Top Charts from the Health Care Sector

Our job as technicians is to find trends, with the belief that trends are more likely to persist than reverse course.

One of the easiest ways to identify those trends is to look at a stock’s current price and compare it to the level and direction of a moving average of trailing prices. If the current price is above a rising moving average (MA), then prices are in an uptrend. Below a falling MA, a downtrend. Pretty simple, right?

Things are a little more difficult when you get mixed signals: the level says one thing, but the MA trend says another. What if price is above a falling MA? That’s key first step toward a new uptrend, but it doesn’t always mean prices have bottomed. The same logic holds for a price that’s below a rising MA.

So what do you call it when prices are directly on top of a flat moving average? In this case, we call it Health Care.

There’s no trend to be found in Health Care at the sector level, which means there’s no reason for this sector to be at the center of a portfolio – either from the long or short side. That’s been the case all year long.

If we look past the influence of the sector’s largest components, we see a picture that’s materially weaker. The equally weighted Health Care sector shows us just how much opportunity cost there’s been. Compared to the benchmark S&P 500 index, Health Care is breaking down to multi-year lows.

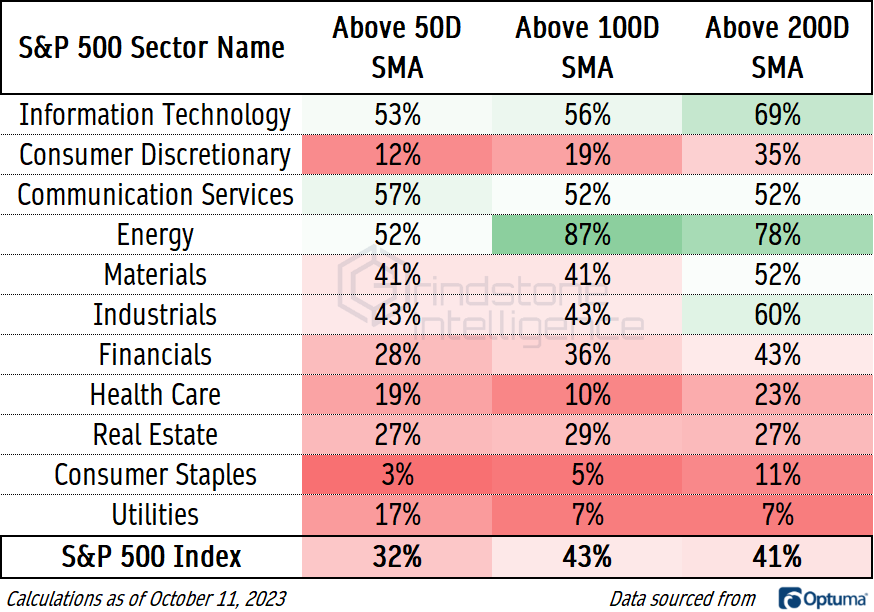

Breadth within the space is weak, too, when compared to the rest of equities. Less than a quarter of Health Care stocks are above their 200-day moving average, compared to 41% for the S&P 500 as a whole.

And the weakness gets more pronounced the further down the market cap spectrum you go. Small cap Health Care broke below support on an absolute basis and has continued to deteriorate.

