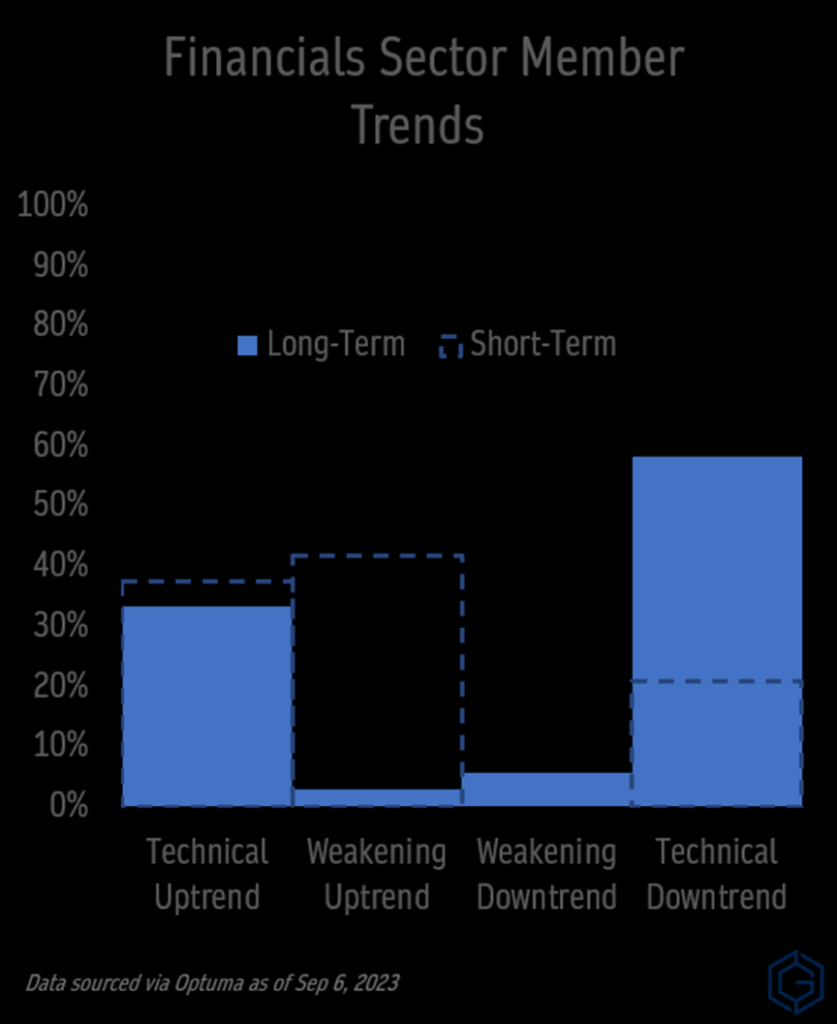

Breadth is showing some improvement. True, more than half of Financials stocks are still stuck in technical downtrends on a long-term basis, and that’s enough to keep us on the sidelines. But 80% of those members are now in short-term uptrends. Barring a deeper selloff over the coming weeks, that means more and more stocks are set to shift from long-term downtrends to long-term uptrends.

And the group is starting to outperform the S&P 500, too. If you’re not familiar with Julius de Kempenaer and his Relative Rotation Graphs®, you can learn about them here. We’ll probably write more about the math behind these charts in the future as they get featured more in our publications. The basic idea, though, is that the relative strength and momentum of stocks and sectors are normalized against a benchmark to show which stocks or sectors are Leading (upper right), Weakening (lower right), Lagging (lower left), or Improving (upper left).

The Financials are improving and moving toward the Leading quadrant. That has our attention. Until we get more confirmation that a new uptrend is in place, though, we’ll have to be selective within the space.