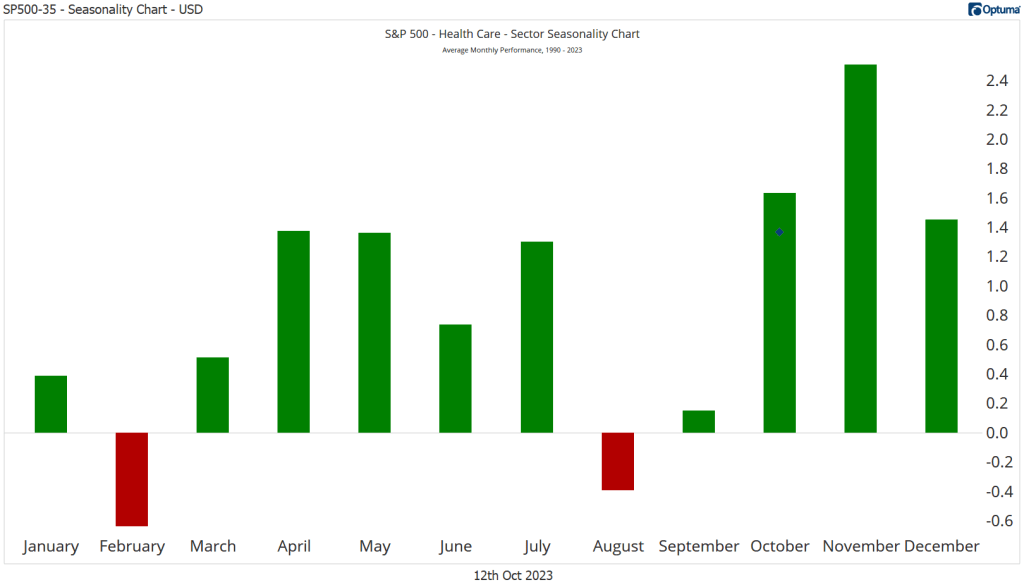

Fortunately, we’re entering the most bullish time of the year for Health Care stocks. October and November have been the sector’s two best months since 1990, with average monthly gains of 1.6% and 2.5%, respectively.

We’ll see whether the month’s strong start can carry over to the balance of the year.

Digging Deeper

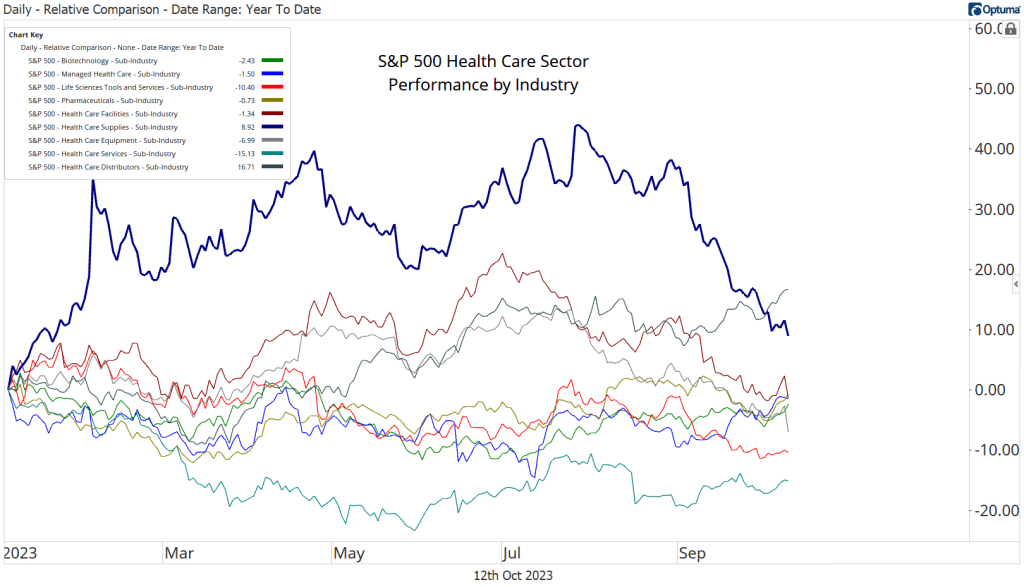

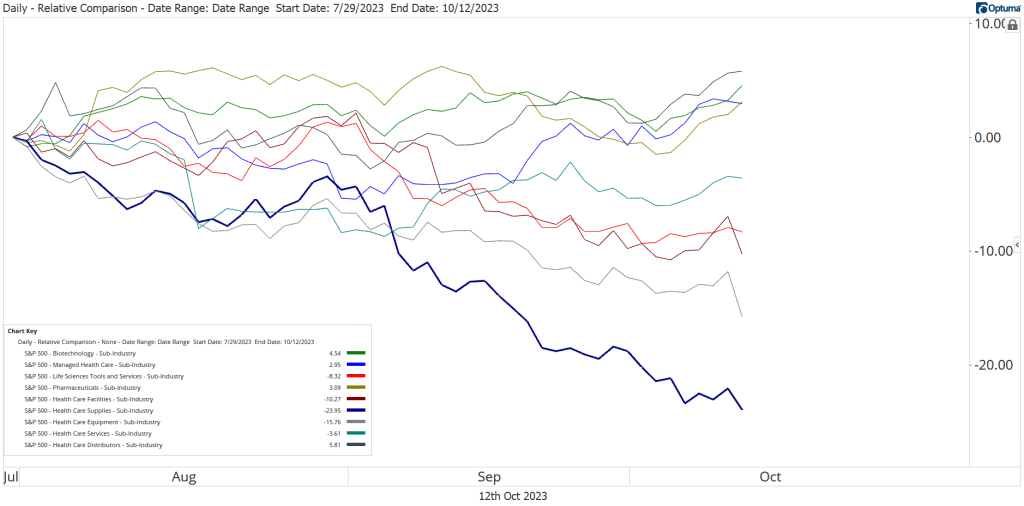

For nearly the entire year, the Health Care Supplies Sub-Industry sat in the pole position. However, nearly all of the group’s outperformance occurred within the first quarter. In fact, Health Care Supplies has been the worst place to be since the S&P 500 set its peak at the end of July.

We can see the relative weakness clearly when we look at the sector’s weekly Relative Rotation Graph. Health Care Equipment & Supplies is firmly in the Lagging quadrant and hasn’t shown any signs of improvement.