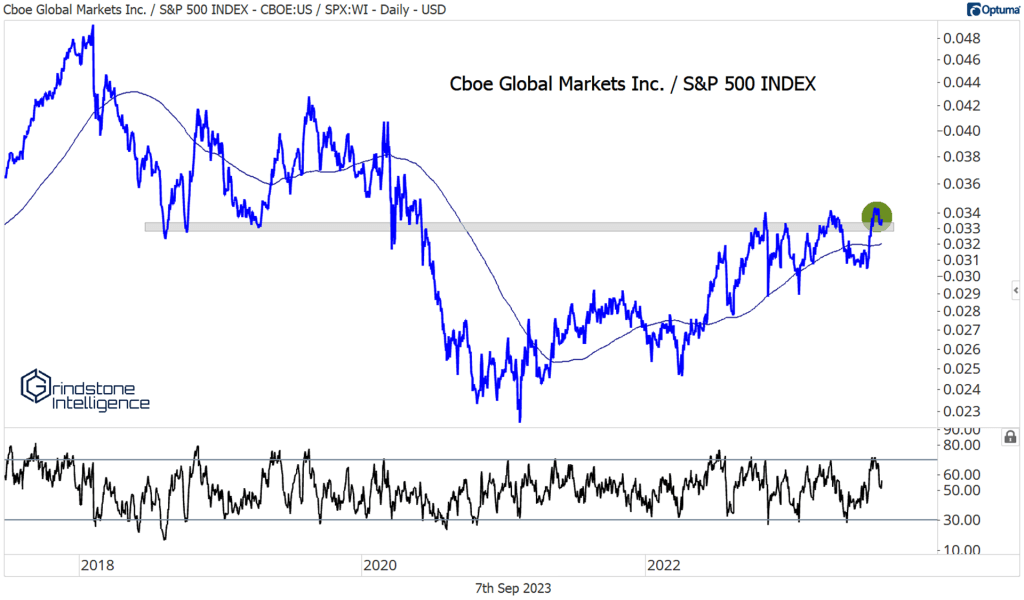

Cboe just broke out of a 5-year base after building what looks like a big inverse head-and-shoulders continuation pattern . If this stock is above $137, we like it with a target of $175, which is the 161.8% retracement of the 2018-2020 decline.

It just broke out on a relative basis, too. We like stocks that are both rising and outperforming other investment options. That’s what we’ve got going on here:

The ratings agencies are working on successful backtests of summer breakouts. Moody’s found support at $325, which was a key resistance level in the summer of 2022. We can be long above that level with a target of near the former all-time highs.

We’ve got the same setup in S&P Global. For this one, we only want to be long above $385, with a target of $515, which is the 261.8% retracement from the COVID selloff.