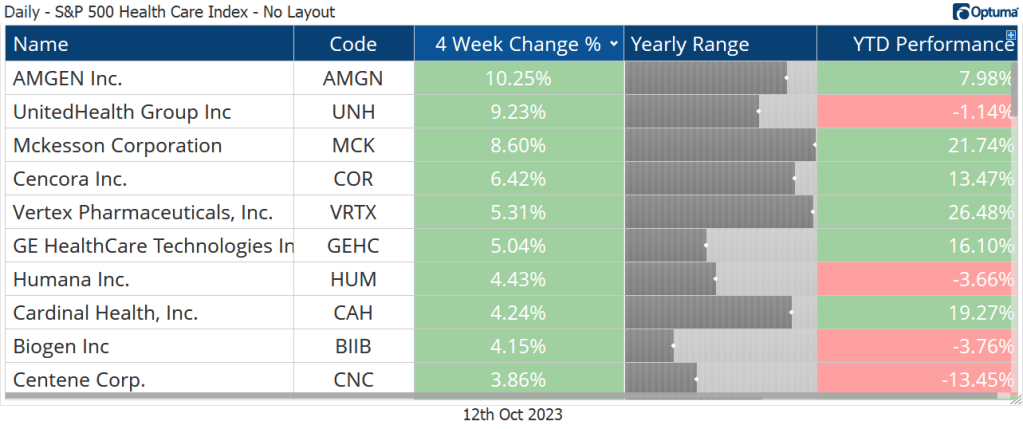

Leaders

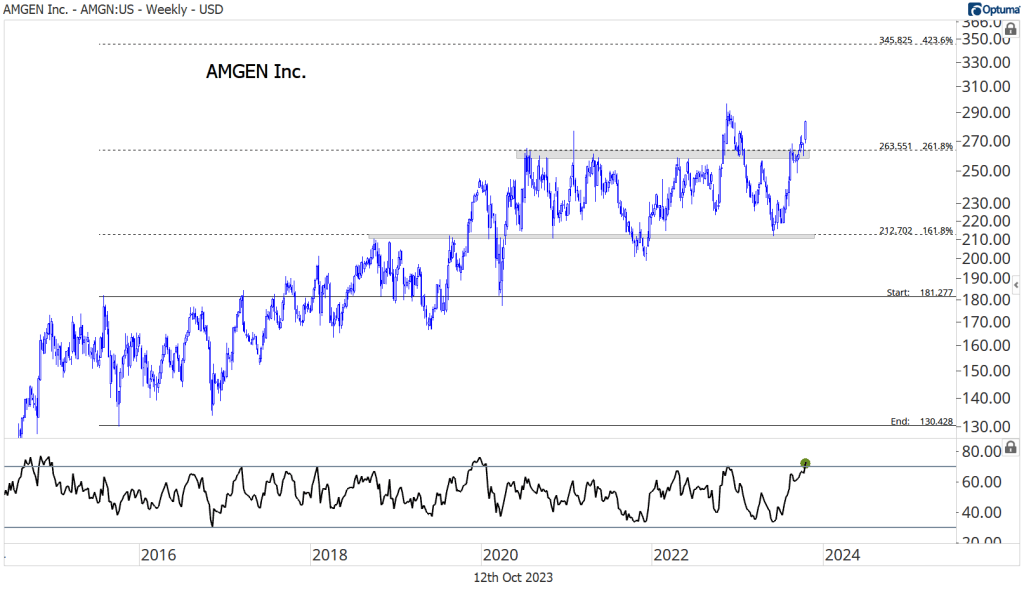

Amgen was the top performing stock over the last 4 weeks, rising 10.25%. That came after AMGN was able to recapture a key rotational level: the 2020-2021 highs. With $265 acting as support on any further pullbacks, we’re targeting $345, which is the 423.6% retracement from the sharp 2015 selloff.

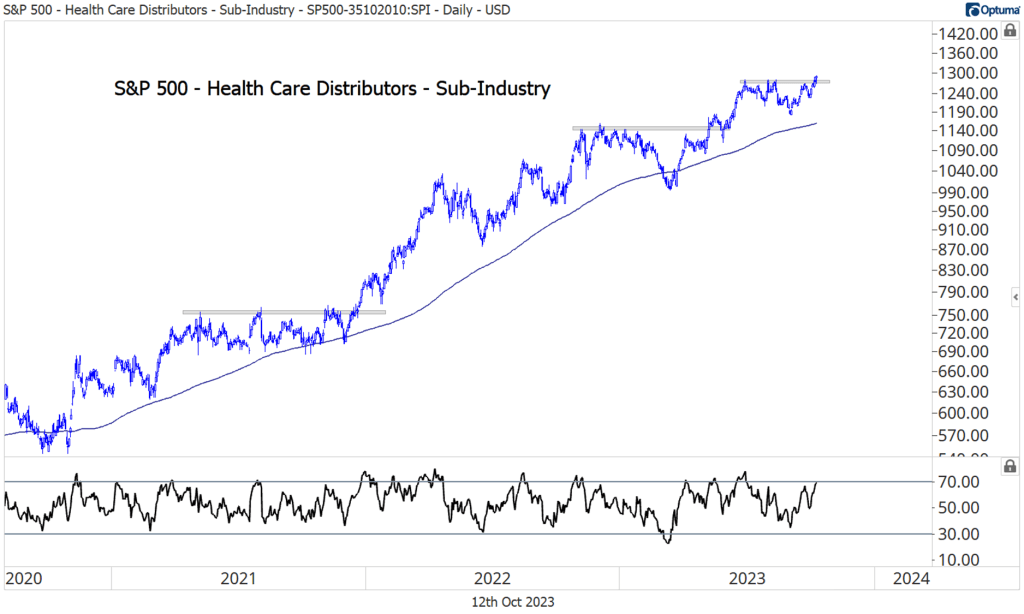

You’ll also find a handful of Health Care Distributors on the recent winners list: McKesson, Cencora (formerly AmerisourceBergen), and Cardinal Health. And if you were paying particularly close attention to the sub-industry performance derby from earlier, you’d have noticed that Distributors are at the top of the list – both for the year and since the broader market’s peak.

Distributors have been a great place to be for the last several years, in fact. They’ve risen steadily since 2020, and just broke out to new highs.

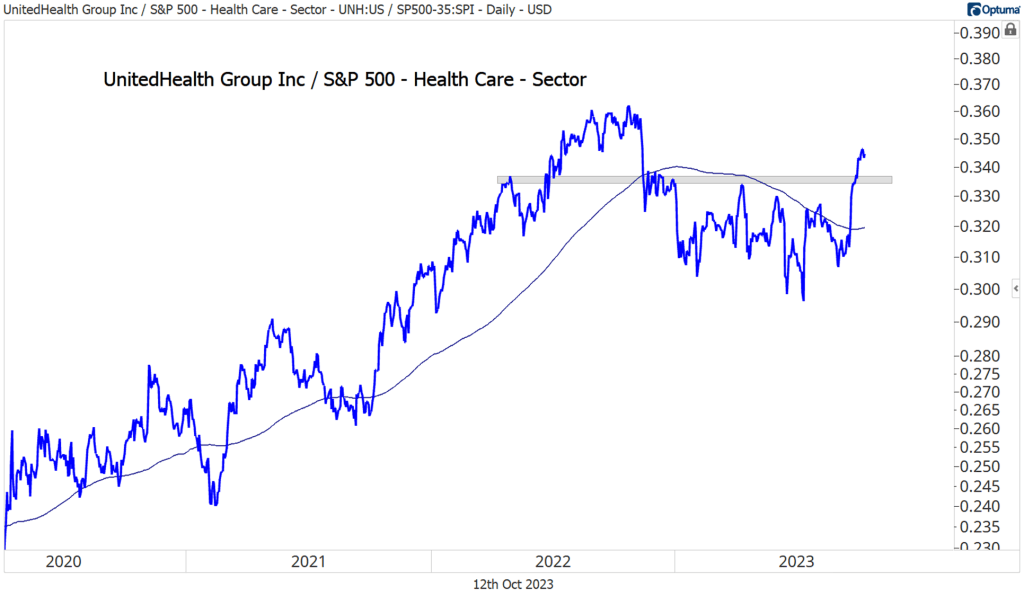

United Health is another standout. It set its all-time peak relative to the S&P 500 last fall, and struggled to gain ground over the first half of the year. In recent weeks, though, it’s managed to surpass a key level of former resistance, pushing the stock to year-to-date relative highs.

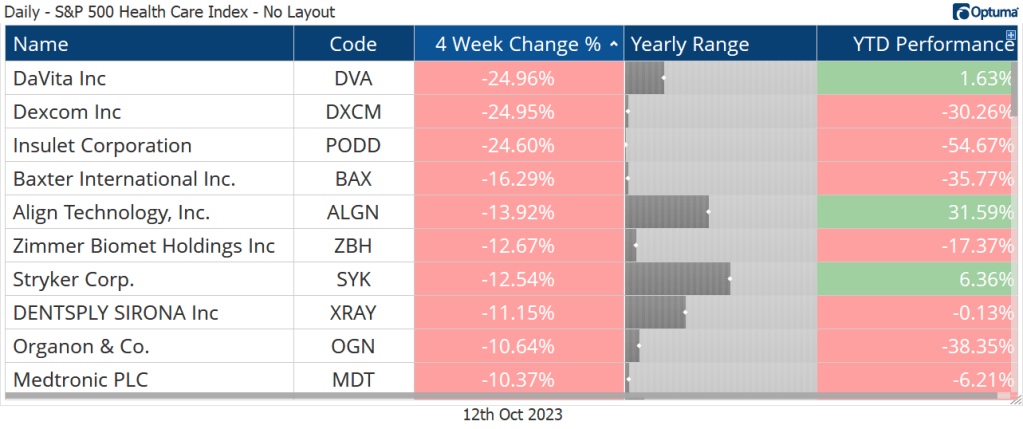

Losers

It seems that obesity drugs are having unintended stock market consequences. Last week, a Walmart executive noted that customers using the revolutionary GLP-1 weight loss drugs seemed to be buying less food. That caused sharp selloffs in makers of snacks and beverages. This week, Novo Nordisk announced that its own GLP-1 drug, Ozempic, was showing early signs of success in delaying the progression of kidney disease in diabetic patients. Dialysis service provider DaVita dropped 17% on the news.