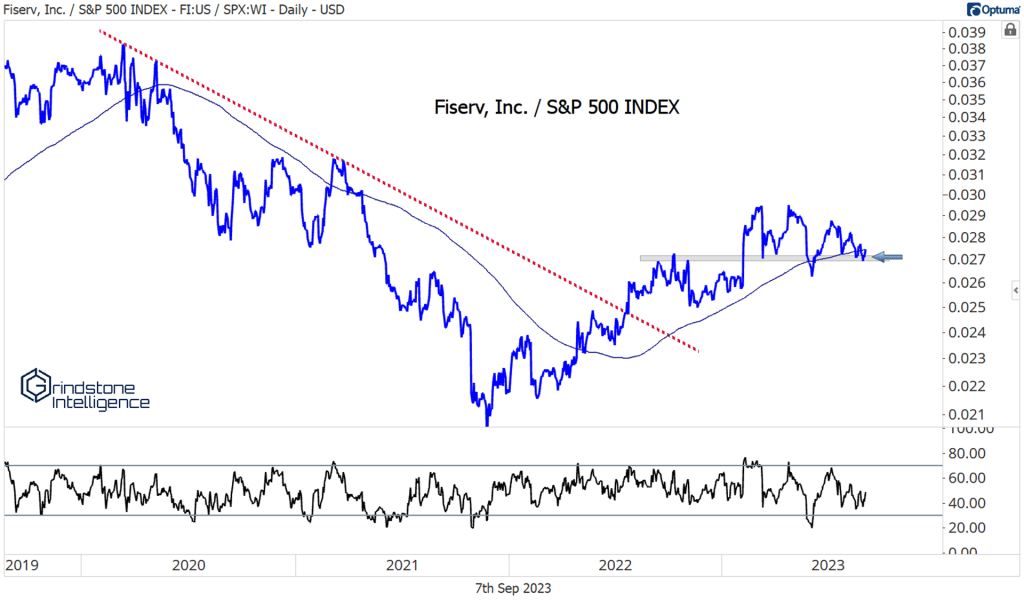

Within payments, we’ve been watching Fiserv as it tries to break out of a multi-year base. FI was one of the best uptrends you could find in the decade leading up to COVID, and now it’s had some time to digest all those gains. The first attempt to get going this summer resulted in a failed move, but we like how momentum stayed out of oversold territory on the selloff. We want to be long above $123 with a near-term target above $150.

What’s more is that the stock has clearly reversed the relative downtrend that was in place from 2020-2021. Now it’s in a new uptrend when compared to the S&P 500 – as long as the ratio can hold this support level.

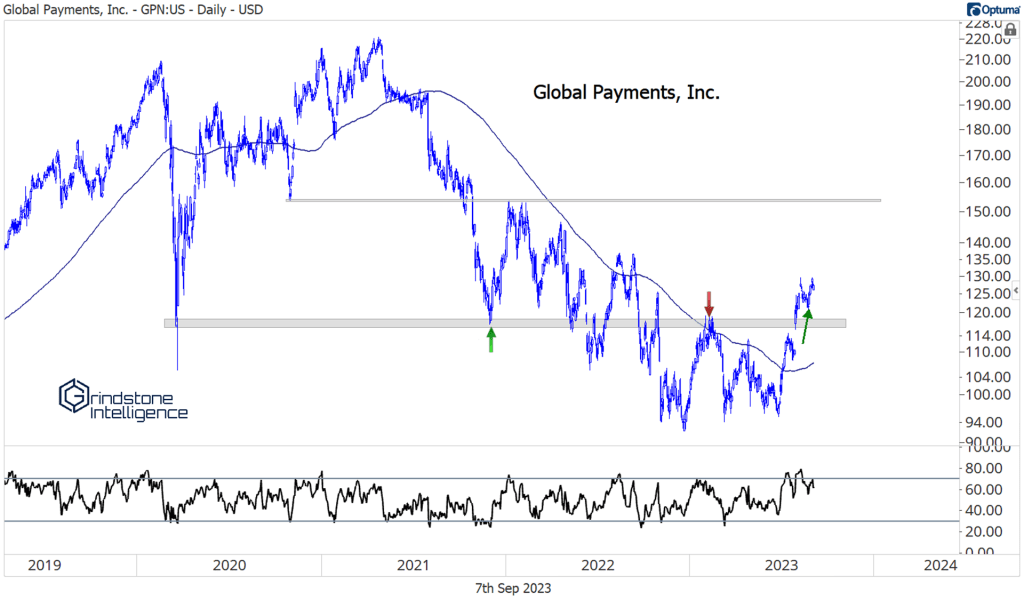

Speaking of downtrend reversals, how about Global Payments? It’s back above the COVID lows, which had been resistance all year. That level is now support, and we want to own it above $118 with a target of $150.

And FleetCor, another player in the payments space, is reversing a downtrend against the S&P 500 by breaking out to multi-year relative high.

There’s clearly something happening within payments that we need to pay close attention to.

One place we haven’t yet seen signs of a new uptrend? Regional Banks. To be fair, the regional banks make up only a tiny sliver of the Financials at this point. Their direct impact on the sector’s price is fairly immaterial. But they are a good reflection of risk appetite for the group, and it’s hard to imagine the Financials staging prolonged outperformance if the regionals are falling.

It’s not just the regional players that are struggling. Lenders in general are feeling the pain, thanks to deposit flight, a weakening consumer outlook, and pending shifts in the regulatory landscape. Citigroup is threatening to break to multi-year lows.

And Discover already has.

We’ll need to see those names at least stabilize if the Financials are to have any hope of becoming a true leader.

The post Top Charts from the Financials Sector first appeared on Grindstone Intelligence.