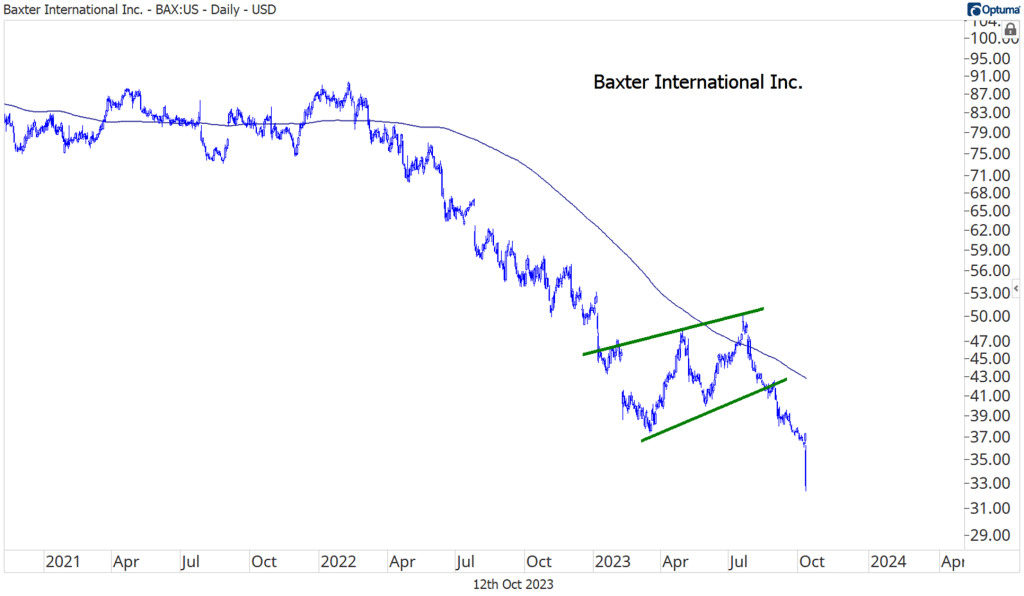

The selloff broadened to most of the medical care equipment and services space. Baxter International dropped to its lowest level in more than a decade. This is a great example of a consolidation resolving in the direction of its underlying trend.

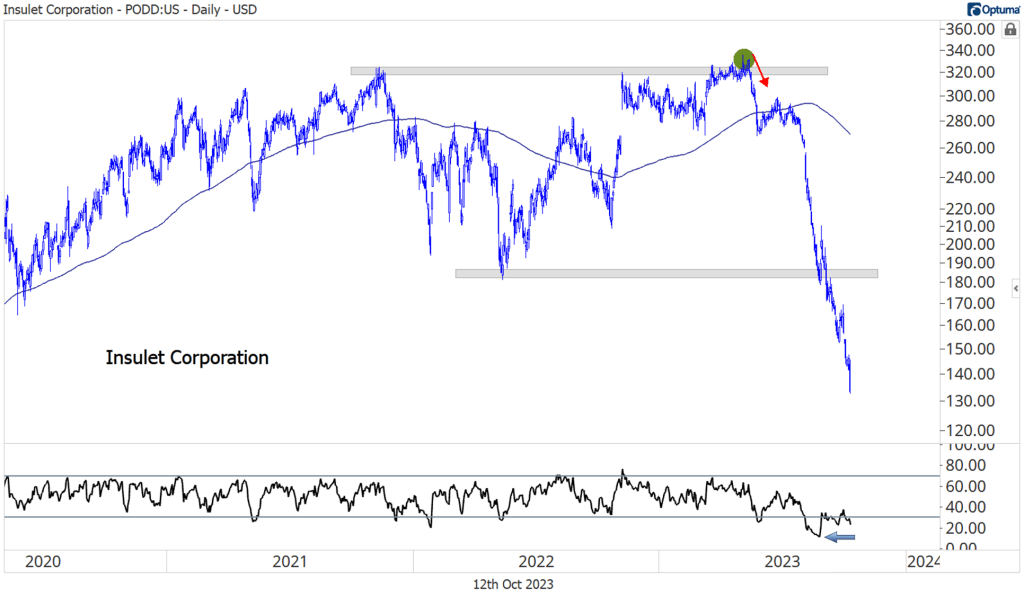

Insulet is a prime example of why managing risk is so important. It was one of the best performing stocks in the world from 2019 to May 2023, when it was setting all-time highs. It would have been easy to fall in love with this stock and think prices could never go lower. Instead, the breakout in May turned into a failed move. From failed moves come fast moves in the opposite direction:

It’s also worth pointing out how oversold Insulet got at the end of August. The 14-day RSI in the lower panel got all the way down to 11. Some people think ‘oversold’ means prices are due for a bounce. What they really show is that sellers are in control. PODD proves that oversold stocks – even severely oversold stocks – can keep falling.

Growth Outlook

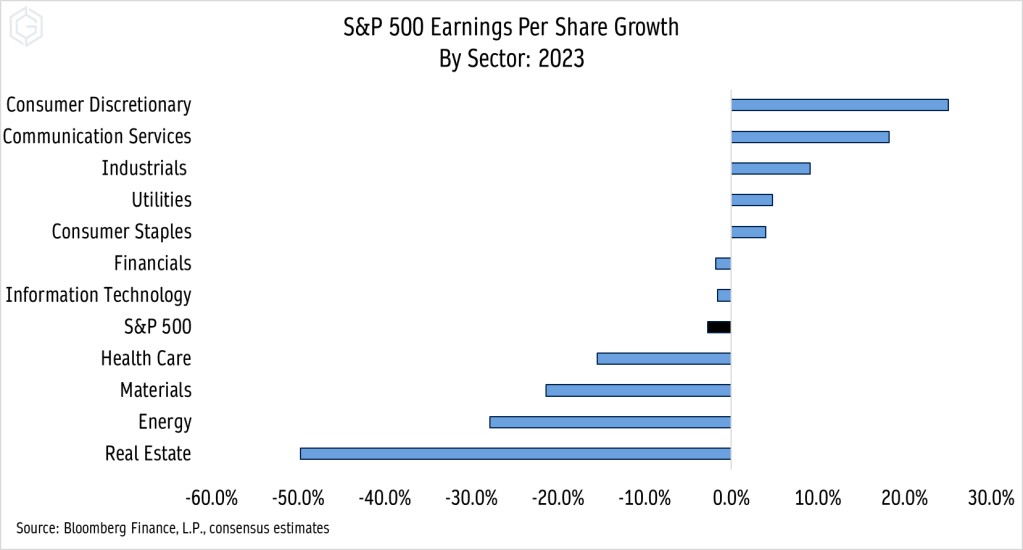

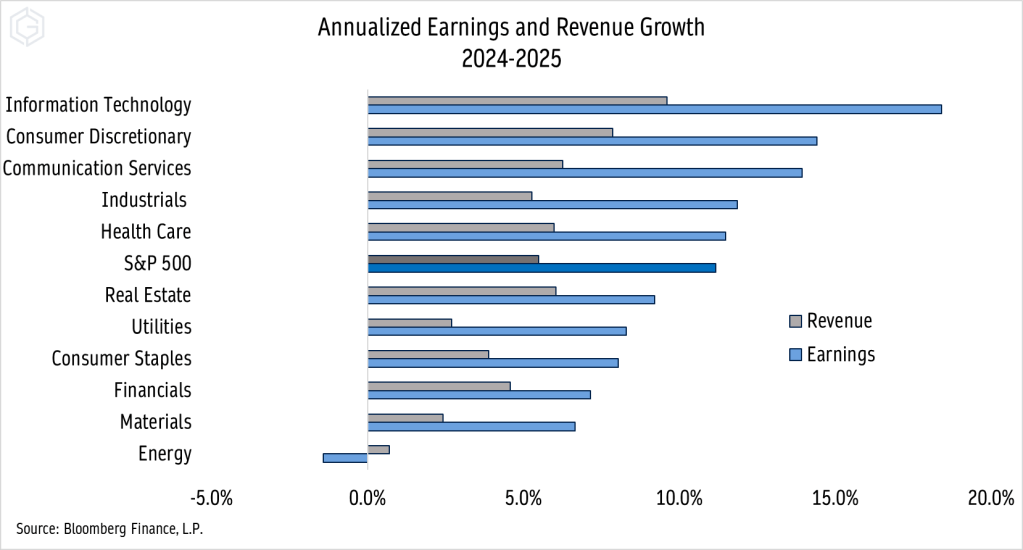

Earnings for the Health Care sector are expected to decline 15% this year, according to Wall Street analysts. That’s among the worst declines in the S&P 500 index, and far worse than the 3% EPS decline that’s expected for the index as a whole.

Over the next two years, though, sector earnings growth is expected to rebound to an above average rate. The annualized growth through 2025 is projected to be north of 11%.

Bottom Fishing

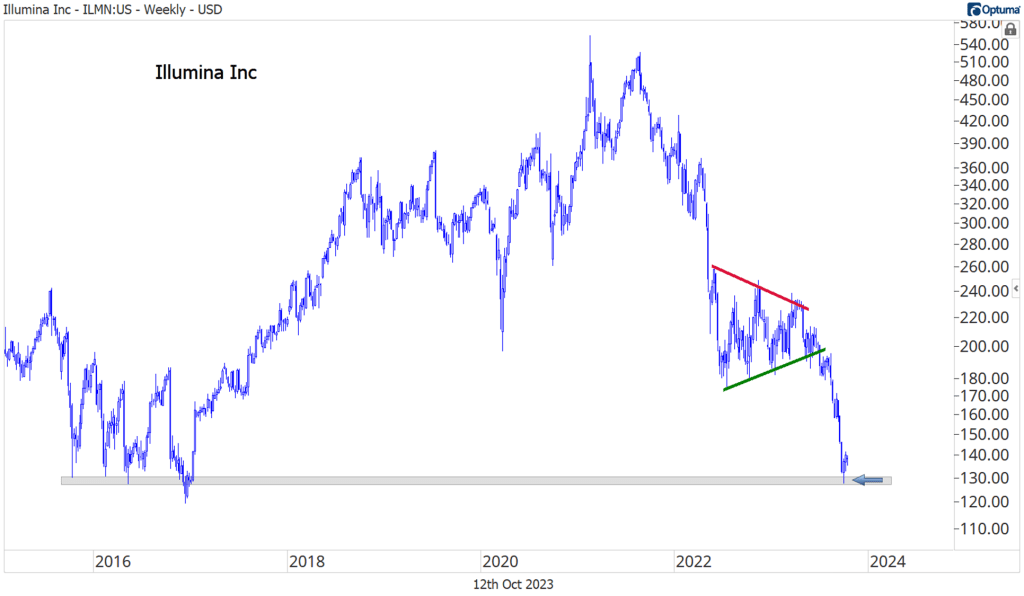

We aren’t big on trying to catch falling knives, but we know some of our readers are. So here’s one for you bottom fishers.

Illumina has dropped 75% from its 2021 highs, with barely a stop on the way. Now its at a major level of former support. This is as good a place as any for the stock to begin a mean reversion rally. We think it’s worth a shot above $130, with a target up near $185.

The post Top Charts from the Health Care Sector first appeared on Grindstone Intelligence.